sbelov/iStock via Getty Images

Lumen Technologies (NYSE:LUMN) hasn’t benefitted from the great increase in bandwidth demand from work-from-home requirements, but the stock has held up in the recent crash due to the large dividend. The company continues to restructure the business for growth leaving shareholders caught in a constant reshuffle. My investment thesis remains Bullish on the telecom stock due to deep value, though results remain disappointing.

Same Problems

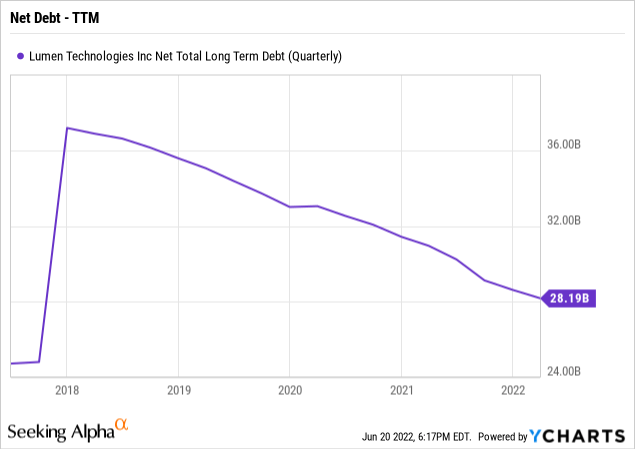

The recent quarterly results for Lumen reinforced the ongoing trends for the telecom. The company reported declining revenues, but Lumen continues to generate strong cash flows utilized to reward shareholders with big capital returns and debt repayment.

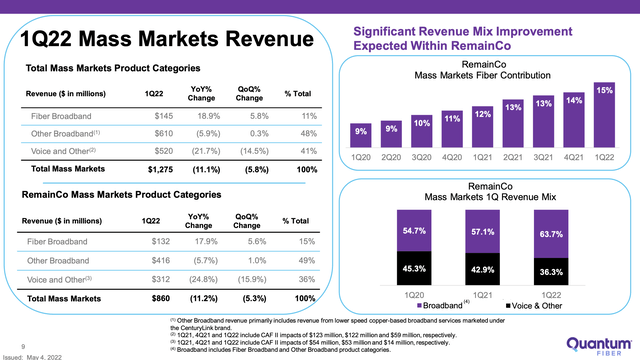

The new Quantum Fiber product rebranded in 2020, along with the asset sales, is expected to help arrest the constant revenues declines. Lumen has increased capex spending to alter the investment dynamics of the company. Even the RemainCo. business was down 5.3% for the Q1’22 period.

Source: Lumen Q1’22 presentation

The Quantum product is still in ramp mode with the footprint of the ILEC business being sold having fewer fiber customers and options. In total, the remaining 16 markets only have $132 million in quarterly fiber revenues with voice still up at $312 million. Total broadband revenues would finally swamp the voice revenues at $548 million, but even in this scenario the quarterly revenues still declined due to voice declines in Q1’22.

The Quantum Fiber product just comes with a $59 ARPU, but the product does provide Lumen with a growing category. With COVID, home broadband became a requirement and fiber speeds ensure consumers can both WFH and utilize the internet for school and entertainment, simultaneously.

Quantum Fiber was averaging a buildout of 400,000 new locations per year at a cost below $1,000 per location. The company has increased the goal to add 1.5 million to 2.0 million locations per year now with a goal of passing 12.0 million locations with fiber.

The once-promising Enterprise segment is now struggling. Customers both delayed additional deployments to focus on near-term WFH security issues, but also some businesses never recovered from COVID shutdowns. Lumen saw the Enterprise business drop 5.8% YoY due in part due to voice related products still covering over 20% of the business.

Big Yield

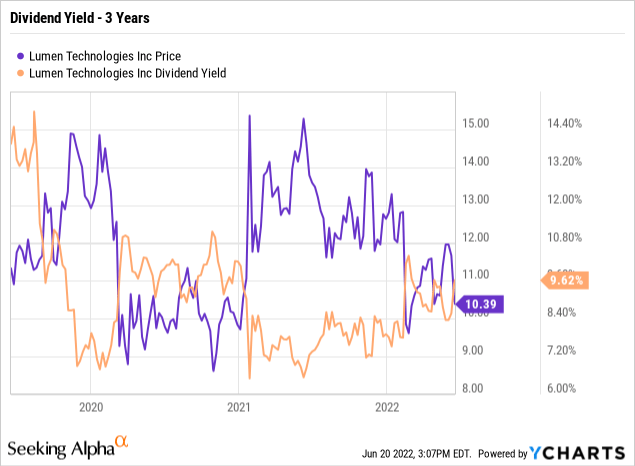

Lumen didn’t benefit from the higher demand for bandwidth during the COVID surge, which has been a big problem for both wireline and wireless businesses. While the stock didn’t see the big rally in 2020, investors have now benefitted from a large dividend supporting the stock during the current market crash.

The stock trades down at the lows and Lumen offers a nearly 10% dividend yield here. For Q1’22, Lumen paid $271 million in dividends and generated $846 million in free cash flow providing plenty of extra cash to repay debt.

The complicated nature of the current investment is the divestitures. Lumen boosted 2022 EBITDA targets to ~$7.0 billion due to hiking estimates by $0.4 billion based on the ongoing delays in closing the ILEC deal.

The new forecast has the FCF jumping to $2.1 billion, even with capex up at $3.3 billion for the year. The company only spent $577 million on capex during the first quarter placing the average quarterly spending at $874 million for the rest of 2022 reducing the FCF per quarter to ~$400 million.

Lumen was delivering FCF of $3.0 billion with COVID boosts from lower capex, but the new plan has boosted capex reducing FCF. The telecom only spent $2.9 billion on capex last year and forecasts spending $400 million in additional funds this year primarily to enable more fiber broadband coverage.

The complication will involve comparing 2022 numbers to 2023 with the ILEC deal likely to close at the end of Q3. Lumen will obtain $7 billion in cash to offset the lost EBITDA originally targeted at around $1.4 billion (5.5x $7.5 billion cash and debt deal) and forecast still at ~$400 million for the Q3’22 hike.

The stock only has a market cap of $10.7 billion with an influx of $7 billion in cash within months. Lumen still had net debt of $28.2 billion, so the cash infusion and $1.4 billion debt assumption by Apollo will help eliminate substantial amounts of debt to reduce interest expenses (boosting cash flows) or allow for cheap share repurchases.

Takeaway

The key investor takeaway is that the stock isn’t likely to provide big returns for shareholders, but Lumen provides a nearly 10% dividend yield here and some capital gains potential with the stock trading at the lows in the $10s. The telecom has spent the last few years whittling down the debt and the Quantum Fiber project will help push the business back towards actual growth. Naturally, the stock isn’t without risk of having so much debt entering a likely recession in the U.S.

Be the first to comment