interstid/iStock via Getty Images

We are short International Battery Metals (OTCPK:IBATF), a Canada-based developer of lithium extraction technology led by a CEO whose two previous mineral extraction ventures wiped out shareholders. IBAT shares have been swept higher by glowing projections from management and widespread enthusiasm for EV-associated battery metals: in the last two years IBAT’s market capitalization is up 125x to $500m (all figures in CAD), gratuitous considering IBAT has yet to show that it’s mobile direct lithium extraction (DLE) technology works at pilot scale.

The start-up track record of CEO Dr. John Burba does not inspire confidence. While IBAT calls Burba “The Godfather of Lithium” (a title we have not been able to confirm was not self-anointed), immediately prior to IBAT he led two high-profile mineral extraction failures. Burba served as CTO of MolyCorp, a rare earth mineral excavator that advertised analogous claims of economically attractive mineral production powered by proprietary technology but went bankrupt, and as CEO of Simbol Materials, another DLE start-up with ambitious plans to revolutionize lithium extraction in the Salton Sea which ended in receivership.

IBAT is likely to follow a similar path in our view, as we expect its supposed mobile extraction prowess will fail when applied at commercial scale. Expectations of sustained lithium demand to satisfy the growth in electrical vehicle production has led to a wave of capital into the lithium sector. However, only a handful of new extraction technologies will succeed, and we don’t think IBAT will be among them based on our opinion that it lacks an established partner and a credible management team. We think the stock’s $500m market capitalization is implying excessive optimism, particularly considering IBAT’s thin balance sheet.

IBAT has struggled to find respectable funding, a clue that experts lack confidence in what IBAT is selling. The company’s licensee and largest shareholders are obscure entities with little or no background in the space invested 95% below current prices. IBAT owes $20m in debt to these shareholders and with only $4m cash as of the second quarter (approximately two quarters of burn), IBAT needs to raise substantial cash in the near term.

MolyCorp: Burba’s Highly Touted Mineral Extraction Venture Ends in SEC Investigation and Bankruptcy

CEO Burba has worked in lithium extraction for most of his career at industrials including Dow Chemical, FMC, and Chevron Mining. In 2008 Burba became Chief Technology Officer at MolyCorp, a rare earth miner at the time owned by Chevron and in 2009 he was appointed Executive Vice President.

MolyCorp went public in 2010 raising $400m with plans to reactivate a large but dormant mine in Southern California. The mining operation claimed – in the same vein as IBAT – its superior technology would lower the costs and environmental impact of mineral extraction compared to standard methods. Within four months of the IPO MolyCorp shares tripled reaching a market capitalization of $6b.

However, MolyCorp consistently missed production targets and underestimated costs. In 2012 the SEC investigated the company over the accuracy of its disclosures. MolyCorp’s CEO resigned the following month, and Burba left three months later. In 2015 MolyCorp filed for bankruptcy protection.

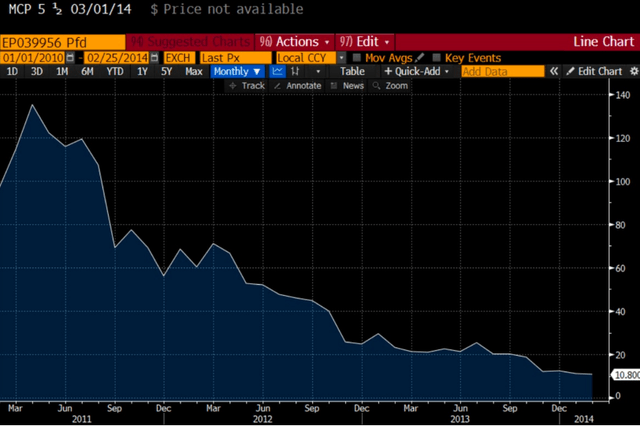

MolyCorp 5.5 2014 Convertible Bonds

MolyCorp 5.5 2014 Convertible Bonds (Bloomberg)

Despite the operational problems management maintained a confident outlook as detailed in investor class action lawsuits. In Armstrong v. MolyCorp, 2014, former employees allege management and specifically Burba perpetuated a misleading confidence even though operations lagged expectations.

A MolyCorp engineer alleged Burba focused on meeting target numbers over proper processes:

Armstrong v. MolyCorp, 2014 (PACER)

The engineer described how a critical mineral leaching system under Burba’s purview failed to work, yet MolyCorp built it anyway before conducting adequate diligence:

Armstrong v. MolyCorp, 2014 (PACER)

According to a MolyCorp Production Supervisor, Burba and CEO Mark Smith failed to adequately convey the engineering issues to investors, instead representing progress according to plan:

Armstrong v. MolyCorp, 2014 (PACER)

The lawsuit was eventually dismissed as it was ruled management did not purposefully mislead investors. However, the promotional statements and projections made by MolyCorp management including Burba were not disputed – defense lawyers called them “corporate optimism” and “puffery”. We think investors should consider this history when assessing Burba’s claims at IBAT.

Simbol Materials: Another Hyped Lithium Extraction Venture, Another Shareholder Wipeout

Burba next served as CEO of Simbol Materials between 2013 and 2015. IBAT stock promotion articles point to Simbol and its unconsummated buyout offer from Tesla as evidence of the company’s value. But Simbol, like MolyCorp, ended in total losses for shareholders.

The hype surrounding Simbol was nearly interchangeable with IBAT’s story: Simbol purportedly developed a cost efficient and environmentally conscious lithium extraction technology which generated considerable excitement even though it was unproven at commercial scale.

In 2014 Tesla, looking for a lithium source for its then under construction Gigafactory 1 plant in Nevada, offered to buy Simbol for $325m. The bid turned out to be a head fake, falling apart for numerous reasons including a Simbol counteroffer nearly 5x Tesla’s original bid.

Another reason: the technology failed to work at commercial scale. According to the CEO of EnergySource, a geothermal energy producer which at the time was partnered with Simbol, the start-up’s extraction method did not properly filter brine before processing it for lithium removal which caused issues:

There was a key step in the process that Simbol was trying not to do because it was expensive. And their demonstration plant, for that reason, never really operated continuously very well. – Eric Spomer, CEO EnergySource

Spomer noted that even though the process never worked at commercial scale, a member of Simbol’s management nevertheless patented it:

One of their principles just patented everything you could think of.

We suspect Spomer is referring to Burba, who advertises a “directory” of 80 patents on IBAT’s website.

Simbol was ultimately unable to attract sufficient investment and entered receivership in 2015 under which its IP was bought for approximately $1m. The patents have been traded between obscure DLE operators since.

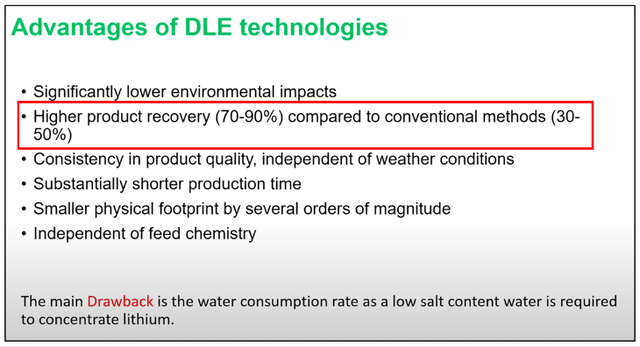

IBAT Claims “Validation” of Extraction Technology, But Disclosed Data is Limited

In September, IBAT touted test results of its mobile DLE plant, reporting a lithium extraction rate of “more than 65%” and recycling of 94% wastewater. IBAT called the results a “step-change” in lithium extraction. But the testing was extremely narrow, conducted on three extraction cycles over three days in August. By IBAT’s own admission, this was a “high-level due diligence review”. Moreover, IBAT’s extraction rate is unremarkable compared to other DLE operations which claim 70% to 90% rates.

University of Technology Sydney (YouTube)

Investors should be aware that IBAT faces considerable competition in DLE. Jade Cove Partners, a lithium-focused consultancy, is tracking at least 70 DLE methods and according to a Jade Cove principal, “some major lithium producers are tracking hundreds of technologies” [15:00]. Experts think only a handful will survive. According to David Deak, President of Marbex, a battery metal consultancy, only “one, maybe two types of different DLE platforms” will be operating by 2030 [30:30].

Funded by Obscure, Troubling Counterparties

According to a March 2018 promotional article (for which IBAT paid $90k), Robert Hillis Miller was one of the company’s early financiers (Miller’s LinkedIn profile lists him as CEO of Battery Metals Inc in 2016 – it’s not clear if this is the same entity as IBAT).

Miller is a former Vancouver-based broker who the SEC charged with securities fraud and disclosure violations in 2019. The SEC is accusing him of improperly selling $1.4m of stock in unregistered sales of ABAKAN, a company he founded and led as CEO which developed “nano-composite coatings”. The SEC alleges:

The funds were used to prop up Abakan’s struggling business, which never generated significant revenue, including paying Abakan’s vendors and employees such as Miller himself.

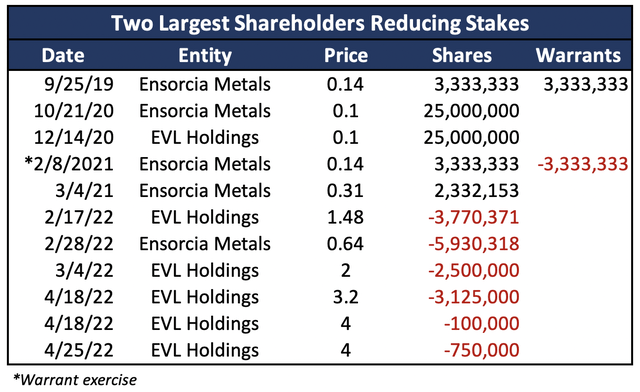

IBAT has primarily been funded by two entities: Ensorcia Metals which is led by CEO Daniel Layton, an energy executive affiliated with obscure energy and power related entities, and EVL Holdings, a Louisiana-based LLC set up roughly one month prior to investing a November 2020 IBAT private placement.

In 2018 IBAT licensed its extraction technology to Ensorcia in exchange for a 6% royalty on netback sales (sales minus COGS) and a 10% interest in Ensorcia, but no cash. Ensorcia was granted two-year warrants at $0.163.

Ensorcia purchased 34m shares in three private placements during 2020 and 2021 at an average price of $0.12 for a total cash outlay of $4m. EVL participated in one private placement in 2020, purchasing 25m shares at $0.10 for $2.5m. Ensorcia and EVL are considered IBAT insiders as both own over 10% of outstanding IBAT shares.

In February, Ensorcia and EVL began selling significant amounts of IBAT stock in private transactions. Ensorcia sold 5.9m shares at $0.64 and EVL sold 10m shares at an average price of $2.3. IBAT trading volume is relatively minute so it’s unclear how these sales were transacted. We asked management for further information but have not heard back at the time of publishing.

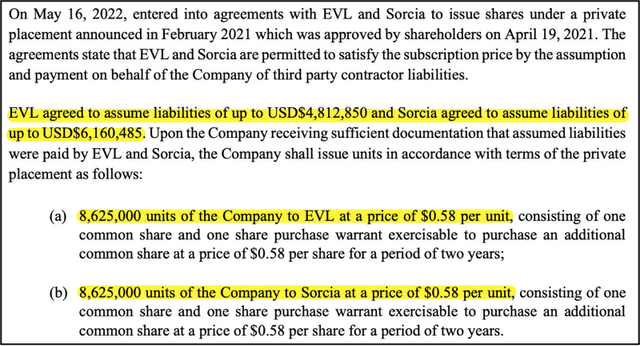

IBAT is Attempting to Settle $11m in Debt with Equity+Warrants at a 90% Discount

Ensorcia and EVL have also funded IBAT through payments on the company’s behalf which are accrued under trade payables. As of the end of July, Ensorcia and EVL are due $9m and $10m respectively.

IBAT attempted to settle the debts by offering Ensorcia and EVL shares and warrants in May under the terms of a private placement approved in 2021 priced at $0.58. The swap would exchange $11m in liabilities for 17.3m shares plus 17.3m two-year warrants. At a share price of $3.5, the equity and warrants are worth at least $110m, or 10x the amount owed to Ensorcia and EVL.

Annual statement for year ended January 31, 2022

Financing under terms offering such extreme benefit to insiders at the expense of non-insider shareholders is concerning. Moreover, it’s a clue that IBAT’s DLE tech isn’t well-regarded by industry experts and credible investors.

In September, IBAT disclosed the Canadian Securities Exchange required written confirmation from 50.1% of disinterested shareholders to approve this debt settlement. Considering the massive price discount, we think it’s unlikely IBAT will get such confirmation. If not, IBAT, with only $4m or less than two quarter of cash, will likely conduct another dilutive offering with warrants and it’s hard to imagine it pricing anywhere near the current stock price.

We asked management for more information on Ensorcia and EVL and how it plans to settle the $19m it owes to both if the debt for equity exchange is not approved. We have received no response at time of publishing.

The Godfather of Lithium?

IBAT marketing materials call Burba “The Godfather of Lithium”. We couldn’t find where the moniker originated. Neither could a leading lithium expert and former colleague of Burba whom we spoke with who has over 25 years of international lithium experience. He advises governments, suppliers, lithium-ion battery producers, and investors on lithium sector issues.

I never heard anyone refer to him as that… I laughed when I heard this, and the first time I heard him being called that was last year.

The expert also urged caution with respect to DLE in general:

It’s gotta be proven commercially which in my mind it has not been, it’s also not a one size fits all solution, just because it works in Chile doesn’t mean it’ll work in Argentina… DLE is a bespoke situation… it’s gotta be customized, even if it succeeds in Argentina, it might not work [elsewhere] because it depends on the brine.

We asked IBAT for clarification on the nickname but have received no reply at time of publishing.

The expert also provided his opinion on IBAT’s claims and chances for success. His comments can be found in a more full report on our website.

A $500m Lithium Start-Up Desperate for Cash: We Urge Caution

We believe IBAT must raise more capital in the near-term, likely with another warrant leaden offering or by diluting shareholders with a heavily discounted equity gift to its obscure insider shareholders. We think investors should heed reputable investors and avoid IBAT stock.

We recommend investors exit long positions. We believe IBAT is overvalued and recommend risk tolerant investors hold short exposure via stock (IBAT does not have listed options) The borrow rate on Interactive Brokers was recently 8% for shares traded on the CSE, although quantities are limited.

Risks to the upside include positive developments with IBAT’s mobile extraction technology including validation at commercial scale and disclosure of data showing lithium extraction rates in-line with other DLE technologies and water conservation near IBAT’s claims above 95%. Settlement of debt to Ensorcia/EVL and raising additional and substantial capital near current prices would support the stock as would partnerships with credible counterparties.

Be the first to comment