Jezperklauzen/iStock via Getty Images

We are in a cycle and moving toward the closing stages of the cycle.

History does repeat itself.

And, investors must learn from earlier examples.

Andy Kessler, writing in the Wall Street Journal attempts to address this problem.

Mr. Kessler refers to our current situation as being in “A Market Hype Cycle.”

Mr. Kessler gives several examples of earlier “Hype” cycles with reference to specific situations and specific organizations.

He writes about when “everyone got too excited about future possibilities, deep into the hype cycle of new technology.”

“That’s when,” he continues, “the toxic cocktail of greed, stupidity and hubris takes over.”

Asset Bubbles

I have been writing about “asset bubbles,” situations where asset prices rise for no particular reason directly connected with the asset, but, in the early stages, sustain increasing price levels that draw many new investors into the market place.

Of course, just as rising cycles turn into falling cycles, asset bubbles “pop” and move in the opposite direction.

My particular story is that in the current case the Federal Reserve moved to protect the U.S. economy by flooding the market place with lots and lots of liquidity, in the trillions of dollars, hoping to keep the U.S. economy from tumbling into a vast financial market collapse and an economic disaster.

In this battle, the Federal Reserve won and the “collapse” and the “disaster” did not occur.

But, asset prices went through the ceiling.

And, consumer price inflation picked up, so much so that the Federal Reserve had to reverse course and enter the battle against rising prices.

We are now on the down-side of the bubble.

And Mr. Kessler brings up examples of the swing in prices that has taken place in such areas as cryptocurrencies, special purpose asset companies (“SPACs”), and so on.

Crypto exchange Coinbase Global, Inc. (COIN) went public in April 2021, about one year after the Federal Reserve really began to pump money into the economy.

The valuation briefly traded at a $100 billion valuation.

“Coinbase now is barely worth $10 billion.”

The FTX exchange began in May 2019, slightly before the Fed began to expand.

FTX reached a valuation of approximately $32 billion before it met its collapse into bankruptcy.

It valuation now remains to be determined.

History

Two things happened here.

First, there was the technological innovation that brought on the cryptocurrency hysteria. Based on Blockchain technology, which is really quite an advancement, cryptocurrencies were created and rode into the 2010s on a wave of excitement.

Second, the technological advancement was built upon by the excitement created in the world of new innovations and all the money that was now lying around the financial markets as a result of the largess of the Federal Reserve.

The two factors played on one another.

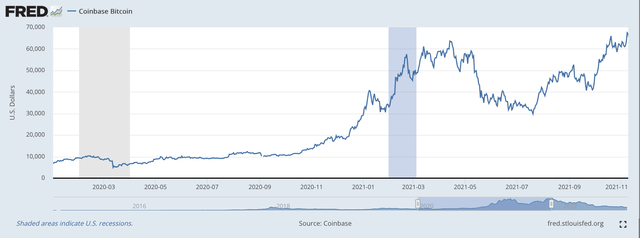

And, where the price of one Bitcoin (BTC-USD) was only around $10,000 in the early later months of 2020, the price rose to around $67,500 in November of 2021.

The price has moved downward ever since.

The price is now around $17,000.

The point is, whether these statistics represent a “hype” cycle or an “asset bubble,” the movement is the same.

Early stage, prices rising, almost out-of-control, due to the enthusiasm that builds up relating to the assets.

Then the “bubble” pops or the “hype” is destroyed.

This is the normal, historical picture.

But, to many of the early-stage investors, “times are different now!”

A collapse will not happen in the current cases.

Time To Move On

Now is the time to move on.

Especially in the case of cryptocurrency, regulation is coming.

The government and its regulators cannot let this situation pass.

What will the future picture look like?

That we don’t know. It is too early in the historical map to define where the industry is going.

We are in a position of radical uncertainty.

But, the time of the libertarians is over.

Cryptocurrencies may have been the “child” of the libertarians, an innovation that did not need central control of guidance. However, it is now moved into the hands of the traditional finance.

And, it will not look anything like what the libertarians wanted it to be.

Perhaps China is the ultimate model here.

China has banned cryptocurrencies.

China is working to build its own digital currency and it will be this digital currency that will reign in China…and perhaps the world.

Many people around the world have called the cryptocurrencies, a “Ponzi” scheme. Every financial leaders like Jamie Dimon, Chairman of JPMorgan, Chase & Co., have talked down Bitcoin.

Cryptocurrencies have yet to provide an explanation for any economic value.

Still, there are possibilities that cryptocurrencies might, in some way, justify a purpose and ensure its economic survival.

The future, however, is unknown. We are in an age of radical uncertainty.

We just don’t know what all the options are.

And, this is what investors face.

The Digital World

The world is going digital.

Since we don’t know at this time what all the options of a digital world look like, we really cannot define what the structure of that digital world is going to be.

This is where investors must be careful.

I am not saying “don’t” invest in this space. Just be careful. Be aware of hubris. Be aware of hype. Be aware of stupidity.

Furthermore, I don’t think that the Fed will be flooding the financial system with funds in order to keep a financial calamity from happening.

Of course, I don’t know how the Federal Reserve might “pivot” with respect to its monetary policy if the stock market crashes or there is a debt crises somewhere in the world.

But, this is why investors need to be cautious.

We are not in a space where a strategy like “buy to decline” will work. We need to be more careful than that. I still think we have a long way to go in this cycle.

Be the first to comment