Luke Sharrett

British American Tobacco (NYSE:BTI) has drawn our attention after we spent the past week screening for promising consumer staple stocks. After a thorough analysis and considering various qualitative and quantitative observations, we determine two scenarios for the tobacco giant. The first is a valuation that could stretch beyond $64 per share by December 2023, and the second is a more modest scenario, determined by an asset pricing model, which indicates that the stock could gain 12.62% within the next twelve months to reach the high $40s.

The Consumer Staples Appeal

British American Tobacco is perfectly suitable for the current risk-off market environment as it’s a dominant consumer staple stock. Stocks segmented as consumer staples are non-cyclical and thus aren’t overly sensitive to economic headwinds.

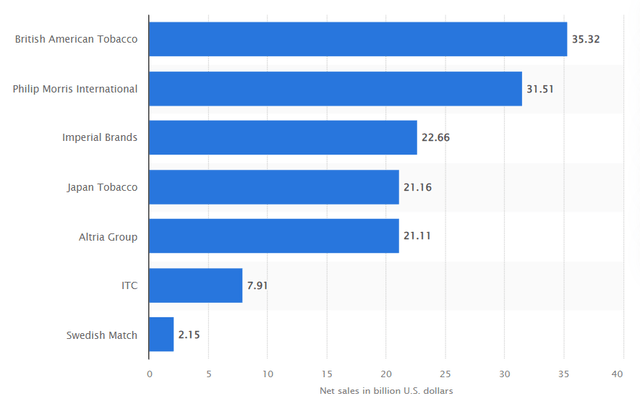

Furthermore, British American Tobacco holds a dominant market position (chart below) in the Tobacco industry, which is growing at a steady compound annual growth rate of 2.4%, more or less in line with global GDP growth.

After releasing its earnings report mid-last year, British American Tobacco’s management stated that it anticipated the firm’s revenue to compound by more than 5% annually until 2025. However, due to experiencing an array of supply-chain shocks and input cost surges, the management revised its short-term growth outlook to 2% to 4% (for 2022).

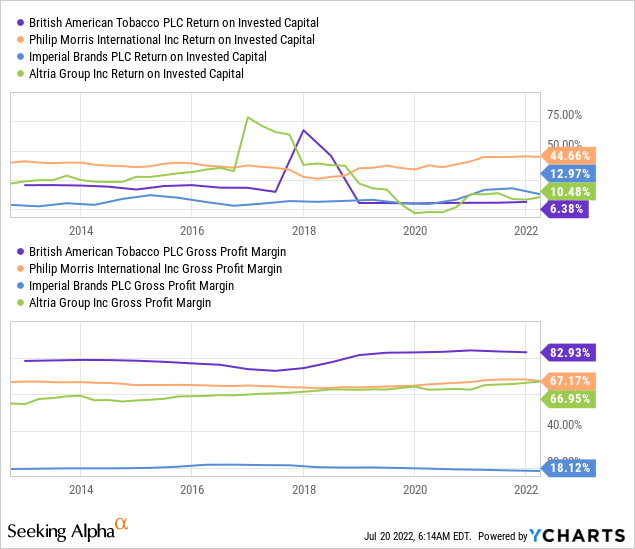

Although the firm’s management has softened the company’s growth outlook, British American Tobacco’s market position and its non-cyclical product offerings could see it dodge many short-term headwinds. In addition, the company’s industry-beating gross profit margin (82.93%) suggests that it holds much pricing power as a consequence of achieving deep economies of scale.

A more in-depth look at British American Tobacco relative to its competitors tells us that it can be considered a “best in class” asset. The company’s experiencing tremendous growth in its non-combustible segment, which reached $19.4 million in Q-1. A non-combustible tobacco pivot could provide a new growth paradigm for British American Tobacco. As such, I’m encouraging investors to track the space closely.

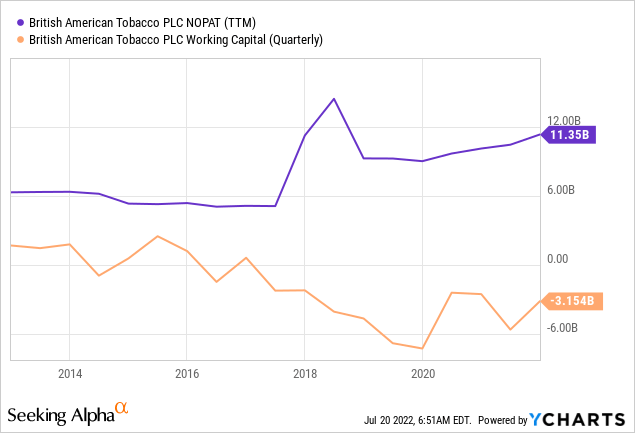

Although British American Tobacco illustrates surplus market share and superior economies of scale relative to its peers, the company’s return on invested capital (‘ROIC’) is lagging the industry by a long way, suggesting that its operating profits after tax (‘NOPAT’) isn’t justifying its operating liabilities very well. Therefore, as investors, we need to hope that British American Tobacco utilizes its working capital more effectively, as it did in 2019 (see chart below).

Pricing The Stock

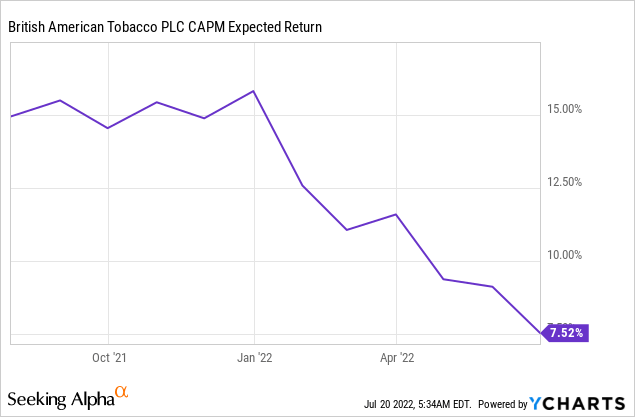

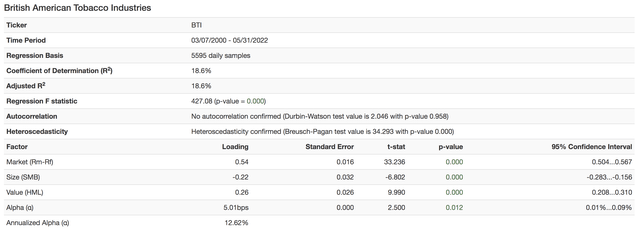

Asset pricing is a broad topic. However, for this thesis, I emphasized British American Tobacco’s beta (0.46) sensitivity in the context of market segmentation. The diagram below can be enlarged for a better view.

Here’s a parsimonious explanation of what I discovered.

A three-factor pricing model, which regresses British American Tobacco’s beta to risk premiums on market size, book value, and a market portfolio, discovers statistical significance (p-value of the F-stat below 10%) in explaining the stock’s returns relative to its given level of risk.

Although the model did not discover any autocorrelation, it did pick up heteroskedasticity in the stock’s short-term return distribution, which could’ve led to falsely concluding model accuracy. As such, the Breusch-Pagan test was deployed to convert the data to stationary.

The model’s end product suggests that British American Tobacco presents an implied annual return of 12.62%.

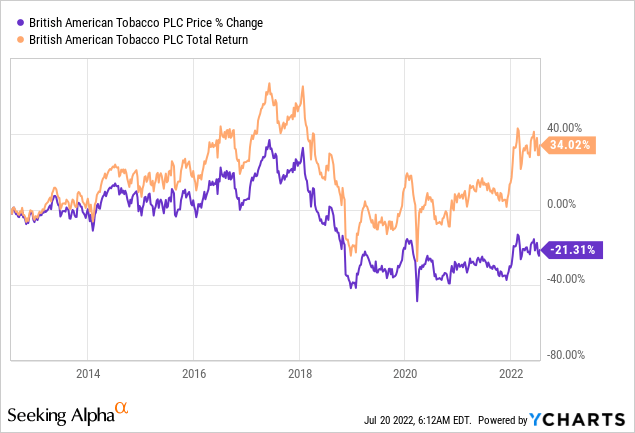

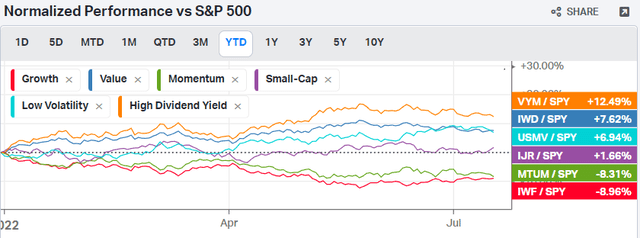

Many might question why one would invest in British American Tobacco after exhibiting a negative price return during the past ten years. Firstly, it needs to be understood that the past decade has been characterized by moderate to high economic growth and low inflation. Thus, higher beta bets, such as technology stocks, have prospered while lower beta stocks such as consumer staples, stagnated. However, with supply-side inflation remaining resilient and economic growth waning, we’ll likely see defensive stocks such as British American Tobacco proliferate during the next few years as opposed to high-beta assets.

A second factor to consider is that British American Tobacco’s high dividend payout (roughly 55% to 75%) could, at times, erode its stock price returns (not total returns). However, the market seems to be dividend-seeking (see the succeeding chart below) at the moment. Therefore, I don’t expect the mentioned inverse relationship to hold for the foreseeable future.

Koyfin

Justified Valuation & Dividend Analysis

I observed a mix of British American Tobacco’s P/E ratios to determine its relative value. The company’s forward P/E underscores its current P/E, implying that analysts anticipate earnings-per-share growth, which could lead to a British American Tobacco stock surge. Lastly, I computed British American Tobacco’s justified P/E, which is higher than its current P/E, conveying that British American Tobacco is, in fact, undervalued on a relative basis.

| Justified P/E | 13.61x |

| Forward P/E | 10.09x |

| Trailing P/E | 10.59x |

Source: Seeking Alpha; Author’s Calculations

Here’s how I computed the stock’s Justified P/E.

- Firstly, I defined the formula as [(Payout Ratio) x (1+SGR)]/(CAPM-SGR).

- CAPM is the cost of equity that shareholders demand, which I captured from the chart below.

- SGR (sustainable growth rate): The sustainable growth rate is computed as (1-payout ratio) x ROE (return on equity). I assumed British American Tobacco’s payout ratio at a rounded 65%, which is a 3rd party estimate and the company’s stated long-term policy (until 2025) a year ago. Additionally, I extracted the ROE datapoint from Seeking Alpha at 10.47%.

- The final equation: [(65%) x (1+2.62%)]/(7.52%-2.62%) = 13.61

Following my justified P/E calculation, I derived the company’s December 2023 earnings-per-share estimate from Seeking Alpha. Based on a price-multiple formula that multiplies projected earnings-per-share with the stock’s justified trailing P/E ratio, it’s conveyed that British American Tobacco could reach a fair value of $64.37 per share by December 2023.

| Forecasted EPS (December 2023) | 4.73x |

| Justified P/E | 13.61x |

| Price Target | $64.37 (rounded) |

Source: Seeking Alpha; Author’s Calculations

One of British American Tobacco stock’s appeals is its dividend yield, which is in the upper quantile of the dividend-paying stock universe. As previously mentioned, inflation’s resilience and the current risk-off sentiment could prompt an abundance of investors to invest in dividend-paying stocks such as British American Tobacco. Moreover, although not illustrious, the company’s dividend coverage ratio of 1.6x implies that British American Tobacco’s current level of dividend payments is safe and secure.

| Dividend Yield (‘FWD’) | 7.02% |

| Dividend Coverage Ratio | 1.6x |

Source: Seeking Alpha

Notable Risks

The first notable risk for British American tobacco is trivial. Persisting supply chain issues could hinder the company’s longer-term prospects as its gross margins might recede. Additionally, global supply risk brings with it uncertain monetary policy. British American Tobacco is a multinational company, and thus hedging currency risk during uncertain monetary policy could be challenging.

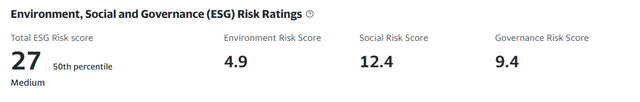

Furthermore, the company ranks poorly on various ESG rating indices. Although many investment funds aren’t ESG driven yet, there’s certainly a shift towards “negative screening”, which could shrink British American Tobacco’s investor pool.

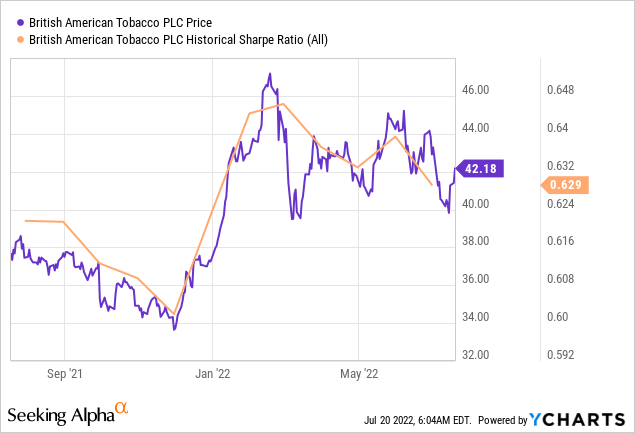

Lastly, British American Tobacco stock’s quantitative metrics indicate that the broader market’s volatility dominates the stock’s excess return prospects. A Sharpe Ratio below 1.00 means that the stock’s quantitative risk/return prospects aren’t intact.

Concluding Thoughts

After a thorough analysis of British American Tobacco, we conclude that the stock’s a strong buy given how its attributes could coalesce with the current market environment. Our models span a 12 to 18-month horizon, which concludes that the stock could prosper. In addition, British American Tobacco’s dividend characteristics could appeal to investors for as long as inflation remains resilient.

Be the first to comment