Angela Weiss/Getty Images Entertainment

Footwear and other apparel are incredibly important for a number of reasons. Not only do you have the utility of it all in the respect that it keeps us protected from the elements, there’s also the fact that what we wear has a big impact on how people perceive us and how we internalize our own vision of ourselves. One company that is fairly small compared to some of the other larger firms in the footwear and apparel space that warrants consideration is Steven Madden (NASDAQ:SHOO). Although shares of the company might be priced at levels that are comparable to what other players in the space are priced at, the company is still cheap on an absolute basis. Add on top of this the continued growth on both the top and bottom lines that management has succeeded in capturing, and the company is definitely worthy of a ‘buy’ rating in my book.

Trying Steven Madden on for size

According to the management team at Steven Madden, the company focuses on designing, sourcing, and marketing fashion-forward branded and private label footwear. It’s also responsible for the production and sale of accessories and apparel for women, men, and children. The company’s current portfolio of brands is significant. For instance, it sells a line called Steve Madden Women’s, which is a lifestyle collection of women’s fashion-forward footwear and accessories for women between 16 and 35. Under the Madden Girl brand name, the company produces a full collection of directional young women’s footwear and accessories targeted largely at those between 13 and 25.

The Steve Madden Men’s category focuses on footwear for men between 18 and 45, while the Madden brand is a collection of casual and business casual footwear focused on meeting the needs of trend-conscious young male consumers between 16 and 35 years of age. The company has a variety of other key brands, such as Mad Love, Dolce Vita, Superga, and others. In 2019, the company acquired a digitally native footwear brand called GREATS, while in 2018 it entered into a license agreement with WHP Global for a license to use the Anne Klein and other related trademarks in connection with the design, marketing, and sale of footwear and accessories.

To best understand the company though, we should break it up into the five key segments that it controls. The first segment worth paying attention to is called Wholesale Footwear. Through this, the company provides all of its designing, sourcing, and marketing of brands to department stores, mass merchants, off-price retailers, shoe chains, online retailers, and other similar parties. Last year, this segment accounted for 54.8% of the company’s revenue. This segment was also the true cash cow of the company, accounting for 66.1% of the combined profits of the segments that were profitable in 2021. Next in line, we have the Wholesale Accessories/Apparel segment, which focuses on providing the same aforementioned customer base with items like handbags, apparel, fashion scarves, wraps, and other miscellaneous accessories. This segment accounted for 18.4% of the company’s revenue but for only 8.1% of its profits last year.

The Direct-to-Consumer segment of the company focuses on the company’s branded retail stores, outlet stores, shop-in-shops, and directly operated digital e-commerce websites. Last year, it was responsible for 26.1% of the company’s revenue and for 22.7% of its profits. The First Cost segment of the company, meanwhile, represents all of the activities that it engages in of one of its wholly owned subsidiaries that earns commissions for serving as a buying agent for footwear products under private labels for national chains that it works with. It also provides those same services for specialty retailers and value-priced retailers. This unit accounted for only 1.3% of the company’s revenue and for 0.6% of its profits last year. And finally, we have the Licensing segment of the company, which is responsible for the licensing of its trademarks for use in connection with the manufacturing and sale of various apparel categories. It’s also responsible for the company’s licensing of the Betsey Johnson trademark for the production of various apparel and accessories. Last year, this segment was responsible for only 0.5% of sales, but it accounted for 2.5% of profits.

It’s also worth mentioning the geographic concentration of the company. Although the enterprise prides itself as being a global player in the production of footwear and apparel, it is also true that 87.9% of its revenue in 2021 came from its domestic markets. Having said that, this number is a bit deceptive when you consider that some of the sales associated with domestic customers are ultimately transferred outside of the US for the ultimate end sale. Factoring this into the equation, a more modest but still significant 70.3% of the company’s revenue came from here at home.

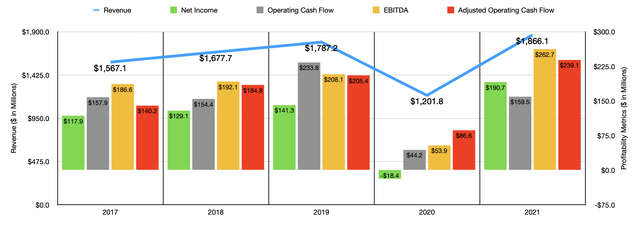

Financially speaking, the performance of Steven Madden has been quite solid in recent years. From 2017 through 2019, sales of the company expanded from $1.57 billion to $1.79 billion. Due to the COVID-19 pandemic, sales plummeted to $1.20 billion in 2020. However, that decline was short-lived, with sales skyrocketing to $1.87 billion in 2021. This 55.3% increase in revenue year over year was driven by strength across all of the company’s segments (except for the First Cost segment), with the Wholesale Footwear segment reporting a 43.3% rise in revenue year over year. A similar increase was seen when it comes to the Wholesale Accessories/Apparel segment. But one of the true drivers of growth, from a percentage basis, was the Direct-to-Consumer segment, with revenue there shooting up by 103.8% from $239.4 million to $487.9 million. The reason for this tremendous increase was that a good portion of that segment’s sales come from the 214 brick-and-mortar retail stores the company has an operation. Those were impaired significantly because of the COVID-19 pandemic in 2020.

On the bottom line, profits also rose nicely, climbing from $117.9 million in 2017 to $141.3 million in 2019 before plunging to a negative $18.4 million in 2020. In 2021, profits came in strong at $190.7 million. Other profitability metrics also followed suit. Operating cash flow in 2021 totaled $159.5 million. That was significantly higher than the $44.2 million experienced in 2020. On the other hand, it was still below the $233.8 million reported for 2019. If we adjust for changes in working capital, however, we would have seen cash flow last year of $239.1 million. That compares favorably to the $86.6 million seen in 2020 and is even higher than the $205.4 million seen in 2019. Another metric to pay attention to is EBITDA. Last year, this came in at $262.7 million. Just like in the case of adjusted operating cash flow and net income, this was the highest for the company on record.

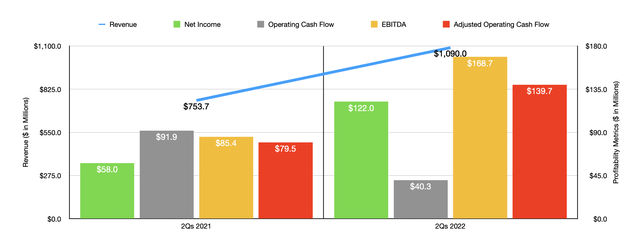

So far this year, financial performance for the company has been incredibly strong. Revenue in the first half of the year totaled $1.09 billion. That represents an increase of 44.6% over the $753.7 million the company generated the same time last year. The greatest strength for the company so far this year has come from both of its wholesale operations, while the Direct-to-Consumer segment posted a more modest, but still impressive, increase in revenue of only 21.8%. Profitability for the company has also been strong so far. Net income in the first half of 2022 came in at $122 million. That’s more than double the $58 million seen one year earlier. Operating cash flow did drop, declining from $91.9 million to $40.3 million. But if we adjust for changes in working capital, it would have risen from $79.5 million to $139.7 million. And over that same window of time, we saw EBITDA climb from $85.4 million to $168.7 million.

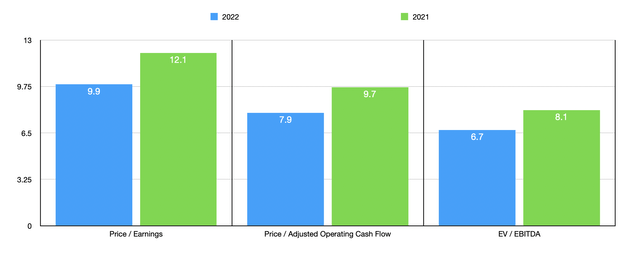

When it comes to the 2022 fiscal year as a whole, management expects revenue to climb by between 13% and 15%. Adjusted earnings per share should be between $2.90 and three dollars. That would imply net income, at the midpoint, of $232.2 million. If we apply the same year-over-year growth rate on that front to the adjusted operating cash flow and EBITDA of the company, we would get readings of $291.1 million and $319.9 million, respectively. Using these figures, we can calculate that the company is trading at a forward price to earnings multiple of 9.9, at a forward price to adjusted operating cash flow multiple of 7.9, and at a forward EV to EBITDA multiple of 6.7. These numbers compare favorably to the 12.1, 9.7, and 8.1, respectively, using data from last year. As part of my analysis, I also compared the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 7.8 to a high of 20.8. Compared to the multiples for Steven Madden using data from 2021, we can see that three of the five companies are cheaper than our prospect. Using the price to operating cash flow approach, the range is between 11.5 and 113.4. In this scenario, our prospect is the cheapest of the group. And when it comes to the EV to EBITDA approach, the range is between 7.5 and 13.6, with only one of the companies being cheaper than Steven Madden.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Steven Madden | 12.1 | 9.7 | 8.1 |

| Wolverine World Wide (WWW) | 12.7 | 22.0 | 11.5 |

| Rocky Brands (RCKY) | 8.8 | 15.7 | 8.9 |

| Crocs (CROX) | 8.7 | 11.5 | 9.5 |

| Skechers U.S.A. (SKX) | 7.8 | 113.4 | 7.5 |

| Deckers Outdoor Corporation (DECK) | 20.8 | 51.6 | 13.6 |

Takeaway

Based on all the data provided, I do believe that Steven Madden makes for a solid prospect for investors at this time. There’s no doubt that the broader economy might be in a rather precarious situation right now. However, shares are cheap enough that even a weakening in profitability could lead to limited downside for investors, while an eventual recovery could offer strong upside. Due to these factors, I cannot help but to rate Steven Madden a ‘buy’ for now, reflecting my belief that, over the foreseeable future, it’s likely to outperform the broader market.

Be the first to comment