Matheus Obst/iStock Editorial via Getty Images

Yesterday, Daimler Truck (OTC:DTRUY) released its three-month financial accounts. Here at the Lab, our investment case was based on the following:

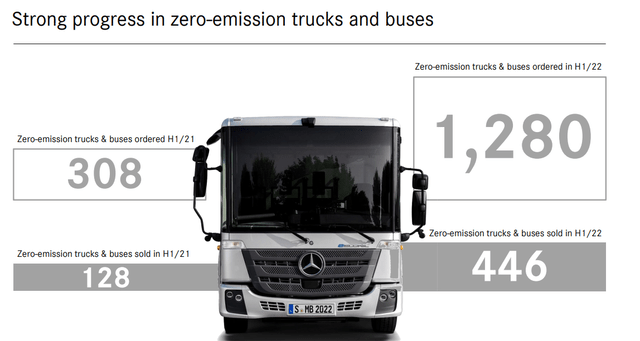

- the company’s specific portfolio advantages in autonomous driving solutions and the early adoption of Zero Emissions Vehicles with industrial plants for Battery Electric Vehicles production and Fuel Cell Electric manufacturing;

- in addition, as already mentioned in our Iveco’s initiation of coverage (OTCPK:IVCGF), we are positive about the continuous food requirements to meet population demand that is constantly growing.

This year, we already covered Daimler Truck twice, providing analysis on its megatrends and a Q1 comment on the company’s performances.

Q2 Results

Before analyzing the half-year results, we should mention that the German player has been less exposed than other truck manufacturers to supply chain disruptions due to the Russian invasion of Ukraine. Unlike its competitors namely Traton and Iveco, Daimler Truck did not source cabling from the country. As we can see below, despite rising revenues, Iveco recorded falling profits due to supply chain-related issues in the second quarter.

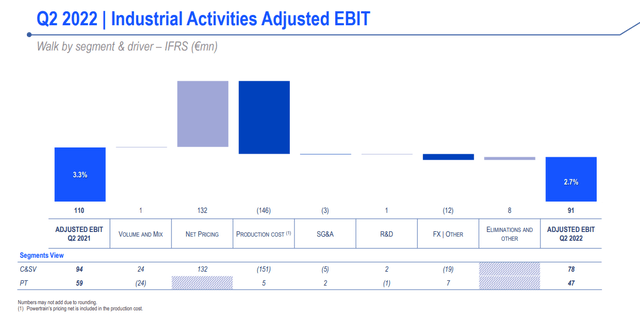

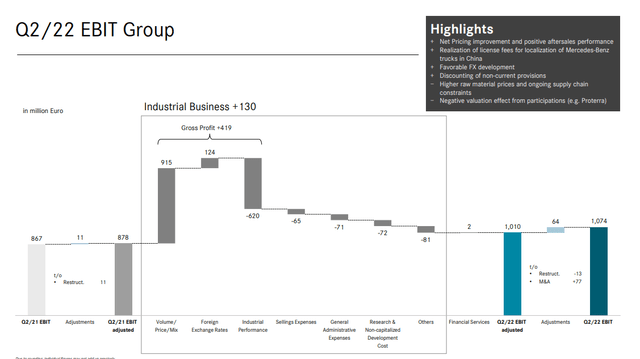

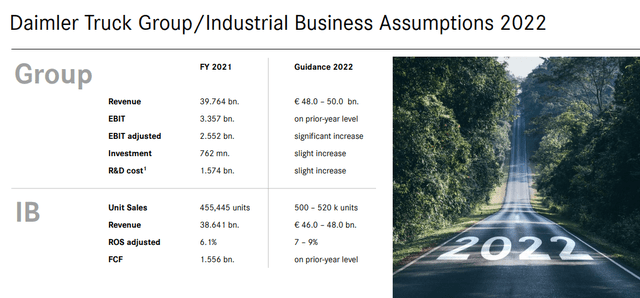

Numbers in hand, the truck and bus manufacturer saw revenues rise to €12.1 billion with a plus 18% year on year, beyond analysts’ expectations to €11.8 billion. Daimler Truck also recorded a 15% increase in adjusted EBIT to €1.01 billion in the second quarter, once again far exceeding analysts’ expectations that were forecasting €767.8 million. This was due to the high demand and positive currency development. In fact, double-digit growth was achieved at a net profit level that reach 946 million. However, the adjusted ROS (Return on sales) fell to 8% compared to 8.1% the previous year.

During the Q&A call, the company reiterated its positive outlook on a strong demand that will allow it to continue passing on rising energy and raw material costs to customers.

Conclusion and Valuation

The CEO is expecting a decrease in “supply bottlenecks compared with the first half of the year and no production downtimes due to the availability of gas“. Indeed, he confirmed the 2022 guidance and maintained revenues of €48-50 billion and a ROS of 7-9%. However, it reduced the Trucks Asia division’s ROS to 1-3% from the 3-5% previously estimated due to the impact of supply chain bottlenecks in China in the second quarter. Important to note is the fact that Daimler Truck sees “supply and not demand still a limiting factor” confirming that the company’s order book remained solid. The Daimler Truck figures are a positive reading for Iveco, which has revised its growth estimates upwards with the publication of the accounts for the second quarter. Regarding Daimler Truck’s valuation, we confirm our buy rating and target price at €35, appreciating the higher-than-expected adjusted EBIT, even if it was favored by FX development and the ROS confirmation of 7-9% by the end of the year. The risk paragraph is included in our initiation of coverage.

Be the first to comment