sitox

Introduction

The coal, oil and gas markets always receive the bulk of the attention when it comes to the energy sector but as my previous article highlighted, investors could grab a very high 10%+ dividend yield from Dorian LPG (NYSE:LPG) that is akin to the breadcrumbs of the global energy shortage, metaphorically speaking. Subsequently, the following months saw their shareholders enjoying a very large rally as the market started noticing the immense value offered by their shares. Whilst this quick money may have shareholders already heading for the exits, I feel their shares are still very desirable, even after a near 50% gain.

Background

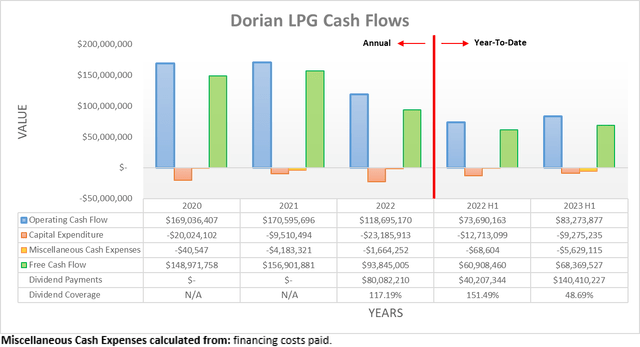

Despite weak cash flow performance during fiscal year 2022 as their operating cash flow of $118.7m landed well below its previous result of $170.6m during fiscal year 2021, thankfully it seems their fiscal year 2023 is enjoying a better start. The first half now sees their operating cash flow at $83.3m and thus modestly higher year-on-year versus their previous result of $73.7m during the first half of fiscal year 2022 with further improvements likely forthcoming as charter rates for LPG vessels strengthened into the current third quarter of their fiscal year 2023 on the back of the global energy shortage.

When looking ahead, naturally their cash flow performance will continue fluctuating quarter to quarter but if nothing else, it is very positive to see they have always consistently generated free cash flow, at least during the past three fiscal years that landed at $149m, $156.9m and $93.8m respectively during 2020, 2021 and 2022. Speaking from experience, this is quite rare for a shipping company and thus, by extension, quite attractive, especially given the accompanying turmoil of the Covid-19 pandemic. If interested in further details regarding their cash flow performance, their ability to capitalize upon the global energy shortage or their financial position, please refer to my previously linked article, as these aspects have not materially changed and the focus today more so relates to their current valuation.

Given the inherent volatility of the shipping industry, not to mention their accompanying variable dividend policy, it makes this task tricky. In my eyes, the best starting point in this situation is assessing their average annual dividend capacity, which in this case relates to their free cash flow during the last three fiscal years. In theory, companies can afford to safely return anywhere up to 100% of their free cash flow on average, thereby meaning it can serve as a proxy for their dividend capacity.

When looking at their free cash flow during fiscal years 2020, 2021 and 2022 as detailed earlier, it equates to $3.69, $3.89 and $2.33 per share respectively, given their latest outstanding share count of 40,350,535. If averaged across these three years, it equals $3.30 per share and thus, even as a quick rule of thumb measurement, represents a very high free cash flow yield of more than 16% given their current share price of $20.34. Even at the bottom end of this range, $2.33 per share would still see a very high free cash flow yield of circa 11.50%. Whilst this already leaves their shares looking desirable and undervalued even without any benefit from the global energy shortage, this is enhanced once expanding into a more detailed valuation.

Discounted Cash Flow Valuations

Following the discussion thus far and their clear preference for dividends within their shareholder returns policy, it stands to reason they are primarily on the radar of income investors and definitely not those seeking rapid growth from cutting-edge technology. This means that their intrinsic value is heavily dependent upon the future income they can provide their shareholders, and thus, can be estimated by utilizing discounted cash flow valuations that replace their free cash flow with their dividend payments. If interested, further details regarding the inputs utilized for these valuations can be found in the relevant subsequent section.

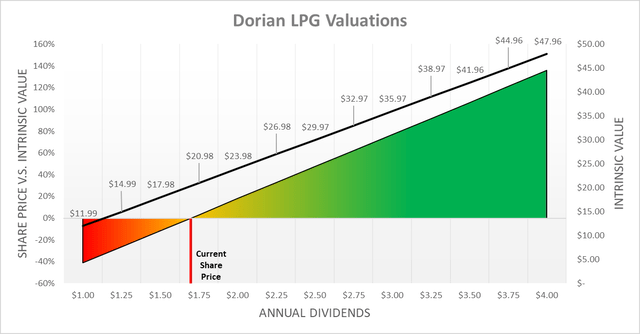

When approaching valuations, there are numerous ways due to the infinite range of imaginable future scenarios, especially given the inherent volatility of the shipping industry. Given this issue, it seems reasonable to structure these around their annual dividends by comparing their current share price against their intrinsic value for various dividend scenarios. In turn, these can subsequently be compared against their free cash flow to judge whether such a scenario is realistic and, equally as important, whether it also encompasses a margin of safety.

In my view, the most bearish scenario would see their annual dividends average $1.00 per share before subsequently ceasing after thirty years to account for the long-term threat to LPG demand from the clean energy transition, despite the current global energy shortage in the short to medium term. This would represent a massive deviation from their current dividends that, recently, have consistently been $1.00 per share quarterly and thus annualized to $4.00 per share. It would be difficult to imagine a scenario whereby they cannot afford these dividends because at their latest outstanding share count, they would only cost circa $40m per annum, which was easily generated during each of the last three fiscal years, despite the accompanying volatile economic conditions from the Covid-19 pandemic.

Concurrently, the most bullish scenario would see their recent quarterly dividends continuing and thus as a result, see their annual dividends average $4.00 per share, before once again ceasing after thirty years. This would be ever-so-slightly ahead of the $3.89 per share possible via their free cash flow during fiscal year 2021 and thus, barring any presently unknown future event, it would not be realistic to expect anything higher. Meanwhile, the remaining scenarios residing in between this range see various annual dividends at $0.25 per share intervals to represent a range of middle-of-the-road scenarios, which obviously are also ceasing after thirty years.

After reviewing the results of these scenarios, it was very exciting to see their current share price of $20.34 corresponds with an intrinsic value towards the lower end of the range and thus more aligned with a bearish scenario, rather than a bullish scenario. Equally as exciting, the intrinsic value for a scenario whereby their annual dividends average $3.25 per share sees an intrinsic value of $38.97 that is a massive 92% above their current share price, which corresponds very closely to their previously discussed $3.30 per share average annual dividend capacity from the last three fiscal years. Plus, they still see an intrinsic value of $26.98 that is a very impressive 33% higher than their current share price if their annual dividends average $2.25 per share, which is very close to the $2.33 per share bottom end of their annual dividend capacity.

Not only do these results see scope for investors to generate very significant alpha, as they are very favorably skewed to the upside, but it also sees minimal downside risk, which in my mind, makes for a very desirable investment. Furthermore, almost all of the various in-between scenarios still see intrinsic values much higher than their current share price and thus, investors still have strong prospects to generate significant alpha even if their average annual dividend capacity goes underutilized. By providing a variety of results, readers can cross-reference their own views with these valuations, as they may vary from my own.

Valuation Inputs

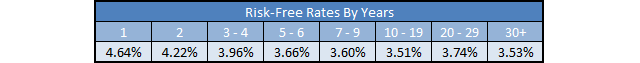

When conducting these discounted cash flow valuations, they utilized a cost of equity as determined by the Capital Asset Pricing Model. The inputs were a Beta of 0.96 (as per Barron’s), an expected market return of 7.50% and risk-free rates per year that track the United States Treasury yield curve on December 13th 2022, as the table included below displays.

Author

Conclusion

No one can see the future and alas, this means the inherent volatility of the shipping industry makes it impossible to predict the short-term, but thankfully, reasonable assessments can still be formed regarding the medium to long-term. When considering their average annual dividend capacity during the last three fiscal years, it seems investors can still look forward to generating significant alpha with their intrinsic value almost 100% higher than their current share price. Equally as important, their current share price corresponds more closely to the intrinsic value of a bearish scenario rather than a bullish scenario, even after their very large share price rally in recent months. In turn, this creates a strong margin of safety with minimum downside risk and thus as a result, I believe that maintaining my strong buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Dorian LPG’s SEC filings, all calculated figures were performed by the author.

Be the first to comment