LUHUANFENG

China Life Insurance logo (China Life Insurance)

Investment thesis

As we pointed out in our previous article on China Life Insurance (OTCPK:LFCHY) “Fundamentals Remains Intact“, and where we gave it a continuous buy stance, there is not much change to its business fundamentals.

Since our first buy stance, it is down almost 25%. However, the share price is always going to be a voting machine and we cannot predict where it is going.

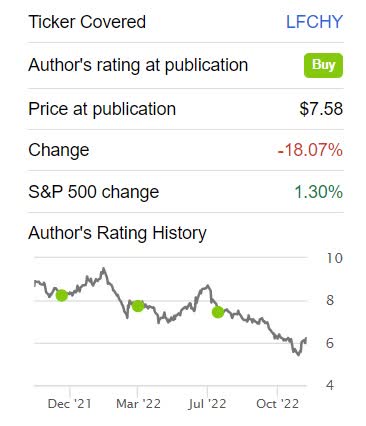

LFCHY was down 18% [SA]

This graph is showing us the drop only up to the point where LFCHY no longer traded on the New York Stock Exchange.

It looks better once we shift our attention to its listing in Hong Kong.

China Life Insurance (02628.HK) – 1 year share development (Yahoo Finance)

Just after it got delisted in the U.S., the share price started to go up.

We focus on the fundamentals and try to buy companies that have strong fundamentals and where we believe that there is a high probability of a good future.

On that topic, we still are of the opinion that China’s economy will continue to lift more people from lower income into middle income and that the demand for life insurance products will grow with an aging population and a need for better health and retirement plans. China Life Insurance is the number one company in this segment.

Let us look at how they did in their latest financial report.

Q3 2022 and the first 9 months’ financial results

Their latest financial results covers Q3 and the first 9 months of 2022. It came out on the 27th of October.

On the top line, the revenue from insurance businesses over the first nine months of 2022 was stable and similar to that of last year. The revenue was RMB 554 billion. Premiums from new policies were RMB 171 billion, which was an increase of 6.3% year on year.

The net profit in Q3 attributable to shareholders was down 24% to RMB 5.74 billion as compared with the same period last year. Over the first nine months, the net profit was RMB 31.18 billion. That is 36% lower than that of 2021.

EPS in Q3 was RMB 0.20, and the nine months’ EPS was RMB 1.10 The decrease in investment income came mostly from the increasing volatilities in the equity market.

Please take note that China Life Insurance as an insurance and investment company is not required to include non-recurring items such as fair value gains/(losses) from financial assets in their profit or loss statements.

Net cash flow from operation for the first nine months was RMB 288.7 billion, which was 17% higher year over year.

Importantly, the solvency of China Life Insurance continued to stay at a higher level. The core solvency ratio and the comprehensive solvency ratio of the Company were 161.93% and 230.26%

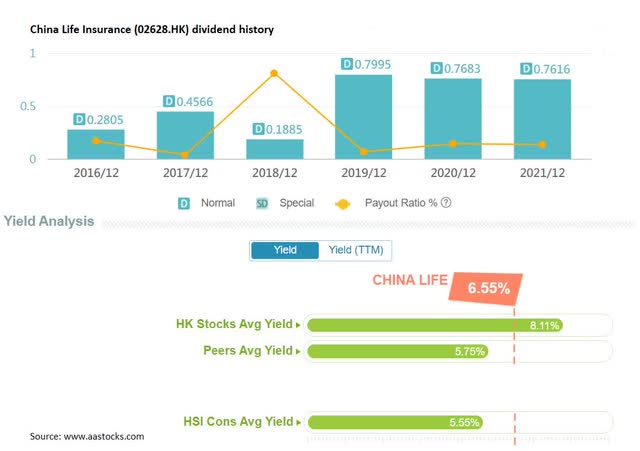

In terms of returning capital to shareholders, China Life Insurance pays out a dividend yearly. Here is the dividend for the last 6 years.

China Life Insurance dividend history (Aastock.com)

Presently, the yield is 6.55% which is quite acceptable and slightly higher than that of its peers.

Some regular followers have complained to me this year about their Hong Kong stock portfolio. It is understandable as the market did go down about 38%, but has since recovered about 35% of this.

But what is interesting from the graph above, the web portal aastocks.com claims that the average dividend yield for Hong Kong stocks is 8.11%.

That is quite high, and most likely a result of depressed share prices despite profitable businesses. We look at this as an opportunity.

Delisting of the ADS from NYSE

The other day we received an email from one of our readers that asked:

Dear sir, I have shares of LFCHY in the stock market of America. After the stock has delisted and stopped trading, what is the easiest solution a) to be transferred to the Hong Kong stock exchange b) to be sold and in what way? Looking forward to your advice. Thank you “

On the 26th of August, China Life Insurance announced that it had decided to exit the US stock market after taking into account two main factors – the limited trading volume of its American depositary shares (ADSs) relative to the worldwide trading volume of its underlying overseas listed shares (H shares) and the considerable administrative costs of maintaining the listing of the ADSs on the New York Stock Exchange.

The real reason could perhaps be the then unresolved auditing dispute between Chinese companies and U.S. regulators.

Several large Chinese state-owned companies decided they do not need to be listed in the U.S. to attract capital, as the capital market in China, including Hong Kong, does this well.

Investors who held the ADS should contact their brokers for settlement. It should not be difficult for them to sell through the same brokers they purchased the shares. They can then choose a discount broker in the country of their residence to purchase shares in these companies listed in Hong Kong.

Risk to the thesis

In our last article, our main concern was whether the government would restrict their large state-owned companies, like China Life Insurance as to how much money they should make.

There are many ways they can do this. They could intervene and put “price caps” on certain insurance products, or as the western world now is doing to the energy industry, just add on a “windfall tax”.

Xi Jinping has secured his position and it remains to be seen what they do in their pursuit of “common prosperity”. It is not a bad thing to address the inequality in society and the growing difference between the rich and poor.

From reading the tea leaves, it does seem like preferential treatment will be given to large state-owned companies over smaller private companies.

Conclusion

Long term, the wealth creation that is taking place in China will, in my personal opinion, continue.

China Life Insurance is well placed to offer service products to cater to this demand.

Historically, people in China have used real estate as their form of saving for old age, but I do think the last couple of years with many of them losing money in that asset class, and the media attention it got, could perhaps change people’s perception of what good investments are. Other forms of investments may benefit from this.

China Life Insurance should benefit from this

My buy stance remains intact.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment