hxyume/E+ via Getty Images

Investment Thesis

In my previous article on Seneca Foods Corporation (NASDAQ:SENEA), I concluded the company was undervalued based on my DCF model. You can read about it here. Since then, the stock is up ~13.5% vs a loss of ~5.6% for the S&P 500. I believe SENEA continues to be undervalued from an absolute perspective and is fairly priced for a 9-10% annual long-term return, excluding buybacks. SENEA is still a buy at the moment if you want to get exposure to the US frozen and canned food market, but inflation is likely to put more pressure on margins going forward.

Recent Developments

On February 10th, 2022, the company reported Q3 FY22. Sales reached ~$446 million in the last quarter, which represents an ~8% YoY decline. The total net sales decline of $38.8 million, was largely attributable to reduced sales volumes, which equated to a $63.5 million loss. The decline in volumes was offset by higher selling prices and an improved revenue mix, which had a $24.7 million beneficial impact. I am personally not so worried about the decrease in sales volumes, as this was anticipated by the market and by management, which acknowledged that it would be hard to exceed the volumes experienced during the COVID-19 pandemic.

SENEA generated $45 million in gross profit in Q3 FY22 compared to ~$78 million in Q3 FY21. The gross margin was 10.1% in Q3 FY22 vs 16.0% in the same quarter last year. The decline in gross margin was largely attributable to cost inflation for numerous inputs such as steel, commodities, ingredients, packaging, and transportation, as well as a substantial LIFO charge in FY22. SENEA’s LIFO charge was $19.0 million in Q3 FY22, compared to a credit of $4.7 million in Q3 FY20.

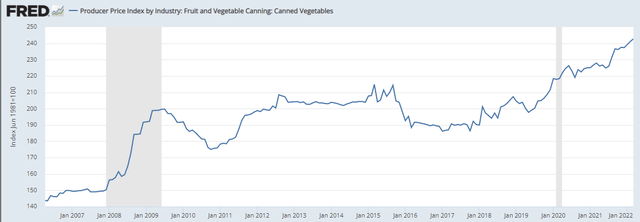

High inflation is the main reason behind SENEA’s weak margins in the last quarter and this trend seems to be persisting. The industry’s PPI has reached an all-time high in March 2022 and producer prices are up more than 6.4% YoY. As the Fed is slowly starting to increase interest rates, inflation should peak in the coming months, but the timing is still very uncertain in my opinion. Therefore, inflation is likely to be an issue for SENEA in Q4 FY22 and possibly in subsequent periods. If inflation turns out to be much stickier or higher than anticipated, this could have a profound impact on companies with tight margins, such as SENEA.

FRED/ U.S. Bureau of Labor Statistics

The business generated ~$39 million in cash from operating activities in the last quarter and spent ~$8 million on its CapEx program, resulting in $31 million of free cash flow. $21 million was used to retire debt and $10.5 million was allocated to share repurchases. SENEA bought back ~220,000 class A common shares in the last quarter at an average price of $48.76 per share. Most of the purchases were made in December 2021 when the stock was trading cheaper, which shows that management is ready to deploy more capital when the stock is trading lower.

Company Valuation

In my previous article on SENEA, I have come up with an intrinsic value of $78 per share, which I assumed at that time to be conservative based on the fact that the company was buying back stock and had a lower weighted average cost of capital.

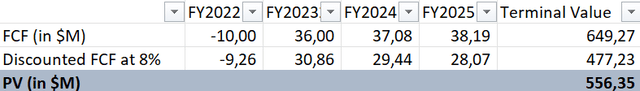

Based on 8.6 million shares outstanding, and a price of $55.2 per share, the company has now a market cap of approximately $474 million, or ~10% higher than when I wrote my first article on SENEA. In this part, I have updated my DCF model to reflect some of my latest assumptions:

- I have lowered the FY22 expected free cash flow to -$10 million from ~$34.7 million to reflect a more accurate estimate. SENEA’s YTD free cash flow stands at a negative $47.5 million, which means there is a low probability the company will exceed $10 million in FCF in FY22.

- A 3% growth rate instead of the historical 3.7% used in my previous model. I have lowered the annual expected growth rate to account for a slowdown in volume. I also believe this rate provides a more conservative value.

- I am still using a 2% terminal growth rate.

- I have increased the discount rate from 7% to 8% to account for the increase in SENEA’s WACC.

Based on my updated model, the fair value of the stock should be around $65 per share, down from the previous $78 per share. This still represents an ~18% upside from the current level, which leaves enough room to generate a good absolute return. On top of that, I believe the continuous buybacks and the high book value relative to the market capitalization offer a good margin of safety in this situation. All in all, SENEA is still a positive risk-reward opportunity and provides a good margin of safety in my opinion.

Key Takeaways

SENEA’s latest results came in as expected, with volumes slowly declining compared to FY21. Higher inflation is one of the main takeaways of the latest results, as it is likely to continue pressuring margins going forward. The stock did relatively well compared to the market since my previous article. That said, I still believe SENEA is cheap and offers a good margin of safety.

Be the first to comment