Khaosai Wongnatthakan/iStock via Getty Images

Investment Thesis

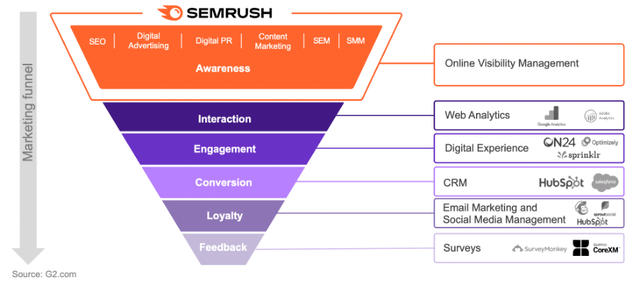

Semrush (NYSE:SEMR) is a SaaS company that operates a leading online visibility management platform, helping businesses make sense of all the data available to them in order to effectively reach customers online. This platform helps businesses to identify and reach the right audience for their content, in the right context, through the right channels – whether that is via social media, search, digital media, or more.

Semrush May 2022 Investor Presentation

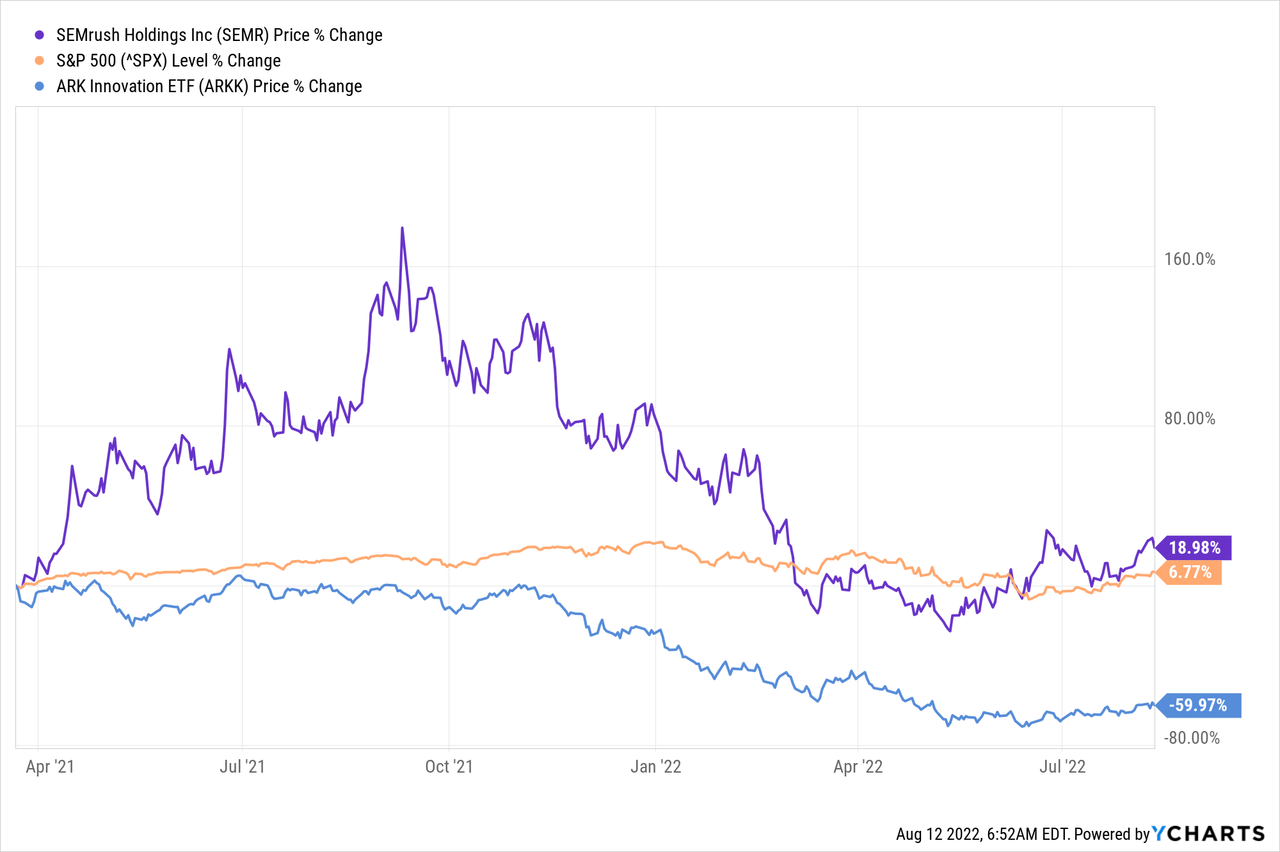

Semrush went public in March 2021, which unfortunately coincided with the beginning of the end for high growth tech companies. Yet Semrush has shown impressive relative strength, with shares rising 19% since its IPO compared to the S&P 500’s (SPX) return of 7% & the ARK Innovation ETF’s (ARKK) return of -60%.

I believe this speaks to the quality of this company, and the main reason that shares have not delivered thus far for investors is more to do with the overall market sentiment – the business itself remains strong.

In my previous article, I outlined in detail why I believed Semrush to be a great investment; in short, my investment thesis revolves around Semrush’s ability to land and expand with its customers. It has a sticky platform, and once a company gets their marketing set up on Semrush, they have no incentive to switch. Furthermore, the amount of data available to companies is only going to increase, making businesses like Semrush all the more important. It also offers an open, transparent, and independent approach to digital marketing, differentiating it from the walled gardens of Google and Meta Platforms.

The company just released its Q2 results, and shares reacted by jumping ~8% but finished the day ~4% down – although this was a day where the market as a whole was down, meaning that there was no great reaction in either direction. But should there have been, or was it just a bang average earnings report? Let’s take a look.

Earnings Overview

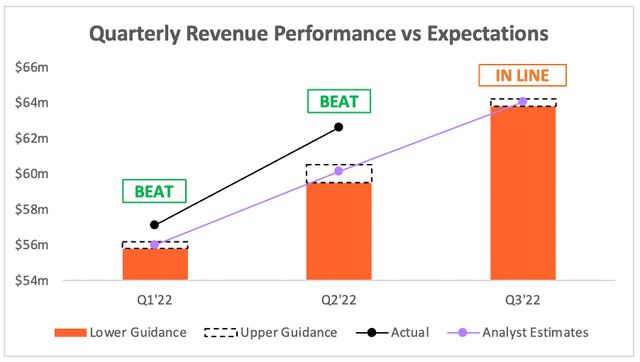

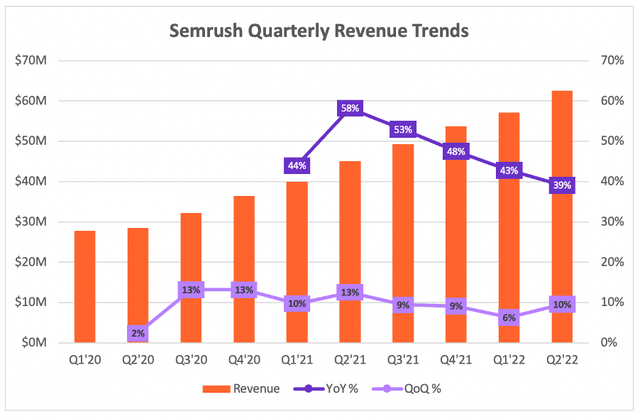

Starting from the top, and Semrush’s revenue grew 39% YoY to $62.6m, comfortably beating analysts’ estimates of $60.1m & coming in ahead of management’s $59.5-$60.5m guidance.

Investing.com / Semrush / Excel

A solid top line beat in the quarter, and management’s guidance for Q3’22 of $63.8-$64.2m was in line with analysts’ estimates of $64.0m. Perhaps after a substantial beat this quarter, investors would’ve been expecting to see Q3 guidance come in ahead of expectations, but CFO Evgeny Fetisov added some color to this on the earnings call:

Looking ahead to guidance, we expect the current economic conditions to persist and therefore we’re guiding for slower growth in the third quarter, before abounding in the fourth quarter.

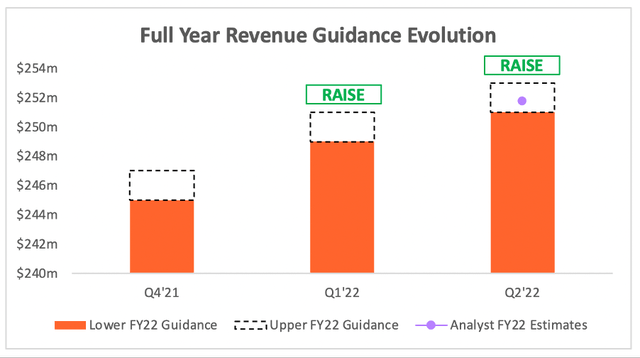

Semrush must certainly see revenue abounding in Q4, as they went and raised full year revenue guidance yet again, going from $249-$251m to $251-$253m; this was also in line with analysts’ expectations.

Seeking Alpha / Semrush / Excel

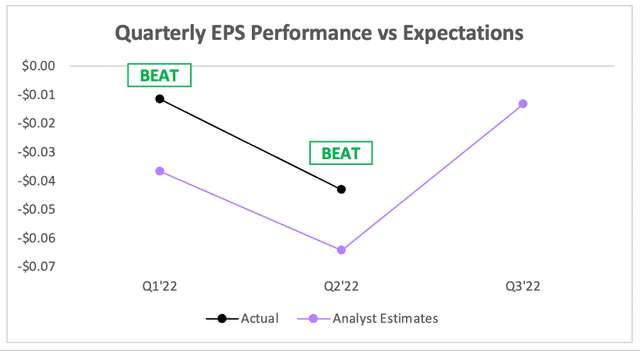

Going onto the bottom line, and the EPS for Semrush once again beat analysts’ estimates. Whilst this isn’t a company that’s focusing on optimizing its EPS, as it reinvests for the growth opportunity ahead, it’s always comforting to see EPS coming in above expectations.

Investing.com / Semrush / Excel

All in all, a really strong quarter for Semrush when we look at the headline numbers. It’s especially impressive when you consider that Semrush serves a number of SMBs (small & medium sized businesses), so I had expected it to be hit by the impact of a recession – particularly with the economic uncertainty in Europe. Thankfully, despite these difficult conditions, Semrush continues to show strength & shareholders should be very happy with these results.

Business Performance & Key Trends

Taking a look at some of the numbers behind the numbers, and I’ll start with Semrush’s quarterly revenue trends. When looking at YoY comparisons, it’s clear to see a slowdown from Q2’21 onwards – but, clearly the impact of COVID is causing these figures to be somewhat skewed, particularly because Q2’20 was a very weak quarter.

Sometimes it’s more interesting to look at the sequential trends, although there is a level of seasonality to Semrush’s business (summer can be quieter). When we look from a sequential point of view, this QoQ growth is the best Semrush has experienced since Q2’21 – which is even more impressive when we consider the difficult macroeconomic environment faced!

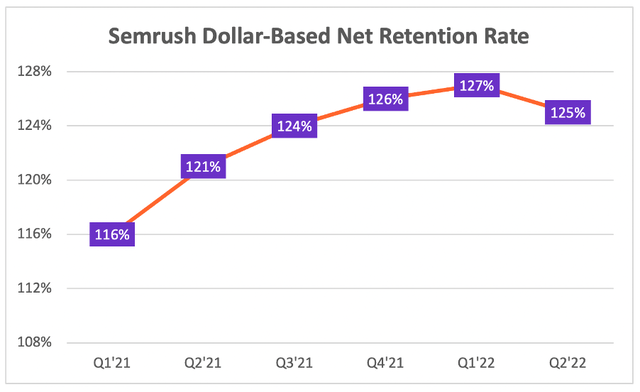

Even when we look at Semrush’s dollar-based net retention rate, there may be a QoQ slowdown, however 125% is still very strong – and, for example, the Q1’22 DBNRR was coming off an easier YoY comparison vs Q1’21.

Once again, given the recessionary environment, I think there is a lot to like about these figures. There’s also a lot to like about Semrush’s customer mix in this latest quarter, as Co-Founder and CEO Oleg Shchegolev highlighted on the earnings call:

I’m pleased to see our customer mix continue to improve in the quarter. The number of customers who pay more than $10,000 annually was up more than 80% from a year ago. We remain focused on the SMB market, but we continue to share rated growth from mid-market and enterprise customers as well.

Larger customers generally mean more stability, and also enterprise level businesses have deeper pockets that Semrush can dig into with its land and expand approach.

Moving away from the numbers, and one of the risks attached to Semrush that I highlighted in a recent article was its association with Russia – however, I also said:

Thankfully, the company announced in Q1’22 that it planned to wind down operations in Russia, with a goal to relocate substantially all employees by the end of September 2022. The company has taken clear steps to distance itself from Russia and remove the geopolitical risk, and so I do not foresee this being a risk to Semrush moving forward.

Well, it looks like Semrush has done a great job of finalizing these relocations quickly, as Shchegolev pointed out:

We have made remarkable progress in the relocations. We opened multiple offices across Europe and relocated nearly all of our full-time employees. As of today, we have no operations in Russia. I’m extremely proud of the Semrush team, the complexity and scale of relocating so many people over a short period of time was immense, but we rose to the change and made it happen.

Given all this, I think there are plenty of reasons for shareholders to remain optimistic about Semrush’s long-term success; the company is continuing to execute well in a difficult environment.

Valuation

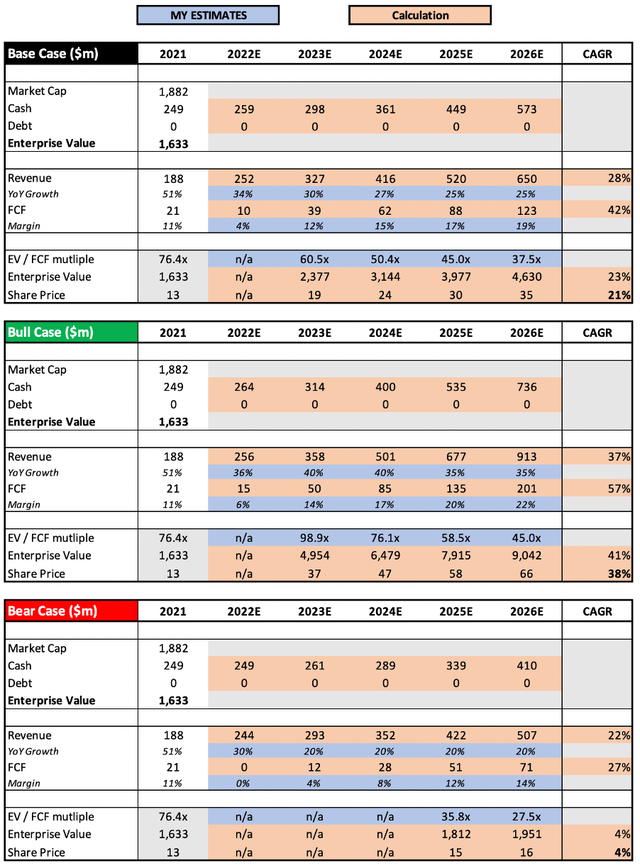

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Semrush is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

I have changed my approach to valuation slightly from my previous article, as I believe this will give a better understanding of the upside and downside in the bull and bear case scenarios.

The base case scenario hasn’t changed much; I have assumed that revenue will grow at a 28% CAGR through to 2026, which I think is more than achievable for this company. I’ve assumed FCF margin expansion (long-term EBIT margins should be ~20%, as per the May 2022 Investor Presentation), and used an appropriate EV / FCF multiple given the company’s revenue growth and margin expansion prospects beyond 2026.

The bull case scenario assumes that Semrush is able to accelerate growth in 2023 and 2024 as it continues to upsell existing customers whilst moving upmarket to larger enterprise businesses, with the revenue CAGR over the period coming in at 37%. Alongside this increase in revenues, margins are higher than my base case as Semrush scales up. My bear case scenario effectively assumes the opposite; that Semrush’s growth will falter coming out of the pandemic & going into a recession, and that the company never truly recovers to hit the heights that it could.

Put all that together, and I can see Semrush shares achieving a CAGR through to 2026 of 4%, 21%, and 38% in my respective bear, base, and bull case scenarios.

Investment Thesis: On Track

Semrush is continuing to put up strong results in a difficult environment, and there is nothing here to make me worried about my thesis. I still believe that this <$2 billion company is sorely undervalued, and that the current share price provides a very attractive opportunity for long-term investors. Given all this, I will reiterate my previous ‘Strong Buy’ rating for Semrush.

Be the first to comment