TimArbaev

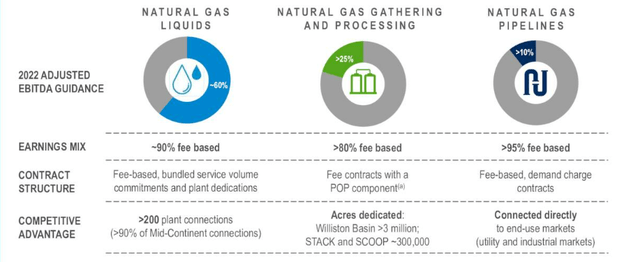

ONEOK, Inc. (NYSE:OKE) is a natural gas and natural gas liquids (NGLs) transportation and storage company based in Tulsa, Oklahoma. The company operates through three segments: natural gas gathering and processing, natural gas liquids, and natural gas pipelines.

ONEOK is a natural gas company that makes money by purchasing natural gas from producers and selling it to customers. The company operates a vast network of natural gas pipelines and storage facilities, which it uses to transport and store the natural gas it purchases. ONEOK also has the ability to process natural gas, removing impurities and converting it into products like propane and butane. These processed products are also sold to customers, providing additional revenue for the company.

ONEOK generates revenue through a variety of different sources. In addition to selling natural gas and processed products, the company also earns money through its transportation and storage services. Customers, including other natural gas companies and utility companies, pay ONEOK to use its pipelines and storage facilities. The company also earns income from its investment in natural gas gathering and processing assets, as well as through fees and tariffs charged for using its facilities.

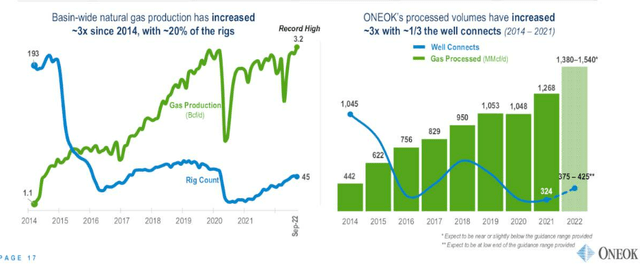

ONEOK is currently in the midst of a major expansion, with plans to build new natural gas pipelines, gathering systems, and natural gas processing facilities. The company recently provided an update on operations in its Q3 earnings release.

Financial Update

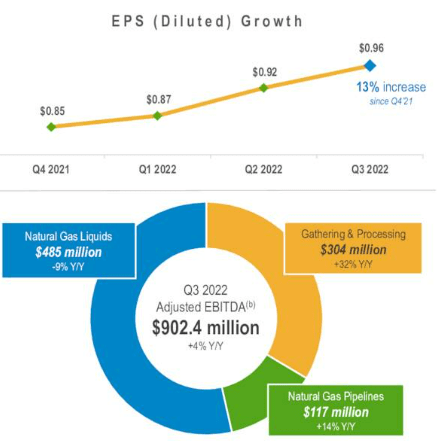

The company’s third-quarter net income totaled $432 million or $0.96 per share, a 10% increase compared with the third quarter of 2021 and a 4% increase when compared with the second quarter. The company’s third-quarter adjusted EBITDA was $902 million, a 4% year-over-year increase and an increase from the second quarter. This fueled the continuation of a series of fine EPS improvements.

ONEOK

The company’s CEO, Pierce Norton, stated that the company expects continued strength in producer activity and increased volumes and higher earnings from its fee-based services in all of its business segments in a favorable commodity price and increasing demand backdrop. Walt Hulse, the company’s CFO and Executive Vice President, also discussed the company’s insurance update, stating that ONEOK received notice in September that its Medford property insurers agreed to pay $100 million unallocated first installment of insurance proceeds, with $45 million already received and the remaining amount expected to be received before year-end.

The company has also provided its 2023 growth outlook, expecting to exceed $4 billion of adjusted EBITDA. This growth is expected to be driven by increased volumes and higher earnings from its fee-based services, along with the company’s continued focus on its core growth areas, including its expanding NGL and natural gas gathering and processing infrastructure in the Anadarko Basin and its expanding natural gas infrastructure in the Williston Basin.

ONEOK also has priced an offering of $750 million of its 10-year senior notes at a coupon of 6.10%. The net proceeds from the offering are expected to be $742 million, which the company plans to use to repay amounts outstanding under its commercial paper program. To the extent the net proceeds from the offering exceed the amounts outstanding under its commercial paper program, ONEOK intends to use the additional net proceeds to repay other indebtedness or for general corporate purposes. The notes offering is expected to close around November 18, 2022.

Natural Gas Volatility

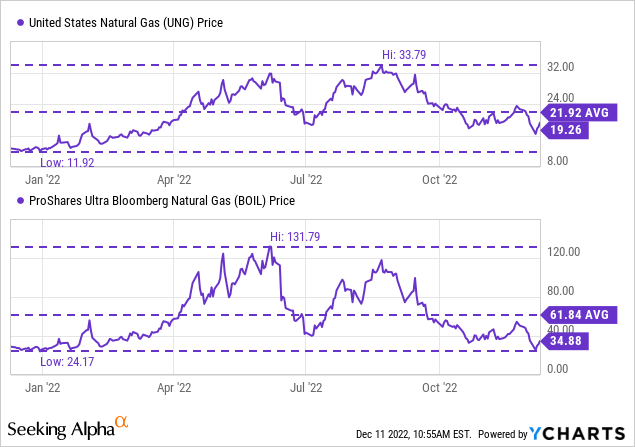

One potential issue for ONEOK is the volatile nature of the energy industry. Natural gas and NGL prices can fluctuate significantly, which can impact the company’s revenue and profitability. However, the company has a strong hedge portfolio that helps to mitigate this risk.

Natural gas prices have been impacted by the ongoing war in Ukraine. Ukraine is a major transit route for Russian natural gas exports to Europe, and the conflict has disrupted the flow of natural gas through the country.

The war in Ukraine has led to increased tensions between Russia and Europe, which has raised concerns about the reliability of Russian natural gas supplies. As a result, European buyers have been seeking alternative sources of natural gas, which has increased demand for natural gas from other regions, including the United States.

The increased demand for natural gas from the United States has put upward pressure on natural gas prices. This would normally trigger a wild upward run, except for the fact that producers have been proactively responding. In other words, the conflict with Russia also has led to excess production of natural gas in the United States. Ukraine is a major transit route for Russian natural gas exports to Europe, and the war has disrupted the flow of natural gas through the country.

As a result, the United States has seen an increase in demand for its natural gas exports. This has led to excess production of natural gas in the United States, as domestic demand for natural gas has not kept pace with the increased production. This excess production has put a somewhat balancing downward pressure on natural gas prices, which has been detrimental to natural gas producers such as ONEOK.

The excess production of natural gas in the United States has also led to a glut of natural gas on the global market.

This has so far made it difficult for natural gas producers to sell their natural gas at profitable prices, which has led to lower revenues and profits. The excess production of natural gas has also made it difficult for some natural gas producers to justify investing in new production capacity, which could impact the long-term growth of the industry. But all of this was done in preparation for the possibility of a winter without Russian energy supply to Europe. It remains to be seen if the excess supply will outstrip the heightened demand, but recent price action in natural gas exchange-traded funds (“ETFs”) is encouraging.

It is important to remember that the company benefits greatly from increased production volumes, as it relies heavily on revenue fees, but that price will greatly influence production volumes in the long term.

Dividend Outlook

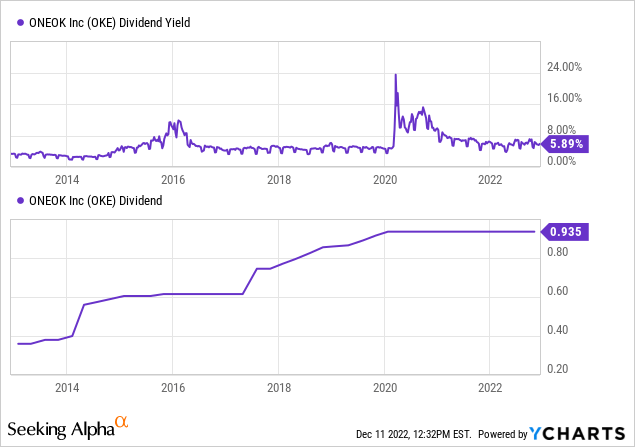

The main pull for many ONEOK investors is the dividend.

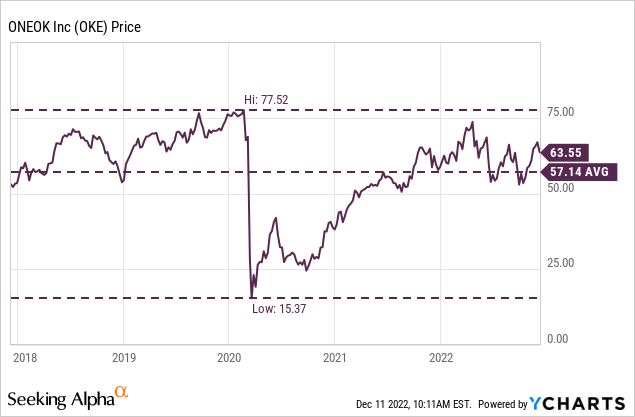

The company has a long history of paying dividends and currently offers a dividend yield of 5.9%, which is attractive to income-seeking investors. The leadership team has consistently increased dividends over the past decade, but those increases have stalled recently. This is understandable when you recall what the pandemic did to the energy industry, with oil prices briefly becoming negative in one historic trading day.

One of the key measures of a company’s ability to continue paying dividends is its current ratio, which is a measure of its ability to pay short-term debts. A ratio of less than 1 indicates that the company may have difficulty meeting its obligations. ONEOK’s current ratio is 0.7, which is on the lower side. However, the company recently completed a $750 million debt offering, which will improve its current ratio and strengthen its financial position.

Overall, while ONEOK’s current ratio is a concern, the company’s long history of paying dividends and the improvement in its financial position from the recent debt offering suggest that its dividend payments are likely to remain safe in the near term. This is crucial because ONEOK is more of a dividend aristocrat than a growth stock. The recent energy market volatility has temporarily changed the nature of the stock, but under normal conditions, ONEOK is not known for sensational volatility like some technology stocks, for example.

The Takeaway

ONEOK is a company in a great moment right now. We are seeing natural gas catch on in developed nations, and this move will likely be supported by tensions in Russia and the desire for energy independence over the long term. The dividend looks safe, and an increase is not off the table. The business model works and is easy to understand, which is always a great sign for investors. I rate ONEOK as a Buy.

Be the first to comment