Massimo Giachetti/iStock Editorial via Getty Images

I bet many of you are growing exceptionally frustrated with how the markets have performed since the start of the year. It’s now more important than ever to opt for cherry-picking rather than to be invested in broad-based indices that are in the midst of a rebalancing process. We think CVS (NYSE:CVS) is on solid foundations and will most likely do well for the rest of the year, purely due to the company’s alignment with consumer behavior and the stock’s connection with investor sentiment.

Latest Earnings and Economic Conditions

I’d like to start off with a few economic conditions before getting into the earnings analysis.

The two key features to analyze are the implied inflation and the unemployment rate because we’re exploring a company that sells its products in the United States and, in addition, relies on a high-volume business model.

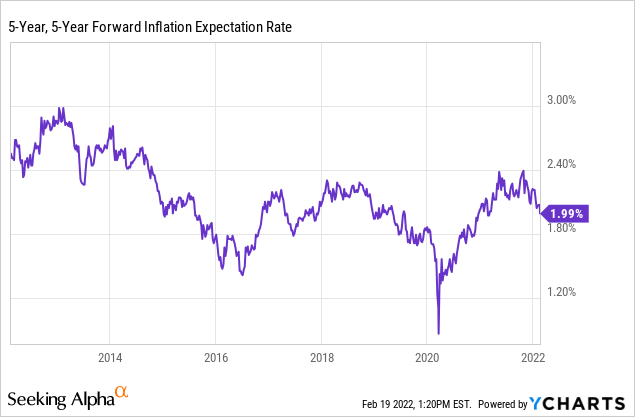

Implied inflation doesn’t look too bad but what needs to be remembered is that a large part of the sentiment is made up of interest rate hikes, as big banks think we could see up to seven rate hikes this year.

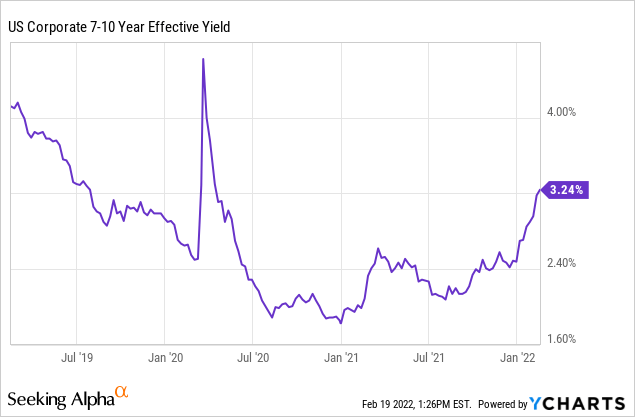

Raising interest rates aggressively will first reduce spending power before incentivizing consumers to spend more, so there will be a tradeoff in the short term, and the inversion of the yield curve conveys this in the chart below.

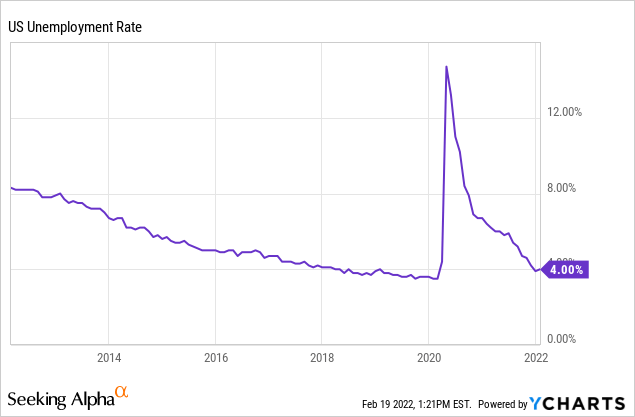

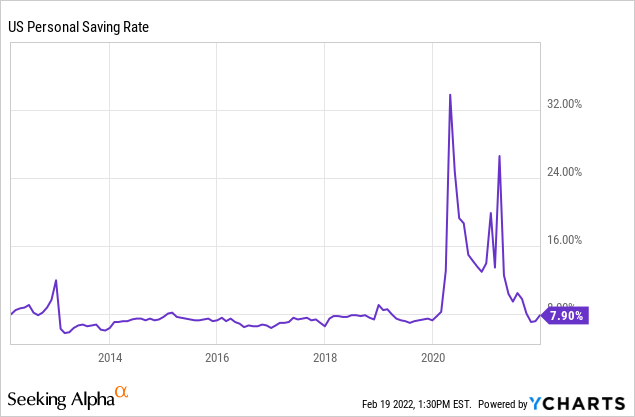

When unemployment is factored into this, the story remains much of the same. We’re likely to see a shift in marginal utility soon as personal savings (chart below) reaches the lower bounds again, which could encourage workers to return to work. Again, this will likely cause a short-term slowdown in the economy but growth towards the latter stages of the year.

So, let’s connect all of this to CVS’ earnings performance.

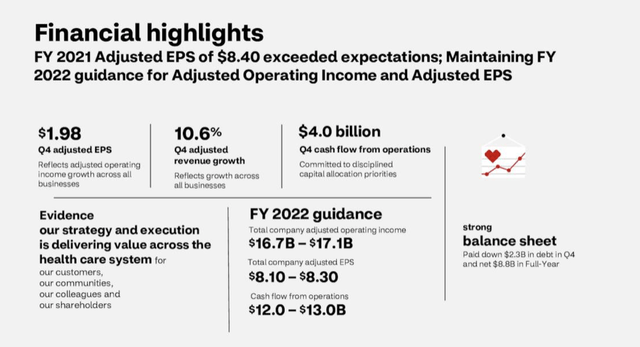

CVS exceeded its expected adjusted EPS target by $8.40 in its fourth quarter and also managed to beat its revenue estimates by $1.13 billion. The company remains bullish on its outlook for 2022, and considering the economic alignment; it’s easy to see why.

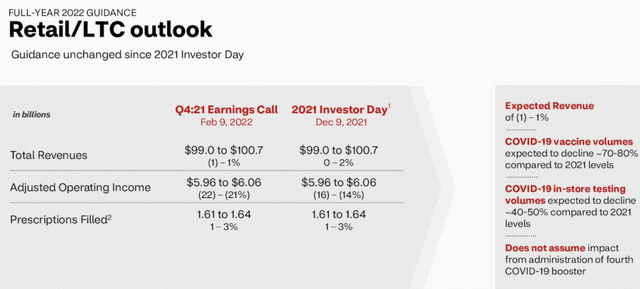

The retail outlook shouldn’t be of any surprise. The flatlining growth is due to vaccine reductions, but the backdrop could be offset by sustained regular retail sales growth. The plus side for LTC is that consumers don’t really back out from prescription sales or related products. The dearth of consumption during inflationary periods doesn’t hold in prescription drug segments, and that’s why you’d often see investors opt for health care stocks during recessions/economic downturns.

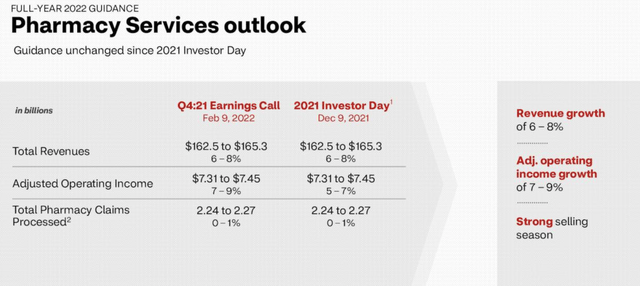

Pharmacy services should hold up firm, and we could relate this to the previously mentioned consumer habits amid economic tightening. The expected revenue growth could be due to the company’s bolstered online presence during the pandemic lockdowns. Retail companies can more accurately predict consumer behavior with the use of machine learning data analytics these days, which bolsters toppling and bottom-line earnings.

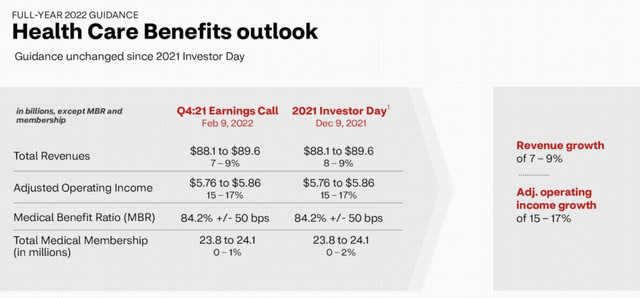

CVS’ medical benefit ratio is projected to be below the 85.00 mark this financial year. This also needs to be considered in tandem with revenue. The revenue growth projection makes sense considering the improvement in employment rates and the potential of a larger target market for CVS. We’re also likely to see total medical membership to grow for the same reasons.

Attractiveness from a Market Vantage Point

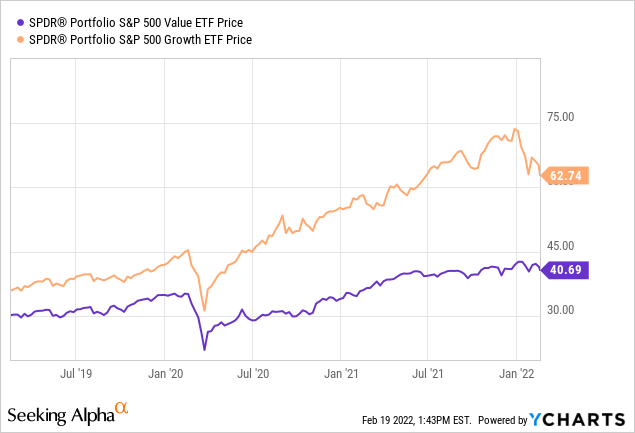

Two things should be noted from the chart below. That’s growth’s weak start to the year and its previous bull run over the past 3-years. We’ve been in a low-inflation and medium then low rate environment since the housing crisis, which has proliferated the gains of growth stocks. However, along with economic change comes stock market change, and the market will likely be value seeking moving forward for two reasons. The first is that they’ll look for companies with more consistent cash flows due to their stronghold over suppliers and their loyalty from consumers. The second reason is that higher interest rates will likely capitulate the growth of growth’s stocks’ future cash flows, whereas value stocks are generally more mature with linear cash flow growth, thus won’t be as susceptible to rising rates.

Let’s have a look at a few of CVS’ key valuation metrics.

| EV/EBITDA | 10.82 |

| Price to Sales | 0.46 |

| Price to Cash Flow | 7.34 |

| Price to Earnings | 12.14 |

Source: Seeking Alpha

The EV/EBITDA is a helpful metric to use when analyzing a company’s efficiency in terms of output relative to its resources. CVS is trading at an 88.77% EV/EBITDA discount relative to the industry, which is excellent. CVS has expanded its enterprise value in recent years with notable moves such as the acquisition of Target’s 1600 pharmacies in 2015, expansion of its online presence, acquisitions of Omnicare to provide better long-term care solutions, to name a few. The company still carries quite a bit of debt with a debt to equity ratio of 100.82%, but with sales being robust, we’re confident that enterprise value will go from strength to strength.

As mentioned the market’s on the lookout for value. CVS is trading at sector discounts based on its price to earnings, price to sales, and price to cash flow. Although the stock’s trading at multiples higher than its 5-year standardized average, we need to link the scenario back to the economic circumstances in which we’re likely to see consumers concentrate their spending on necessities, thus prompting investors to favor health care stocks potentially.

Risks

CVS is reliant on government incentives, which aren’t always easy to predict. The firm is also subject to federal state reimbursement laws, which could diminish its profitability.

Furthermore, CVS is facing considerable competition in its pharmacy segment from the likes of Walgreens, Target (NYSE:TGT), and Walmart (NYSE:WMT). The basic theory of Market share could mean that the company’s value and its stock price stagnate as a consequence.

Finally, the market’s in a rather bad spot at the moment, and although idiosyncratic risk can be overcome, broad-based systemic risk could ultimately cause the stock to draw down regardless of how bright its prospects may be.

Final Word

CVS could be an outlier in a down market. This is because of the nature of the company’s business, which isn’t susceptible to consumer slowdown. In addition, the stock is aligned with current market interests as it possesses value in abundance. Risks remain far and few, and we think CVS stock will do well this year.

Be the first to comment