Scott Olson

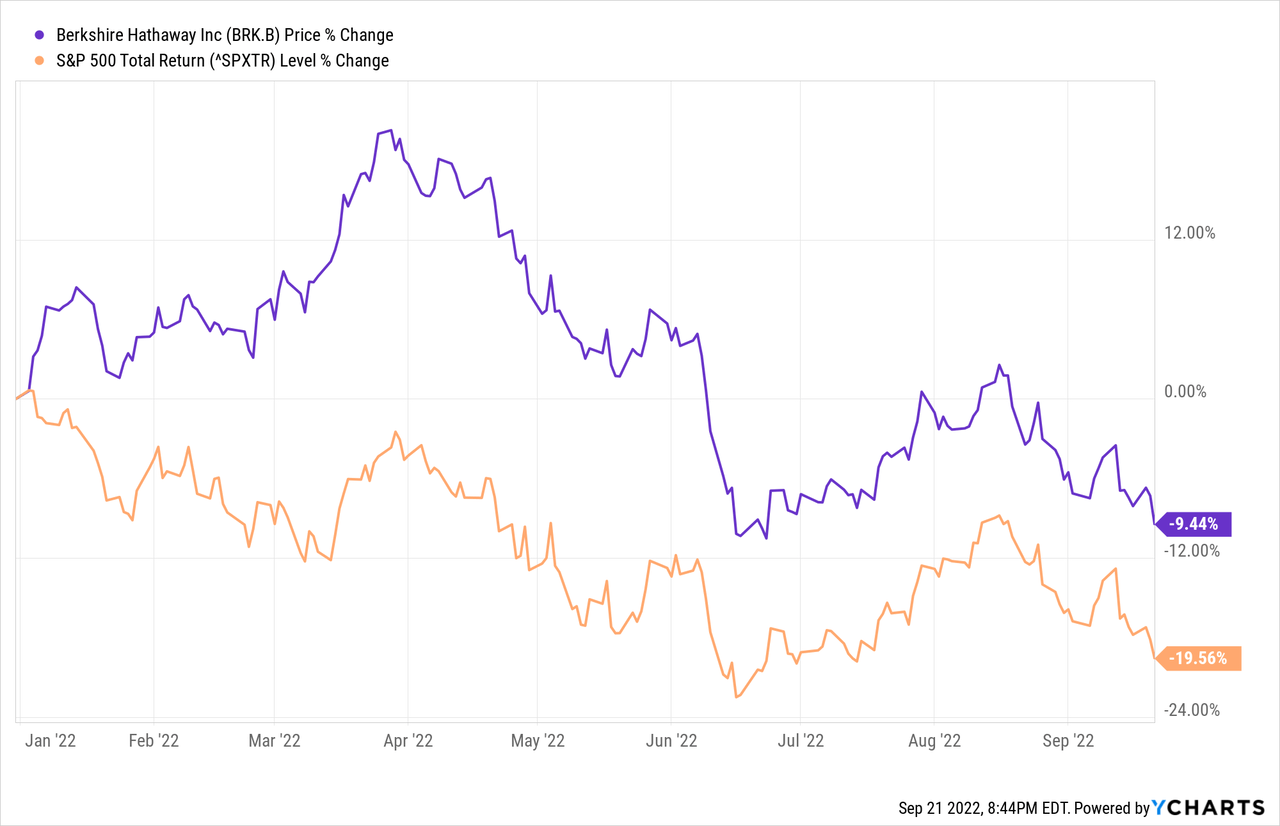

In my early 2022 writing on Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) I predicted an outperformance of 15% versus the market, as measured by the S&P 500. My prediction is on track, but wow, what a path to get there!

After peaking at $362/share earlier this year, Berkshire has declined with the rest of the market, yet it is still outperforming the S&P 500 by over 10%. As 2022 continues on, I believe Berkshire is well-positioned to continue outperforming.

Berkshire’s Operating Businesses – Are They Inflation-Resistant?

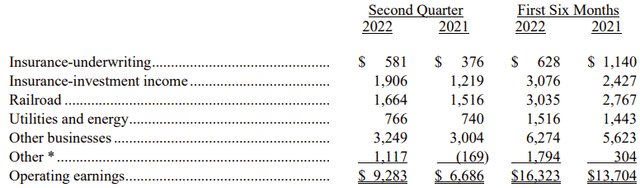

Berkshire posted excellent operating earnings in the second quarter, which got little fanfare, likely because of the depressed broader market and the $53 billion in mark-to-market losses in the equity portfolio.

Berkshire Q2 Earnings Release

Even if we back out “Other” which included around a billion in foreign currency gains, this quarter showed a clear, broad based improvement over 2021 despite what most would consider to be a more difficult operating environment.

Going forward, I believe Operating Earnings will continue to be strong because Berkshire’s businesses tend to be inflation-resistant. For those that have read Buffett extensively, it’s one of the key things he looks for in a business. Perhaps his most repeated quote on the subject is the following:

The single-most important decision in evaluating a business is pricing power. If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business. And if you have to have a prayer session before raising the price by a tenth of a cent, then you’ve got a terrible business. I’ve been in both, and I know the difference.

While there is no quantitative way (at least that I know of) to prove this, I believe the collection of Berkshire’s businesses will prove to be more inflation-resistant than the average S&P 500 company.

Berkshire Hathaway’s Recent Price Action And Current Book Value

Shareholder’s equity as of the Q2-2022 10-Q was $461 billion, compared to a current market capitalization of $598 billion. That puts Price/Book at 1.3x using last quarter’s numbers.

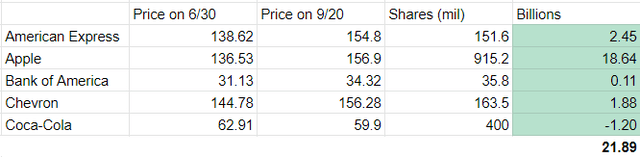

But last June ended near the lows for many of Berkshire’s holdings, particularly Apple and the banks. Most are up since then.

Author

Berkshire’s top 5 holdings are up $22 billion ($17.4 billion when adjusting for deferred taxes) since June 30th. Add another $8 billion in operating earnings, and we’re closer to a 1.25x multiple. Berkshire has been cheaper at points over the last few years, including much of 2020, but this is towards the lower end of its recent valuation range.

Berkshire earned $16.3 billion in the first half of this year. I think a repeat performance is likely in the back half, driven by increased investment income and seasonal strength in the energy business. Let’s round down and assume $32 billion in earnings for the year.

For the full year, that puts Berkshire at a ~18.7x Price/Earnings ratio, even ignoring the “look through” earnings of Berkshire’s substantial equity holdings!

Compare this to Morgan Stanley’s (MS) latest earnings estimates for the S&P 500, which they just decreased. (I think there is further downside to these numbers, but let’s go with them.)

- 2022: $220 (from $225 prior)

- 2023: $212 (from $236 prior)

- 2024: $226 (from $237 prior)

At 3800 on the S&P 500, this implies a forward multiple around ~17.3x for the index, with almost no growth slated for the next 3 years.

There has been much ink spilled over the many different methodologies on how to properly value Berkshire, but most all of them give some value to the equity book beyond the dividends that show up in Operating Earnings.

But Berkshire, with its huge cash buffer, is barely more expensive than the index just based on operating earnings. Even with conservative treatment of the equity investments, Berkshire seems significantly “cheaper” than the S&P 500.

Cash Is No Longer Trash; Cash Is King.

Berkshire was very active purchasing equities earlier this year, purchasing $40 Billion in three weeks in Q1 by initiating a large stake in Occidental (OXY), Citigroup (C), and HP, Inc. (HPQ) while adding to stakes in Activision Blizzard (ATVI) and Chevron (CVX).

As a result, Cash and U.S. Treasury bills dropped from $143.9B at year-end to $105.4B on June 30th (still a substantial amount.)

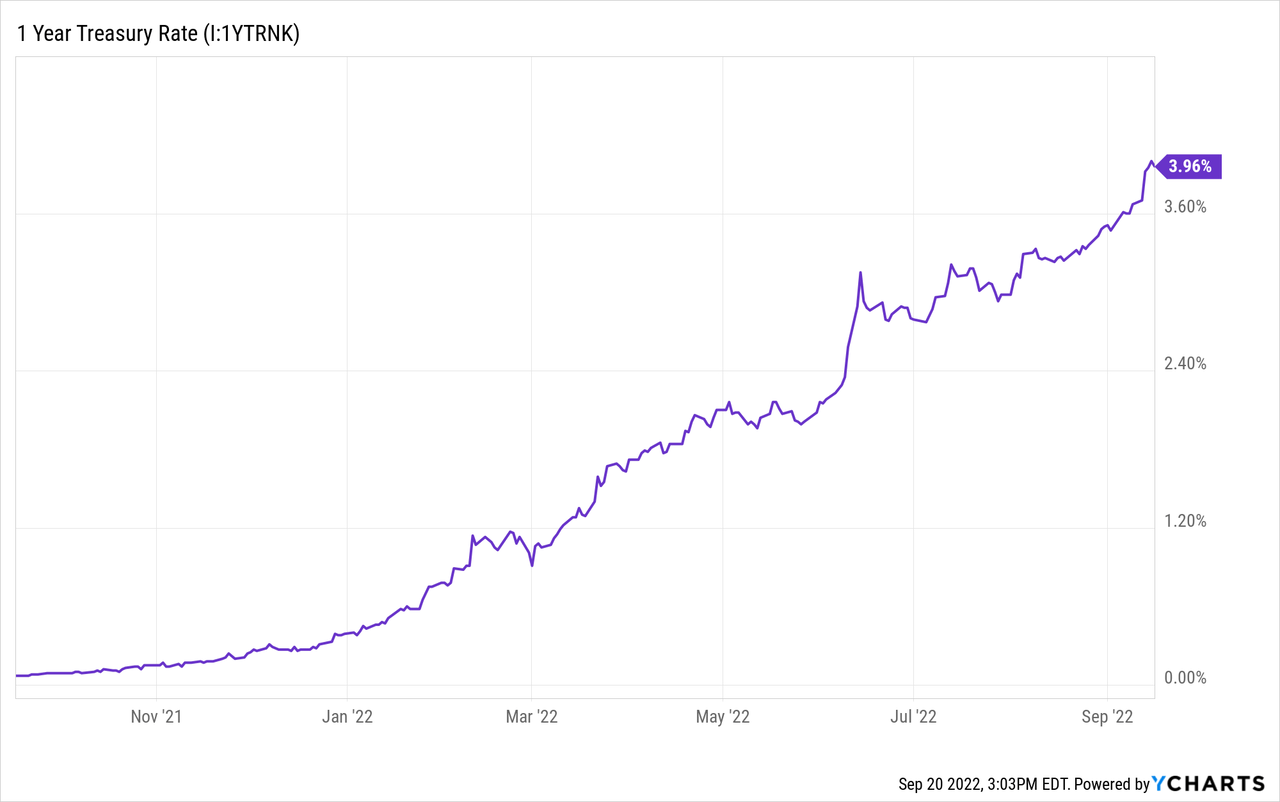

An abundance of cash on the balance sheet earning almost zero has been a drag on Berkshire’s results for the past several years when the Fed was cutting rates to zero. This headwind has now turned into a tailwind, as lower yielding debt matures and Berkshire can roll into 1-year paper yielding 4%.

Some may argue that Berkshire is still “losing” to inflation this way. Personally, I’d rather them “lose” to inflation earning a 4% nominal yield and wait for bargains to appear than get pushed into risk assets because cash is yielding nothing. Beyond that, Berkshire has $119 billion in “Notes Payable and other borrowings” most of which is at fixed rates. In aggregate, higher interest rates are a win for them.

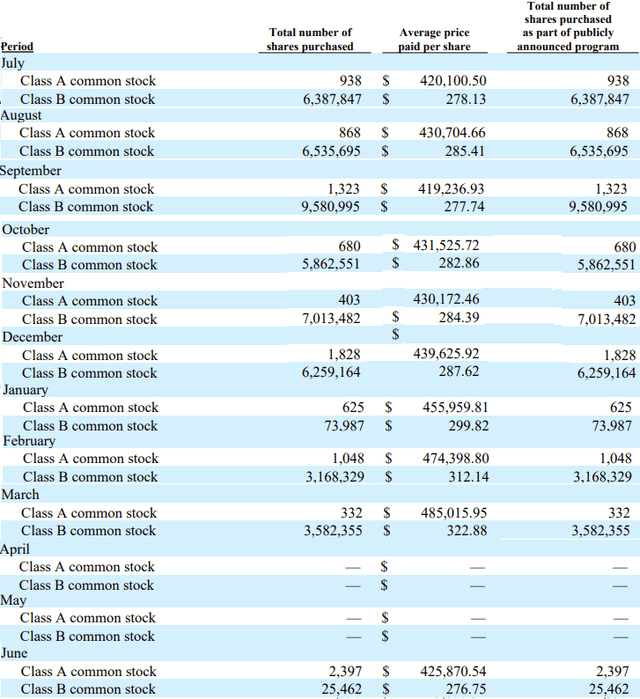

Berkshire Repurchases

Buffett and company have stayed true to their word on repurchases, only doing so when they believe shares are trading at a significant discount to intrinsic value. They bought back significantly when the shares were in the $270-280 range, slowed their purchases above $300, and stopped entirely in April/May when the price spiked.

Berkshire 10-Q’s and 10-K’s

We’re now back to the $270 range, where Berkshire has been aggressive with repurchases in the past. This doesn’t mean Berkshire will resume repurchases, and Buffett has warned investors that repurchases are not meant to act as a floor to the share price and that Berkshire will not “defend” any particular level on the stock. (April-May 2020 proved this; Berkshire repurchased nothing despite shares approaching 1x book value.)

With a smaller cash balance and higher uncertainty in the economy, I think there’s a good chance Berkshire holds back repurchases and rebuilds cash, especially with the $11.6 billion purchase of Alleghany (Y) yet to close.

But in any case, I’m glad to see Berkshire show the self-discipline that is so lacking from many S&P 500 firms, which often repurchase shares aggressively during the “good times” when share prices are high, but then halt repurchases after prices have declined.

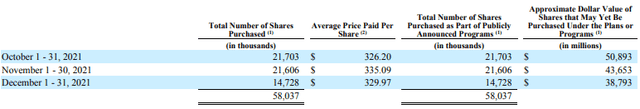

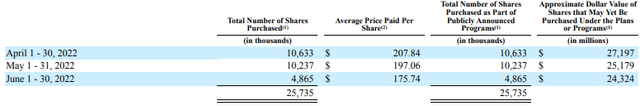

Meta Platforms (META) was repurchasing hand over first above $300 in Q4

META Q4 2021 10-K

and now in Q2, with far lower share prices, they’re repurchasing less than 25% of the dollar volume – and buying even less as the share price declines further!

META Q2 2022 10-Q

The majority of the banks have halted repurchases entirely because of economic uncertainty, despite share prices being down significantly and some like Citigroup (C), trading at a large discount to tangible book.

The market doesn’t seem to want to reward Berkshire for being a good steward of capital, but to me, it’s another good reason to be invested in this over the S&P 500.

Conclusion

I’ve long believed that Berkshire would outperform the indexes in a true bear market and so far that is what we’ve seen, even though it still stings to watch shares fall 25% from their highs earlier this year. I believe Berkshire will continue to outperform on a relative basis.

I like Berkshire here, but I’m not pounding the table on it and haven’t added to my core position yet. I continue to be patient and wait for bargains to appear, whether in Berkshire or elsewhere, especially as we start heading into tax loss selling season.

Be the first to comment