mphillips007/iStock via Getty Images

Co-produced with “Hidden Opportunities”

There are always going to be risks ahead on the investment path. I have seldom seen perfect economic conditions where every prominent analyst gives the green light to enter the market. However, everyone will eagerly discuss the tales of economic bogeymen, inflation and rate hikes being the latest villains in the series.

So if you think you can time the market, sell now and buy when the “very obvious” market bottom strikes, and try to navigate the market with chart signals and stop-loss orders, I wish you the best.

“The inflation tax has a fantastic ability to simply consume capital. … If you feel you can dance in and out of securities in a way that defeats the inflation tax, I would like to be your broker – but not your partner.” – Warren Buffett

But mortals like me don’t have the skills or the risk appetite to zig when the market zigs and zag when the market zags. I’d rather stay away from the noise and do what has been rewarding for the better part of a century.

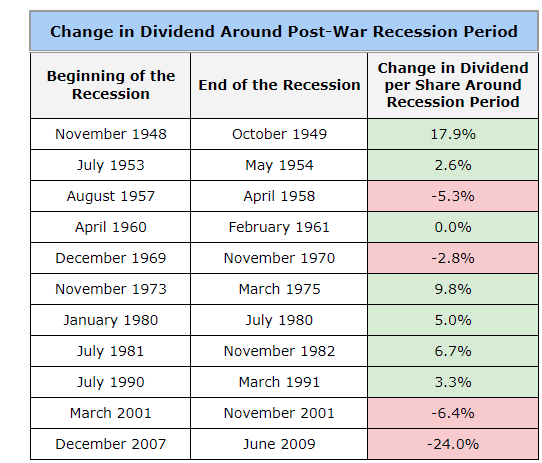

Dividends paid by fundamentally strong companies are much more resilient than you think. Looking at the 11 recessions since World War II, broader market dividends were reduced only four times. During other times (including the terrible 70s and 80s that everyone is talking about), these dividends provided meaningful and growing passive income to supplement investors’ quality of life.

Data Source: National Bureau of Economic Research

At HDO, we are investors in quality dividend-payers, and bear markets are like the holiday shopping season. We won’t let the news make us avoid buying securities to enhance our passive income. We discuss two picks to keep that passive income flowing without further ado.

Pick #1: DMLP, Yield 12.8%*

If high gas prices are your concern, then Dorchester Minerals, L.P. (DMLP) is your best friend. DMLP is the acquirer, owner, and administrator of Royalty Properties and NPI in the oil-rich Bakken and Permian basins in the U.S. and pays virtually all its income as distributions to shareholders.

Note: DMLP is a master limited partnership that issues a schedule K-1 for tax purposes.

We also note that DMLP pays a variable quarterly distribution based on the volume and price of hydrocarbons in the preceding quarters.

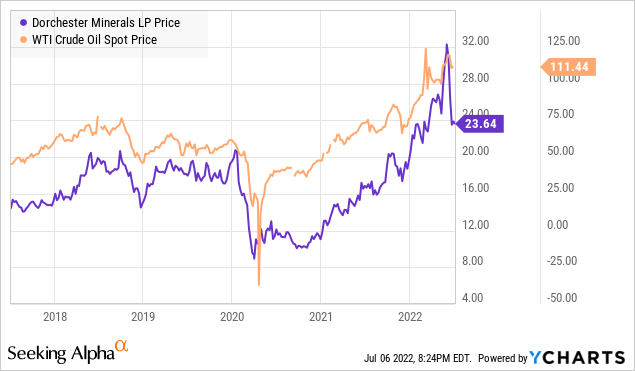

With WTI over $105 (2022 average is $101), we project the following two distributions to be above $0.8/share. This calculates to a whopping 12.8% annualized yield. DMLP share price almost always tracks the WTI crude oil spot price (and logically so since they own hydrocarbon royalty interests). But recently, we saw a significant deviation from the trend and consider this a buying opportunity.

Gas tax holiday or not, higher crude oil prices are expected to persist for a while. While the Biden Administration’s attempts to relax taxation on retail gasoline will undoubtedly lighten the burden on consumers, the underlying problem of constrained supplies due to underinvestment in the industry remains unsolved.

MLP represents the true definition of passive income, as it is passive even for the firm. The firm maintained a minimal administrative workforce, reported a 75% net margin in 2021, and maintained the same high margin level in Q1 2022. In the past four years, 98% of the firm’s net cash from operations was paid out as distributions to shareholders, with the general partner not receiving more than 4% of the total distributable cash flow in any year.

Insiders love the stock, with the CFO and COO continuing to buy in the past six months. This tells us that DMLP presents solid long-term income prospects despite commodity prices remaining on the higher side.

It is important to note that DMLP doesn’t pursue any hedging arrangements to protect itself from fluctuating oil and gas prices. This means the stock (and distributions) will soar as the commodity prices remain elevated and fall as the prices plunge. Despite this price sensitivity, the partnership has remained a stellar value creator for an income portfolio, providing an average of 7% in pure cash returns.

Despite what mainstream media will have you believe, hydrocarbons are more critical than ever for a growing economy, and the current situation is mainly due to denial of that fact. We are happy to load up on DMLP when we see irrational price drops. We get a massive yield of nearly 13% from pure mineral royalties and a shareholder-friendly partnership structure.

Pick #2: BTO, Yield 7.3%

With large U.S. banks performing well in the Federal Reserve stress tests, we are optimistic about their ability to return capital to shareholders during the economic roller coaster. The results show that all assessed banks are well-capitalized and could weather a severe economic downturn. The scenario that the Fed had devised for this year’s tests is reportedly worse than any recession since World War II (including the one following the 2008 financial crisis).

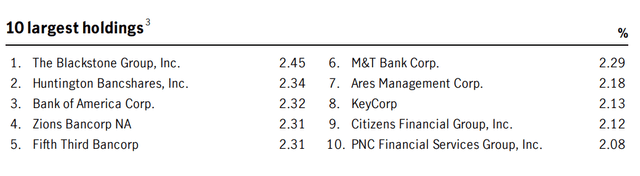

John Hancock Financial Opportunities Fund (BTO) is a closed-end fund (‘CEF’) that aims to invest at least 80% of assets in equity securities of U.S. and foreign financial services companies. BTO’s most significant positions are some of the leading banks in the country, with 7 out of the top 10 names part of the Fed’s test.

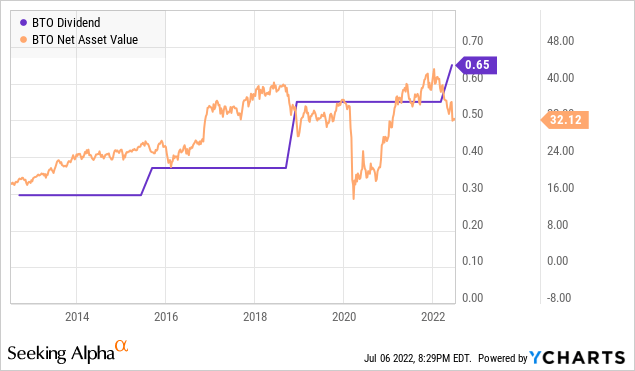

BTO is diversified across 173 companies, with a modest 17% leverage employed to boost shareholder returns. BTO has achieved growing NAV and paid out increasing distributions in the past ten years. For income investors, this is like winning the CEF lottery.

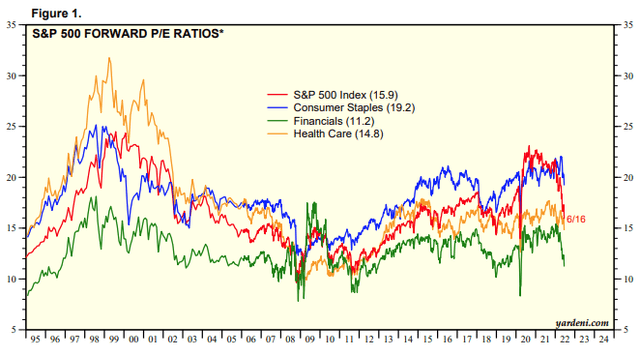

Financials are officially the cheapest S&P sector, trading below their 10-year average.

Amidst this cheap valuation, we find safety in high yields from BTO, which just got tastier with an 18% increase in its most recent payment. The CEF’s current annualized yield stands at 7.3%. BTO’s portfolio is 92% U.S. institutions and 1.6% Canadian, and 1% French (where banking regulations are stricter than in the U.S.).

To sum up, banks are suitable investments when we experience rising rates. Moreover, leading U.S. banks are well-positioned to weather a tough recession, so it is time to take advantage of the cheap sector valuation and lock in high yields.

Dreamstime

Conclusion

Billionaires are born out of bear markets. These stressful markets create an enormous transfer of wealth from the investors who sell off their holdings during a market correction to those who buy on the dips. Successful investors like Warren Buffett have repeatedly treated bear markets as their holiday shopping season and reaped the fruits of their fear-shopping over time.

If I am running low on gas in my car and someone comes to me and says that gas prices are expected to fall by $0.50 in August, should I wait? How certain they are – no one knows. It could get more expensive. It doesn’t really matter, because I need gas now. The costs of waiting to see if they might be right are too high. As my father used to say, “How much would you pay for a single gallon of gas when you are stranded on the side of the road?” A lot more.

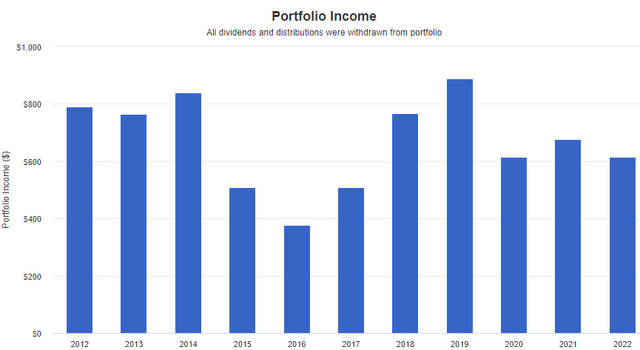

Similarly, I need my investments to produce cash today, and I see discounted dividend-paying stocks in the market. Can they get cheaper in a month? It is possible, but I will not sit staring at my screen or the news. I will enjoy the cash from my dividend-paying investments to fuel my summer adventures. Are you ready to do the same? Two picks with yields of up to 12% to get you started.

Be the first to comment