R.M. Nunes/iStock via Getty Images

Introduction

As interest rates have risen globally, most fixed income ETFs and preferred share ETFs have been battered. The Global X U.S. Preferred ETF (NYSEARCA:PFFD) has fared no better as the ETF price has fallen from $26 to $20 since November 1, 2021. Investors who expected a safe haven to avoid the equity bear market have been disappointed.

Nonetheless, I have started to buy preferred shares to hold over the next leg of the bear market. PFFD is a low-cost ETF, sports a dividend yield of 5.66% and provides me with more liquidity than thinly traded individual preferred shares.

Macro Analysis

Today, the first major investment bank released a forecast for a recession in Q4 2022. Nomura released a research note, where they stated: “With rapidly slowing growth momentum and a Fed committed to restoring price stability, we believe a mild recession starting in Q4 is now more likely than not.”

Nomura economists Aichi Amemiya and Robert Dent wrote in a note that: “Financial conditions are likely to tighten further, consumers are experiencing a significant negative sentiment shock, energy and food supply disruptions have worsened and the outlook for foreign growth has deteriorated.”

Interest Rates

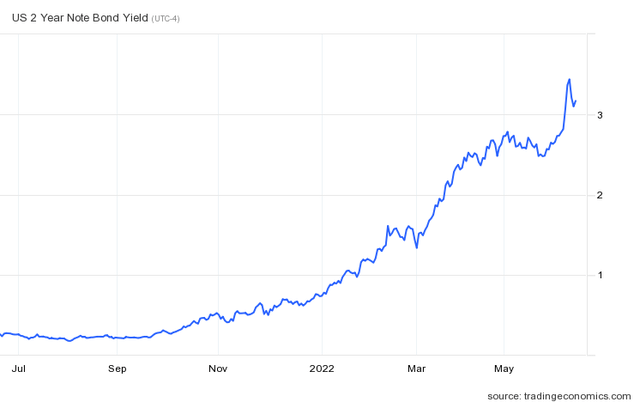

Generally, one does not want to own preferred shares while interest rates are rising. In a higher rate environment, there is less reason to take credit risk with preferred shares.

Right now, an investor can get a 3.2% yield with a 2-year U.S. government bond yield. This is comparable to the 5.66% yield that one can get with the PFFD. Thus, as bond yields rise, preferred shares and ETFs such as PFFD become less attractive.

The U.S. and other central banks have embarked on a major tightening cycle. Your expectation of how many more rate increases are in the cards for 2022 will largely determine if you want to opt for a short-term government bond or a preferred share ETF.

Expense Ratio

There is little to pick and choose between the major preferred ETFs. It really comes down to fees. The expense ratio of the PFFD is 0.23%. The average preferred stock ETF expense ratio is 0.55%. The expense ratio for the most popular preferred ETF is 0.52%. The expense ratio is 47.3% lower than the industry average. The savings of 0.3% per year is the major benefit of the PFFD.

However, the low expenses do not equate to low quality. PFFD is liquid, diverse and holds companies of a high credit quality.

Liquidity

Individual preferred shares have little liquidity. It is not uncommon for some preferred shares to only trade a thousand shares per day. By contrast, the trading volume of the PFFD is over 875,000 shares per day. This liquidity mismatch has been noted across the entire ETF industry. Some investors are concerned about what would happen if many ETF holders tried to liquidate their position at the same time. Since an ETF such as PFFD holds securities that are thinly traded, this could become an issue if that were ever come to pass. Thus far, it has not been an issue.

Diversification

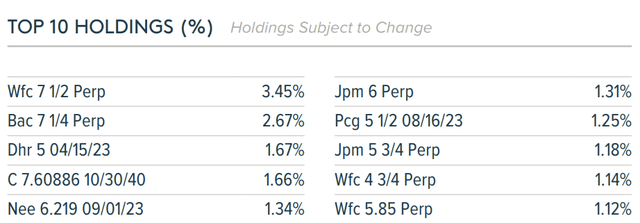

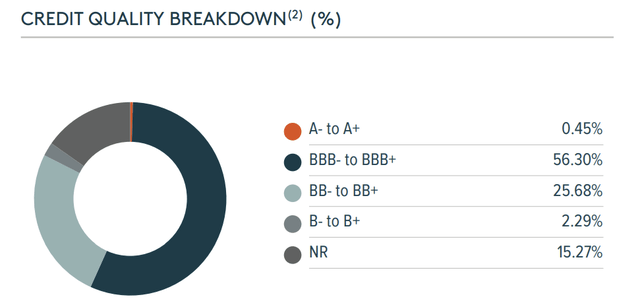

Diversification is a major benefit of PFFD. The ETF holds 294 securities, and the top ten holdings are less than 18% of the entire portfolio.

However, it should be noted that the diversification is only at a company level. PFFD is not diversified across many different industries. Banks, brokers and insurance companies make up most of this ETF.

Historically, I have avoided preferred stock ETFs because of the large concentration of financial companies. Even though I am not fearful of another 2008 credit crisis, I tend to avoid financials as I find disclosures to be rather opaque.

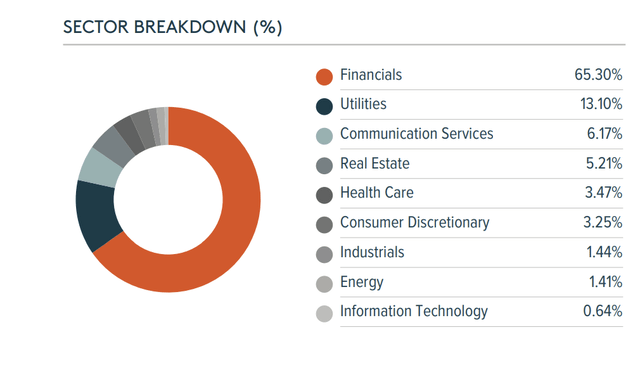

Credit Quality

The credit quality of the companies in the PFFD is primarily triple B rated. I could climb the risk ladder and buy a junk bond ETF such as the SPDR Bloomberg High Yield Bond ETF (JNK) to generate a 6.97% yield. However, I do not want to buy junk bonds at this time. I prefer better credit quality just in case the next recession ends up being more serious than expected.

Conclusion

PFFD is a solid choice for investors looking for a short-term instrument to park some cash and generate yield. Many investors want to “keep their powder dry” to take advantage of potential bargains that may spring up over the next 6-9 months. If I can make 5-6% while waiting out the next leg of the bear market while avoiding major drawdowns, I would be quite satisfied.

PFFD features a yield of 5.66% and an expense ratio of 0.23%. Credit quality, liquidity and diversification are in line with other similar ETFs. In years past, I avoided PFFD because it was heavily concentrated in financial companies. However, I am reasonably confident that the credit excesses of the previous cycle were mainly in venture capital, private equity and alternative assets. I am confident that the dividends from PFFD should be able to withstand a mild recession.

Be the first to comment