Nastasic/E+ via Getty Images

The concept of anti-matter is well known among physicists, but not to the general public, as the latter is only familiar with what’s visible to the naked eye. In the business world, stores like Walmart (WMT), Target (TGT), and Home Depot (HD) are perhaps the most visible, but not behind the scenes operators like NCR Corporation (NYSE:NCR).

NCR Corp. has seen material share price weakness over the past 12 months, as shown below, and in this article, I highlight why the stock is a worthy contender for potentially strong total returns from here.

NCR Stock (Seeking Alpha)

Why NCR?

NCR Corporation may not be a household name, but its technology services operate behind the scenes and touch the lives of everyday people. It provides payment and software solutions primarily to the banking, restaurant, and retail sectors. This includes digital banking, ATMs and self-service, Enterprise POS (point of sale), self-checkout, and restaurant software. Next time you’re at the checkout stand, take a look at the brand on top of the machine, and you might well see the NCR name.

NCR is gradually transforming itself into a higher quality enterprise, as it continues to grow its software-as-a-service revenue. This results in a more predictable and importantly, recurring revenue stream, which currently represents 62% of its total revenue. This is generally viewed as being far more favorable to perpetual revenues, which are one time in nature, and dependent on the unpredictability of the timing of customer upgrades.

NCR is demonstrating resilient growth amidst a challenging economic backdrop, with high interest rates and inflation. This is reflected by revenue being up by 8% YoY on a constant currency basis during the third quarter. This was driven by expanded partnerships, including one with a chain of 950 convenience stores and gas stations, with software subscriptions on 5,000 platform lanes.

Moreover, NCR is benefiting from a strong hospitality environment, with strong demand across enterprise and SMB customers, as consumers are showing no signs of slowing down, especially on pent up travel and restaurant spending despite higher inflation.

Also encouraging, NCR is showing strong signs of positive operating leverage, as adjusted EBITDA outpaced revenue growth, at 15% YoY growth. This was driven by a 230 basis point EBITDA margin expansion over the prior year period, as new customer additions to its software-led platform require low incremental operating expense.

Looking forward, dividend seeking investors have something to look forward to with the upcoming split in NCR’s business. The two companies will have each have a simplified business structure with different segment focuses. The SpinCo is anticipated to be less capital intensive with a stable recurring revenue stream and in return, deliver a dividend to shareholders. This was highlighted by management during the recent conference call:

NCR RemainCo will include our retail, hospitality, digital banking and merchant services businesses. RemainCo is transforming to a software-led growth company. These businesses operate in markets where we expect to see continued spending on technology to run the store, run the restaurant and deliver digital-first banking solutions. We believe NCR’s RemainCo will continue to be a strong competitor for those upgrade imperatives.

ATM SpinCo, which is our ATM business, includes the majority of our Payments and Network business aside from the Merchant Services and all of self-service banking. SpinCo is expected to be a stable recurring revenue business with solid cash flow generation that can allow us to deliver cash back to shareholders through a dividend payment.

One thing to be mindful of is that NCR employs a fair amount of leverage, with a 3.4x expected net debt to EBITDA ratio for RemainCo and a targeted 3.4 to 3.8x leverage ratio for SpinCo (which will be less capital intensive and require less growth spending). Over time, I’d like to see leverage trend down below the 3x.

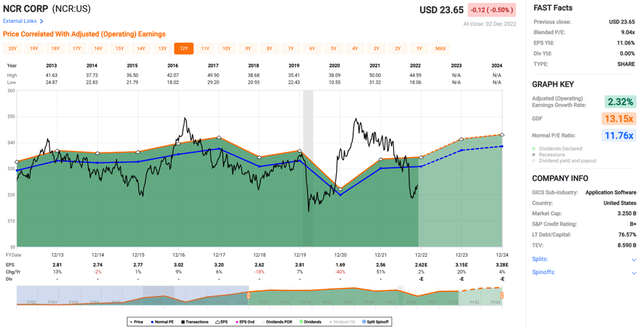

Turning to valuation, I find NCR to be rather cheap at the current price of $23.65 with a forward PE of 9.1, sitting below its normal PE of 11.8. This is considering the stable pick and shovel nature of NCR’s business and the 8 to 17% annual EPS growth that analysts estimate over the next two years. Analysts have a consensus Strong Buy rating on NCR with an average price target of $29.38, implying a potential 24% upside from the current price.

NCR Valuation (FAST Graphs)

Investor Takeaway

NCR is a software-led company that is benefiting from strong demand across its retail, hospitality and banking businesses. The upcoming split of NCR into two companies will allow the newly formed ATM SpinCo to have a stable recurring revenue stream and deliver dividends to shareholders. Valuation wise, I find NCR attractive with a forward PE ratio below its normal average with strong upside potential.

Be the first to comment