metamorworks

Investment Thesis

There is an overwhelming amount of data online for businesses to sift through to try and effectively target their customers, and so they call on Semrush (NYSE:SEMR) to help aggregate this data and turn it into meaningful insights. The company went public in March 2021, which is unfortunate timing for a high growth tech stock – yet this company has actually outperformed the S&P 500 since its IPO!

Does this outperformance speak to Semrush’s relative strength amongst technology companies? I put the company through my investing framework to see whether or not it looks like a good investment right now.

Business Overview

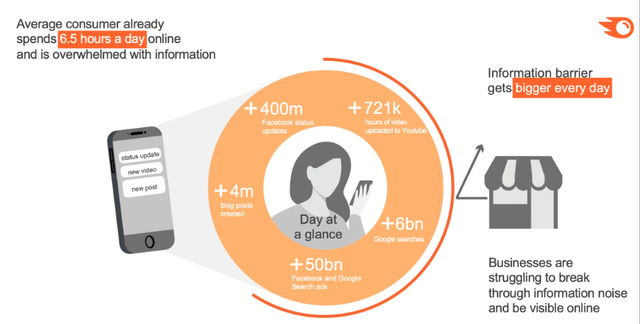

Semrush is a leading online visibility management platform, operating a software-as-a-service model. Businesses are finding it increasingly difficult to reach customers online as the sheer amount of information and data available becomes overwhelming to both businesses and customers alike.

Semrush May 2022 Investor Presentation

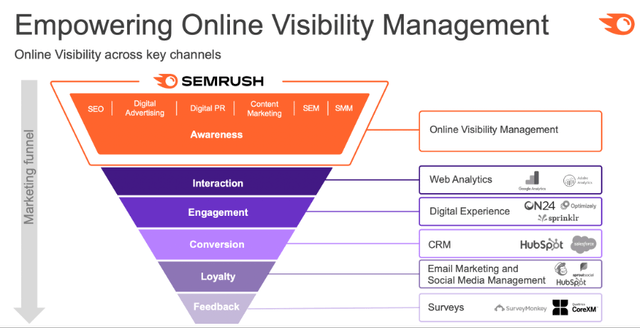

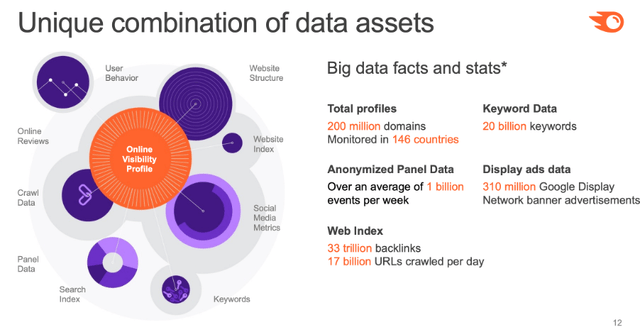

Semrush’s platform helps companies to identify and reach the right audience for their content, in the right context, through the right channels – whether that is via social media, search, digital media, or more. The platform enables Semrush customers to understand trends, and gives actionable insights to improve their online visibility, drive high-quality traffic to their businesses, distribute highly targeted content to their customers, and measure the effectiveness of their digital marketing campaigns.

Semrush May 2022 Investor Presentation

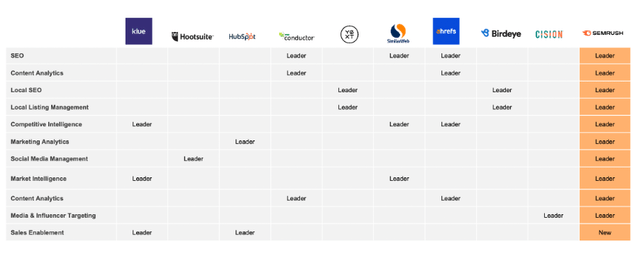

Semrush’s customers vary substantially in both size and industry, ranging from Meta (META), Salesforce (CRM), and Disney (DIS) to Mailchimp, boohoo (OTCPK:BHOOY), and even Seeking Alpha. It is able to serve all these customers thanks to the huge amount of data it has access to combined with the sheer breadth of services it offers. According to G2.com, Semrush is a leader in a huge number of traditional martech (marketing – technology) categories, demonstrating its ability to offer solutions that are at a similar level to its competitors who maybe only specialize in one or two.

Semrush May 2022 Investor Presentation

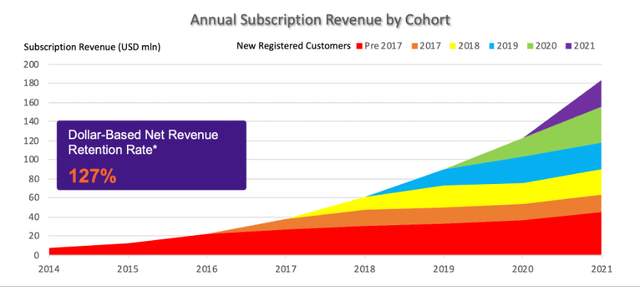

Perhaps the most exciting aspect for investors is Semrush’s ability to land and expand with its customers. This business demonstrates one of the most attractive cohort analyses that I’ve seen, and clearly demonstrates why this company has seen great success since its founding. Not only are cohorts remaining with Semrush, but they are continuing to increase their spend – leading to a dollar-based net revenue retention rate of 127% as of Q1’22.

Semrush May 2022 Investor Presentation

Economic Moats

With every business, I look to see if there are any durable competitive advantages (aka economic moats) that will help the company continue to thrive whilst protecting itself from competition.

One of the most substantial economic moats for Semrush comes from its scale, which is an unusual thing to say for a ~$1.7B company. Yet we have already seen that Semrush has one of the broadest range of offerings in the industry, and it becomes much more attractive for a business to have all its marketing tools on one platform, provided this platform does a good job. It will also be difficult for competitors to catch up with Semrush across all these different solutions due to the level of data that Semrush possesses – another benefit of its scale.

Semrush May 2022 Investor Presentation

That data then leads us onto a second moat, albeit a weaker one, and that is the network effect. As Semrush grows the number of customers on its platform, it receives more data from those customers, which it can then integrate with its own data and use to improve algorithms and outcomes. Improved outcomes leads to more customers, leading to more data, and the virtuous cycle keeps on repeating.

Another moat demonstrated by Semrush’s impressive dollar-based net retention rates and its cohort analysis is switching costs. Once a company gets their marketing set up on Semrush, and integrates their data into the Semrush platform, it becomes onerous to switching without good reason. Plus, the latest DBNRR of 127% shows that not only are customers sticking with Semrush, but they are also spending more. This is even more impressive when you consider that Semrush does serve SMBs (small and medium sized businesses), which are more likely to go bust and therefore leave Semrush – but even taking this churn into account, they achieve a DBNRR of 127%? Very impressive.

If that wasn’t enough, Semrush also benefits from counter-positioning against the walled-gardens of Google (GOOG) (GOOGL) and Meta, as well as the other specialized competitors. Google and Meta offer competing solutions, but are incentivized to prioritize their own paid channels (e.g. Facebook, Instagram, YouTube, Search) and do not operate across rival networks. Semrush is open, transparent, and independent, meaning that customers of Semrush can take comfort in the fact that there are no potential conflicts of interest.

I’m also going to give the company credit for its brand, purely because it has such a broad range of offerings and is a leader across so many different categories.

For a $1.7B company, Semrush has an awful lot of moats to enable growth whilst fending off the competition.

Outlook

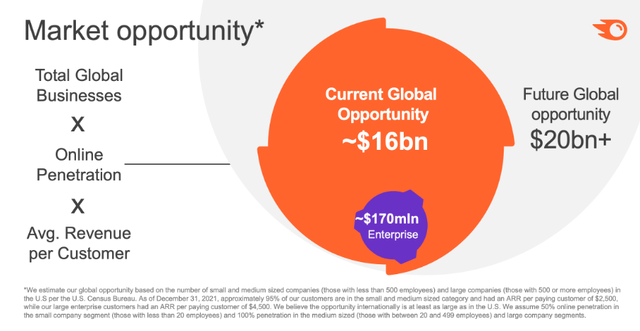

Semrush sees its current total addressable market as ~$16B, with the potential for that to expand to $20B over time. The company generated $205m in revenue over the past 12 months, which equates to ~1% of this $16B opportunity – clearly this is a business with plenty of room to expand in the future.

Semrush May 2022 Investor Presentation

I also believe that the amount of data generated online is only going to continue to increase exponentially, and businesses will be more and more reliant on specialist companies who can deal with such vast swathes of data and use it to provide actionable insights. I think this is a tailwind that will help push Semrush onto continued success.

Management

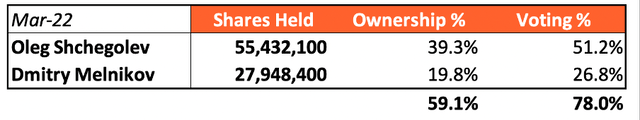

When it comes to fast-paced, innovative companies, I always aim to find founder-led businesses where inside ownership is high. I’m happy to say that we have not one, but two founders still involved in the business: CEO Oleg Shchegolev and Board Member Dmitry Melnikov.

Semrush announced in June 2022 that there would be some changes to its leadership team, with Shchegolev stepping down as President to be replaced by CSO Eugene Levin, and Dmitry Melnikov stepping down as COO to be replaced by Vitalii Obishchenko. It’s interesting to see both co-founders take a bit of a step back, but Shchegolev in particular remains in that CEO role and will continue to be instrumental to Semrush’s success.

Semrush May 2022 Investor Presentation

I want to invest in companies where leadership has skin-in-the-game, and Semrush boasts the highest level of insider ownership that I have seen in any company thus far! The two co-founders own ~59% of the company, and have a combined voting power of 78%. These two certainly have skin-in-the-game, and therefore their incentives are highly aligned with those of shareholders.

Semrush 2022 Proxy Statement / Excel

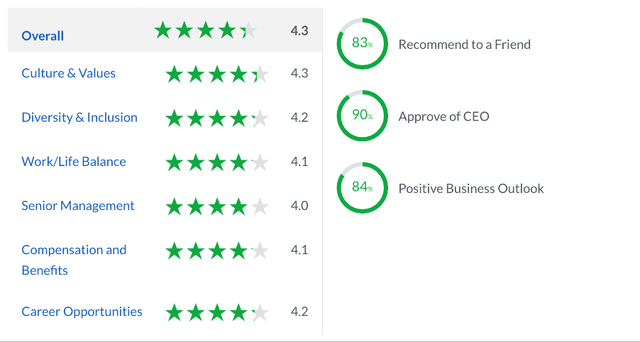

I also like to take a quick look on Glassdoor to get an idea about the culture of a company, and Semrush gets some strong scores from the 167 reviews left by employees. Any score over 4.0 is impressive, and Semrush achieves or exceeds this score in every single category. Not only this, but the company gets above 80% for Recommend to a Friend and Positive Business Outlook. All these signs point to a business where employees both believe in the company’s prospects and where they also love to work.

Financials

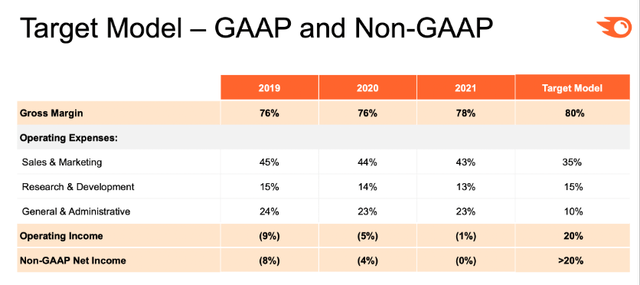

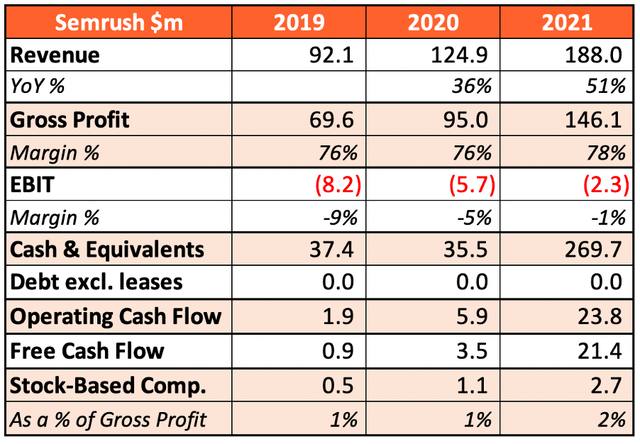

Whilst there may not be a ton of historical data, what I can see from Semrush’s financials brings a smile to my face. The company accelerated its revenue growth in 2021 to 51% YoY, doing so whilst growing gross margins to an impressive 78% and generating positive free cash flow. The company may currently be loss-making, but only just, and it has a pristine balance sheet to help it cope with any sudden changes in the market.

Also, take a look at that stock-based compensation – there are a lot of companies out there who could learn a thing or two about SBC from Semrush! Despite increased IPO costs, SBC in 2021 was a meager 2% of gross profit, so this company is able to grow whilst avoiding shareholder dilution and the other risks associated with high stock-based compensation.

Valuation

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Semrush is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

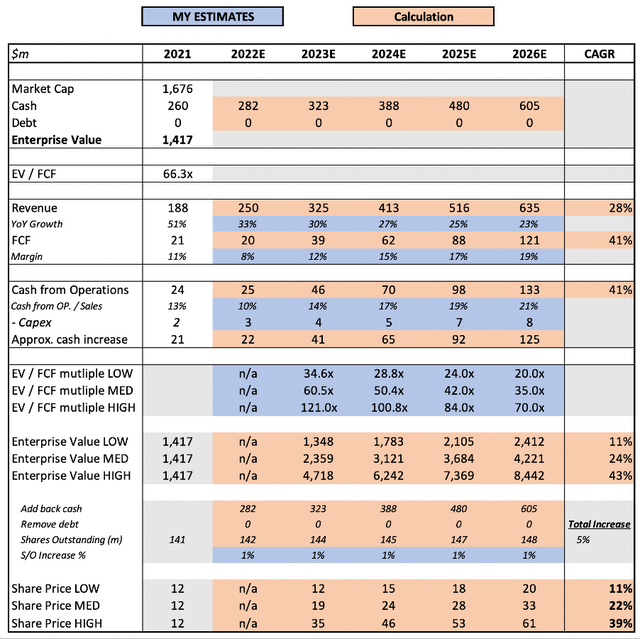

I have assumed revenue growth of 33% for 2022, in line with guidance offered by management in the Q1’22 earnings release. I have also allowed for a fall in the 2022 FCF margin due to relocation expenses, but more on that in the risks section. I have conservatively assumed a gradual slowdown in revenue growth, such that Semrush’s revenue grows at a 28% CAGR over the period. I’ve also assumed FCF margin expansion roughly in line with Semrush’s long-term operating margin of 20%.

Semrush May 2022 Investor Presentation

My final EV / FCF assumption for 2026 is 35x, which I feel is also a conservative estimate – particularly if Semrush grows revenue above my expectation, which I believe it very well could. Either way, I’ve added in a range of multiples if you think I’m being too optimistic or pessimistic.

Put all that together, and I can see Semrush shares achieving a 22% CAGR from 2022 through to 2026 in my mid-range scenario.

Risks

There are a few risks for investors to be aware of: I think Semrush will protect itself successfully from the first two.

The first risk comes from competition, particularly from the behemoths of Google and Meta. Yet as we have seen, Semrush already has a number of moats protecting the business from competition, and it also benefits from counter-positioning against these tech giants. Until Google or Meta change their walled-garden approach, I do not foresee them damaging Semrush’s future growth – they certainly haven’t done so far.

The second risk comes from Semrush’s ties to Russia, which has been heavily sanctioned following its invasion of Ukraine. As per the company’s annual report, 691 of Semrush’s 1,173 full-time employees were based in Russia, although sales in the region are not significant. Thankfully, the company announced in Q1’22 that it planned to wind down operations in Russia, with a goal to relocate substantially all employees by the end of September 2022. The company has taken clear steps to distance itself from Russia and remove the geopolitical risk, and so I do not foresee this being a risk to Semrush moving forward. It’s worth highlighting that there will be incremental one-time relocation costs of $14m-$16m for the winding down of Russia operations, but it is a small price to pay.

The final risk that I think could hit Semrush harder than other SaaS businesses is that of a recession, or at least difficult economic times ahead. Whilst the company serves customers of all sizes, the annual recurring revenue per paying customer in 2021 was $2,584 – this is not a huge amount, and highlights the fact that Semrush does serve a substantial number of SMBs who will be hit hardest by a recession. Furthermore, marketing spend is probably the first thing to get cut when a recession hits – although you could certainly argue that Semrush’s tools help to make marketing more efficient, and therefore may be more in-demand as marketing departments try and get as high an ROI as possible.

Semrush is a company that has constantly beaten Wall Street’s expectations, so it will be interesting to see if management achieves (or even exceeds) its revenue guidance of 33% YoY growth in 2022 given the macroeconomic turmoil. If it does, then this is a sign of considerable strength from Semrush.

Bottom Line

Honestly, I think Semrush is an absolutely brilliant business.

It has a ton of economic moats, a perfect balance sheet with an equally strong financial profile, tailwinds driving it forward, co-founders with an insane amount of skin-in-the-game, and it has continually executed on its strategy.

With a market capitalization of ~$1.7B, I believe that this high-quality small cap stock has been kicked to the curb during all the market turmoil. Semrush has so much going for it, and I for one will be adding to the small existing position that I currently have.

Be the first to comment