Liudmila Chernetska/iStock via Getty Images

Co-produced with Treading Softly.

I’ve long loved watching Christmas movies after Thanksgiving has passed as we prepare for Christmas to arrive.

One of those movies was the classic “Rudolph the Red-Nosed Reindeer.” It contained a cast of “misfits” who eventually saved Christmas from disaster.

Not only does this crew of an unusual reindeer, dentist-wannabe Elf, and failed prospector help solve multiple problems, but they also make landfall on an island of misfit toys – toys that are unloved and seemingly unwanted.

Misfits finding misfits – go figure.

When it comes to the market, some stocks fall into the misfits section. They’re misunderstood or seemingly unwanted by “conservative” investors. Does that make them “bad”? No! Like the misfits in the movie, these misfit stocks can save Christmas by fueling your portfolio with substantial dividends!

Today we’re going to unbox a few misfits and examine what makes them tick and how you can benefit from their misfit label.

Let’s dive in!

Pick #1: NLY – Yield 16%

2022 will be a year for the record books for the mortgage industry. The Federal Reserve is hiking at the fastest pace since the Volker Fed, and the real estate industry is feeling it.

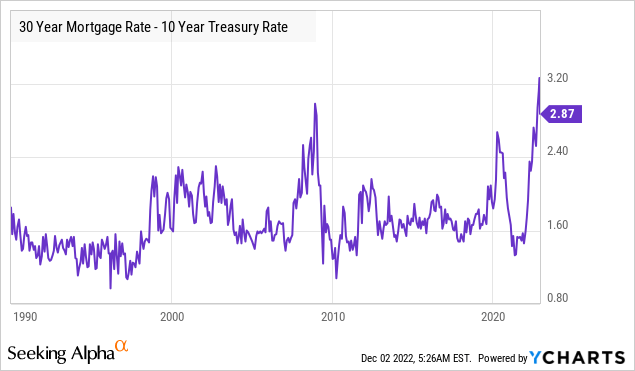

While Treasury rates have risen quickly, mortgage rates rose even faster. The difference between the 10-year Treasury rate and the 30-year mortgage rate exceeded the heights during COVID and even the heights reached during the mortgage meltdown that sparked the Great Financial Crisis.

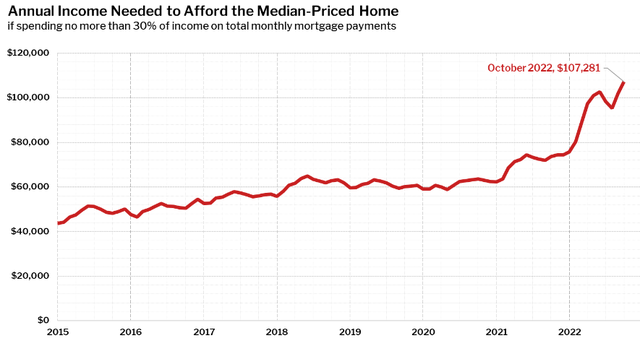

We are stunned that the Federal Reserve is apparently happy with utterly crushing the housing market. The affordability of homes has hit a new low. For years, a family with a $60,000 income could afford an average home. Today, they would need nearly 80% more income. Source.

Sure, inflation has been beneficial for wages, but your average worker isn’t earning 80% more than they were pre-COVID.

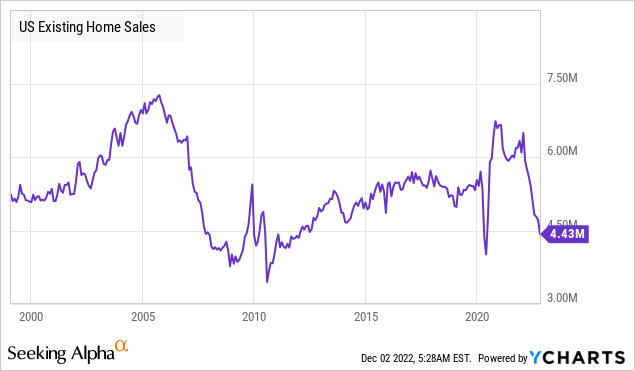

The result is blindingly obvious to us – the housing market is going through a recession that will make the GFC look like a mild dip. Existing home sales have already crashed faster than in any period in history.

Sellers continue to hold out, refusing to reduce prices, but Econ 101 applies. When supply is greater than demand, prices come down. Demand is heading to all-time lows. Even if people want houses, very few can actually afford them.

For companies like Annaly Capital Management, Inc. (NLY), the rising spread between mortgage rates and Treasury rates has led to a dramatically lower book value. This is because NLY is long agency MBS (the securities that determine “mortgage rates”) and is short U.S. Treasuries. So when MBS rates climb faster than Treasury rates, NLY’s decline in value from MBS is larger than their gain in value from their short position for a net loss.

Fortunately, it is an unrealized loss, as NLY’s business strategy is to buy and hold agency MBS – not to trade in and out.

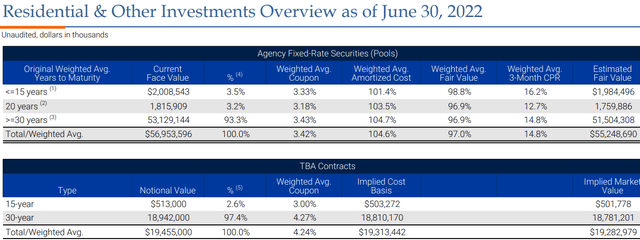

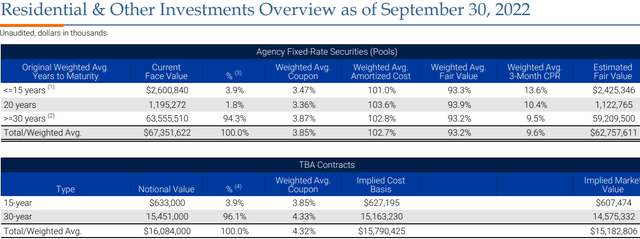

Note that in June 2022, NLY owned about $76.4 billion in face value in agency MBS and agency TBA Contracts (MBS futures).

In September, they increased that amount to $83.4 billion:

NLY is not realizing losses. They are buying into the dip and averaging down so that when MBS prices go up, they will own more than they owned on the way down.

With spreads between mortgage rates and Treasury rates at the highest they have been since the early 1980s, it is not a huge leap to believe that the spread will come down. Either through MBS prices rising or Treasury rates declining. It is more like an inevitability, with the big question being “when?”

The housing market is crashing.

What does this mean for residential agency mortgage-backed securities?

- The supply of new mortgage MBS has diminished dramatically. If people are not taking out new mortgages, then new MBS are not created.

- A lower supply of agency MBS will be a tailwind for MBS prices.

- The housing market in the U.S. is huge. It is inevitable that the economic damage in the housing market spreads over to other sectors of the economy. When it does, the “flight to safety” trade will provide a tailwind for agency MBS prices.

- The Fed historically responds to a recession by cutting interest rates. The high coupon MBS that is being bought today will trade at a large premium.

NLY’s earnings, and dividend, have held up through the decline in book value because the spread between mortgages and the cost of borrowing is what determines NLY’s ability to make money. The higher the spread, the higher earnings they have on MBS. The forward earnings on MBS that NLY is buying today are higher than they have ever been in the history of the company.

Can mortgage rates go higher? Yes. That could continue to be a headwind for NLY’s book value. Yet earnings continue to be dramatically higher than the dividend.

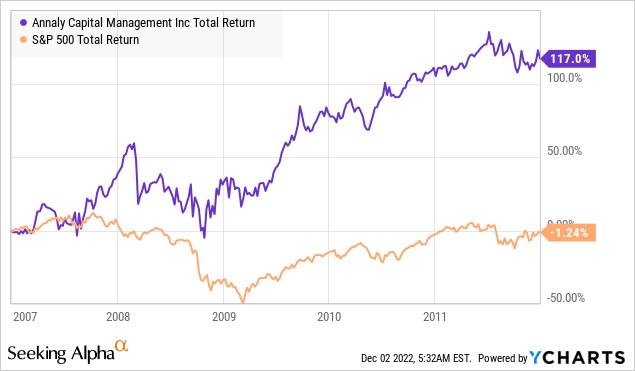

What happened the last time the mortgage to 10-year spread spiked up, when home sales plummeted, and the residential housing market collapsed? NLY’s price and dividends skyrocketed.

We didn’t expect the Fed to so willingly crush the economy, but since that seems to be the path the Fed is determined to take, we are happy to hold NLY in our portfolio.

Pick #2: HQH – Yield 8.6%*

The healthcare sector is one that frequently marches to the beat of its own drummer. On one hand, healthcare is an essential need. On the other, it is elective healthcare that produces massive profits.

The Baby Boomer Generation is the largest and wealthiest generation ever seen. As they age, their demand for healthcare is becoming insatiable. Yet healthcare is a sector that politicians love to regulate. Regulation can have numerous intended and unintended consequences.

Small companies can become huge overnight successes with a single drug, usually acquired by one of the majors with shareholders experiencing huge gains. Yet, many companies working on supposedly potential blockbuster drugs operate on shoestring budgets, and shareholders face endless dilution as the promised results never arrive.

In short, healthcare is at once one of the most profitable sectors in any economic environment while also being very risky at the individual company level.

If you are going to be making individual picks in the healthcare sector, you really need to know what you are doing. There are a lot of landmines for investors.

Rule #1 of investing: Know what you don’t know. I can’t even pronounce the names of the medications my doctor gives me, let alone make intelligent predictions about which ones will be the next big thing.

Fortunately, I don’t need to in order to collect great dividends and see great returns from investing in the healthcare sector. I turn to one of my favorite income investor tools: the closed-end fund (“CEF”).

CEFs can be a great way to gain exposure to a sector with a manager who knows it far better than you do. For healthcare, my manager of choice is Tekla, which has been investing in healthcare for decades and has had great success.

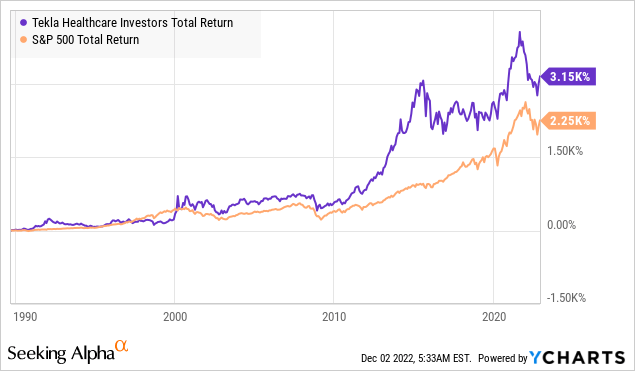

Tekla Healthcare Investors (HQH) has outperformed the S&P 500 index since the 1980s.

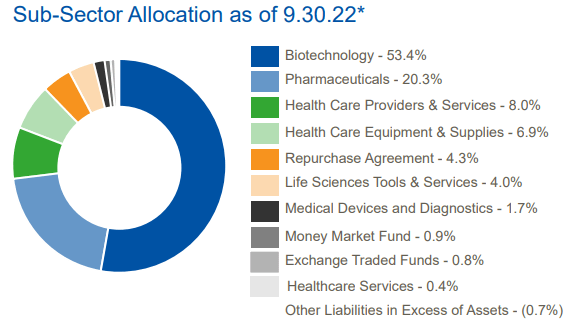

HQH invests in a variety of healthcare sectors, with a focus on biotech and pharmaceuticals.

Factsheet

This provides investors with diversified exposure to the healthcare sector through 150 holdings.

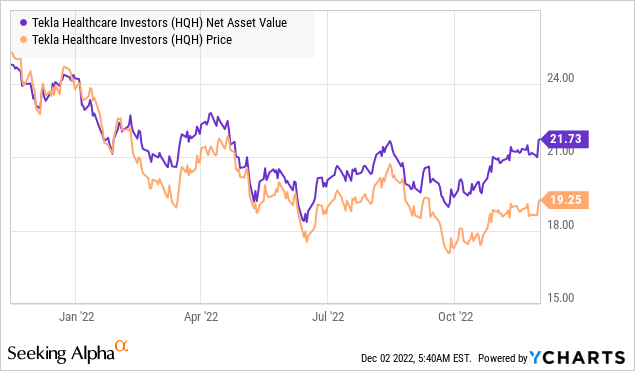

Part of HQH’s longevity is its variable distribution policy*. HQH distributes 2% of NAV each quarter. A policy that ensures HQH is able to retain holdings through downswings while providing assurance to investors that they will get dividends when prices recover. For the past year, NAV has been declining, and the dividend has declined with it.

Over the past two months, we have seen NAV materially recover. The next dividend of $0.39 (declared Nov. 15th, ex-div was Nov. 23rd) is based on NAV as of September 30th. However, that was a low point for HQH’s NAV, which has gained 11% since then on its way to the next computation date of the distribution on Dec. 30th.

Perhaps the knowledge that the December payout will be relatively low is why the price of HQH is at a huge 11% discount to NAV. That is fine with us because we are long-term investors. We aren’t buying for just December’s dividend. We are buying to collect dividends for several years.

We can buy today before the market price catches up with the recovery in NAV. If the stock market takes another turn down and NAV falls, we already bought at a lower price, and the dividend yield will still be attractive at over 8%. If the rally continues, then we can enjoy the market price racing to catch up, and our dividend income will grow with NAV. Either way, the current price makes for a very attractive point to buy.

*The 8.6% yield calculation includes a projection of the March distribution which will be based on the Dec. 30th NAV.

Conclusion

HQH and NLY are big income-paying picks that can be confusing when an investor takes a casual glance their way. How can they pay such big distributions, and how do they really work? Well, we’ve helped shave a few layers of mystery off of these misfit income producers.

When it comes to cheering for the underdog, pulling for the outcasts, or helping out the misfits, we naturally love to do so when we feel stability in our own lives.

With misfit investments, those who understand them can benefit from the market casting them off. Not all misfits are good investments for all goals. Knowing your goal, your focus, and your risk tolerance is important before making any investment decision.

NLY and HQH can play an important role in one’s income portfolio if they know how they operate and have adequate risk tolerance.

Those who don’t take time to take stock in themselves may find themselves unsure and stressed – the opposite goal of our Income Method! So take time to properly evaluate any pick before making a decision. This way, you can have an enjoyable holiday season.

Next up, I’m going to watch Frosty!

Be the first to comment