LifestyleVisuals/E+ via Getty Images

Generally speaking, now is a great time to buy REITs (VNQ).

Rents are growing the fastest in decades.

Balance sheets are the strongest in history.

And the negative impact of rising rates is much lesser than the positive impact of inflation on most, but not all, REITs.

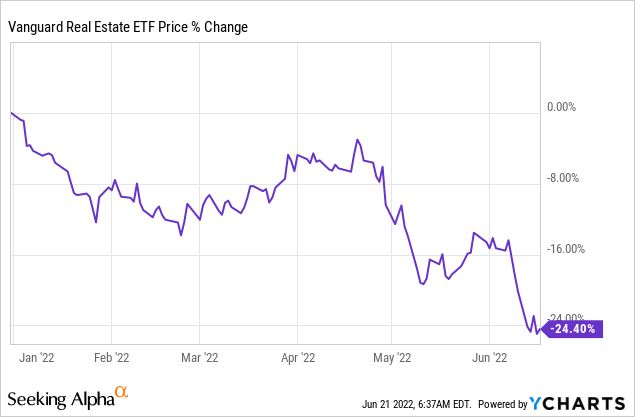

And yet, their valuations are the lowest in years, trading at steep discounts to net asset value after dropping by 25% earlier this year:

REITs drop heavily in 2022 (YCHARTS)

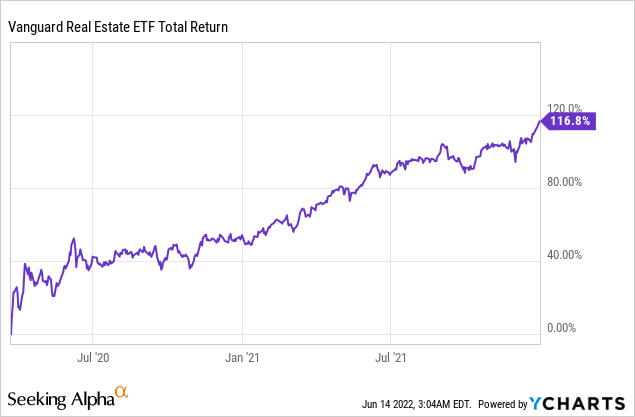

The market severely mispriced REITs early into the pandemic, and the sell-off was followed by a quick recovery with REITs doubling investor’s money in slightly over one year:

REITs nearly double in the recovery of the pandemic (YCHARTS)

Will this time be different? We doubt so.

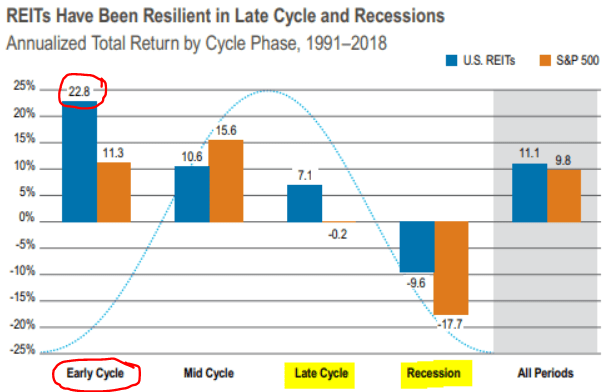

The market worries about the rising rates and a potential recession, but these are only temporary concerns. Soon already, we will likely end up in a recession, inflationary pressures will cool off, and interest rate hikes will again turn into interest rate cuts.

The narrative will then change and REITs will strongly recover just as they did following the initial pandemic sell-off:

REITs outperform during recessions (Cohen & Steers)

Therefore, we are today significant net buyers of REITs at today’s discounted prices. We issued 8 Buy Alerts at High Yield Landlord over the past month alone.

But despite being bullish, we have also sold a few of our holdings to recycle capital into better opportunities with greater upside potential.

PS Business Parks, Inc. (PSB)

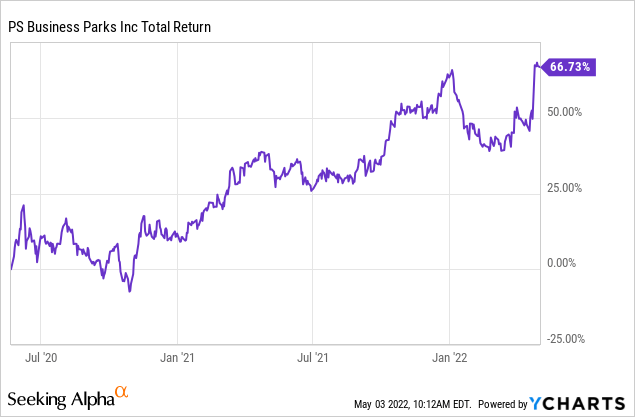

Earlier this year, Blackstone (BX) announced that it was going to buy out one of our Retirement Portfolio holdings, PS Business Parks (PSB).

We invested in the company almost exactly two years ago, and it has earned us a 67% total return:

PS Business Parks outperforms (PS Business Parks)

Normally, when a buy-out is announced, we immediately sell our position because we are not arbitrage traders. But in this case, we held on to our position for a bit longer, hoping that another buyer would come out and offer a higher bid.

After all, we have seen this previously.

When Monmouth Realty (MNR) came on sale, it attracted interest from several different investment groups and its buyout price kept getting bid up.

First, Equity Commonwealth (EQC) made an offer, and just as it seemed like they would get it, Starwood (STWD) came out with a slightly better offer. In the end, Industrial Logistics Properties (ILPT) made an even better offer and end up acquiring MNR at a 4% cap rate.

This just shows that industrial real estate is in high demand these days.

PS Business Parks property (PS Business Parks)

PSB owns a one-of-a-kind portfolio of flex industrial properties that would be hard to replicate. Blackstone (BX) made a decent offer, but they are opportunistic, and surely, they are thinking that they are getting a good deal.

Could Prologis (PLD) or another major industrial REIT offer a better price?

That’s what we were hoping. But as the market began to dip, and it became clear that a better offer was even less likely, we sold our position in PSB to reinvest elsewhere.

What did we buy?

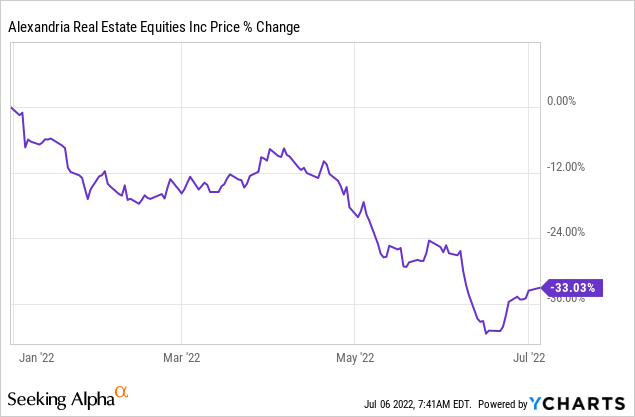

Shortly after the PSB deal was announced, Alexandria Real Estate (ARE) began to drop like a rock, and we used our proceeds from the PSB sale to start accumulating a position:

ARE’s drop was especially surprising since it posted strong Q1 results and hiked its full-year guidance.

For those of you who aren’t familiar with ARE, it is the only REIT that specializes solely in life-science buildings.

Life science building by Alexandria Real Estate (Alexandria Real Estate)

It is one of our favorite growth plays because its rents are deeply below market and as leases expire, we can expect substantial rent hikes in the coming years. The management noted that it expects 30-35% rent increases in 2022 for its expiring leases.

On top of that, ARE is in a great position to develop new assets to meet the growing demand for life-science buildings in the post-covid-19 world. It owns a lot of land that’s waiting to be developed and we think that the market has overlooked this part of the story because the land isn’t generating any cash flow yet.

We think that ARE’s share price should have risen when the results were announced, but its share price actually declined because of the recent market volatility. Therefore, it was and still is a good time to sell PSB to double down on ARE. We expect ~50% upside to our fair value target, and beyond that, it has the potential to deliver ~12% annual returns from its yield and growth prospects. That’s very attractive coming from what’s one of the safest blue-chips in the REIT sector.

British Land Company Plc (BLND), one of our UK holdings, had held up surprisingly well this year. It is up by 2% over the past year, even as most other European REITs have crashed due to fears of high inflation, a recession, and the war in Ukraine.

BLND’s performance is especially surprising when you consider that it is an office and retail REIT with lots of development projects. In that sense, it could be materially impacted if and when we go into a recession. You would expect such a REIT to drop a lot more than self-storage REITs as an example, and yet, it’s the opposite that has happened. Go figure.

BLND is not expensive, but relatively speaking, it is now a lot less attractive than many of our holding international holdings.

For this reason, we sold our entire position, earning a ~50% total return over our 2-year holding period:

HYL transaction (Interactive Brokers)

What did we buy with the proceeds?

Our second British REIT, the leading self-storage REIT Big Yellow Group (OTC:BYLOF), is down massively over the past year. It has dropped from GBp 1,700 all the way down to GBp 1,299.

It is hard to make sense of this huge disparity in performance between British Land and Big Yellow since self-storage is far more resilient to recessions and inflation.

After all, people need to store stuff regardless of economic conditions. In fact, during a recession, it may be even cheaper to downsize your residence or office space and rent storage space for the extra stuff. As a result, self-storage REITs delivered positive returns even in 2008-2009:

Self storage (Big Yellow Group)

Moreover, BYG is currently hiking its rental rates by 10%+ across the board. The company has no problem passing the inflation on to its customers.

Therefore, we think that the dip is an opportunity and we bought more of it:

HYL Transaction (Interactive Brokers)

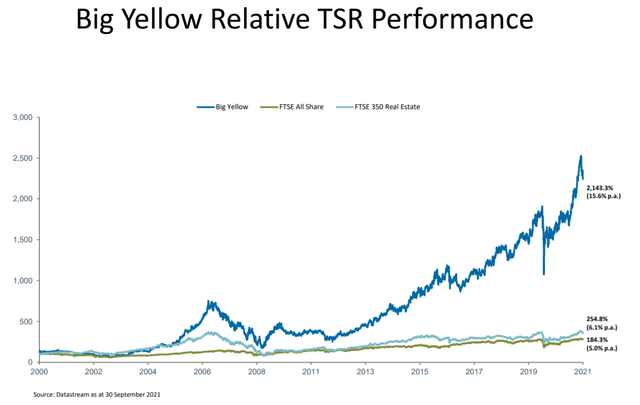

The company is now the cheapest it has been in years, and historically, it has always paid off to buy the dips in the company:

Big Yellow Group outperforms (Big Yellow Group)

The dividend yield is not significant at 3%, but if you add 10-15% of annual growth to that, you get very compelling total returns, and that’s coming from a defensive investment. All in all, we see this is an opportunity to earn above-average returns with below-average risk, which is what active investing should be all about. As the market recovers, it also offers 30%+ upside potential.

Bottom Line

Recycling capital from one REIT to another is one of our strategies to add alpha to our Portfolio.

Generally, we are long-term oriented and expect to hold our positions for years to come, but if a REIT becomes overpriced relative to others, we don’t hesitate to sell to boost the future upside of our portfolio.

Lately, the market has been very volatile and it has led to many such opportunities, allowing us to optimize our portfolio for the recovery.

Be the first to comment