Bet_Noire

Introduction

I kept asking myself, “where to start?” before writing this article as we’re dealing with an incredibly complex market environment including, but not limited to: Supply side problems, high inflation, an aggressive Federal Reserve, very bearish market participants, a market that may or may not be cheap, and a housing market that seems to be cooling off faster than expected. The worst part is that most of these things are related, which means finding solutions isn’t easy either.

In this article, we’ll take a closer look at economic developments and the Fed’s role in driving market sentiment. The problem is that economic growth may not be bad enough to warrant a sustainable market bottom, ignoring the chance of a short squeeze.

While the latest numbers show that economic growth is too strong for the Fed to pivot (i.e., core inflation, non-farm payrolls, and job openings), we‘re getting closer to a point where Fed members will have to prioritize financial stability over fighting inflation.

It could lead to a market bottom. However, when done wrong, it’s a recipe for disaster.

So, let’s get to it!

Why We’re In This Mess, In The First Place

I’m fully aware that I’m risking turning this into another lengthy article, but we need to take a quick look back before we discuss what may come next.

At the end of September, I wrote an article covering why the Fed is in a tricky situation. We’re going to do that in this article as well. However, it’s important to note that the Fed is part of the problem.

It pretty much started in 2020 when the pandemic caused one of the fastest and most severe economic shocks in modern times. Countries around the globe quickly implemented lockdowns, which resulted in an implosion of economic demand. Moreover, nobody really knew how bad things could get, which made the uncertainty much worse.

However, the bear market of 2020 lasted just 33 days according to statistics presented by Hartford Funds. That made it the shortest bear market ever. On average, bear markets last 289 days. That’s about 9.6 months. The average length of a bull market is 991 days or 2.7 years.

Not only that but the S&P 500 added more than 16% that year, which makes it an above-average year.

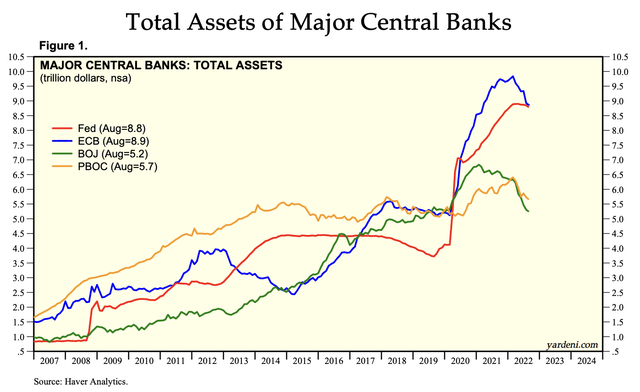

Both 2020 and 2021 were good years for fiscal and monetary reasons. Central banks boosted their balance sheet at a record pace, adding more than $10 trillion in less than two years. That’s a surge of roughly 50%.

Yardeni Research

On top of that, governments engaged in stimulus including direct payments to citizens and other measures that directly impacted the velocity of money.

Moreover, because of lockdowns, supply chains were broken. Companies did not order new supplies because the outlook was simply too insecure.

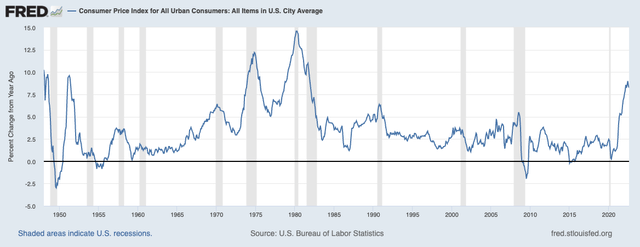

As a result, when economies reopened, a lot of money started to chase a declining number of available goods: (High) inflation was born. As of August 2022, the consumer price index is up 8.2% compared to August 2021. That’s one of the highest numbers since the 1980s.

St. Louis Federal Reserve

Now, the Fed needs to get inflation down while also dealing with a slowing economy.

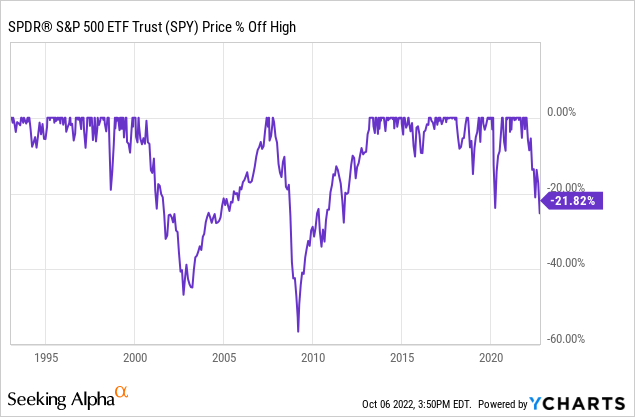

This is causing a very tricky situation where the Fed has to decide between financial stability and fighting inflation. Hence, uncertainty has pushed the market into its second bear market since the Great Financial Crisis.

The difference, this time, is that neither the government nor central banks will provide an easy way out.

When Can We Expect A Pivot?

Technically speaking, the Fed can cure a recession by lowering rates. The Fed can cure inflation by raising rates.

So far so good.

However, what happens when the Fed needs to do both at the same time? This is an issue hurting both the stock and credit market. While high inflation is good for individuals and corporations with a lot of debt, a recession poses a high risk to its ability to service its debt: Bankruptcy risks start to rise.

Bluntly speaking, it’s extremely easy for the Fed to make a big mistake in this situation.

It brings us to the following trade-off: Protecting financial stability vs. fighting inflation.

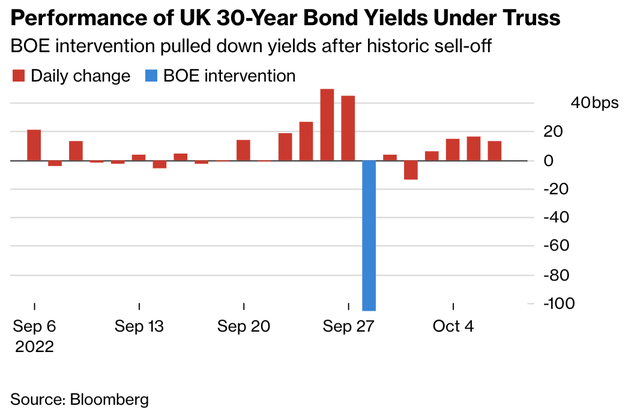

A “good” example can currently be witnessed on the other side of the pond as the Bank of England is struggling with similar issues. Last week, the BoE was confronted with a nightmare scenario, much earlier than some may have expected. The bank had to go back and buy longer-term government debt in order to solve a liquidity crunch. The daily performance of UK 30-year bond yields since early September is something we don’t see too often.

Bloomberg

According to Bloomberg:

The problem is that to deal with the market fallout from the government’s unfunded tax-cutting plan, it’s buying gilts, the first time it has done so on financial stability grounds. At the same time, its inflation-fighting mission means it’s raising interest rates and preparing to sell gilts from the separate £875 billion quantitative easing portfolio.

The BoE is the first major central bank, which combines both loosening and tightening, causing a blurred line between monetary policy and financial stability.

After all, it has shown that it’s a market maker of last resort. If the government cannot solve the fiscal situation, it can always rely on the BoE to do the right thing. At least, that seems to be the base case.

In the US, the Fed is dealing with a similar situation. One can make the assumption that raising rates increases both recession and market liquidity risks. The combination may be worse than inflation.

This brings us to the question: What stops the Fed?

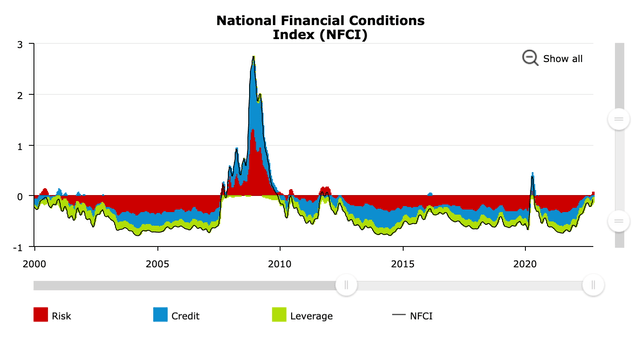

While I’m writing this, financial conditions have tightened, quite significantly. The NFCI – Chicago Fed’s National Financial Conditions Index – provides a weekly update on the US financial conditions in money markets, debt and equity markets, and the traditional and shadow banking system. Financial conditions have tightened the most since the pandemic. Since the Great Financial Crisis, financial conditions have tightened on several occasions: The debt crisis of 2011, the manufacturing recession of 2015/2016, and the pandemic. Add to that the current crisis, which I think will get a fancy name after it’s over.

Chicago Fed

What this means is that the Fed needs a way out. The bank is looking at tightening financial conditions, a looming liquidity crisis, BoE capitulation, Credit Suisse default risks, US housing market weakness, and a weakening labor market.

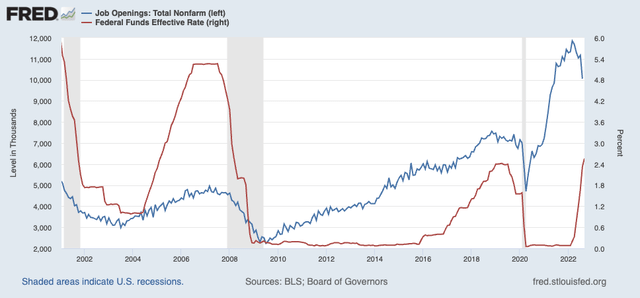

A great indicator of economic conditions – even better than non-farm payrolls – is the number of job openings. In August, that number came in barely above 10 million. The decline of more than 1.1 million jobs was one of the largest ever. Only April 2020 was worse.

In the graph below, I added the federal funds rate, which shows that the Fed has paused its hiking cycle every time when the job market started to weaken. After that, it started cutting rates.

St. Louis Federal Reserve

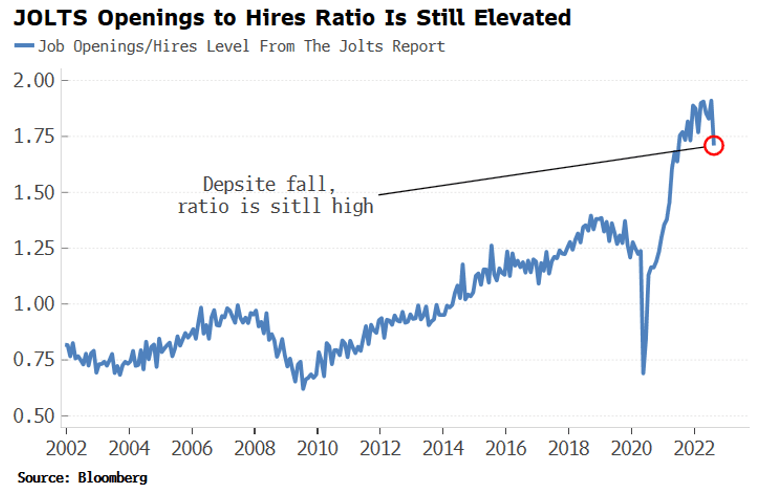

What matters here is that the latest decline represented a decline of roughly 10%. In 2020, the decline was 20%. We have seen 10% declines during recessions, but also during non-recession times. The number of openings per unemployed person is still 1.7. That is still inflationary, and the Fed knows that.

Bloomberg

It also doesn’t help (the Fed pivot) that non-farm payrolls continue to be strong. In September, the US economy added 263K new jobs. That’s above expectations of 250K. Average hourly earnings growth came in at 5.0% year-on-year, which is 10 basis points below expectations. JPMorgan makes the case that that’s “way too hot.” Former Fed official Randall Kroszner told Bloomberg TV that this keeps the Fed on track for a 75-basis-point hike at the next meetings.

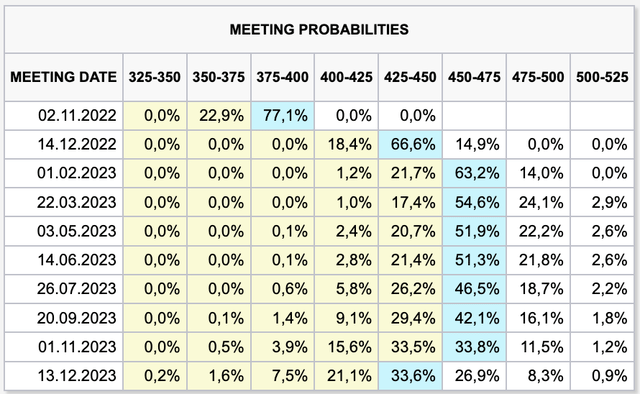

Hence, the market has started to re-price the expected Fed policy. Unfortunately, not in favor of stock market investors like myself. The market is now expecting the terminal rate to be 450 to 475 basis points. That isn’t new. However, the market doesn’t expect a cut in the summer anymore. The earliest cut is now expected to be announced during the December 2023 Fed meeting.

CME Group

If we look at December 2022 versus December 2023 Eurodollar futures, we see that the market is pricing in 17 basis points worth of cuts. That’s roughly one cut. Expectations were that the Fed would cut much more aggressively as the chart below shows as well. That’s off the table for now – despite worsening economic news. In case you were wondering, that’s why the market is so nervous.

TradingView (GEZ2022-GEZ2023)

It also didn’t help that new Fed comments hint at a continuation of the current rate hike path.

In yesterday’s Seeking Alpha market closing article, I had the pleasure of contributing some of my comments.

Essentially, Minneapolis Fed President Neel Kashkari came out saying the central bank is “quite a ways away” from pausing its tightening campaign. That’s bad because it confirms the fears market participants had, and because Kashkari has been one of the most dovish Fed members for a very long time.

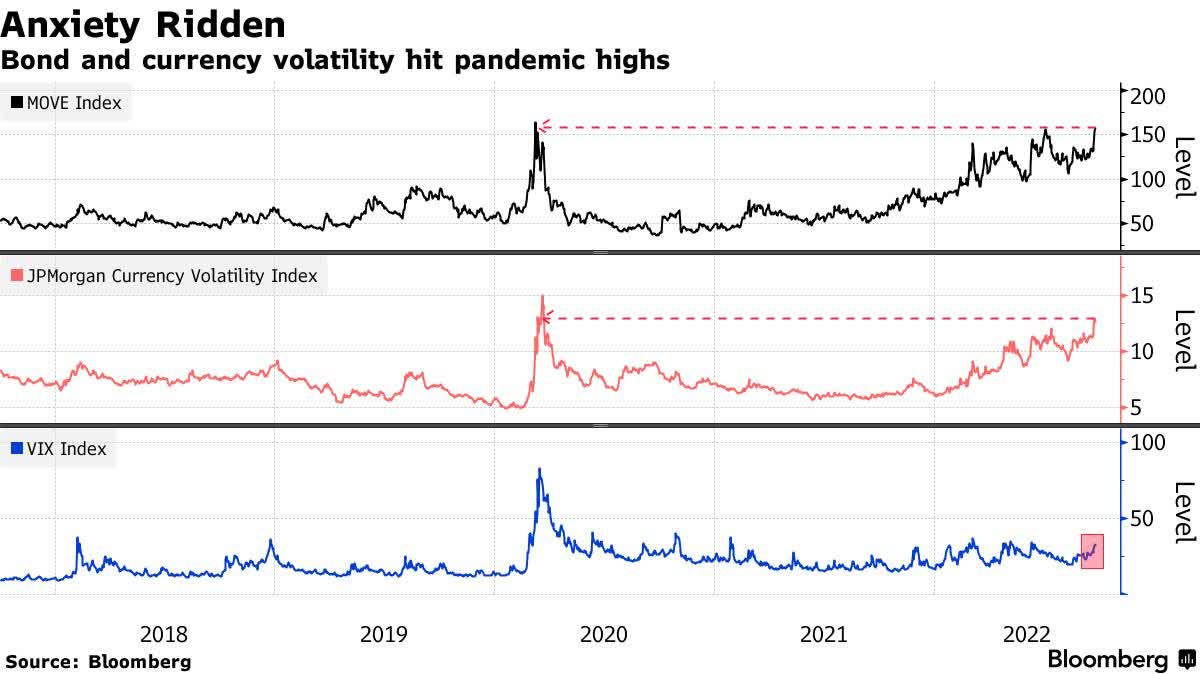

We’re basically in a headline-driven market (more than usual) between good and bad news, which is causing volatility in all asset classes to soar as the chart below shows.

Bloomberg

Or, as Rich Steinberg puts it:

“I don’t think the Fed is going to be ready to pivot so quickly,” said Steinberg, chief market strategist at The Colony Group. “We’re going to be in this kind of tug of war between good news, bad news. There’s going to still be a lot of volatility to this market.”

And it’s not just Kashkari. No, five officials made remarks that the hawkish “campaign” is the right way, and that market volatility won’t keep them from achieving the desired outcome of inflation.

“The focus of monetary policy needs to be fighting inflation,” Governor Christopher Waller told an audience at the University of Kentucky in Lexington. “We have tools in place to address any financial stability concerns and should not be looking to monetary policy for this purpose.”

As I previously mentioned, that’s tough to do as inflation is largely supply side driven. Oil, for example, is working its way up to $90 as OPEC is cutting output. The Fed cannot print oil, nor can it repair supply chains. It can only impact demand.

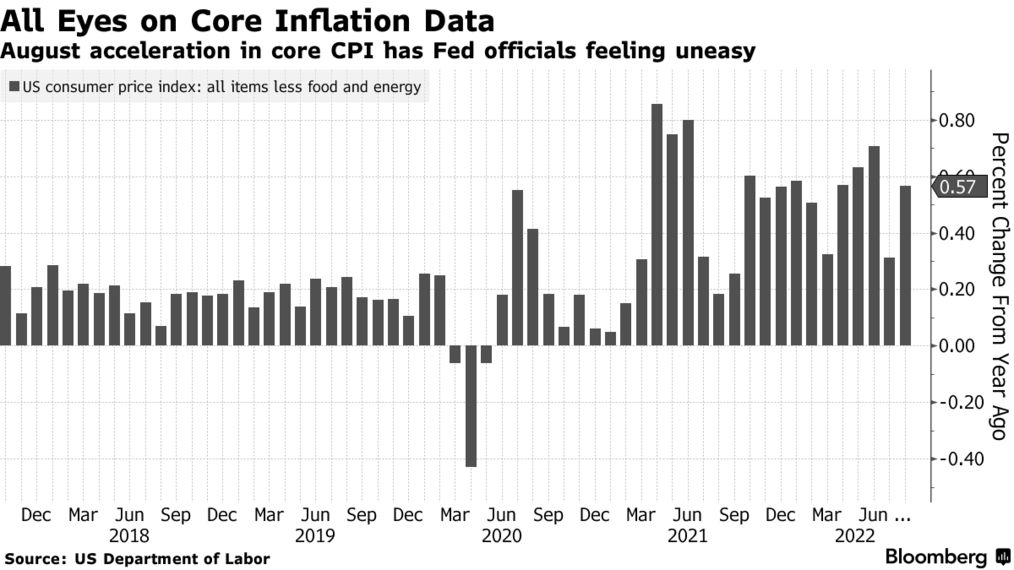

And to make things worse, core inflation remains very stubborn.

Bloomberg

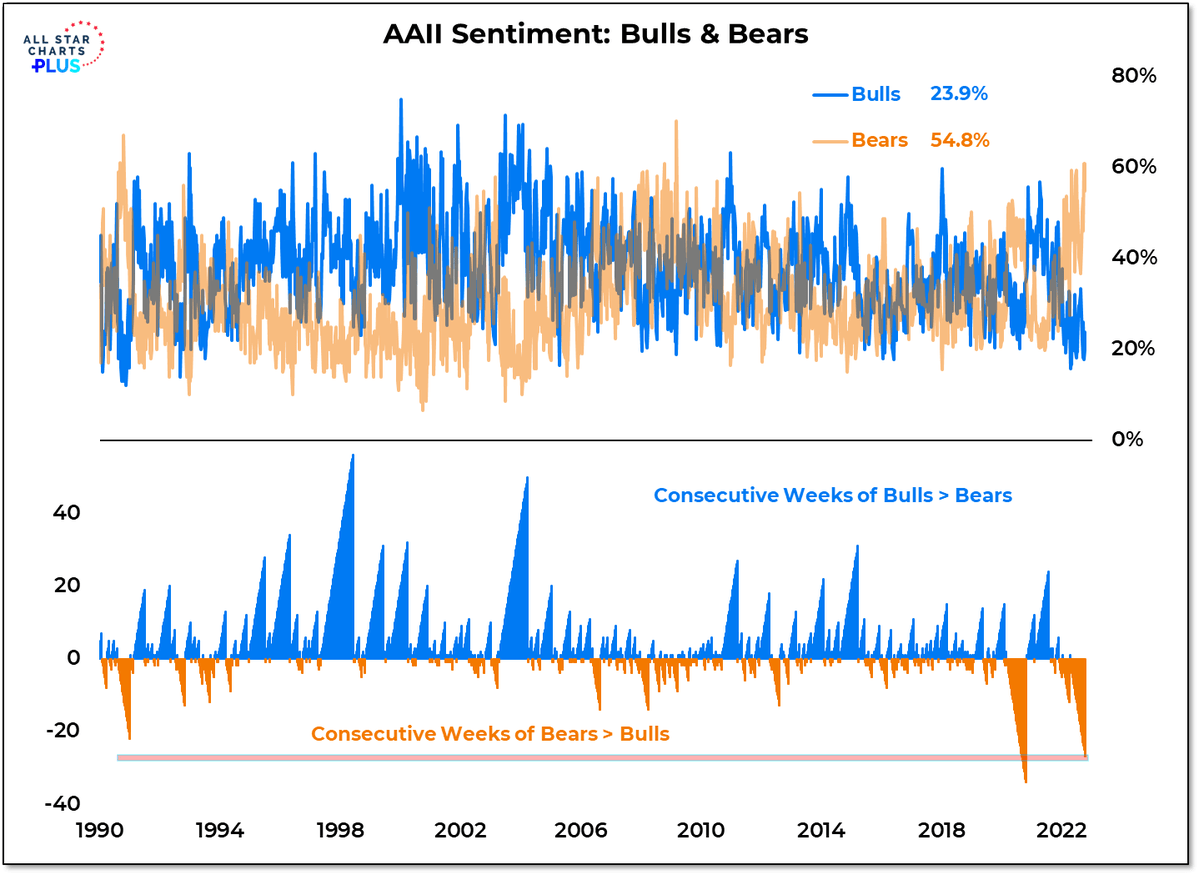

The Market Remains Extremely Bearish

What helps is that the market is very bearish. While the number of bears dropped a bit after the recent rally from the lows, overall sentiment remains in deep bearish territory.

All-Star Charts

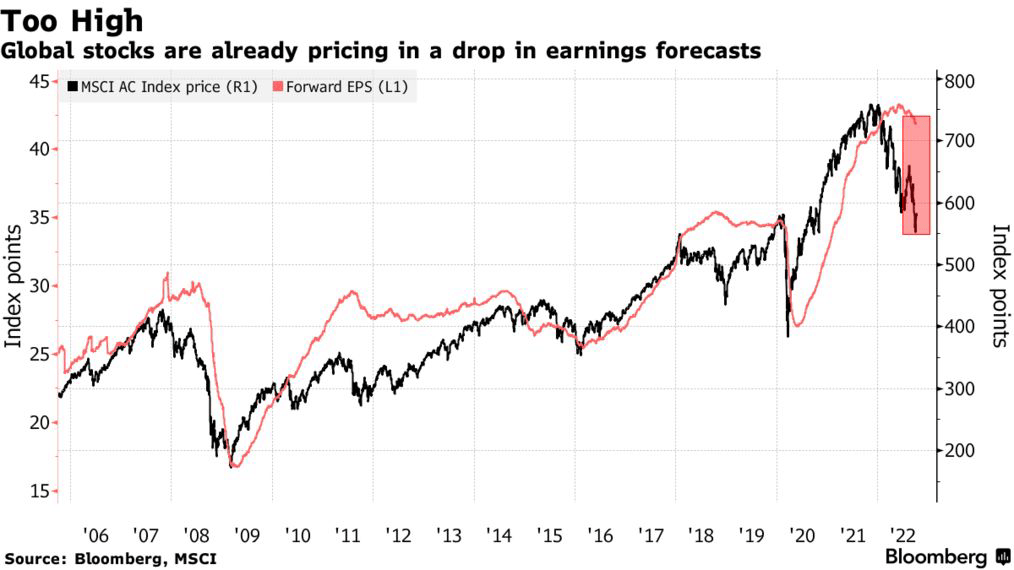

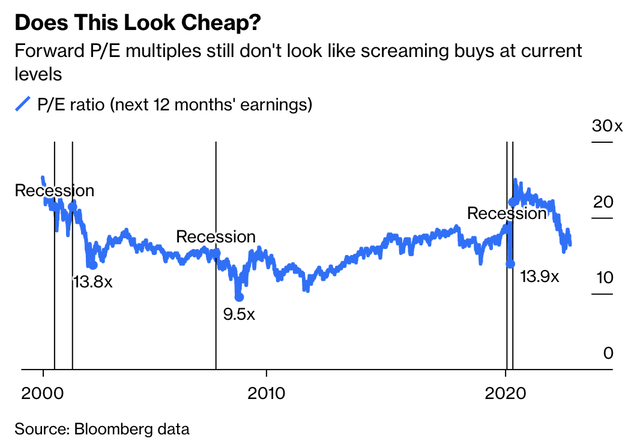

It also helps that the market is pricing in a steep decline in earnings expectations as forward EPS expectations remain high.

Bloomberg

While that helps the bull case a bit, it needs to be said that once EPS expectations come down (assuming stocks remain unchanged), the valuation will increase. Hence, a lot of valuation ratios right now, seem cheaper than the market really is.

Globally, Buckland and his team see analyst profit forecasts as “too high,” with bottom-up consensus at 10% EPS growth for the MSCI AC World in 2022, followed by 6% in 2023. They expect a 5% earnings contraction for 2023, consistent with below-trend global GDP growth and above-trend inflation. However, they note that should be much milder than the average EPS downturn in the last three big global profit recessions, which was 31%.

Bloomberg

Takeaway and My Strategy

The stock market remains in a terrible environment. Inflation remains stubborn, economic growth is coming down, and the Fed will have to choose between financial stability and fighting inflation. Achieving both is extremely unlikely.

At this point, it looks like the Fed will continue its campaign to crush inflation. Even Fed members who were dovish until the very last moment are now sticking to what has become an aggressive hiking cycle.

So far, data support these comments. The job market remains strong. While job openings are rapidly falling, they are only normalizing so far, as the number of available jobs per unemployed person is still “too high.”

Moreover, the just-released job numbers indicate that there’s enough support for multiple 75 basis points hikes. Wage growth is strong, and so far, the Fed is not seeing evidence that its actions are indeed crushing the economy.

The terminal rate is now expected to be close to 5%, with a rate cut in December of 2023.

That said, cracks are starting to appear. Financial conditions are quickly deteriorating, volatility is spiking in all major asset classes, and the Bank of England already is experiencing what it means to deal with financial instability and high inflation. The result is a mix of tightening and loosening – as weird as that may sound.

I believe that the market is oversold and ready for a bounce. A lot of bad news has been priced in and market participants have become extremely bearish.

However, we’re not out of the woods yet. Economic conditions need to become much worse for the Fed to pivot. That could end up pushing stocks lower than current levels again before we get dovish comments.

I expect a pivot in the first half of 2023. If economic growth continues to decline, I believe we will encounter elevated financial instability, pressuring the Fed enough to pick financial stability over pressuring inflation.

My strategy, therefore, remains unchanged. I’m deploying cash to buy what I believe are undervalued long-term investments. While I believe that the market could see new lows, I’m buying whenever I see quality stocks trading at a good price. I recently bought more Norfolk Southern (NSC) and Home Depot (HD) shares, I added to CME Group (CME), and I am expecting to buy some “yield-plays” in the weeks ahead from companies that suffer despite a very conservative and defensive business model. I will write an article on that this month.

I also covered Caterpillar (CAT) from a long-term “net zero” point of view.

For now, it’s important to remember that we’re not out of the woods yet. Economic growth is simply too strong for the Fed to pivot. That’s what makes market participants so nervous. Hence, I’m not in a rush to buy anything as I doubt the market will make a serious attempt to get out of this bear market anytime soon. In the first half of 2023, I expect things to turn around.

(Dis)agree? Let me know in the comments!

Be the first to comment