Nikola93/iStock via Getty Images

The significant expansion of technology in recent years has had an interesting impact on the consumer goods space. The proliferation of technology has enabled tremendous data collection and analysis. This has opened the door to using this data for the purpose of optimizing sales and profits. Naturally, it stands to reason that some firms would come into existence that would be dedicated to facilitating this kind of activity. One such smaller player on the market today is a company called Aterian (NASDAQ:ATER). From a revenue perspective, the business has done extremely well to grow in recent years. But the firm is generating significant net losses and cash outflows. At the end of the day, investors buying into the firm are doing so not based on the fundamental value of the business, but instead on the idea that management can scale the enterprise rapidly enough to ultimately create value down the road. This is an incredibly risky way to invest, akin more to speculation than investing, but the upside for the winners could be tremendous.

A look at Aterian

According to the management team at Aterian, the company operates as a technology-enabled consumer products platform that uses data science to design, develop, market, and sell its products. At present, the business offers 14 different brands. These include, but are not limited to, hOmeLabs, Vremi, Squatty Potty, Xtava, and RIF6. Many of these brands actually focus on what investors would consider low-tech offerings. For instance, hOmeLabs emphasizes the production and sale of air purifiers, kitchen appliances, and refrigeration equipment. RIF6 focuses on office chairs, exercise bikes, and other types of furniture. Perhaps the most interesting product the company has is the Squatty Potty, which is essentially a footrest that a person can use at their toilet to make their body squat more ergonomically for the purpose of passing bowel movements. For the most part, the company acquires products that it believes will perform well based on the results of their data analysis. In 2021, the company acquired three different brands. And in 2020, they acquired five different brands.

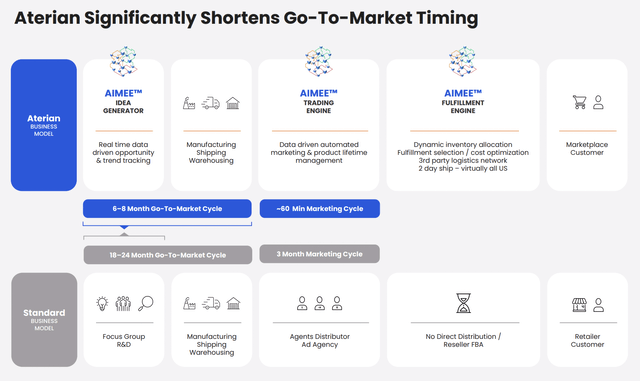

Where the aforementioned data and technology really comes in is when it involves the company’s AIMEE platform. This is a proprietary technology that serves as a cloud-based modular platform that management says incorporates a multi-tenant architecture. This platform connects to multiple e-commerce sites, including Amazon (AMZN), in order to collect and analyze data that can be used in product research, analysis, and other activities. This platform helps the company to automate and manage the lifecycle of their consumer product portfolio and helps to identify a wide range of opportunities such as product and market prospects, enabling the execution and management of marketing strategies, automating aspects of the company’s fulfillment processes, and more. Long term, the company also believes that it can generate revenue by offering its platform as a service to other consumer product firms.

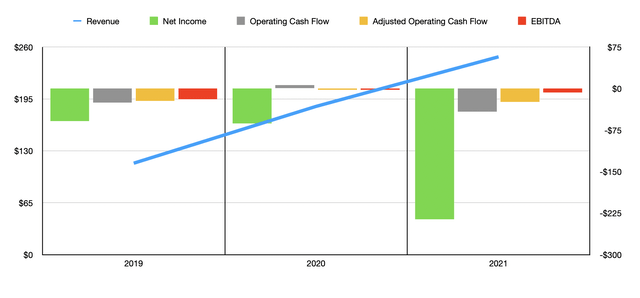

Over the past three years, management has done really well to grow the company’s top line. Sales for the company totaled $114.5 million in 2019. This increased to $185.7 million in 2020 before climbing to $247.8 million in 2021. As I mentioned already, a good portion of this revenue growth came from various brand acquisitions. To illustrate just how important acquisitions have been, it helps to understand just how many new products the company launched in the past couple of years. In 2020, for instance, the company launched 37 new products. This number increased to 40 last year. Management has not provided any guidance for the 2022 fiscal year, but it’s likely that this trend will continue for the foreseeable future.

While revenue growth for Aterian has been strong, the same cannot be said of profitability. The firm has actually seen its bottom line worsen year after year. In 2019, for instance, management reported a net loss of $58.8 million. This loss widened to $63.1 million in 2020 before surging to $236 million in 2021. Although the company saw its gross margin improve from 45.6% in 2020 to 49.2% last year, other costs went through the roof. Sales and distribution expenses more than doubled from 2020 to 2021, while general and administrative costs surged by 47.2%. However, it is worth noting that one of its major loss items was irregular and unlikely to repeat itself. This was the loss on extinguishment of certain debts. In 2021, this number came out to $138.9 million. That compares to the $2 million the company recorded one year earlier.

Perhaps a more appropriate way to look at the company is through the lens of cash flow. Operating cash flow was negative to the tune of $25.2 million in 2019. The company briefly saw positive cash flow of $6.1 million in 2020 before seeing a net outflow of $42 million last year. If we adjust for changes in working capital, the picture looks better still. After seeing a net outflow of $22.5 million in 2019, the outflow narrowed to $2.4 million in 2020 before widening to $24.4 million last year. Even better has been EBITDA. This number went from negative $19.5 million in 2019 to negative $7.2 million last year.

In order to continue expanding, management does have to continue to raise capital. The latest such move came from the issuance of stock and warrants earlier this year. That transaction resulted in gross proceeds of $27.5 million. That should bring net debt for the company down to about $20.1 million as of this writing. Factoring in the dilution associated with the warrants, because they are in the money, the firm’s market capitalization is $464.36 million. That does leave it with a fairly low amount of debt relative to its equity value. Even so, this does not really make it possible to value the business. So, at the end of the day, investors are really having to price the company based on their own expectations of what the future might hold as opposed to what the current picture looks like.

Takeaway

Based on the data provided, Aterian comes across as the rapidly-growing prospect that it is. But the firm’s larger net losses and cash outflows are disconcerting. You can’t really value the enterprise at this point in time because of its negative readings, but it does have limited debt and the ability to issue even more stock in exchange for cash if it so desires. All things considered, this prospect still is too risky for me. But I can understand why some investors would be drawn to the business.

Be the first to comment