Laser1987/iStock Editorial via Getty Images

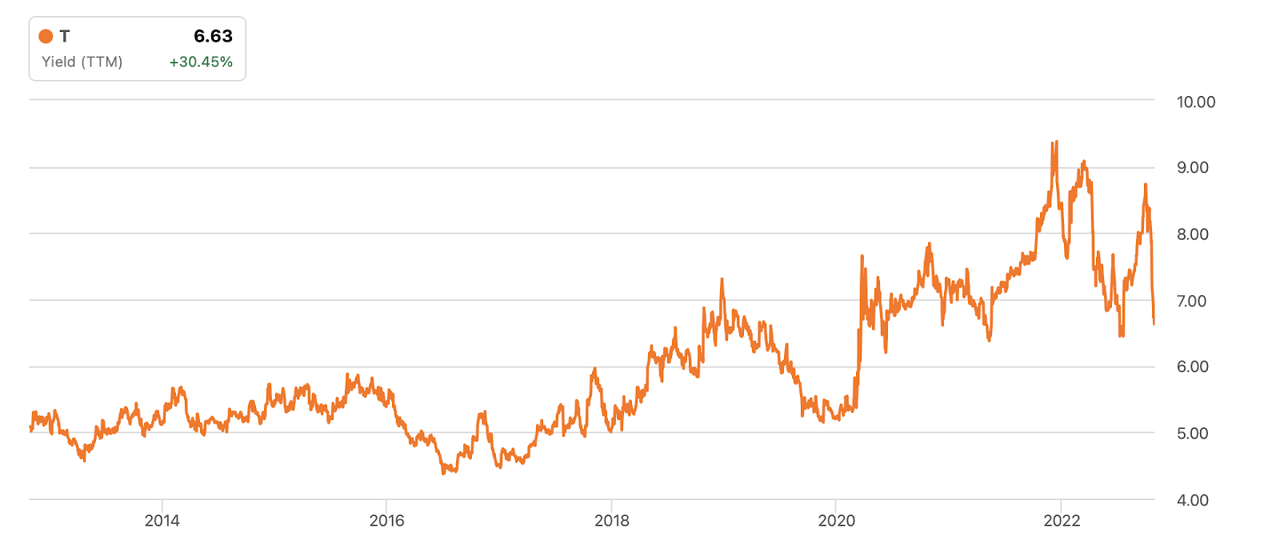

AT&T (NYSE:T) ticked up slightly after releasing an upbeat earnings report. While management appears to be delaying an inevitable cut to 2023 free cash flow guidance, the stock remains cheap here at just 7x earnings. The 6% dividend yield looks adequately covered by earnings, but the company likely needs to pay down debt for many quarters before it can resume meaningful share repurchases. Given where the rest of the market is trading today, I am still unable to recommend buying the stock – instead I want to see strong execution on debt paydown before committing my capital.

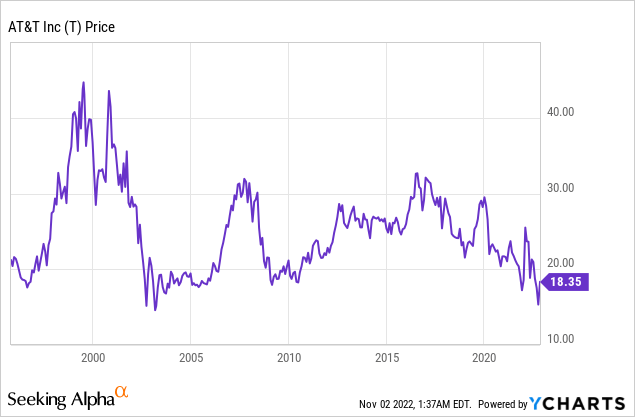

T Stock Price

It may surprise some to know that T stock trades at the same levels it did in 1995.

I last covered the stock in August where I highlighted the overlooked management risk. With the stock trading at just 7x earnings, that risk remains ever-present for the otherwise cheap stock.

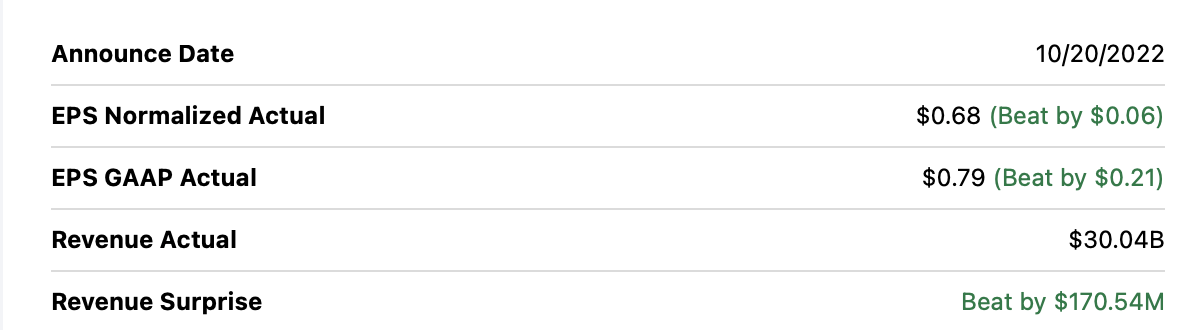

What Were AT&T’s Expected Earnings?

Consensus estimates called for stagnant top-line growth and minimal earnings growth.

Did AT&T Beat Earnings?

T ended up handily beating expectations on both the top and bottom lines.

Seeking Alpha

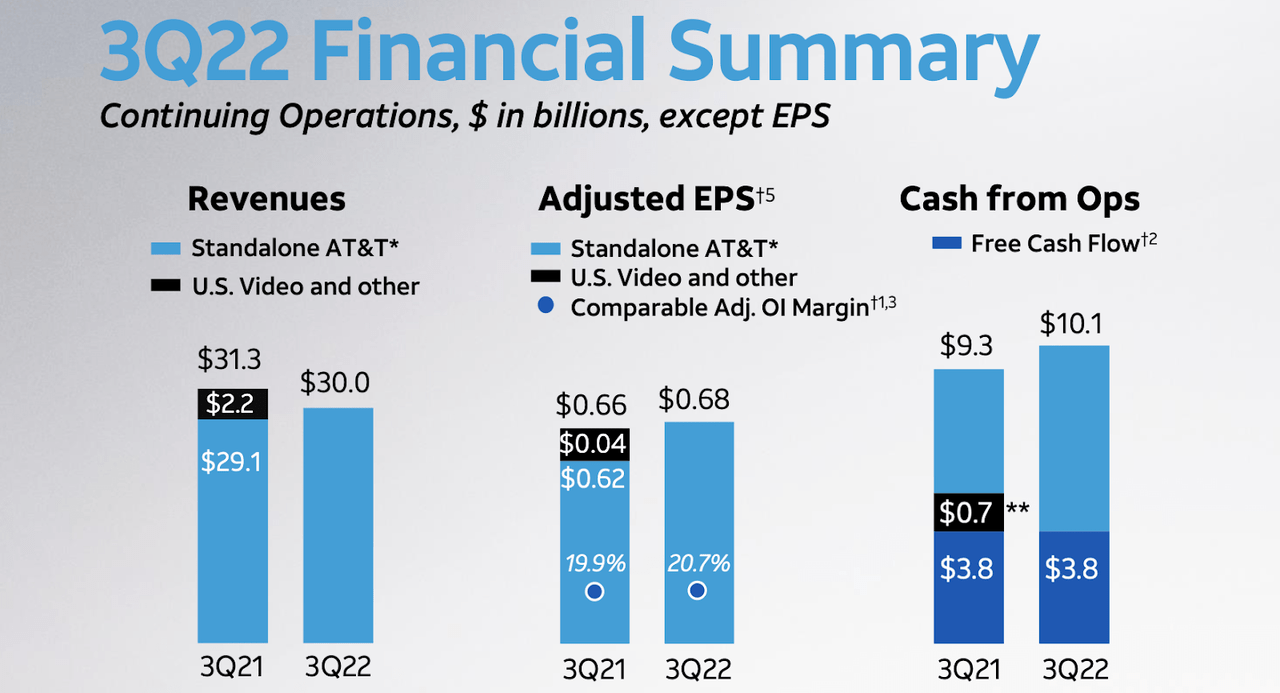

AT&T Stock Key Metrics

Revenues grew by 3% (based on standalone AT&T financials) and earnings by 9.7%. Management expects to earn at least $2.50 in adjusted EPS this year.

2022 Q3 Presentation

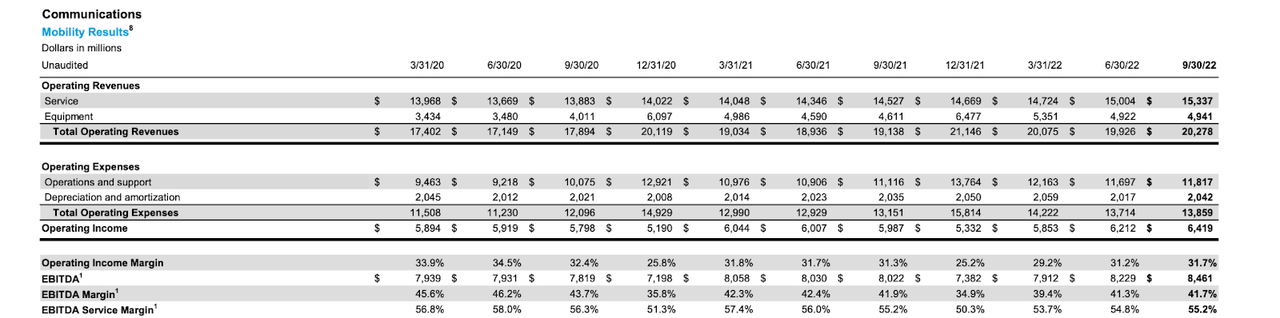

After the spinoff of WarnerMedia, it may be useful to check back on where the business stands today. I view T as being influenced by three primary drivers. First, its mobility business has provided slim top-line growth with consistent margins.

2022 Q3 Supplement

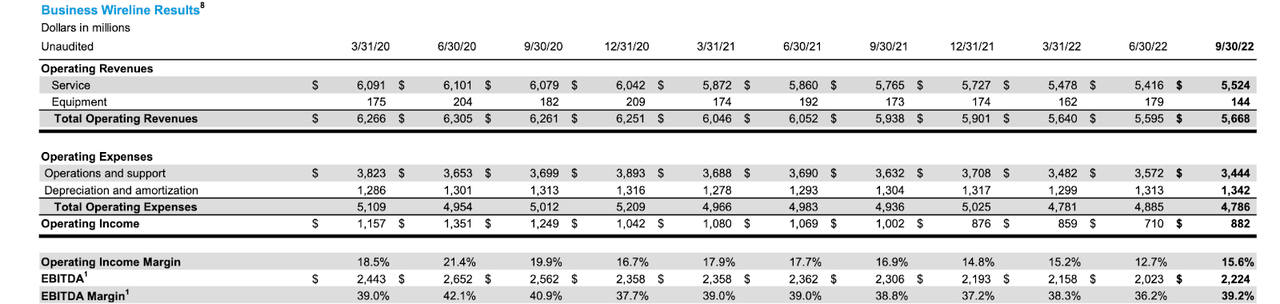

T has been pulled down by the business wireline segment which is facing secular headwinds and sizable margin contraction.

2022 Q3 Supplement

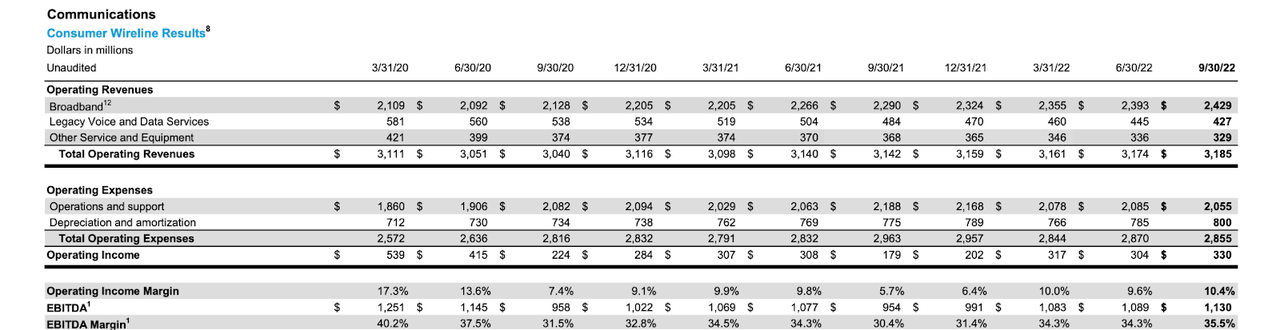

Those results are offset by rapid growth in broadband internet.

2022 Q3 Supplement

The company expects to generate $14 billion in free cash flow for 2022 versus around $8 billion needed to pay the dividend. Management had previously guided for $20 billion in free cash flow in 2023 but the commentary since seems less convincing.

And Kannan, on free cash flow, as I said earlier, we’re not updating our guidance for 2023. But what I did say, we’re over 3/4 of the way through this year. And based upon our view of where the macros and all the potential risk, we expect this business to grow both earnings and free cash next year and for all the reasons I articulated earlier on.

And in terms of just the broader macros, look, we’re not immune to them. But these businesses are generally more resilient even in an economic stress situation. So overall, I mean, that’s — we’ll give you an update next year.

Management appeared confident that they will begin to see operating leverage result in accelerating adjusted EBITDA growth. Management noted their priority to use excess cash flows to reduce leverage to a net debt to adjusted EBITDA range of 2.5x.

How Much Debt Does AT&T Have?

T ended the quarter with $133.5 billion of debt versus $2.4 billion of cash, representing a 3.22x debt to EBITDA ratio (down from 3.53x in the prior year, driven mostly by $27 billion of debt reduction). I estimate that the company will need to reduce debt by around $30 billion before it reaches its leverage target – representing around five years’ time based on the current $6 billion of retained cash flow after the dividend and assuming zero growth. Based on interest savings from debt paydown and some cash flow growth, perhaps the company can reach the 2.5x target within four years.

How Is AT&T Doing Financially?

Everything must be put into perspective. While T is far from growing rapidly, it continues to generate ample free cash flow and that may be enough considering the low expectations facing the stock. The company has a sizable leverage ratio but that debt load looks manageable considering the retained cash flow after the dividend.

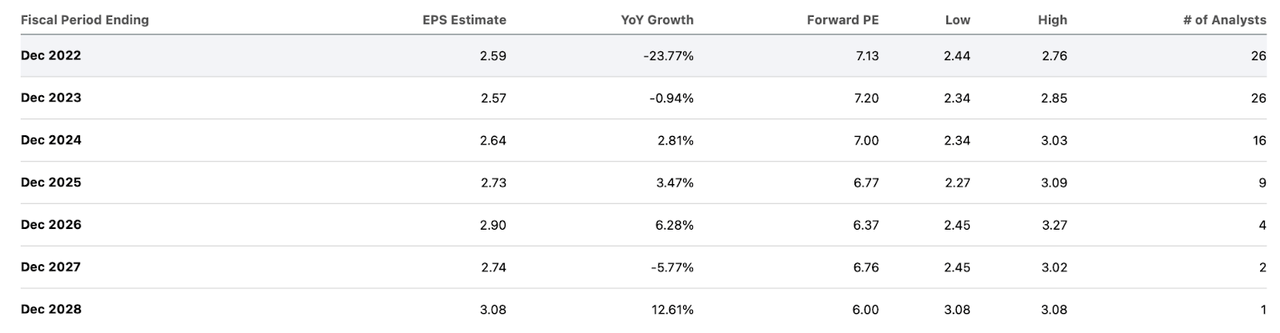

Is AT&T Expected To Grow?

Consensus estimates call for minimal revenue growth over the coming years.

Seeking Alpha

That plus cost savings is expected to lead to modest earnings growth.

Seeking Alpha

Is T Stock A Buy, Sell, Or Hold?

Bulls may argue that growth isn’t needed to make this investment work. The stock trades at just 7x earnings and at a 6% dividend yield.

Seeking Alpha

Due to the need for debt paydown, this stock may feel more like a 6% earnings yield rather than the 14% earnings yield that it trades at, as shareholders may only get the dividend for the time being. But even then, I suspect that many investors would be willing to wait 3-4 years as debt is paid down and the multiple begins to reflect that progress. I could see the stock trading up to 12x earnings as leverage comes down and share repurchases resume in full force. That reflects around 100% potential total return upside over the next four years.

Here’s the problem. Management has a long track record of failed M&A, based on unfulfilled promises and resulting in nagging debt loads. From DirecTV to TimeWarner, the recent acquisitions have not panned out for investors. Long time investors may attest that management has long been promising debt paydown and a reduction in leverage. I find it possible (if not likely) that management identifies an M&A target over the next few quarters which leads to leverage rising once again. Given this risk as well as the lack of share repurchases in the near term, I find it prudent to wait for real execution on debt paydown (I am waiting for debt to EBITDA to reach 2.8x) before buying the stock, as this may be “dead money” until free cash flow gets returned to shareholders.

Be the first to comment