kroach/iStock via Getty Images

Good news is bad news.

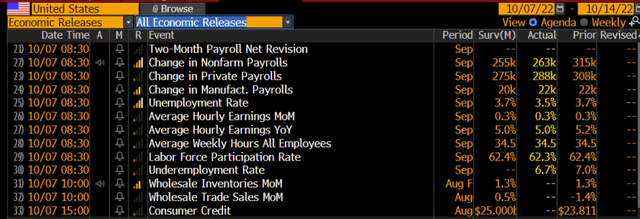

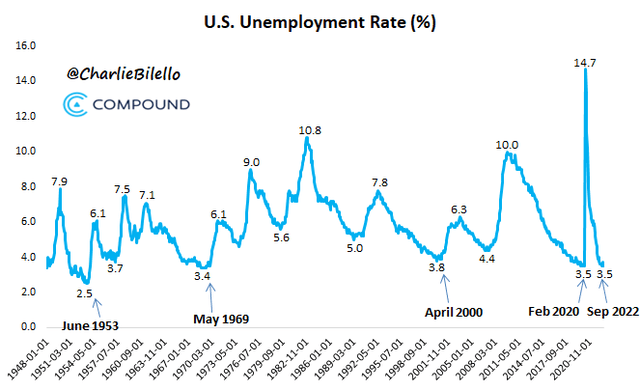

The September payrolls report came in a bit hotter than market estimates with a 263,000 monthly job gain while the unemployment rate dropped big to 3.5% versus a consensus forecast of 3.7%. Closely watched, average hourly earnings verified in-line with economist forecasts at +4.98% year-on-year, the slowest since December 2021. The labor force participation rate, meanwhile, dipped a tick to 62.3, indicative of a still-tight jobs market. It was the sixth straight higher-than-forecast payroll gain, according to Bespoke Investments.

September Jobs Report Survey & Actuals

Christian Fromhertz, Bloomberg

Headline Unemployment Rate Back At Cycle Lows

The initial reaction was to the bearish side in both stocks and bonds. S&P 500 futures fell about 0.9% while the benchmark U.S. 10-year Treasury note yield rose more than 6 basis points to 3.89%. The short-term 2-year rate jumped to near its cycle highs above 4.3% after falling under 4% earlier in the week. The U.S. Dollar Index rose, with the USDJPY pair breaking above 145, the highest since the 1990s.

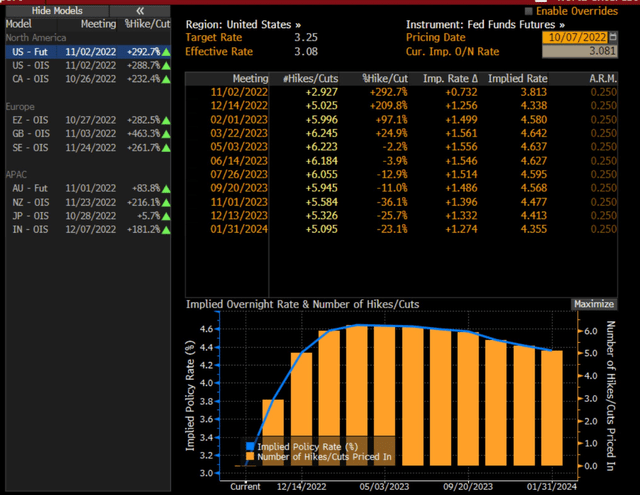

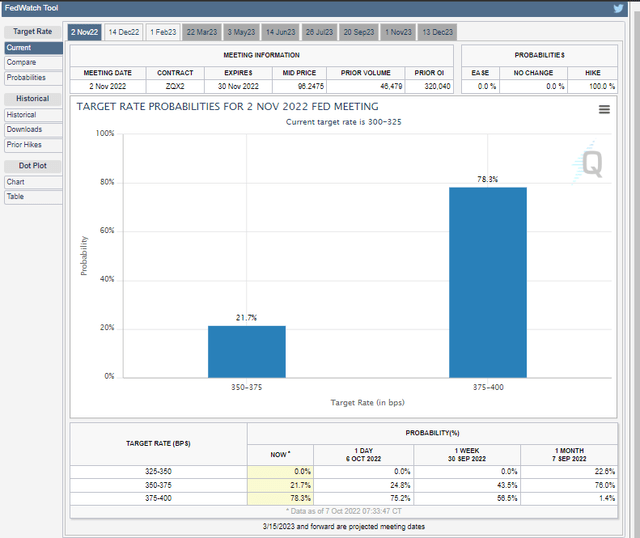

All eyes remain on how Chair Powell and the rest of the Federal Open Market Committee view this morning’s employment report. Traders now place a 78% chance of yet another 0.75 percentage point policy rate hike at the November Fed meeting in less than four weeks.

Post-NFP Fed Funds Futures: A 78% Chance of Another 75bps

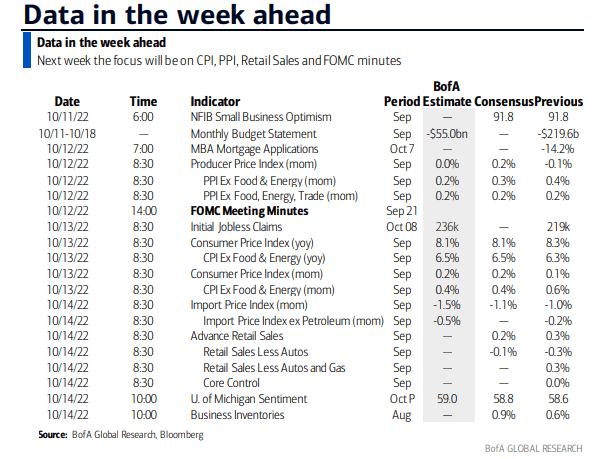

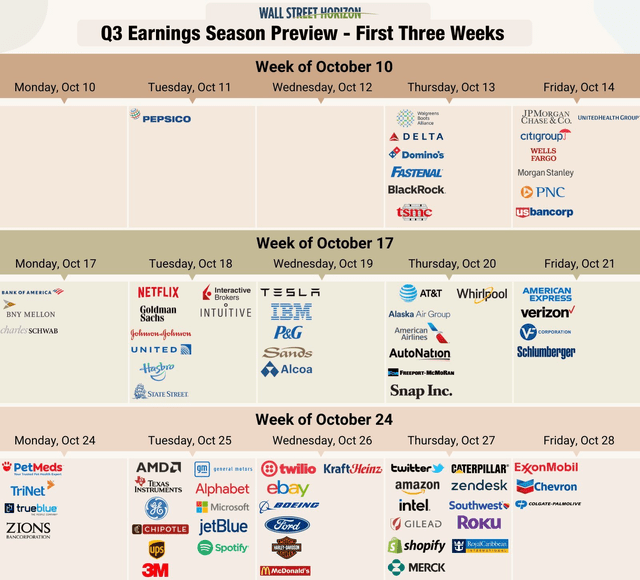

What ultimately determines the November 2 Fed rate decision might be the September CPI report. Investors will digest inflation data next week, first with PPI data Wednesday morning and then CPI figures crossing the wires Thursday morning.

According to Bank of America Global Research, economists expect a 0.2% monthly rise in consumer prices, but a 0.4% jump in the core rate which excludes the volatile food and energy components. Fed minutes and Retail Sales are other key data points next week. Earnings season also kicks off with Pepsi Tuesday and the banks on Friday.

Next Week’s Major Economic Data

BofA Global Research

Third-Quarter Earnings Season About to Ensue

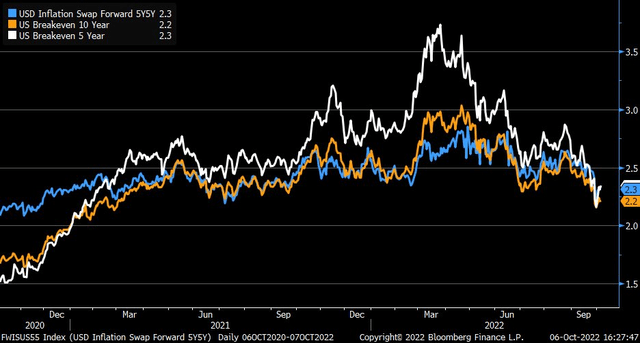

Heading into this month’s NFP report, inflation expectations had been on the retreat. Looking out five and 10 years, swaps and TIPS yields implied just a 2.3% average inflation rate across various terms. That’s something Chair Powell must like to see, but a still-strong labor market remains a big bearish bogey in terms of upcoming policy action.

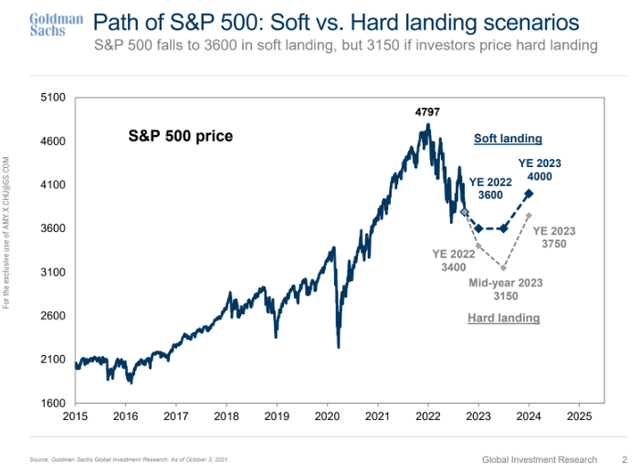

As of now, it appears the Fed is not too concerned about piloting a soft landing, but it’s rather hell-bent on squashing inflation, which could lead to a hard landing. Much will depend on if the domestic labor market cools.

What’s Positive? Tamer Inflation Expectations

Goldman: SPX Hard vs Soft Landing Scenarios

Goldman Sachs Investment Research

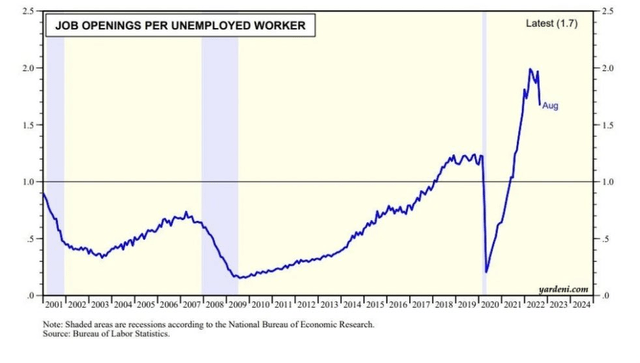

The jobs market has shown some signs, though, of softening. The August JOLTS report issued this past week showed a steep drop in the number of job openings.

JOLTS Drops

Investors should keep their eyes on what happens with short-term yields. The market expects the Fed’s policy rate to peak near 4.6% following this morning’s jobs figures, which caused short-term rates to spike once again. One fund can keep your money relatively safe along with providing a strong yield.

Fed Funds Futures: A Terminal Rate Above 4.6%

Christian Fromhertz, Bloomberg

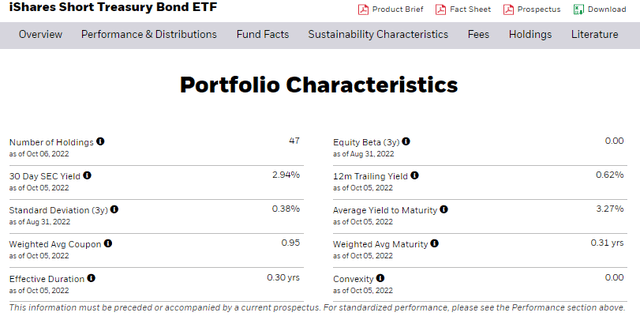

The iShares Short Treasury Bond ETF (NASDAQ:SHV) now offers a yield to maturity near 3.4% after the September employment situation report. While the 2-year yield is much higher, near 3.9%, you can take on much less interest rate risk with SHV since its effective duration is just 0.3 years. So, a 1% parallel rise in rates would lead to just a 0.3% decline in SHV’s net asset value per share.

SHV: A Low-Duration Play with a Strong Yield

SHV’s yield is also more than 0.5 percentage point above what you can get on the best money market funds. Moreover, as the Fed continues to hike rates, SHV’s yield will rise without causing the NAV to fall dramatically. I assert that SHV is a solid place to park cash, such as for your emergency fund, rather than the 1-3 year Treasury ETF (SHY). Keeping duration short while earning a solid yield is possible with SHV.

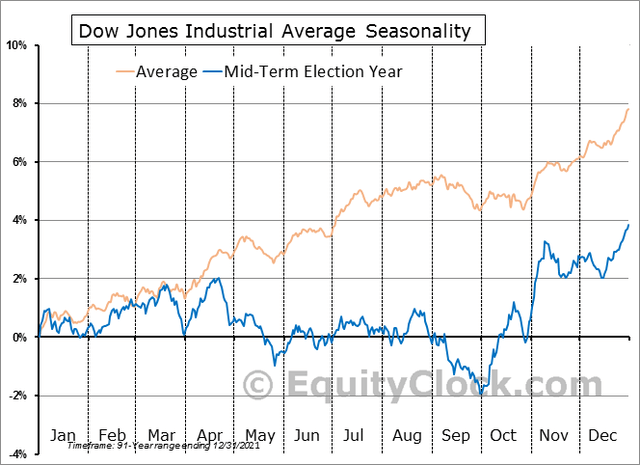

The good news for equity investors is that we are embarking on very bullish seasonal trends that take hold right about now. The fourth quarter of a mid-term year through much of the so-called pre-election year is the best historical stretch for the Dow since 1930.

Bullish: Seasonal Stock Market Trends

The Bottom Line

It’s more of the same – a strong labor market pressures the Fed to tighten financial conditions further. Next week’s inflation data and the start of earnings season will soon capture the headline all while the FOMC continues to attempt to put the brakes on the economy.

Be the first to comment