insagostudio/iStock via Getty Images

Note: All amounts referenced are in Canadian Dollars.

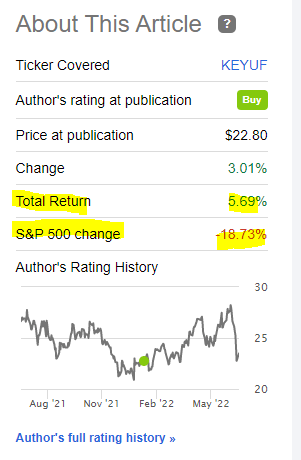

When we last covered Keyera Corp. (OTCPK:KEYUF) we gave it a tentative buy rating as the stock was attractive, but the margin of safety was modest. Specifically, we said:

Keyera’s 2022 EBITDA levels make it vulnerable to a moderate selloff should the markets head lower. We think there is some value to be had here but not enough that we get excited and rush in. We have sold the $27 strike covered calls and cash secured outs for Keyera and that is a level where we are comfortable establishing a small long position. We are still giving this a buy rating at the current price of $28.57, with a 12 month price target of $31.00.

Source: 6.5% Yield From Keyera Offset By Rising Debt Levels

How did that turn out? Well, as Charles Dickens might have put it, “It wasn’t the best of times, it wasn’t the worst of times.” Keyera delivered a very small total return, but the 24% outperformance vs the S&P 500 (SPY) was definitely comforting.

Returns Since Last Article (Seeking Alpha)

The company recently reported Q1-2022 results and updated its guidance. We took a look to see if we can continue with our constructive stance.

Q1-2022

The company reported adjusted funds from operations (AFFO) of $0.81 a share, in line with expectations. The company raised its guidance, mainly due to the marketing segment coming in extra hot. Marketing benefited from strong commodity prices, lower costs as well as a double-digit increase in volumes. The midpoint of marketing EBITDA was raised by over 20%. There was a small offset here with cash taxes moving up, which obviously makes sense when overall income levels increase. The company reiterated that KAPS pipeline was on schedule (Q1-2023 for barrel number 1) and on budget. Both aspects were positives in this high inflation and supply-chain-disrupted, climate.

Outlook

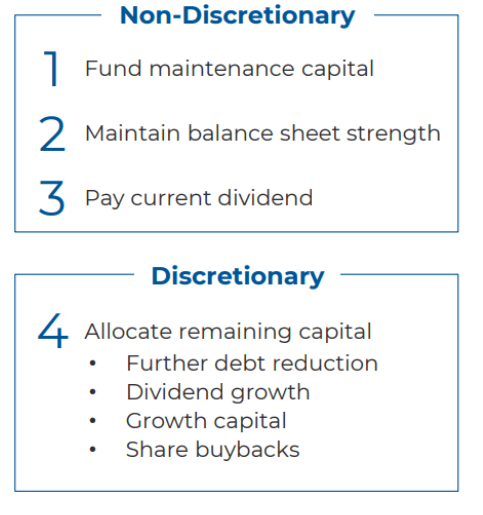

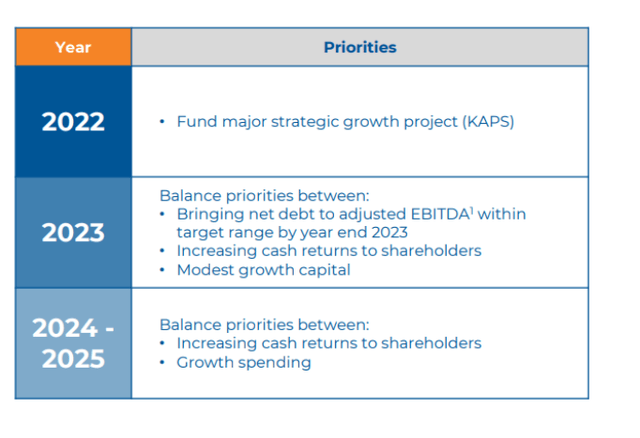

For 2022 we are looking at a $400 million increase in debt load as Keyera funds KAPS and other smaller projects. As we move past 2022, Keyera should be back in a commanding position to execute its strategy.

Keyera Presentation

Capex should move lower and the company should be in a position to actually reduce debt slightly while funding its remaining growth projects and the large dividend.

Since debt remains under 4.0X EBITDA levels, a large focus should be towards dividend increases and/or buybacks. We will reiterate here what we mentioned in the last article. Keyera excludes subordinated debt ($950 million, or about 1X EBITDA) from its debt calculations, and hence you will see glaring differences between the numbers we are talking about and the ones the company refers to.

We also see room to surprise to the upside on all its numbers as Canada remains one of the few places where oil and natural gas levels can increase meaningfully.

Valuation

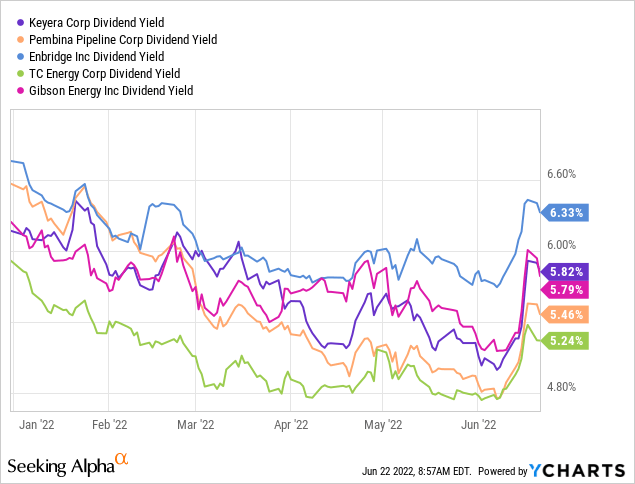

Keyera trades at about 10X AFFO based on 2023 numbers. That is about in line with its peer group of Pembina Pipeline Corporation (PBA), Enbridge (ENB), Gibson Energy Inc. (OTCPK:GBNXF) and TC Energy Corporation (TRP). All offer healthy dividend yields as well and there is not much to choose from between the group just based on that.

Keyera has the strongest growth in terms of change from 2022 to 2023, but that comes mainly as a result of really flat 2022 vs 2021. Looking over longer time frames, Keyera and TRP will be the only two out of the five, that will have 2023 AFFO levels below 2020 levels. So we would not get too excited over the 2023 bump. On a net debt basis, PBA looks the best, but debt levels are not concerning for any of them.

Verdict

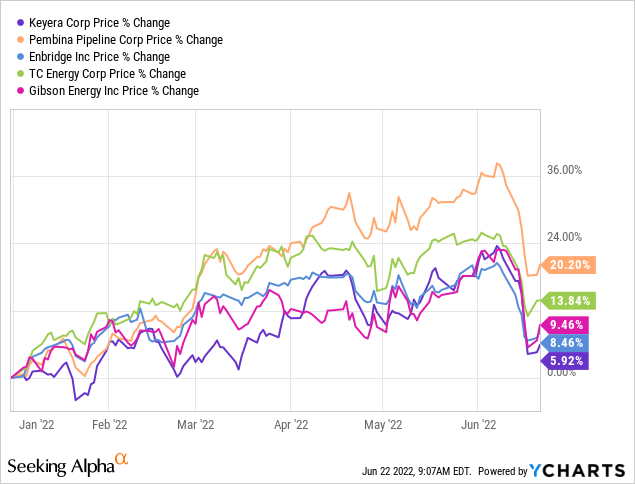

After a scintillating run, the group has given up on average half its gains.

With oil futures looking exceptionally weak this morning (down 7% as we type this), you might get another pullback on this group at the open. This is the kind of opportunity you have to buy in a secular bull market. In the case of Keyera, we adjust our entry point slightly upwards to $29.00. This is due to better performance than expected and a general uplift of commodity prices, thanks to extremely tight supply. Note that despite very bullish fundamentals, we are still exercising discipline and only raising a buy price by just 4%. As always, we never buy direct and sell cash secured puts that gives us a fantastic entry price. We will be looking to do so in the coming days.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment