zhongguo/E+ via Getty Images

If the pandemic showed anything, this once in a generation event showed that business conditions can change dramatically in short order. Structural and cyclical events come and go, but there are also sometimes events that change the way certain industries are look at long-term.

One market that has seen a dramatic change in the last three years has been the coal market. Coal usage in the US and other mature economies had fallen consistently over the last several decades for a number of reasons, but the coal market had turned even before the recent Russian invasion of Ukraine, and the recent geopolitical developments have changed the way much of the world looks at energy.

Peabody Energy (NYSE:BTU) is the largest coal supplier in the United States, and the second largest coal supplier in the world. The company has 32 active mines and 5.5 billion tons of coal reserves. The company sells thermal and metallurgical coal. The company’s business in centered in the US.

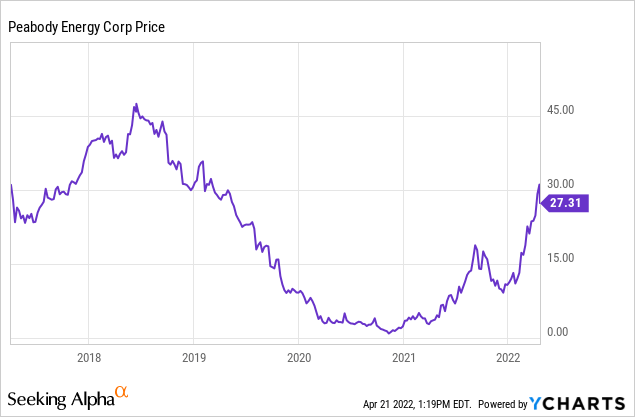

Peabody’s stock has had a nice run since early 2021, as thermal and metallurgical coal prices have risen.

Coal is still the source of nearly 40% of the world’s electricity use, and even though demand for thermal coal has fallen in mature economies over the last decade, demand for coal has risen in emerging markets such as China and India. The rate of demand decline in the US has also slowed, and demand for coal in Europe has risen as disruptions of natural gas supplies has occurred.

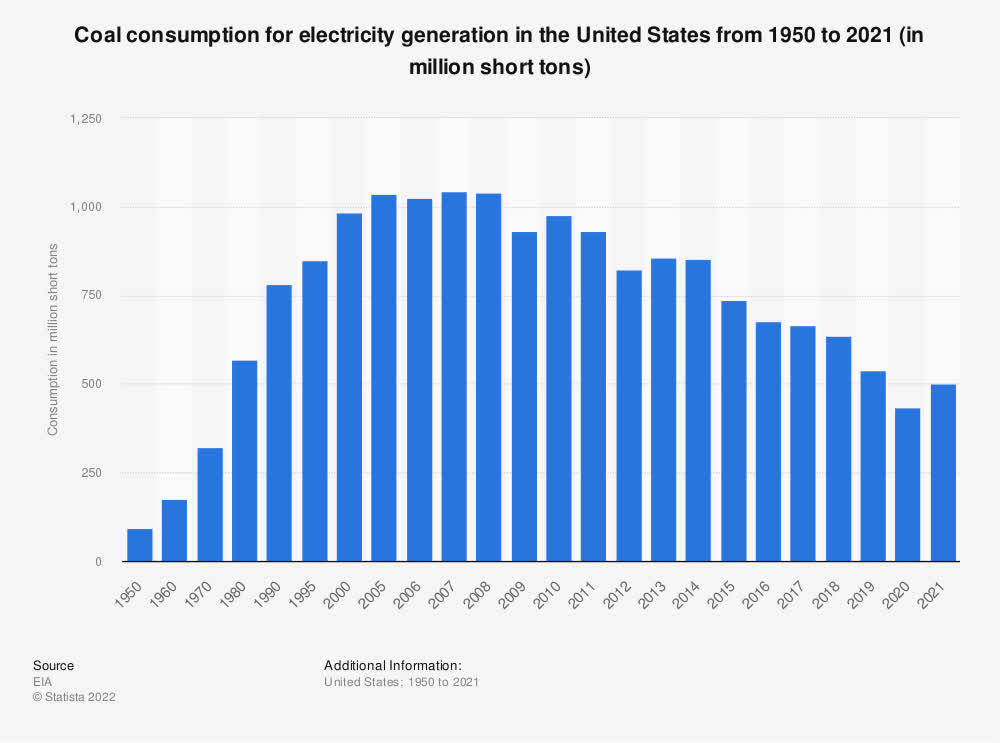

Also, even though US demand for coal has fallen over the last 50 years, the overall rate of decline has slowed significantly in recent years, and the US still uses coal for about 22% of electricity needs.

A Chart of US Coal Consumption (EIA)

US coal consumption has fallen significantly over the last 20 years, but the rate of decline has slowed over the last 5 years, and there has been a very marginal decline in domestic coal consumption since 2019.

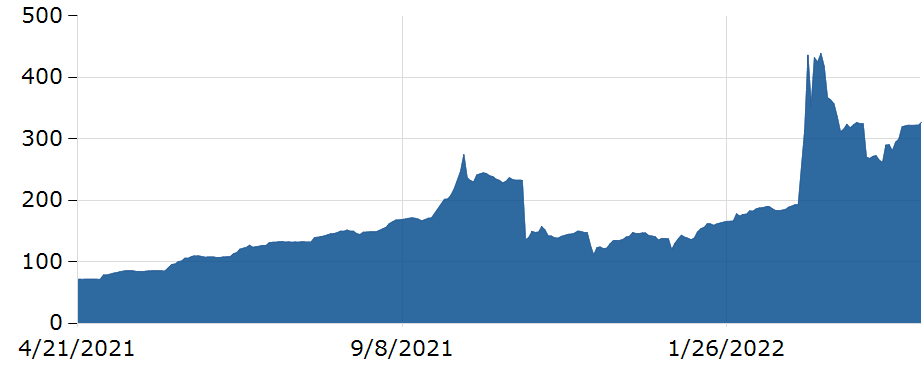

Thermal coal prices overseas have also risen significantly. Historically thermal coal prices have ranged between $50-100 a ton, and prices were at around $150 a ton at the beginning of the year even before Russia exports were effectively taken off the market.

Coal Prices (Markets Insider)

Thermal coal prices have risen dramatically since early in 2021, to prices of over $400 a ton.

Russia made up nearly 18% of coal exports worldwide. Indonesia has recently lifted the country’s ban on coal exports, but Indonesia has had issues with coal shortages, and the country is still limited in efforts to supply continents such as Europe where demand for coal is high right now.

Coal prices have risen in the US and overseas for a number of reasons, and the industry appear to be entering into a long-term bull market. In the US mining capacity for coal has fallen by 40%, there is a shortage of workers in the coal industry, and natural gas prices are much higher in the US and overseas than 4-5 years ago. The amount of coal workers in the US is down by 8.6% since the pandemic. Wages are up 10% in the US coal industry, but companies are still having issues finding workers as the pandemic caused some workers to relocate to less demanding industries with comparable pay such as the auto industry. Natural gas prices have also been higher worldwide, including in North America.

Peabody has industry leading margins as well. The company’s cost per ton ranges from $10 in projects such as the River Basin, to $100 per ton. Peabody’s net margins over the last 12 years have usually been negative, and the company’s best years produced net margins of 12-13%. The company’s current net margin of 10.9% is the high end of the range the company has seen over the last decade, and management is forecasting margins to be even stronger next year as thermal and metallurgical coal prices are expected to remain high for some time.

Metallurgical coal prices can be very volatile in general, particularly overseas, primarily because how Chinese demand can fluctuate when government spending levels fall. In late 2021, when China stopped most domestic steel production to lower pollution levels for the Olympics, but the bull market in thermal coal has been more steady. The Chinese construction industry and Chinese demand for metallurgical coal can rise and fall very quickly. China spent heavily on real estate and infrastructure projects during the pandemic, the country has slowed spending levels significantly over the last year though, and China is likely to spend less domestically on social and economic projects as normal growth rates return.

Thermal coal prices have also risen internationally because of supply shortages in countries such as Indonesia, Russia coal supplies being essentially off the market, high natural gas prices, and disruption natural gas pipelines. Demand for coal in Europe has risen over the last year. China has had issues with supply shortages of coal as well.

A Picture of Coal (gettimages)

Peabody’s core business is in the domestic US coal industry, and the company gets nearly 80% of their sales from the domestic US coal industry, and nearly 20% of sales from overseas. The company sales around 100 million tons of coal domestically, and around 20-25 million tons of metallurgical and thermal coal internationally. Peabody is not currently in a position to supply Europe, but events in Europe obviously still impact coal prices worldwide.

The company did take a loss on paper on seaborne sales because of hedging, but the loss is only on paper, since prices are up significant since these hedges were put in. Management also had to borrow money to cover the margin call on the hedge, but that, again, was because of how prices have risen, which is of course bullish for the company. Peabody took a loan out at $150 million at 10% interest rate to cover the margin call on this trade, the loss from the trade is likely going to be around $300-400 million. The company has nearly 60% of seaborne coal sales unhedged though after some of the company’s largest hedges finish off this year.

Peabody Energy’s stock is also cheap using a number of metrics. The company trades at just 2.45x forward cash flow, 3.4x forward EBITDA, and 3.7x forward earnings. The industry average is 5x forward cash flow, 7x forward EBITDA, 10.4x forward earnings. Peabody also has $950 million in total cash on the balance sheet at the end of last quarter, and the company’s cash flow position should be stronger next year with coal prices likely to remain high and many of management’s hedges on seaborne sales are coming off. The seaborne metallurgical coal market can be very volatile, and management is smart to have some hedges on given Peabody’s market capitalization of $4.4 billion.

The Russian invasion of Ukraine has changed the way the world looks at energy. While some individuals and governments want the transition to green energy to be immediate, the reality is that even for the Greens, transforming global energy grid will take generations, and practical considerations need to be made. Europe gets nearly 40% of the continent’s oil and gas from Russia, and green energy sources won’t come close to substituting for the energy that Europe needs today. With natural gas in a multiyear bull market, coal shortages persisting, and demand for coal in both emerging and developed economies rising, thermal coal should be in bull market for some time. While seaborne metallurgical coal prices will likely continue to be volatile as Chinese demand oscillates, strong thermal coal prices in the US and abroad should support Peabody’s core business for years to come.

Be the first to comment