Carl Court/Getty Images News

In my last article on Moderna, Inc. (NASDAQ:MRNA), I explained why the stock is opportunistic. Since then, the stock’s price has increased by 24%. I am still bullish on MRNA, as there is still a significant demand for its COVID-19 mRNA vaccine. Also, the company’s recent developments support my position on the stock. Comparing Moderna’s financial multiples with the multiples of its peers shows that the stock looks attractive and is undervalued. I evaluate that MRNA has a fair value of $328.

1Q 2022 highlights & recent developments

In its 1Q 2022 financial results, Moderna reported total revenues of $5.9 billion, compared with 1Q 2021 and 4Q 2021 total revenues of $1.7 billion and $7.2 billion, respectively. The company’s cost of sales increased from $952 million in 4Q 2021 to $1017 million in 1Q 2022 (MRNA’s cost of sales in 1Q 2021 was $193 million). Moderna reported 1Q 2022 R&D expenses of $554 million, compared with 1Q 2021 and 4Q 2021 R&D expenses of $401 million and $648 million, respectively. The company’s 1Q 2022 total operating expenses increased 174% YoY and 2% QoQ to $1839 million. Moderna reported a 1Q 2022 net income of $3657 million, or $$9.09 per diluted share, compared with a 1Q 2021 net income of $1221 million, or $3.05 per diluted share. The company’s net income in 4Q 2021 was $4868 million, or $11.29 per diluted share. In the first quarter of 2022, Moderna reiterated its 22 signed advance purchase agreements of about $21 billion. Also, the company expected to have one more program in Phase 3 in the second quarter: the flu vaccine (mRNA-1010).

On 7 June 2022, Moderna announced the first participants dosed in the Phase 3 study of the seasonal influenza vaccine. Also, On 11 July 2022, Moderna announced that its Omicron-containing bivalent booster candidate (mRNA-1273.214), which was already in Phase 3, demonstrated significantly higher neutralizing antibody response against Omicron subvariants compared currently authorized booster. Furthermore, On 12 July 2022, the company announced the first participant dosed in a Phase 1 trial of its Nipah virus mRNA vaccine (mRNA-1215). On 14 July 2022, Health Canada authorized Moderna’s COVID-19 vaccine in young children. Also, on 18 July 2022, the accompany announced that Therapeutic Goods Administration in Australia has granted provisional approval for Moderna’s COVID-19 vaccine in children aged 6 months to 5 years. “Beginning in the fall of 2022, our robust Phase 3 pipeline could lead to three respiratory commercial launches over the next two to three years,” the CEO commented.

The market outlook

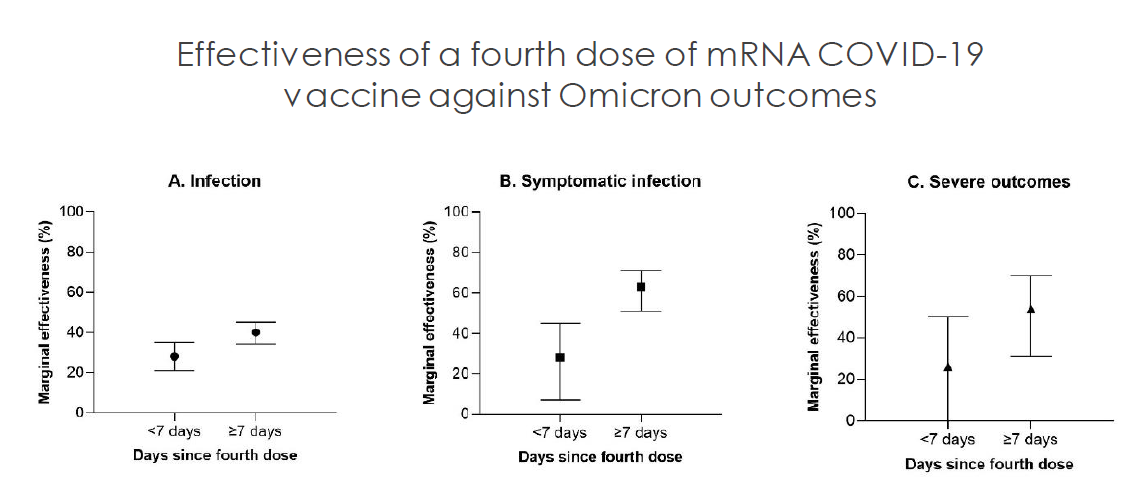

According to Morning Consult polling, 77 percent of vaccinated adults in the United States have said that they would get a COVID-19 booster shot if it is recommended. Another study showed that 33% of Americans are likely to get a fourth COVID-19 booster shot if it is available. Recently, a study about the effectiveness of the fourth dose of the COVID-19 vaccine showed that the fourth dose of the mRNA COVID-19 vaccine reduces the risk of death. Moreover, the results of a study run by the CDC indicate a second booster shot of an mRNA vaccine has significant effectiveness against Omicron variants. Thus, there is still a good demand for Moderna’s COVID-19 vaccine.

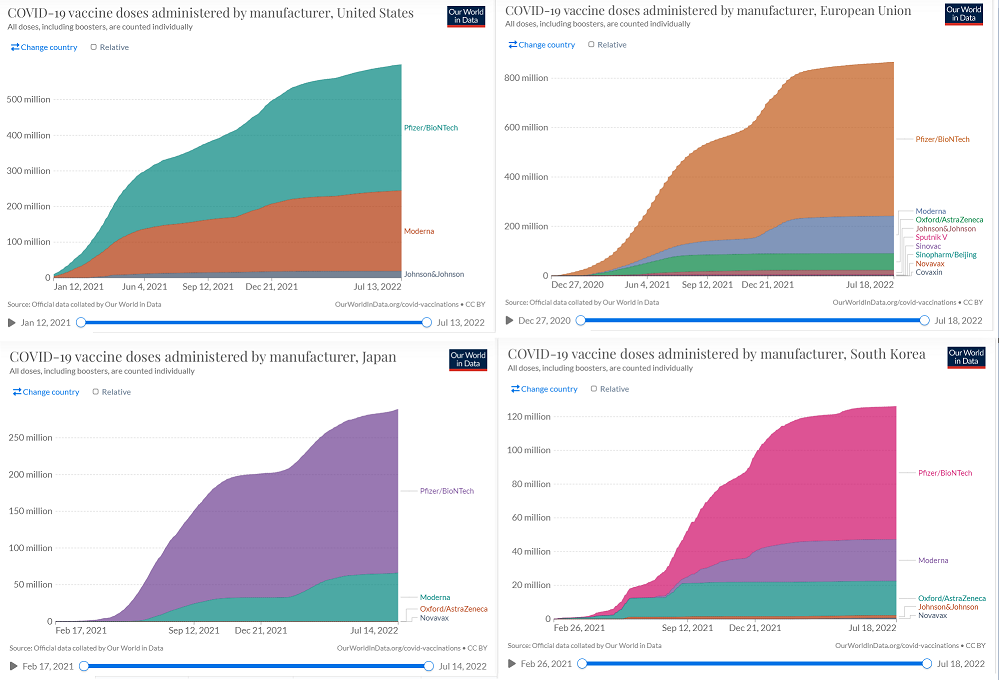

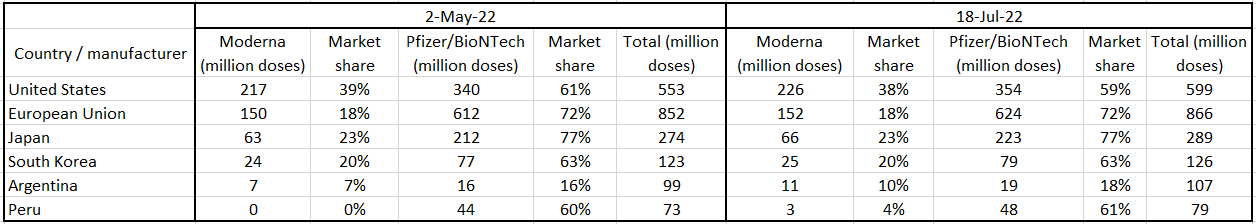

Before the beginning of 2022, Moderna did not have operating commercial subsidiaries in Arica, most parts of MENA, and most parts of Asia. However, with the help of its new subsidiaries and distribution partnerships, the company has been able to sell its products to new customers in 2022. Most of Moderna’s vaccines are administered in the United States and European Union. However, it is worth noting that even in the United States and European Union, the market share of the Pfizer/BioNTech COVID-19 vaccine is higher than the market share of Moderna’s COVID-19 vaccine (see Figure 1). According to Table 1, From 2 May 2022 (when I published my first article on MRNA) to mid-July 2022, the number of Moderna’s COVID-19 vaccine administered in the United States increased from 217 million doses to 226 million doses, up 4.1%. In the same period, the number of Moderna’s COVID-19 vaccine administered in the European Union increased from 150 million doses to 152 million doses, up 1.3%. Moreover, the number of Moderna’s COVID-19 vaccine administered in Argentina increased from 7 million doses to 11 million doses. In Peru, the number of Moderna’s COVID-19 vaccine administered increased from less than 300000 doses to 3 million doses. Figure 2 approves the significant effects of the fourth dose of mRNA COVID-19 vaccine against Omicron outcomes. According to the company’s 1Q 2022 presentation, Moderna expects its sales to be larger in the second half of 2022 than in the first half as SARS-CoV-2 becomes endemic.

Figure 1 – COVID-19 vaccine doses administered by manufacturer

ourworldindata.org

Table 1 – Number of COVID-19 vaccines administered in United States, European Union, Japan, South Korea, Argentina, and Peru by manufacturer

Author (based on data from ourworldindata.org)

Figure 2 – Effectiveness of a fourth dose of mRNA COVID-19 vaccine against Omicron outcomes

1Q 2022 presentation

MRNA stock performance

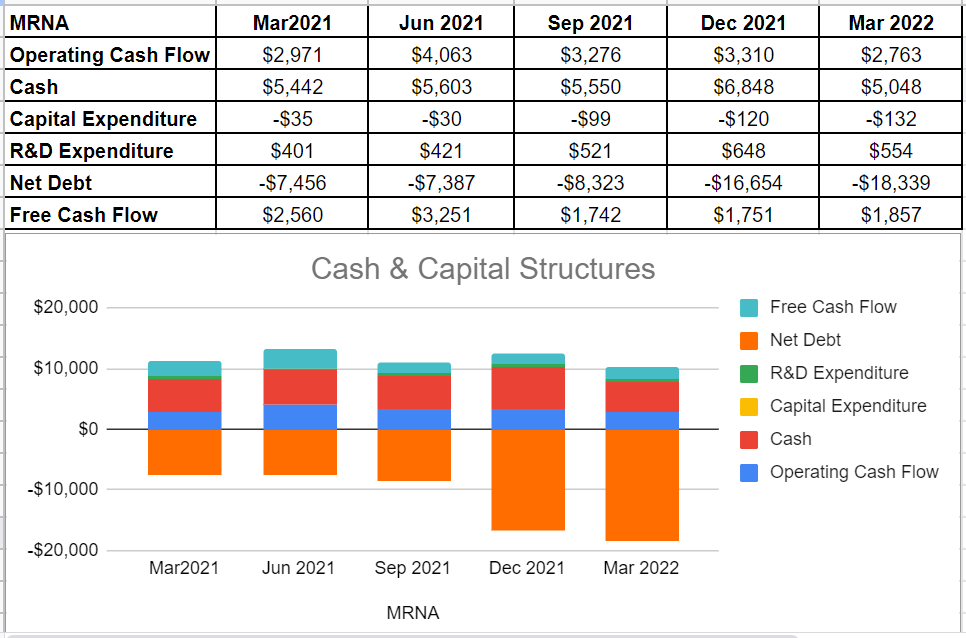

As can be seen from MRNA’s cash flow performance, the company’s operating cash flow of $2763 million during the first quarter of 2022 is almost the same as its level of $2971 million during the first quarter of 2021. However, in light of their up-to-now performance, financial framework, and sales for 2022, we can expect strong cash and capital structure outlook for the rest of 2022. Moreover, the company’s R&D expenditures in 1Q2022 were $554 million. Its full-year 2022 R&D expenditure is expected to continue to approximately $4 billion. Furthermore, MRNA’s 1Q 2022 cash balance is almost the same as its amount of $5442 million in 1Q 2021 (see Figure 3).

Figure 3 – MRNA’s cash and capital structures (in millions)

Author (based on SA data)

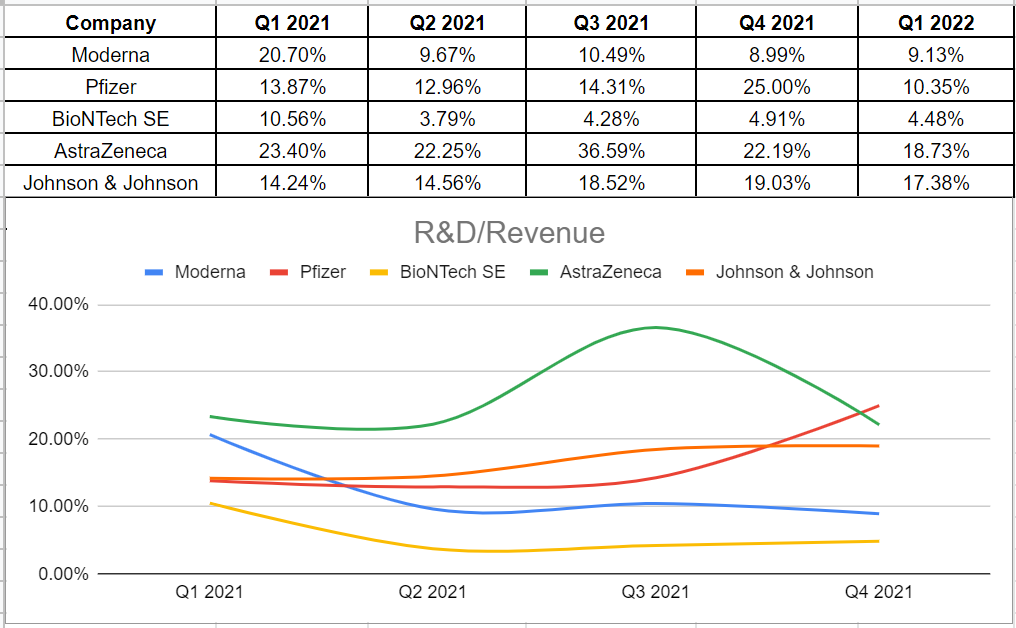

Analyzing Moderna’s R&D to revenue during the last year and comparing it with its peers, we observe that MRNA had the least amount after BioNTech (BNTX). This ratio measures the amount of revenue that is related to research and development expenditures. The trends of R&D spending versus revenue could not easily be interpreted as good or bad. However, combining MRNA’s R&D ratio with other fundamental metrics indicates that for a mature company like Moderna, a lower R&D ratio could be a sign of the company’s strong competitive advantage and the ability to bring considerable improvements during 2022 (see Figure 4).

Figure 4 – MRNA’s R&D percentage to revenue vs. its peers

Author (based on SA data)

Valuation

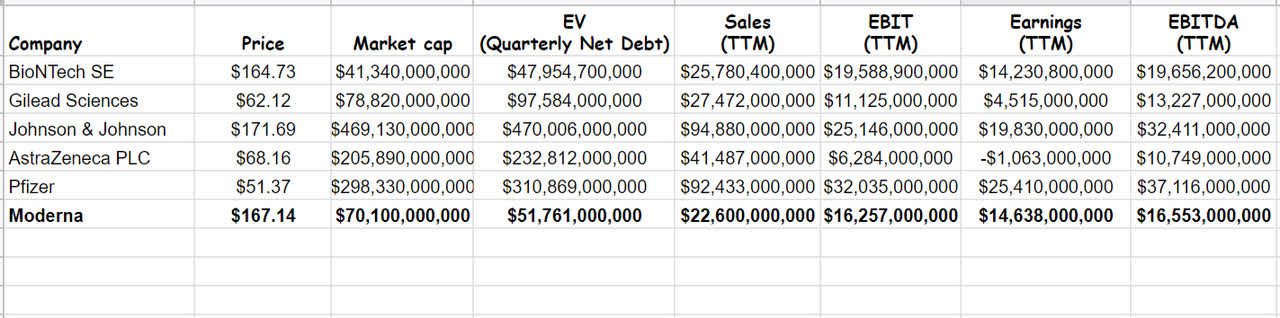

Since my last analysis on Moderna, the stock price has raised about 24%. Now, updating and reevaluating MRNA by using Comparable Company Analysis, I investigate that the stock is still attractive and undervalued. Comparing Moderna with other peer competitors like Pfizer (PFE), Johnson & Johnson (JNJ), AstraZeneca PLC (AZN), and using the CCA method, I estimate that the stock’s fair value is about $328. In the case of choosing competitors, I considered biotechnology companies with similar research and development fields and profitability. Data was gathered from the most recent quarterly and TTM data (see Table 2).

Table 2 – MRNA financial data vs. its peers

Author (based on SA data)

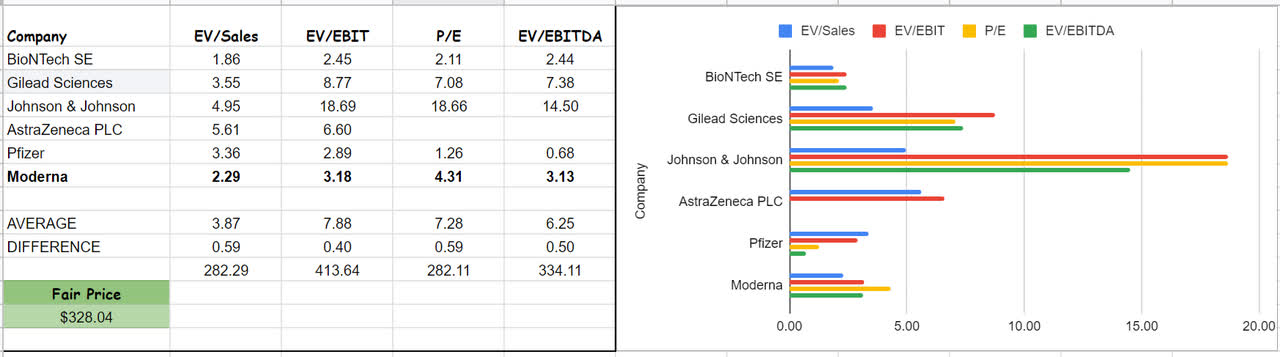

Analyzing other companies’ ratios and comparing them with MRNA’s, we can figure out that Moderna looks attractive and is undervalued. The company’s P/E ratio is 4.31x, which is over 40% lower than the peers’ average of 7.28x. Furthermore, MRNA’s EV/EBITDA is 3.13x compared with the group’s average of 6.25x. In a word, the lower the EV/EBITDA, the cheaper the price for a company (see Figure 5).

Figure 5 – Valuation

Author (based on SA data)

Besides Moderna, I have done some analysis on the peer companies as well. BioNTech’s EV/EBITA amount is 2.44x, which is far lower than the peer’s average. On the other hand, Johnson & Johnson’s EV/EBITDA and EV/sales are 14.5x and 4.95x, respectively, which are far higher than the group’s averages. Generally speaking, the higher EV/sales implies that JNJ is potentially overvalued. Thus, using the CCA method, I evaluate that the stock is potentially undervalued and has a considerable upside potential – a fair value of $328.

Summary

After the publication of my previous article on MRNA on 2 May 2022, the stock price increased by 24%. However, the stock is still a buy. The demand for the company’s COVID-19 mRNA vaccine is robust. Moderna can sell more of its products in the second half of 2022 due to increasing subvariants. MRNA’s 1Q 2022 cash balance is almost the same as its amount of $5442 million in 1Q 2021.

In light of MRNA’s up-to-now performance, financial framework, and sales for 2022, we can expect strong cash and capital structure outlook for the rest of 2022. I evaluate that the stock is worth $328. MRNA is a buy.

Be the first to comment