Richard Drury

Investment Thesis

Robinhood (NASDAQ:HOOD) has seen its shares find significant support in the past several months. The figures coming out from Robinhood are clearly reassuring and point to stability.

This was once a bubble stock. But that period is now in the rearview mirror. Nevertheless, I remain bearish on its prospects.

I believe that the company’s valuation is too speculative and that in a higher-rate environment, its valuation will be further compressed.

The Impact of Rates on Robinhood

I believe that we are in a bear market rally right now. Companies of all stripes are moving higher as investors are hopeful that a slowing down in rate hikes will be seen as bullish for barely profitable equities.

For my part, I maintain, that investing in barely profitable companies in a high-rate environment is not the same as investing in barely profitable companies in a 0% rate environment.

Why are investors so bullish on the impact of interest rates on Robinhood’s prospects? Because there’s the assumption that the Fed will soon pivot.

I declare that this is not the case. The inflation numbers that we are seeing are still significantly above 5%. Even if the Fed slows down the pace of rate hikes, the fact clearly remains that there’s a long way from where the present inflation figures are and 2% inflation.

Even if the Feb settles for 3% inflation and starts to bring down rates, that event is still a considerable time away.

Consequently, I argue that companies with lackluster growth that are barely profitable, aren’t suitable investments when rates are +4%.

But it’s not all bad news.

Revenue Growth Rates Stabilize

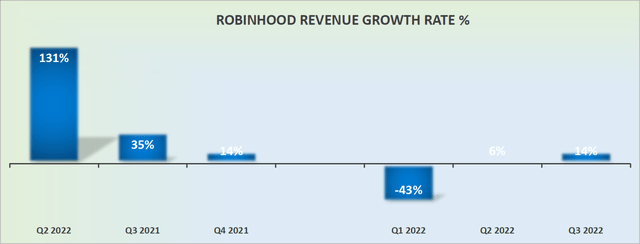

HOOD revenue growth rates

There’s some good news and bad news.

The good news is that Robinhood’s revenue growth rates are not likely to be posting significantly negative y/y figures. After all, we are now more than 15 months away from the top of the equity bubble. A lot of the enthusiasm for trading has waned.

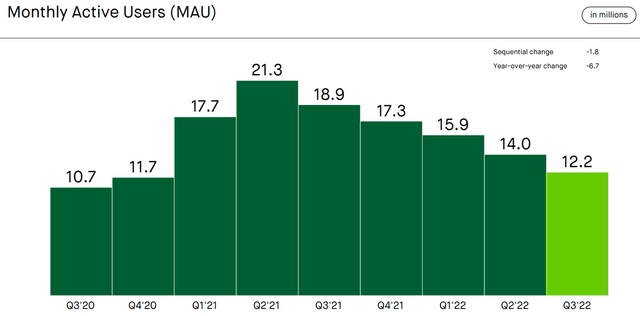

What’s more, it appears that Robinhood’s MAU figures have stopped shrinking.

Robinhood Q3 presentation

In fact, the monthly operating data since this Robinhood’s Q3 results come out, show that for the month of November, MAUs are 12.5 million. So, even if this figure is down significantly from the same period a year ago, investors are undoubtedly welcoming of the fact that the pace of MAU decline has stabilized, and even trended slightly higher.

So, things aren’t so bad, right? Well, not so fast.

What Robinhood Needs to Happen?

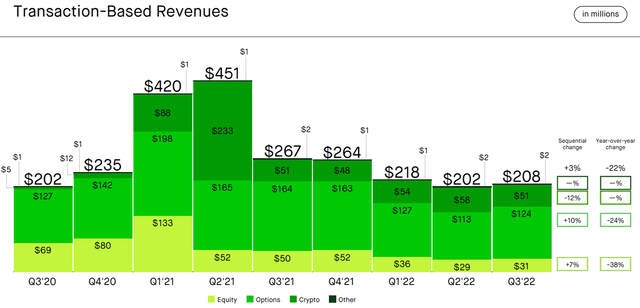

Robinhood Q3 presentation

We know that the crypto market is in the doldrums, and this will continue to be a headwind for Robinhood. Thus, I can’t imagine that Robinhood’s crypto revenues will move much higher than $55 million any time soon.

Furthermore, I can’t imagine that Robinhood will benefit from particularly strong equity-based trading revenues in Q4.

So, the only avenue that Robinhood will have left, will be the options segment. And Q4 has been extremely volatile, so it may be conducive towards Robinhood’s options-revenues increasing from Q3.

Nevertheless, this is my point. One way or another, Robinhood’s growth days are in the rearview mirror. So, what we have here is a stable and unprofitable company, in a high-interest rate environment.

With that in mind, let’s discuss its bottom-line prospects.

Profitability Profile Remains an Issue

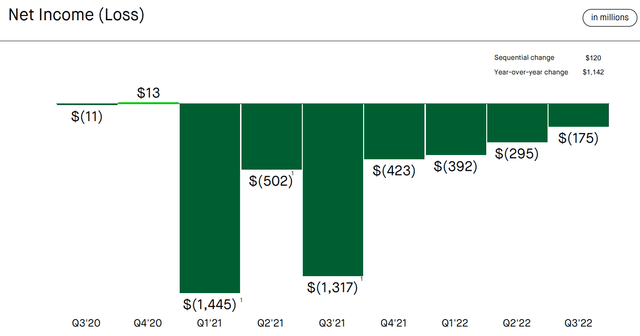

Robinhood Q3 presentation

On the one hand, there’s absolutely no question that Robinhood’s staunch efforts to restructure in the past several months have paid off. The company is seeing its net income line rapidly inching close to breakeven.

Thus, I have to question, what sort of multiple should investors put on Robinhood, a company that’s coming close to breakeven?

HOOD Stock Valuation — Still Too Speculative

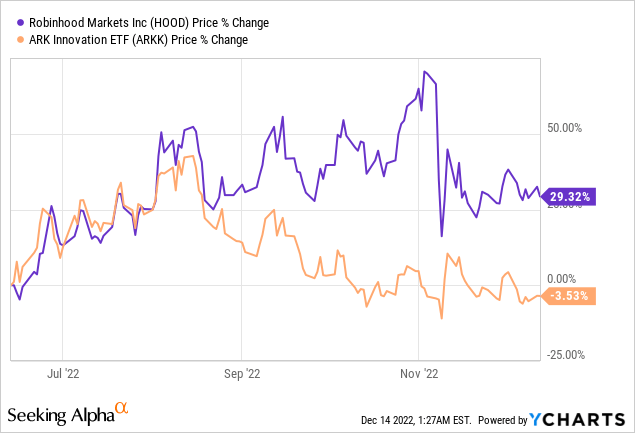

On the one hand, there’s no doubt that Robinhood’s shares have found a bottom in the past 6 months.

In fact, the shares are up significantly more than its proxy benchmark, ARK Innovation (ARKK). So, it’s clear that the company is no longer in serious danger of going under.

But simply because it’s not in danger of moving further down, this does not mean that there’s a positive risk-reward being offered to investors.

The Bottom Line

Let’s be honest. Robinhood has seen its share price fall more than 80% from its highs. That means much of the positive sentiment has now washed out.

And the company’s prospects are not anywhere near as poor as they once were. In fact, as I admit, the company is already coming close to breaking even.

However, the problem is that an $8 billion valuation is still too high, for a company with a high single-digit to low digits topline CAGR, that’s highly cyclical, and the business is as of yet, unprofitable.

For me, this remains a sell.

Be the first to comment