LifestyleVisuals/E+ via Getty Images

REITs are mainly targeted for their income generation potential.

Unfortunately, this often causes investors to chase high yields at the expense of unreasonable risks. The dividend then gets cut and investors are left holding the bag as share prices collapse.

We have seen it time and time again and have suffered our fair share of losses as well. My biggest mistake of all time is probably CBL Properties (CBL), which I had bought for its 10%-plus yield, thinking that it would be sustainable, but in hindsight, we know how catastrophic that investment turned out to be.

I like to think that my losses are my most valuable lessons. They allow me to evolve and learn from mistakes to avoid repeating them in the future as my wealth grows and my investments become more significant.

With that in mind, here are two REITs that I would avoid at all costs.

Orion Office REIT (ONL)

ONL is a new REIT that owns a portfolio of single-tenant office net lease properties. It’s a recent spin-off from Realty Income (O) that wanted to get rid of these assets.

This, by itself, already tells you a lot.

Why did Realty Income want to remove these assets from its balance sheet?

We believe that it’s because they realize that single-tenant office properties with short remaining lease terms are extremely risky in 2022.

Single tenant office building (Orion Office REIT)

They were risky already before the pandemic, but they are now even riskier because of the rise in popularity of remote/hybrid work.

Single-tenant office properties are a lot worse positioned than traditional multi-tenant office buildings post-pandemic because they’re much harder to release and/or repurpose if needed.

I know this from personal experiences working in private equity and dealing with such assets back in 2016. Already before the pandemic, these properties were nightmares when leases expired because they required a huge amount of capex and tenant improvements in order to secure a new lease. In some cases, it was almost impossible to secure a new tenant with economics that made sense and we were left with a huge vacant office building that turned into a liability.

Going forward, the situation will be even worse because increasingly many companies are rethinking their office footprint and we expect a lot of them to give up large single-tenant office buildings and move to a hybrid model combining smaller satellite offices in multi-tenant buildings and/or co-working offices at places like WeWork (WE) and/or use technologies like Zoom (ZM) to work remotely, at least a portion of the time.

Tenants know this and that puts them in a strong position to negotiate lower rents, high tenant improvements, and other benefits as leases expire.

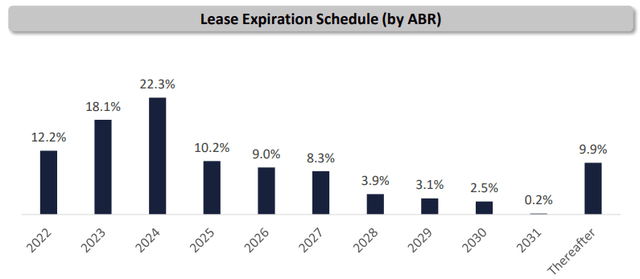

If ONL had long leases, it would be fine for a while, but unfortunately for its shareholders, its leases are very short with more than half of them expiring in the next three years:

Orion Office REIT is facing a lot of lease expirations (Orion Office REIT)

The management knows that it’s going to be a few rough years.

They signaled it very clearly when they decided to set their dividend at a level that was about three times lower than what most investors expected.

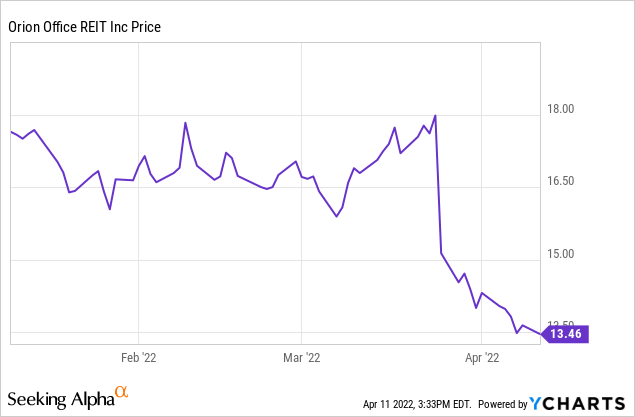

This is the equivalent of a dividend cut if you owned the shares of the company and it caused its share price to collapse when the dividend was announced:

Orion Office REIT is crashing (YCharts)

The dividend was set so low that the yield is just 2.9% even after the crash.

Will rapid growth compensate for the low yield?

We highly doubt it given what we explained earlier. On the contrary, we think that even this low dividend may be cut a few years down the line if they struggle to release their properties.

As we explain in a separate article, it will require a lot of capex to keep their properties alive, and therefore, their cash flow is much smaller than it may appear on the surface.

We would avoid this one.

Omega Healthcare Investors (OHI)

OHI is the leasing REIT that specialized in skilled nursing properties.

These properties were some of the riskiest in the commercial real estate landscape already before the pandemic.

Skilled nursing facility (Omega Healthcare Investors)

Their high cap rates lured yield-starved investors, but in most cases, the tenants would operate on very thin margins that left no margin of safety in case their profitability deteriorated even slightly.

Then came the pandemic, which materially disrupted their businesses.

It lowered revenue by reducing occupancy and rental rates, and at the same time, it increased its cost due to inflation and the difficulty to find people willing to work in these facilities.

As a result, a lot of operators became unprofitable, forcing them to stop paying their rent to OHI, and we expect a lot more such issues in the coming quarters. Today, more than 10% of tenants aren’t paying their rent and over a fifth of OHI’s other tenants are not profitable, and have threatened to stop paying rent in the near term.

The management clearly signaled this in their recent conference call:

“Portfolio occupancy growth stalled in the fourth quarter, driven by a continuing stretched labor market and the early effects of the Omicron variant. This impacted consolidated operator profitability, which declined slightly in the quarter.

“We’re not past tenants that we’re concerned about. I will tell you that we’ve had additional tenants express some liquidity concerns over the next couple of quarters. So I think all of our constituents need to be very careful thinking that the restructuring type scenarios are behind us. I’m sure we will have more. They might be small. They might be bigger, but it’s — there’s no doubt we’re going to be having these discussions for a few more quarters, just no doubt in my mind.”

We think that OHI will face significant challenges in the coming quarters and be forced to grant significant rent cuts to save its tenants. Sabra Health Care (SBRA), one of OHI’s close peers, recently gave a 30% rent reduction to its biggest tenant.

OHI will likely have to give similar cuts to a number of tenants, and as a result, we suspect that it will also be forced to cut its dividend.

This would ruin a 17-year long dividend growth streak and likely cause OHI’s market sentiment to take a big hit. Even today, the shares remain priced at a premium to NAV, and the NAV is expected to decline as rents are cut.

Don’t buy this high yielder.

Bottom Line

It’s almost always a mistake to buy a REIT primarily for its high yield (or its high expected yield, in the case of ONL).

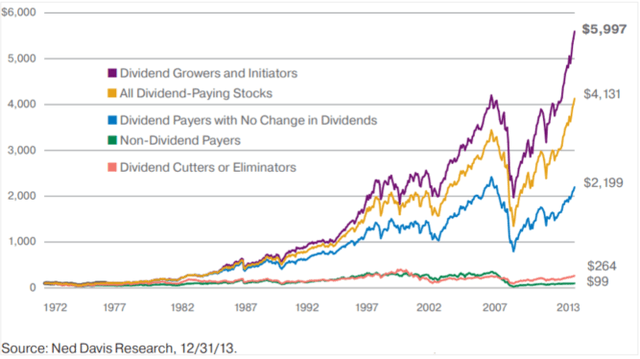

REITs are total return vehicles and high yield does not equate to high returns. On the contrary, research studies have shown that high yielding stocks that fail to grow their dividend or cut it do much worse over time than lower-yielding companies that actually grow their dividend:

Dividend growers outperform unsustainable high yielders (Ned David Research)

We do our best to find the top 5% of REITs that offer the best combination of yield, growth, and value. It is once you get the right mix that you get the best results.

Be the first to comment