Wachiwit

Price Action Thesis

Netflix, Inc. (NASDAQ:NFLX) leads the FANMAG collection into Q2 earnings on its highly-anticipated FQ2’22 report card on July 19.

Expectations are understandably low after delivering two back-to-back quarters of weak guidance. However, we believe it sets up NFLX relatively well, heading into its earnings call.

Wall Street has also moved to a Neutral posture as Netflix disappointed massively. The train wreck has also caused NFLX to fall more than 70% (as of July 8’s close) since its November highs as the market resets its valuation assumptions.

Our price action analysis indicates that NFLX has been resiliently holding its May bear trap (on its long-term chart) over the past two months. Therefore, the consolidation at its near-term support has been relatively constructive. It’s still too early to tell whether it’s an accumulation phase. However, the bear trap (significant rejection of selling momentum) signal from its long-term chart corroborates an accumulation view.

Notwithstanding, we don’t encourage investors to hold the bag on NFLX and treat it as a Speculative Buy. Our internal valuation forecasts suggest that NFLX could continue to underperform the market over the next four years. Therefore, investors should adopt a hit-and-run approach in NFLX, leveraging the current possible accumulation phase.

As such, we revise our rating on NFLX from Hold to Speculative Buy, with a near-term price target (PT) of $220. It implies a potential upside of 17.6% from July 8’s close.

NFLX – Rejected The Bears In May Decisively

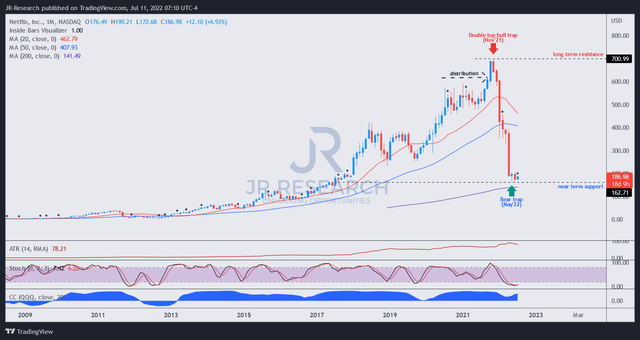

NFLX price chart (monthly) (TradingView)

As seen in its long-term chart, NFLX’s fall from grace was spectacular. But, we believe the hammering was well-deserved, given its much slower growth cadence moving ahead. Interestingly, the market set up the double top bull trap (significant rejection of buying momentum) in November 2021, well ahead of its shocking FQ4’21 earnings release.

Notwithstanding, NFLX formed a bear trap in May 2022 and has held its May lows resiliently. It also rejected further selling pressure in June, as its near-term support appeared to support NFLX decisively.

Given that the bear trap appeared on its long-term chart, we believe the price structure is constructive.

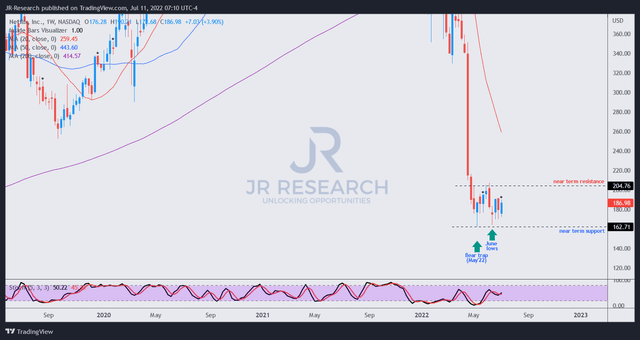

NFLX price chart (weekly) (TradingView)

Moving into its weekly chart, a near-term resistance ($205) prevented further buying upside in early June. Therefore, we urge investors executing our idea to watch for a bull trap that could form subsequently.

In that case, our view would weaken markedly and encourage investors/traders to cut exposure partially or fully before losses could set in, as the market digests a possible bull trap.

Otherwise, we posit that the current zone appears to be an accumulation phase, undergirded by the robustness of its May bear trap.

Notwithstanding, our near-term PT of $220 is above its near-term resistance. Therefore, retaking it decisively moving forward is critical to the success of our thesis.

Making Sense Of NFLX Valuation

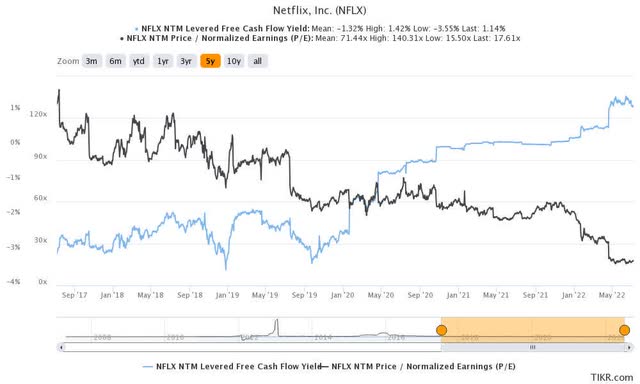

For a company that has struggled to post free cash flow (FCF) profitability, the battering over significantly slowing growth is justified. Furthermore, NFLX last traded at an NTM FCF yield of 1.14%, markedly below its FANMAG peers.

Therefore, we asked ourselves whether the market made a mistake in forming a bear trap at the current levels. It didn’t make sense.

So, we verified our model with the consensus estimates and observed that NFLX is still expected to gain significant operating leverage over the next three to four years.

As a result, NFLX last traded at an FY25 FCF yield of close to 5.9% or an FY25 normalized P/E of 10.5x. Given the forward-looking framework of price action, we believe the market is looking past its FY22 struggles.

As a result, we are confident that the market expects NFLX to have formed its bottom at the current levels unless Netflix drops another massive bomb on July 19.

Is NFLX Stock A Buy, Sell, Or Hold?

We revise our rating on NFLX from Hold to Speculative Buy. Our near-term PT of $220 implies a potential upside of 17.6%.

We believe that the May bear trap on its long-term chart is robust. Moreover, its price action has been constructive over the past two months, and the market also rejected further selling in June.

However, we don’t urge investors to hold the bag, as our internal models suggest that NFLX could underperform the market over the next four years.

Therefore, investors should consider our rating speculative and take their profits if it hits our PT. Investors contemplating pushing further can consider trailing stops to protect gains. Also, remember to set up appropriate risk management stop-losses in case NFLX throws the kitchen sink again in its FQ2 card.

Be the first to comment