Khanchit Khirisutchalual/iStock via Getty Images

As the market is selling-off, I am an advocate of accumulating positions in quality companies that are likely to see sustained structural business tailwinds for multiple years to come. One industry vertical that I particularly like is data-analytics with a focus on website traffic insights. Semrush Holdings, Inc. (NYSE:SEMR), fits the screening perfectly. The stock is down 40% YTD and now trading at very attractive levels. Based on an EV/EBITDA multiples valuation, I calculate a base-case target price of $14.16/share—indicating approximately 20% upside. I initiate with Buy recommendation.

About Semrush

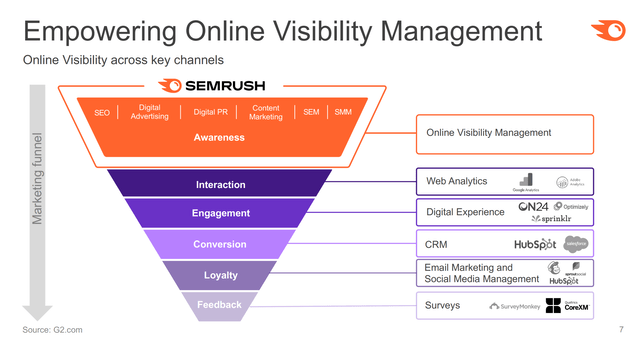

Semrush is one of the world’s most popular SaaS platform for sales and marketing professionals when it comes to online visibility management. Founded in 2008, the company offers solutions connected to digital research, digital marketing optimization and competitive analysis, including solutions that support SEO, SEM, SMM, digital advertising and PR. As of early 2022, Semrush serves over 87,000 paying customers in more than 145 countries, including industry leaders such as Disney (DIS), Salesforce (CRM), Facebook (META), eBay (EBAY), and the Washington Post. Semrush generates 45% of total revenues in the United States, 10% in the United Kingdom, and 45% in the ROW. Semrush first sold shares to the public only recently in May 2021.

Semrush’s Opportunity

I am bullish on Semrush’s value proposition, as I see the global demand for high-quality data analytics and website traffic analysis accelerate. According to company sources, management estimates the Semrush’s current market opportunity at approximately $16 billion annually. The company estimates the total addressable market by multiplying “Total Global Businesses x Online Penetration x Average Revenue Per Customer.” Similarly, the company’s biggest competitor Similarweb Ltd. (SMWB) estimates the industry’s total addressable market (“TAM”) at $34 billion.

That said, Semrush appears well positioned to capture a large share of this opportunity, as the company has established a one-step platform for marketers to search, website traffic and social media analysis. Moreover, since Amazon’s Alexa Web has closed operations in May 2022, the competitive environment for digital intelligence has become more favorable to the two main competitors Semrush and Similarweb. Personally, I have used both Semrush and Similarweb, and I argue both companies’ value-propositions are quite similar in nature. Similarweb might have an advantage from user-friendly use, while I feel Semrush’s data-insights are very slightly ahead.

The competitive environment of Semrush versus Similarweb is a factor that investors should monitor closely. However, the competition could also provide positive upside optionality if the two companies were to merge. Personally, and this is a speculative opinion, I see a merger as likely. And if it were to happen, I would turn ultra-bullish on the combined entity.

Note: Here my article about Similarweb.

Financial Performance

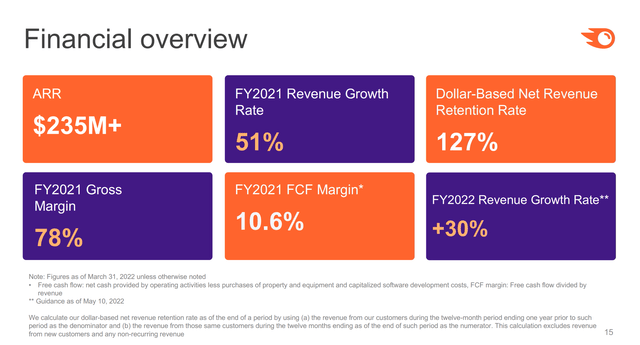

Semrush’s business fundamentals have seen attractive growth in the past few year, as the company managed to grow subscription revenue from approximately $20 million in 2016 to $188 million in 2021. Notably, this implies a 5-year CAGR of >50%. Guidance indicates that the company will grow 33% in 2022 and achieve record revenues between $249 and $251 million. But growth is not the only argument for Semrush, as the company also targets attractive profitability—80% gross margin and 20% net-income margin. However, as of 2021 Semrush was still writing losses. The company recorded an operating loss of $2.3 million and loss attributable to shareholders of $3.3 million, or -$0.03/per share.

The loss should not concern investors at the moment, since Semrush’s balance sheet is strong. By end of 2021, the company recorded $270 million of cash and short-term investments and no debt. In addition, cash from operation was positive at $23.8 million. But even then, given the company’s no-debt position, Semrush should easily be able to raise debt funding—without diluting shareholders.

How analysts see it

Analysts are positive on Semrush, with an average consensus target price of $13.33/share. Out of the seven analysts that cover the stock, three analysts have a BUY rating and four analysts a HOLD rating. According to the Bloomberg Terminal, as of June 2022, analysts see Semrush’s revenues in 2022, 2023, and 2024 at $249.7 million, $312.29 million, $372 million, respectively. This would equal a 3-year CAGR of more than 20% from 2022 to 2024. Respectively, EPS are estimated at -$0.32, -$0.14, and $0.03 for the same period.

Valuation

To value Semrush stock, I propose using multiples, as the company is not yet profitable and visibility for profitability remains limited. However, please note that I am not a fan of multiples valuation. Thus, this section should only be regarded as a reference point to anchor a valuation estimate. That said, I suggest applying the average 1-year EV/EBITDA multiple of the two industry leaders Similarweb (x3.4) and Semrush (x5.9), equal to x4.65. If we apply this multiple for Similarweb’s 2024 revenues of $372 million, we calculate an EV of $1.73 billion and an equity value of $1.99 billion, or $14.16/share (approximately 20% upside). Thus, my valuation for Semrush is about in line with/slightly higher than the average analyst consensus target

Risks

I would like to highlight the following downside risks that could cause Semrush stock to materially differ from my price-target of $14.16/share:

First, Semrush is writing losses. There is no guarantee that the company will achieve significant profitability in the next few years, if ever.

Second, a worsening macro-environment including inflation and supply-chain challenges could negatively impact Semrush’s customer base. If challenges turn out to be more severe and/or last longer than expected, the company’s financial outlook should be adjusted accordingly.

Third, investors should monitor competitive forces in the industry, as I have highlighted the similarity to Similarweb. If competition increases more than what is modelled by analysts, profitability margins and EPS estimates for Semrush web must be adjusted accordingly.

Fourth, much of Semrush’s share price volatility is currently driven by investor sentiment towards risk and growth assets. Thus, investors should expect price volatility even though Semrush’s business outlook remains unchanged. In addition, inflation and rising-real yields could add significant headwinds to Semrush’s stock price, as the higher discount rates affect the net-present value of long-dated cash-flows.

Conclusion

Semrush looks attractive at below $12/share. I believe the company will enjoy sustained and strong business growth for multiple years–driven by an accelerating demand for web-traffic analysis and digital research. Based on an EV/EBITDA multiples valuation, I calculate a base-case target price of $14.16/share—indicating approximately 20% upside. I initiate with Buy recommendation.

Be the first to comment