Jonathan Kitchen

It’s been about 34 months since I wrote my cautionary piece on Schneider National Inc. (NYSE:SNDR), and in that time, the shares have returned about 19.25% against a gain of ~31% for the S&P 500. I’m hunting for decent logistics plays at the moment, so I thought I’d revisit this name yet again. I’ll comment on the financial history here, and will pay particular attention to the sustainability (or not) of the current dividend. I also want to write about the stock, because as we should all know by now, I’m of the view that the lower the price paid, the better the future outcome. Also, I wrote some puts earlier that were, sadly and very unexpectedly, not exercised when the market tumbled in March of 2020. I think that trade deserves mention, and I want to write about options, too.

I’ll come right to the point again in case there was some ambiguity in the title of this article, or in case the bullet points weren’t clear enough for you. I think Schneider is an excellent investment at current prices. In spite of the massive improvement in the capital structure, and the great financial performance we’ve seen lately, the shares are trading hands at near multi year lows. At the same time, I think the dividend is very well covered. Finally, while my regulars know that I really like selling put options, I won’t in this case because the premia on offer isn’t worth it. I’ll simply buy the stock and move on.

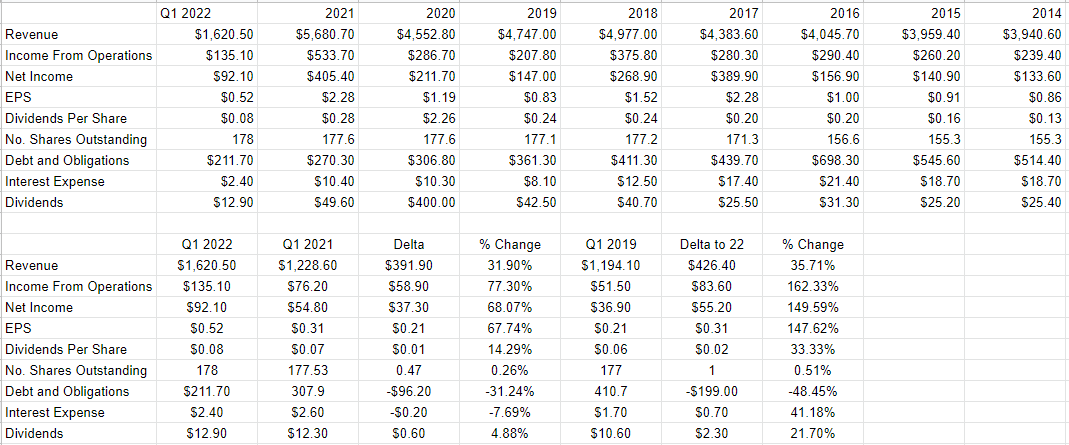

Schneider National Financial Snapshot

The state of Schneider’s financial world is quite good in my estimation. Specifically, during the first quarter of this year, revenue and net income were ~32% and 68% higher than the same period a year ago. To confirm that this isn’t an unsound comparison because 2021 was particularly weak for obvious reasons, I took the liberty of comparing the most recent quarter to the same period in 2019, and came to a very similar conclusion. The most recent quarter was also spectacular relative to the pre-pandemic period. Revenue in Q1 of 2022 was 36% higher than it was in 2019, and net income was about 150% greater!

At the same time, the capital structure has improved materially, with debt and obligations down about $96 million, or 31% over the past year. This obviously has significant implications for the dividend. I want to write about the dividend next, so I’ll write about the dividend next.

Dividend Sustainability

I’m as interested in financial history as the next finance nerd, but investors are particularly interested in a company’s financial future for obvious reasons. In particular, people may be interested to learn about the level of dividend sustainability for two reasons. First, the cash flows received from dividends help smooth investor returns. They’re far less volatile than stock price. Second, the dividend is obviously supportive of stock price. So, readers may be curious about what goes on with the dividend. If you guys have an itch, I’m absolutely committed to scratching it, so I want to spend some time writing about the dividend.

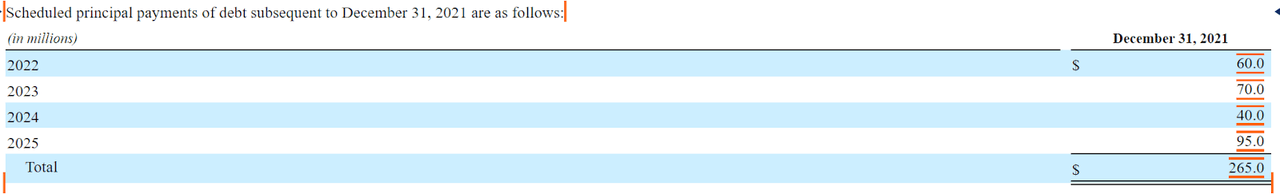

When it comes to tracking the sustainability of a given dividend, I look at cash. I specifically want to compare the size and timing of future cash obligations to the current and likely future sources of cash. Let’s start with the obligations. I’ve taken the liberty of clipping the size and timing of future debt payments from page 53 of the latest 10-K for your reading pleasure. We see from the table below that the company is “on the hook” for ~$60 million this year, and about $70 million next. In 2024, the debt obligations fall to $40 million, and then rises to $95 million in 2025.

Schneider National’s Debt Obligation Schedule (Schneider National latest 10-K)

Against these obligations the company has about $321 million in cash and equivalents. Additionally, they’ve generated an average of $606 million in cash from operations over the past three years, while spending an average of about $432 million on CFI activities. All of the above suggests to me that the dividend is very well covered. For this reason, I’d be very happy to buy shares, assuming that the share price is reasonable.

Schneider National Financials (Schneider National investor relations)

The Stock

I’m about to tread over very old ground. If you subject yourself to my stuff regularly for some reason, you know that I think the stock is distinct from the business in many ways. I’m about to elaborate on that idea yet again, so, strap yourselves in, I guess. Anyway, it’s not too controversial to point out that a business buys a number of inputs, adds value to them, and then sells the results at a profit. The stock, on the other hand, is a traded instrument that reflects the crowd’s aggregate belief about the long-term prospects for the company. It seems that the crowd changes its views about the company relatively frequently which is what drives the share price up and down. Added to that is the volatility induced by the crowd’s views about stocks in general. “Stocks” become more or less attractive, and the shares of a given company get taken along for the ride. Although it’s tedious to see your favourite investment get buffeted because the asset class of “stock” goes in and out of favor, within this tedium lies opportunity. If we can spot discrepancies between the price the crowd dropped the shares to, and likely future results, we’ll do well over time. It’s typically the case that the lower the price paid for a given stock, the greater the investor’s future returns. In order to buy at these cheap prices, you need to buy when the crowd is feeling particularly down in the dumps about a given name.

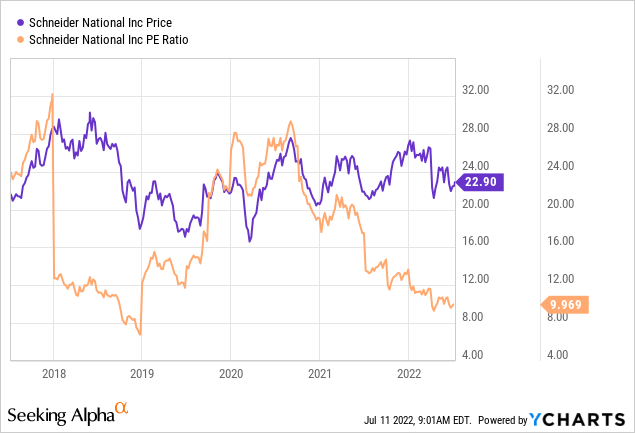

As my regulars know, I measure the relative cheapness of a stock in a few ways ranging from the simple to the more complex. On the simple side, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. Once again, cheaper wins. I want to see a company trading at a discount to both the overall market, and the company’s own history. With that as preamble, feast your eyes on a chart that suggests the PE is near a multi year low:

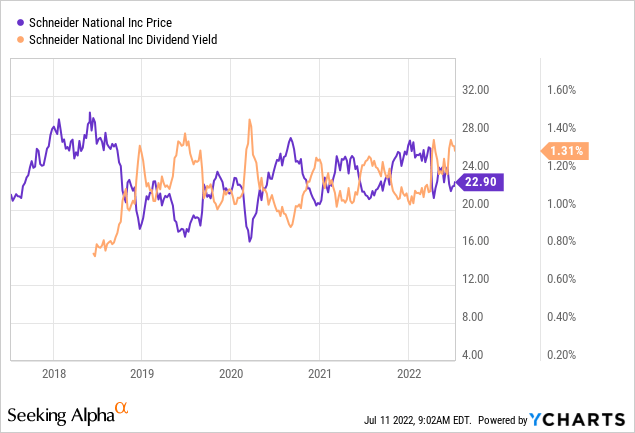

While the shares are trading near multi year lows, investors are getting a dividend yield that’s on the high side by historical standards, per the following graphic. Please note the apparent inverse relationship between price and the somewhat “steady state” dividend. Given that I consider the dividend to be very sustainable, I like this relationship also.

Based on the sustainability of the dividend, the financial strength here, particularly the strength of the capital structure, and the cheapness of the stock, I’ll be buying some Schneider this morning.

Options Update

In September of 2019, I wrote some April 2020 Schneider puts with a strike price of $17.50. In case you forgot, I’ll remind you that in early 2020, the entire world was struck by a fairly massive pandemic that drove markets and economies into a stall. Strangely, and unfortunately, I wasn’t exercised on these puts, though they spent the month of March 2020 very much “in the money.” By the time they expired, they expired worthless. This offers an interesting lesson about selling put options. You won’t always be exercised just because a trade goes into the money. People who buy calls hope to maximise their profits, and this means that they sometimes get whipsawed out of a profitable trade when the stock spikes higher, as happened in this case.

While I normally like to sell puts, I won’t do so in this case, because I think the premia on offer are too thin. For example, the January 2023 puts with a strike of $17.50 are currently bid at $.30. I consider this 1.7% to be too small a return to make the exercise worth it, and for that reason I’ll simply just buy the stock.

Conclusion

I think Schneider is an excellent investment at current prices. I think the dividend is very well covered, and that is going to act as a support to prices going forward. Additionally, the shares are quite cheap relative to their recent history. Even if results return to a more normal level, the strength of the capital structure and the current valuation ensure that it’ll remain a decent investment in my view. I think “price” and “value” can remain unmoored for some time, and I think investors would be wise to buy this great business at current levels before price rises to match value.

Be the first to comment