filmfoto

Investment Thesis

Vermilion (NYSE:VET) is down nearly 20% this past month. I articulate the main reason for this sell-off and why I strongly believe that this sell-off is temporary. In fact, I go as far as to declare that energy commodity investors should actually buy this dip. Unlike other sectors of the market, where I wouldn’t feel comfortable suggesting that investors get involved.

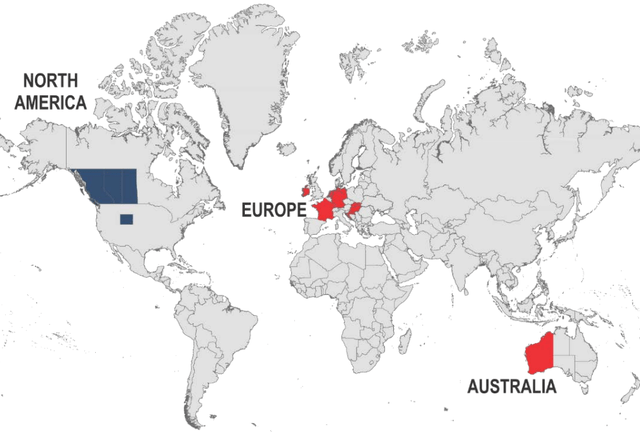

Vermilion December presentation

Vermilion is one of a few companies that should be benefitting from the energy crisis in Europe. And on the surface, it’s not. But as we look beyond the surface, you’ll see that there are reasons to be bullish on this stock.

Winter Is Not Coming, Apparently

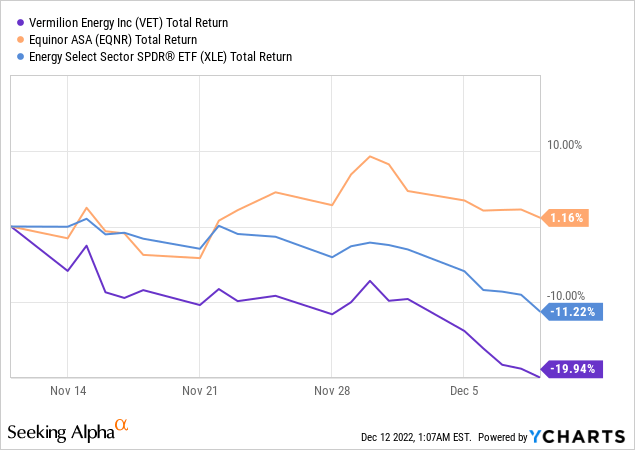

An interesting state of affairs is shown in the graphic that follows. Despite all the reasons why Vermilion should be an outperformer in the past month, this is not happening.

And not only not happening, but in actuality, it’s fairing significantly worse than its closest peer Equinor (EQNR).

And I’m going to soon discuss why. But before that, I’ll turn our focus to what investors may think is dragging down the stock.

Windfall Taxes Are Not The Main Problem

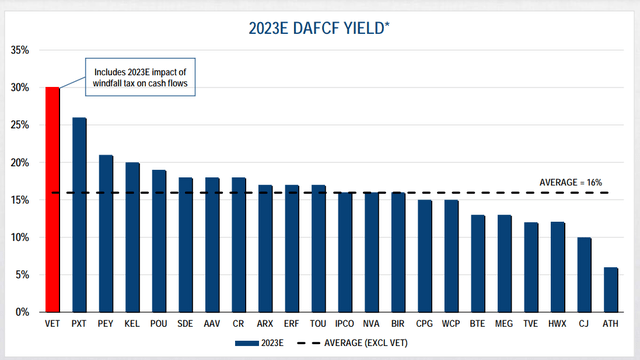

The graphic that follows presents a very rough estimate for Vermilion’s 2023 free cash flow potential.

Vermilion December presentation

The free cash flow yield above includes the windfall tax estimate. It’s an unhedged assumption that US-based natural gas prices average approximately NYMEX US$5.64/mmbtu and Euro gas US$40.28/mmbtu.

I won’t make much of the issue that I believe that these figures are not elevated and may prove to be conservative in 2023. Indeed, I don’t believe that’s the main blemish on this investment thesis, so I won’t expound on this further.

I’ll swiftly get to the core issue facing Vermilion.

Unclear Capital Allocation Strategy

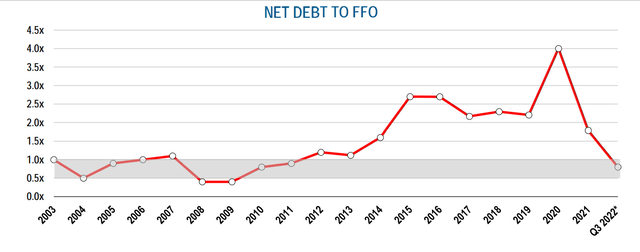

Investors had been told that as Vermilion bought down its debt profile, it would ramp up its capital allocation strategy.

Vermilion December presentation

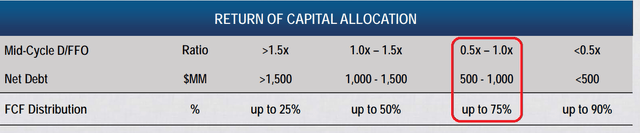

Vermilion had even gone so far as to lay out a capital return framework to guide investors.

Vermilion December presentation

Investors had roughly estimated that with Vermilion’s net debt position below 1x to fund flows from operations as of Q3 2022, investors would be getting a significant capital return.

Instead, together with its Q3 earnings results, Vermilion simply stated that it had suspended its share repurchase program, as it strengthen its balance sheet to allocate capital to the EU windfall tax.

But this simply didn’t make a lot of sense. The windfall tax for 2022 is estimated to be approximately CAD$300 million. While Vermilion’s adjusted free cash flows are approximately CAD$262 million over a 90-day period.

So, it’s clear that Vermilion could, if it so wished, return some capital return to investors.

But instead, without any notification, Vermilion simply changed its policy and is now returning close to nothing to shareholders, asides from a razor-thin yield of 1.3%.

The Bottom Line

To sum up the situation, Vermilion is oozing free cash flow, even after accounting for the windfall taxes.

What has weighed down investor sentiment, or perhaps better said, trust in management here, is management’s lack of clarity on their capital allocation.

Commodity investors notoriously feel they can’t trust most E&P companies because, for years and years, E&P managers have squandered precious capital at precisely the wrong part of the cycle. There’s a long history of this happening.

And investors believe that Vermilion is likely to do the same again, and squander its free cash flow.

Rather than investors seeing Vermilion as increasing its intrinsic value with time, as Vermilion’s balance sheet improves, investors are losing faith in this management team’s ability to adequately navigate through the cycle and signal to investors what their actual capital allocation strategy is.

As a final reference point, consider Equinor. Equinor is mostly in the same situation as Vermilion, and despite getting taxed on 75% of its free cash flow, it’s still returning capital to shareholders. Indeed, by my rough estimates, Equinor’s total capital return program reaches 15% via special dividends (not guaranteed) plus buybacks.

And investors are content to reward Equinor company with a higher multiple than Vermilion. My hope is that Vermilion’s management will read this analysis and provide investors with the clarity they are due.

Be the first to comment