Justin Sullivan/Getty Images News

Thesis

With prevailing negative sentiment around interest increases, inflation and a possible slowdown in growth, homebuilders, including LGI Homes, Inc. (NASDAQ:LGIH), have seen significant stock price pullbacks since the beginning of the year, despite already trading at inexpensive valuations. While investor fears might have some merit, the market’s reaction is likely exaggerated. In this analysis, I examine the fundamentals of the homebuilder industry as well as LGI’s growth, profitability, and valuation status.

A Beaten Down Industry

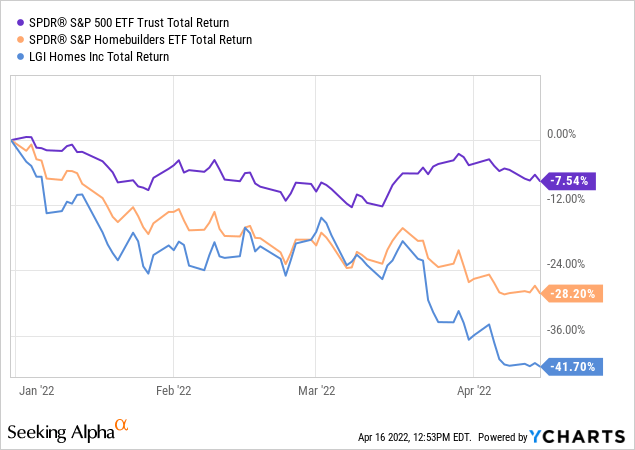

Apart from high-growth technology stocks, it is hard to identify another area of the market that has suffered more from the recent stock market turmoil than homebuilders. Marking a 28% YTD pullback, the SPDR Homebuilders ETF (used as a proxy for the industry) has accumulated 4 times the losses of the S&P 500. Many small-cap stocks in the industry have been hurt even more severely, including LGIH, recording a 42% YTD drawdown. Currently, LGI Homes trade at $90 per share, 52% down from 52-week high levels, at a $2.15B market cap.

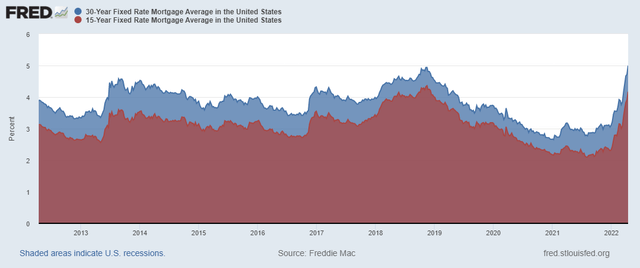

The consensus among analysts remains that the explanation for the recent beatdown is rather simple. Rising interest rates, due to a Fed effort to control raging inflation, impact house affordability as mortgage rates increase to multi-year highs. The Fed has already hiked interest rates and is expected to do so again within the next months, signaling that perhaps the era of inexpensive borrowing is coming to an end. Inflationary pressures also affect materials prices, raising the input cost for homebuilders significantly. Building materials like copper, steel, aluminum and lumber have seen prices increasing more than 40% compared to 2020 levels, significantly affected by supply chain disruptions that have led to shortages across the board.

The current geopolitical crisis, leading to soaring energy prices has also had a negative impact on the industry. Expensive gas leads to increases in materials’ transportation costs, while machinery operating costs are also elevated.

Investors fear that the prolonged housing rally in the United States is about to come to an abrupt ending, leaving homebuilders financially exposed, as sales growth stalls. Deteriorating consumer sentiment, coupled with elevated borrowing costs, would make consumers more hesitant towards purchasing real estate properties.

Illustrated in the chart below, mortgage rates are climbing to 10-year high levels with the average 30-year rate edging to 5%, while the 15-year rate is surpassing the 4% mark. Taking into account a broader timeframe, however, we will find that mortgage rates are still way below the 90s and early 2000s levels, reaching as high as 8 or 9%. Going a few years further back, we will find rates surpassing the 10% level. With the U.S housing market growing throughout the past 40+ years (with some interruptions), it is hard to see how today’s rate hikes could adversely affect growth over the span of the next decade, barring a major economic recession or other consequential geopolitical events.

Focusing on the Positive

If stock market history can offer any insights, the fact that the market overshoots both on the upside and downside is an undeniable one, and possibly the explanation for the downfall of homebuilders’ stocks. Scarred by the late 2000s crisis, homebuilders already carried very low valuation multiples, long before interest rate hikes and raging inflation became apparent. The recent aggressive pullback is, in my view, exaggerated.

Despite a prevailing negative sentiment, overall we could argue that fundamentals actually remain strong. The labor market remains strong as unemployment continues to fall, and despite inflationary pressures, the aggregate demand for houses is robust. As millennials enter their prime home-buying years, the secular trend for the industry points to expansion over the mid-term, despite the significant challenges the market currently faces. Over the short-term, house shortages also support higher price levels.

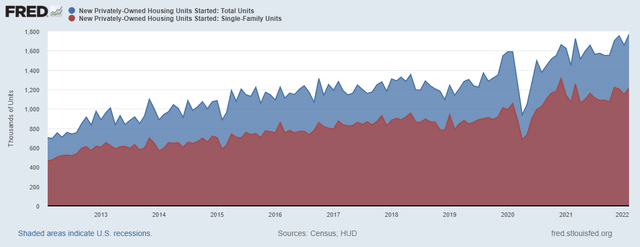

Housing starts still sit at 10-year high levels, with February 2022, marking a 6.8% rebound, to a seasonally adjusted annual rate of 1.769M units, displacing weaker January results. Permits for future homebuilding fell 1.9% to a rate of 1.859 million units, after reaching, however, record levels in January.

One thing that is important to note, in my view, is while the broader demand cool-off outlook for the housing market is probably exaggerated, a consumer-focus shift from luxury houses to entry-level is imminent. Especially as millennials weigh the purchase of their first home, in a rising interest rate environment, the demand for affordable single-family properties is likely to exhibit resilience and sustain its growth trajectory. As I will highlight in a later segment of this analysis, single-family properties also happen to be the prime focus of LGI Homes.

LGI’s Business Growth and Profitability

LGI Homes is a Texas-based builder of new construction homes and housing developments, with its business operations primarily focused in the southwestern and central regions of the United States. Currently recognized as the 10th largest residential builder in America based on units closed, LGI’s business model is focused on offering entry-level homebuyers quality homes at affordable prices. Today, the company’s business is well-diversified, with the central region representing 45% of home closings, the southeast region 22%, and Florida 13%. LGIH operates in some of the hottest real estate markets in the U.S (including Texas and Florida), exhibiting leading population and economic growth prospects.

Over the past 5 years revenue has grown at a 20%+ CAGR, capitalizing on the company’s strategic geographic placement, efficient operations and macroeconomic tailwinds. 2021 represented a year of outstanding financial performance for LGI Homes. The company set new records for closings and revenue. Sales increased almost 29% YoY to over $3B, driven by a 12% increase in closings to 10,442 homes. Focusing on future growth, the company invested over $1B last year, expanding its land portfolio to 92,000 owned and controlled lots, an increase of 49% YoY.

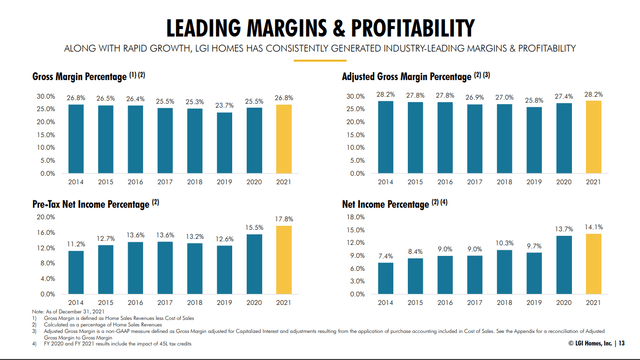

A 22-23% gross margin is often considered by analysts as the threshold for a well-managed and efficient homebuilder. LGI historically displays strong gross margins, reaching 26,8% for the 2021 fiscal year. While in 2022 inflationary pressures, shortages in the supply chain, and slowing sales growth are likely to cause margin contraction, still the company’s profitability is expected to remain strong.

With a focus on shareholder value appreciation, the company returned almost $194 million to stockholders through the repurchase of 1.3M shares of our common stock, in the 2021 fiscal year, while also recently announcing the Board’s approval of an additional $200M for future share repurchases.

Valuation

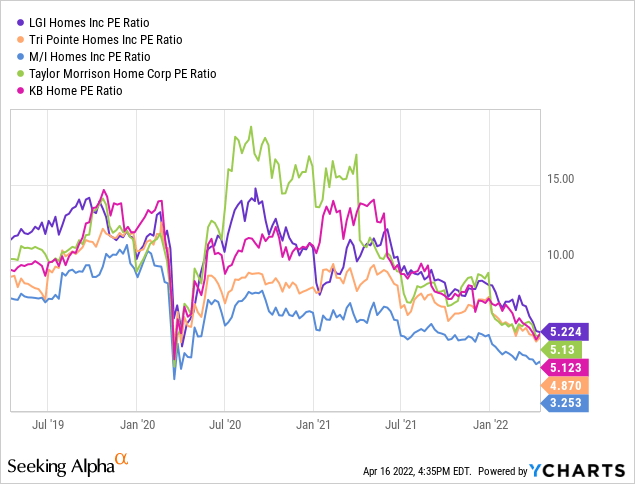

For better or worse, homebuilder stocks are highly correlated and trade on very similar patterns with each other, and of course with the industry SPDR Homebuilders ETF (XHB), at least over the short-term. Picking winners on a valuation basis is really about long-term returns, as finding the better deal could yield improved annualized returns, considering, of course, that the industry as a whole performs well.

In this valuation examination, first, P/E multiples across different companies in the industry are displayed over a 3-year time span. The group of homebuilders selected consists of companies in the $1.2 – 3.2B market cap range.

Valuations are extremely inexpensive across almost every homebuilder company trading in the U.S stock market. With the group selected not providing any exceptions, LGI Homes appear to be actually slightly more expensively valued, compared to its peers, although at a 5.2x P/E expensive is probably a poor choice of words. In terms of historical standards, LGI trades significantly lower than its 3-year average P/E of 10.9x, although that is the case for the entire group. Looking at more valuation metrics, LGI Homes trades at a 1.5x P/B and 0.7x P/S ratios, both very inexpensive.

Final Thoughts

After all things are considered, I believe homebuilder stocks represent an attractive value play in the current market conditions, and LGI Homes is a solid choice within the industry. The company is exhibiting strong growth, ample profitability and excellent geographical positioning inside some of America’s fastest-growing real estate markets. Even if more turbulence is to follow, as for a long-term choice, I would rate the company as a buy.

Be the first to comment