metamorworks/iStock via Getty Images

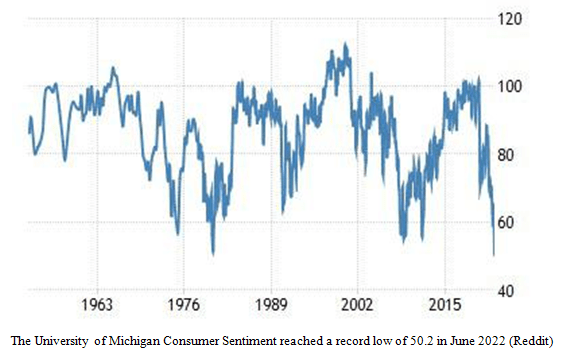

Uncertainty continues to weigh on the stock market. The best measure of America’s recent loss of hope is the University of Michigan’s consumer sentiment index, whose preliminary estimate for June plunged to a record low 50.2, down from 58.4 in May. Within the Michigan index, their “current economic conditions” index plunged to 55.4 (down from 63.3 in May) and their “consumer expectations” index fell to 46.8 (down from 55.2 in May). The good news from all this bad news is that “contrarian theory” says that when sentiment reaches such historic lows, the only way it can go is up. Capitulation usually comes when sentiment is lowest. That makes record-low consumer confidence, like this, a positive indicator.

Previous lows came at the start of long bear markets around 1980, 1990, and 2010 (see the chart below):

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Some other indicators last week reflected super-low consumer confidence. On Wednesday, the Commerce Department announced that retail sales declined 0.3% in May, which is substantially below the economists’ consensus expectation of a 0.1% rise. Also, April retail sales were revised down to a 0.7% increase, down from 0.9% previously reported. In the past 12 months, retail sales have risen 6.9%, but gasoline sales inflated that figure, rising 43.2%, mostly due to price increases. Spending on food and restaurants rose 17.5%, also due to price increases, plus emergence from COVID lockdowns. Excluding food and energy, retail sales are contracting faster, so talk of a recession this year is expected to accelerate.

Sure enough, in the wake of the May retail sales report, the Atlanta Fed on Wednesday revised its second-quarter GDP estimate lower to 0%, down from a +0.9% GDP growth previously estimated. Since the U.S. Commerce Department already said that the U.S. economy contracted -1.5% in the first quarter, a negative second-quarter GDP would mean that the U.S. economy is in a recession during the first half of 2021 – since two consecutive negative GDP quarters defines a recession. The fact that the Fed is aggressively raising key interest rates may even push us into a recession now, or later in the year.

An inverted yield curve is another advance sign of a recession since an inverted Treasury yield curve tends to make banks cut off credit – and it is also devastating for banks themselves. Last week, the 2-year Treasury note yield briefly rose above the 10-year Treasury bond yield, so this spike in shorter-term Treasury yields raised fears of a recession. That’s one reason why a growing number of strategists called for the Fed to raise the Fed funds rate 0.75% at last week’s Federal Open Market Committee meeting.

The latest “dot plot” of FOMC members now shows that the Fed funds rate will rise to 3.25% to 3.5% by the end of this year. Specifically, the FOMC statement said that, “The committee is highly attentive to inflation risks.” I think we can now expect 0.75% key rate increases at the July and September FOMC meetings, which will get the federal funds rate to 3%, which will still be below current market rates.

At the November FOMC meeting, I expect the Fed to lay off any rate increase, since it is just one week before the mid-term elections. Then, at the December FOMC meeting, the Fed can raise rates one more time to get in-line with market rates, but all these 0.75% Fed rate hikes will squelch economic growth.

In other economic news, the Labor Department announced that the Producer Price Index (PPI) rose 0.8% in May and is up 10.8% in the past 12 months. The core PPI, excluding food, energy, and trade margins, rose 0.5% in May and is up 6.8% in the past 12 months. That may sound bad, but the PPI numbers were higher in March, with headline PPI up 11.5% and core PPI up 7.1%, so PPI inflation may have peaked.

Also, the Commerce Department announced on Thursday that housing starts declined 14.4% in May to an annual pace of 1.55 million, compared to a revised 1.81 million annual pace in April. Single-family housing starts declined 9.2% in May, while multi-family starts plunged 26.8%. New building permits also declined 7% in May to 1.7 million, from a revised 1.82 million in April. Since mortgage rates have more than doubled in the last six months, from 2.67% at the end of 2021 to 5.78% currently (according to Freddie Mac), soaring mortgage rates are obviously curtailing new residential building activity.

On the jobs front, the Labor Department announced on Thursday that weekly unemployment claims declined to 229,000 in the latest week compared to a revised 232,000 the previous week, and continuing unemployment claims rose to 1.312 million compared to a revised 1.309 million the previous week.

The Economic Situation Worsens In Europe And Asia

No matter how bad inflation may be in the U.S., it is much worse in Europe, since a weak euro continues to boost the price of commodities – the weaker the currency, the higher the price. The Wall Street Journal reported that some factories have been dependent on cheap Russia natural gas, but those factories are now increasingly expensive to operate due to the much more expensive LNG. Specifically, chemical, fertilizer, and steel manufacturing plants in Europe are now being shut down, since they cannot compete with the Middle East, the U.S., and other regions that have lower energy prices. In fact, one of my stocks, CF Industries (CF), recently caused Britain’s largest fertilizer plant to shut down. Not surprisingly, Britain’s GDP declined in March and April, as higher energy prices for electricity take a toll on growth.

Many factories in Europe are talking about switching to hydrogen from natural gas, but that switch would be cost-prohibitive for most factories since, ironically, most hydrogen is made from natural gas. European manufacturers are also striving to comply with strict emission standards, and I would not be surprised if the European Union (EU) provides some temporary relief to their increasingly strict emission standards.

The European Central Bank (ECB) launched an emergency meeting last Wednesday to discuss surging bond yields in weaker eurozone countries that could choke off credit and tip those economies into a recession. Since the ECB has been withdrawing its quantitative easing (i.e., bond buying), market rates are soaring in all countries, but the spread between countries (such as German and Italian government bond yields) bodes poorly for Italy’s economy. The net result of the ECB meeting is that it has decided to reverse course and create a “new tool” to shield weaker eurozone economies from higher interest rates.

Translated from central banker double-talk, the ECB essentially is preparing to resume its quantitative easing to help stabilize government bond yields in Italy and other weak eurozone economies.

Over in Asia, China’s National Bureau of Statistics announced on Wednesday that retail sales declined 6.7% in May, marking the third consecutive month in which retail sales declined amidst the country’s draconian Covid-19 lockdowns, but May’s retail sales were an improvement over April’s 11.1% decline.

Another impediment to China’s GDP growth is that Beijing is starting to re-impose Covid-19 restrictions in other key cities. Although many U.S. regions have over 20% Covid-19 “positive” rates, our vaccines work better than those administered in China. Eventually, slower GDP growth in China and Europe should curtail global GDP growth and crude oil demand, but so far crude oil prices remain elevated.

President Biden Calls on Oil Companies to “Do Something” To Lower Prices

Speaking of crude oil, I should add that President Joe Biden is obviously becoming increasingly frustrated with the high and rising gasoline prices at the pump. Last Wednesday, President Biden sent a letter to seven major oil companies, calling for “immediate actions” to supply more fuel, saying that his administration was prepared to use “all reasonable and appropriate” tools to help boost the fuel supply.

Biden called on refiners to explain why they had shut down some plants that make fuel, which the Administration argues, contributed to “an unprecedented discount between the price of oil and the price of gas.” This letter from Biden concluded by saying that, “at a time of war, refinery profit margins well above normal being passed directly onto American families are not acceptable.”

The President of the American Petroleum Institute (API), Mike Sommers, countered that the API would welcome the opportunity for an “increased dialogue with the White House,” but he added that the Biden Administration’s “misguided policy agenda, shifting away from domestic oil and natural gas, has compounded inflationary pressures and added headwinds.” The API also stated that U.S. refineries were currently operating close to capacity and fuel production was near the top of the five-year range.

The Wall Street Journal reported that U.S. exports of refined fuels to Latin America and other markets contributed to higher prices at home, especially diesel fuel, which the U.S. has exported for decades.

Commodity costs push up car costs: Ford (F) CFO, John Lawler, said at Deutsche Bank’s Global Automotive Conference that “We actually had a positive bottom-line profit when we launched the Mach-e, but commodity costs have wiped that out.” Lawler added that “You’re going to see pressure on the bottom line when we launch our EVs.” Bloomberg reported on Wednesday that Ford’s hot-selling Mustang Mach-e and its other plug-in models are being rendered unprofitable by rapidly rising raw material costs. And Tesla (TSLA) just increased the price of its EVs for the third time this year, by $2,500 to $6,000, as high lithium, nickel, and cobalt prices continue to put pressure on battery prices.

Navellier & Associates owns Ford Motor (F), CF Industries Holdings Inc. (CF), and a few accounts own Tesla (TSLA), per client request in managed accounts. We do not own, Deutsche Bank (DB). Louis Navellier and his family own Ford Motor (F), and CF Industries Holdings Inc. (CF) via a Navellier managed account. He does not own Tesla (TSLA) or Deutsche Bank (DB) personally.

All content above represents the opinion of Louis Navellier of Navellier & Associates, Inc.

Disclaimer: Please click here for important disclosures located in the “About” section of the Navellier & Associates profile that accompany this article.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Be the first to comment