SHansche

Shipping stocks have been in a turbulent period over the past twelve months. After seeing stellar gains in 2020 and early 2021, most have not moved dramatically since last July. In March, I warned about a potential slowdown in the container shipping market regarding the company Danaos (NYSE:DAC) in “Danaos: Russia Conflict Fuels Both Positive And Negative Shifts For Container Shipping.” At the time, the Russian conflict appeared to be a net negative for the global shipping market due to its likely harmful impact on global economic demand. We have since seen a global decline in economic demand – seen in plummeting leading indicators such as the U.S manufacturing PMI.

That said, container imports remain near record levels as China’s export decline ends, so it is not yet clear if the shortage in container shipping is ending. The Federal Reserve’s global supply chain pressure index remains near an all-time high, though it has declined markedly since December. Accordingly, the overall dynamic of container shipping remains strong as the market remains in a tight shortage. However, the data indicates a peak in container shipping that a contraction will likely follow.

The key questions are how deep will that contraction be and how long will it last? Of course, that bearish factor may also be offset by low valuations in the shipping market. As a silver lining, Danaos shares have declined by 31% since I covered the company last as its valuation has contracted. The stock’s forward “P/E” is extremely low at ~2.75X, so it will remain cheap even if its earnings decline. Danaos may be a solid discount opportunity if shipping prospects do not decrease dramatically.

Shipping and Charter Rates Have Peaked

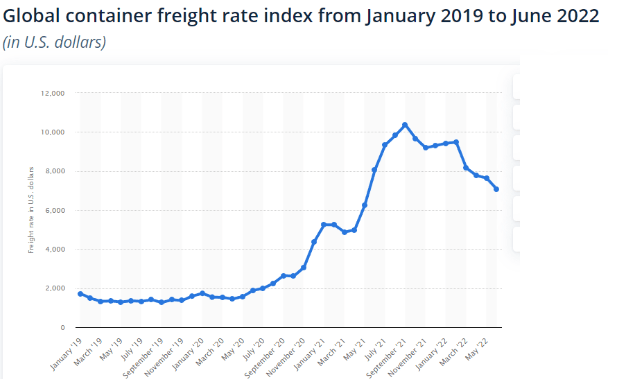

The container shipping freight market saw prices peak last year and have declined. The index was around 1,300 in 2019, rose to 10,360 by last September, and has since fallen back to 7,000. See below:

Global Container Freight Rate Index (Statista)

The sharp decline in container freight rates should not surprise, considering prices were incredibly high last year due to abnormally tight conditions. The decline was partially triggered by the recent lockdowns in Shanghai, which dramatically, though temporarily, decreased China’s exports. However, this factor may have alleviated the shortage and backlog in much of the container shipping market.

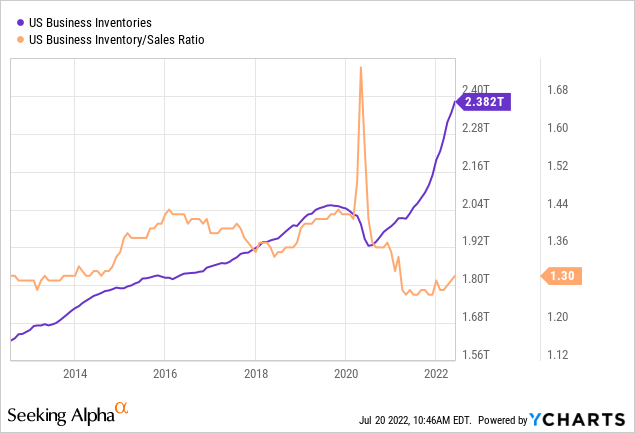

U.S. import demand is also weakening at a dramatic pace. While June’s container import volume was substantial, booking data indicated July’s should be much weaker. Changes in U.S. business fundamentals support this slowdown. A primary cause for the tight shipping market has been a race to increase inventories to offset supply chain challenges. The U.S. Business inventory-to-sales ratio has risen in recent months, though it remains low. That said, business inventories are now extremely high, so a decline in sales may dramatically decrease import demand. See below:

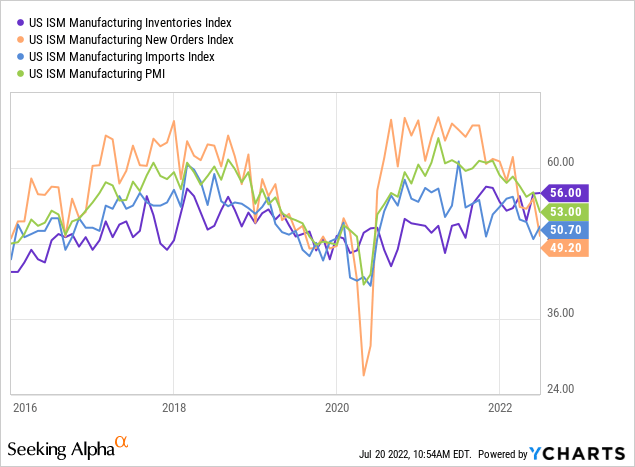

U.S. Manufacturing survey data suggests a sales decline is likely, and businesses are starting to prepare for such. The overall U.S. manufacturing PMI has contracted rapidly since its 2021 peak. New orders, a key component of that metric, have declined even faster. The import index, which indicates future demand for shipping, has also shuttered toward contraction levels. However, manufacturing inventories have continued to accelerate. See below:

PMI data above 50 indicates growth, while below 50 signals a contraction. Thus far, manufacturing PMI data does not imply a contraction but merely a rapid slow growth, which often leads to a decline.

Overall, this data does not indicate solid prospects for the freight shipping market. U.S. order backlogs are finally unwinding as high prices, and falling real incomes, cause consumers and businesses to reduce demand. The shipping market remains very tight by historical measures, but it will only take a slight decline in demand from the U.S. and European economies for the market to return to a glut.

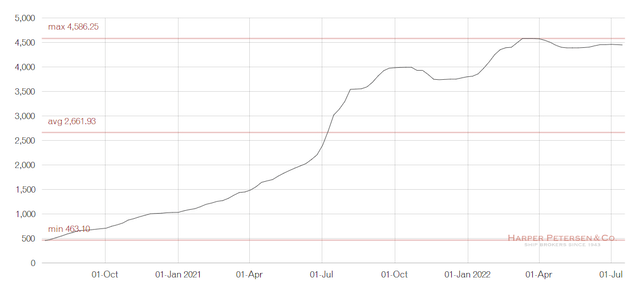

The HARPEX charter rate index, which is more relevant for Danaos’s sales, remains at extreme highs as liners still desire container shipping vessels. That said, the index is not rising at the pace it was before the recent slowdown. See below:

HARPEX Container Shipping Charter Rate Index (Harper Petersen)

Over the coming months, I expect charter rates to follow the direction of freight rates as vessel demand contracts from extreme highs. A high portion of Danaos’s fleet is under long-term contract, and, for now, time charter rates are very high, so the company’s 2022 and likely 2023 EPS should be robust. The global container shipping fleet is aging as fleet growth was extremely low during the 2010s due to low freight rates. There has been an increase in fleet growth since the 2020s boom began, but for now, the container shipping market is in a structural shortage that may take years to fix. If the economic slowdown is significant enough, the market may return to a glut, but for now, that is not indicated by the data.

Danaos’ Valuation Offsets Economic Risk

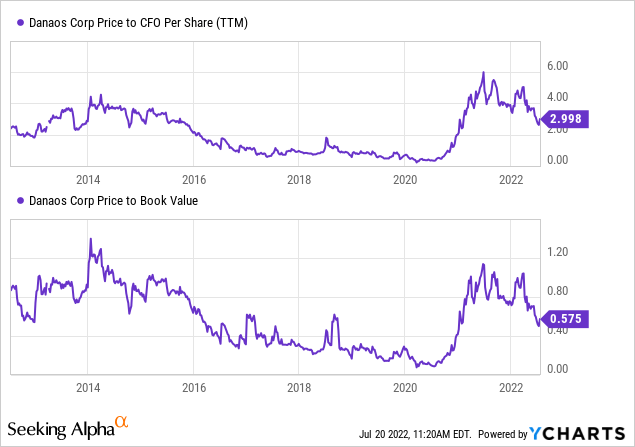

When I covered Danaos last, most investors generally did not believe the economy was slowing, so DAC had not priced in this potential. At the time, the stock’s valuation was undoubtedly low, but I was not bullish since most investors did not realize this significant risk factor. I believe Danaos’ earnings revision risk remains high, but it is far lower than it was in March. Further, the company’s valuation is materially lower. See below:

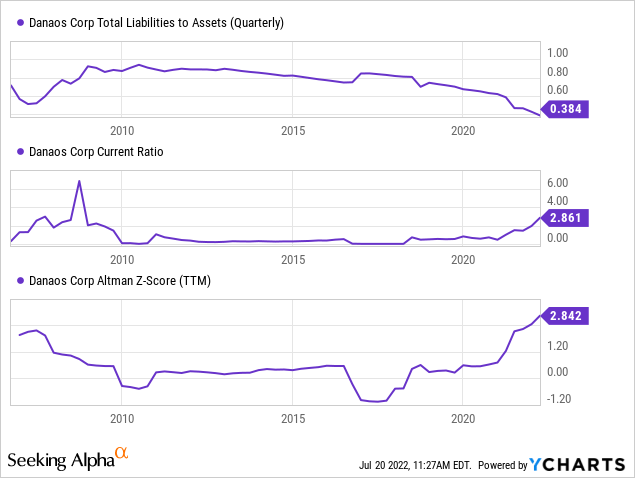

Danaos’s valuation is about average compared to its historical levels over the past decade. That said, compared to almost all other companies, a price-to-cash flow of ~3X and a price-to-book of 0.57X is extremely low and indicative of a ‘deep value’ investment. Danaos was in a difficult period throughout most of the 2010s as charter rates were extremely low due to the global glut. Further, the company struggled with significant debt and had a high bankruptcy risk. Since then, it has dramatically improved its balance sheet as its margins have climbed. See below:

Since 2020, the company has substantially decreased its leverage and has emerged from a nearly chronic negative working capital. Its Altman Z-score, an index measure of a variety of solvency and liquidity statistics, has also markedly improved and is now firmly out of high bankruptcy risk territory.

Given the substantial improvement in Danaos’s balance sheet health, the company’s valuation should be much higher as its bankruptcy risk is low, even if its income declines. The analyst consensus EPS outlook for DAC suggests an EPS of $23.8 this year, followed by ~$24 in 2023 and 2024. This outlook gives the firm a “P/E” below 3X and suggests it will earn back its entire market value over the next three years. Personally, I believe these expectations are a bit too high considering the substantial probability of a contraction in the shipping market. However, the company is still cheap even though its earnings outlook is adjusted lower, particularly considering its improved financial health.

The Bottom Line

Overall, I am moderately bullish on DAC today. I was neutral when I covered the company last as it seemed to have a higher fundamental risk with a low valuation. Those economic risk factors are realized today, and its valuation has declined to extreme lows. Investors should not underestimate the likelihood of a slowdown in the shipping market, but in my view, its current valuation more than discounts that potential. Even more, while it seems a slowdown in the U.S. and European import demand will end the container shipping shortage, I do not believe the market will return to a glut due to the aging container fleet.

Of course, DAC has significant risk factors beyond its high volatility. Like many other inflation-sensitive stocks, DAC could become a “falling knife” as more short-term traders race to take profits or short the stock. My bullish view is specifically a “long-run” view, and DAC may likely decline even further. Additionally, my view is “data dependent.” I will revise my view if the data suggests a severe decline in shipping demand that brings the market back into a chronic glut.

Be the first to comment