gremlin/E+ via Getty Images

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Muted Downside, Muted Upside

Our note from last December covering the two space-sector ETFs (here) aged well. We rated at Neutral, said we were unexcited by their holdings, and thought they were best avoided.

What happened then was that each fund fell. OK. But what’s strange is that both space-sector ETFs – that’s Procure Space ETF (NASDAQ:UFO) and ARK Space Exploration & Innovation ETF (ARKX) – hold not the banzai startups you might expect – and in which case, the decline in each fund’s stock price would be in line with the general assault on growth stocks of all kinds – but instead are essentially value plays with the occasional growth name sprinkled in.

And since growth has been down, you would expect value to be up, ergo, you would expect these funds to have performed rather well versus the growth-heavy S&P and Nasdaq.

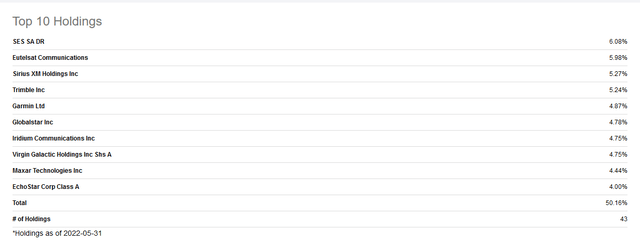

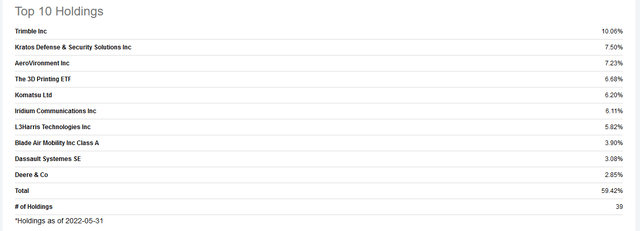

Here’s the top 10 holdings of UFO:

UFO Top 10 Holdings (Seeking Alpha)

And the top 10 holdings of ARKX:

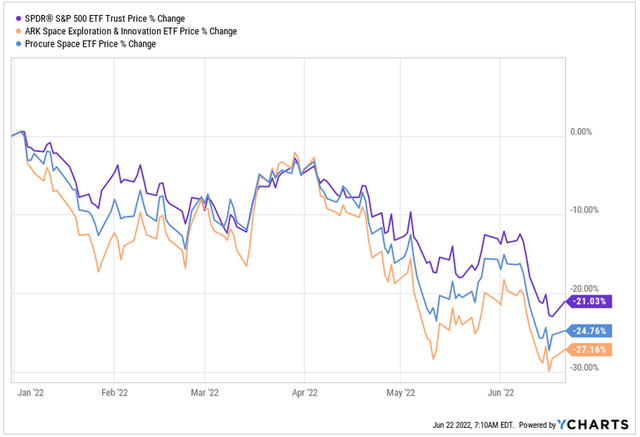

But here’s what has happened to each fund this year.

SPY vs UFO vs ARKX (YCharts.com)

Underperformed the S&P despite the raid on growth all year, and despite the value-oriented positioning in the two ETFs.

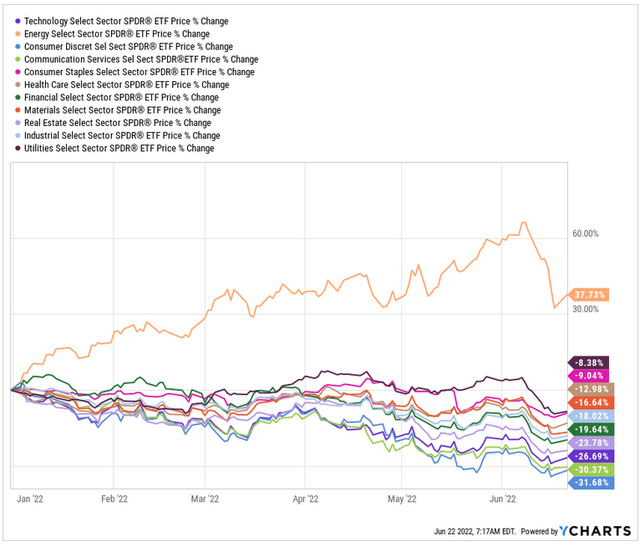

The principal reason for this, of course, has nothing to do with the ETFs themselves; both hold perfectly sensible value names which investors might reasonably expect to perform well in risk-off 2022 year to date. Sadly for anyone thinking rationally in this way, neither growth nor value-at-large has performed this year, and that’s because energy has hogged all the money. Here’s the SPDR sector ETFs, year to date.

SPDR Sector ETFs, 2022 YTD (YCharts.com)

Only energy is up!

Now, going forward, a prudent investor might expect capital to rotate out of energy and into some other sectors, particularly those that have been beaten down. After all even if the market at large doesn’t go up, simply by moving large chunks of capital around from the high flyers to the roadkill, elevating the roadkill and then rotating back into the newly demoted – this can generate positive returns, as long as you have enough money to actually turn the remains of a roadrunner into a phoenix.

So we are expecting the most abused sectors – consumer discretionary, tech, maybe even crypto, who knows – to gain some standing in the coming months, at the expense of energy and maybe utilities.

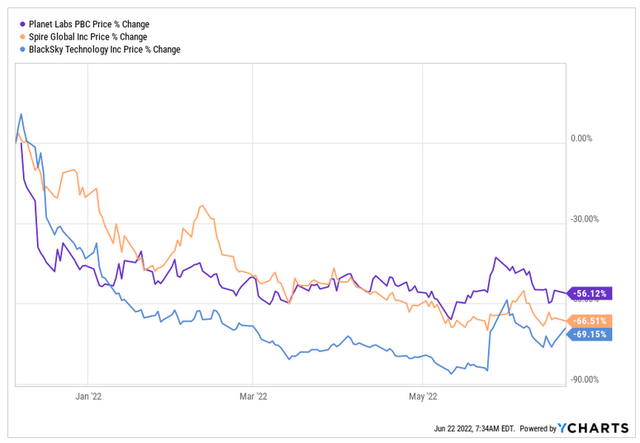

If that’s right, we would expect that in the space sector, the riskier stocks will benefit more than the safe havens. So whilst the holdings of UFO and ARKX are for the most part perfectly sensible things to own, we don’t think these names will necessarily catch an asset-class bid. Whereas names like Spire Global (SPIR), Rocket Lab (RKLB), BlackSky (BKSY), Planet (PL), and Mynaric (MYNA)- here you have major upside potential from high growth companies proffering beaten-up stock prices, and you have proximate lows offering you a place to put stop-losses to keep yourself safe from, you know, yourself.

Indeed at least three of these names might have bottomed insofar as they have not made new lows since the May timeframe, despite the market at large having dropped in June. Spire, Planet and BlackSky are each in the business of earth observation – optical spectrum in the case of PL and BKSY, RF for Spire – and this looks to be a going-up sector with more spending coming from government recently. (Maxar Technologies (MAXR) is also likely to benefit from this – it’s a holding in UFO).

PL vs SPIR vs BKSY (YCharts.com)

In the space sector, for now, we continue to prefer holding individual stocks. In staff personal accounts we own a mixture of early-stage growth (SPIR, PL, MYNA) and value (MAXR, IRDM) names and anticipate sound upside from here.

Cestrian Capital Research, Inc – 22 June 2022

Be the first to comment