imaginima

Thesis

Leading independent oil and gas producer Devon Energy Corporation (NYSE:DVN) is slated to report its Q3 earnings release on November 1. The market has already drawn in energy bulls expecting a solid release as DVN has recovered remarkably from its September lows.

Accordingly, it posted a 42% price gain from its September lows as DVN looks to re-test its June highs. However, we urge investors not to get overly optimistic at these levels and start jumping on the bandwagon. There are some underlying red flags that investors need to consider carefully.

Reports of near-term tightness in oil supplies leading to a steeply backward dated curve in oil futures and the production cut from OPEC+ have not led to a robust recovery in WTI crude oil futures (CL1:COM). Also, NYMEX natural gas futures (NG1:COM) have fallen markedly from their August highs, re-testing critical support levels.

Therefore, we believe the recent strength in DVN underscores buyers’ conviction in management in its execution through the cycle. Nevertheless, energy investors should not rule out the impact of further demand destruction as a global recession draws nearer.

While Devon Energy is still expected to post another quarter of solid results, its growth momentum is projected to slow further. Furthermore, the weakness in Q3 in the underlying energy markets suggests that it might get even more challenging to overcome the growth normalization moving ahead.

We discuss why investors looking to add DVN should continue to sit out the recent rally and wait for a deep pullback when the bullish sentiments have been digested. For now, energy analysts also seem too optimistic, even though they have slowed the pace of upward revisions for the E&P industry.

Moreover, we believe investors sitting on massive gains should consider using the recent rally to cut some exposure and layer out.

We rate DVN as a Sell.

The Market Has Not Re-rated DVN Significantly

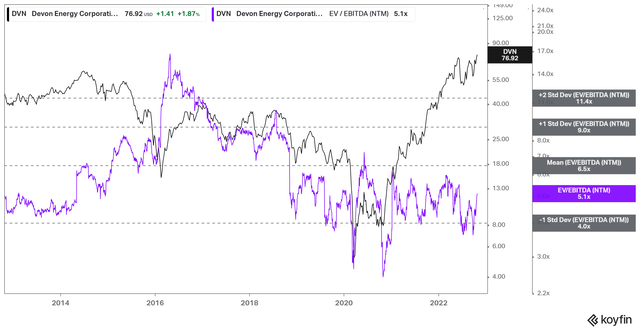

DVN NTM EBITDA multiples valuation trend (koyfin)

DVN last traded at an NTM EBITDA multiple of 5.1x, well below its 10Y mean of 6.5x. Therefore, the market has remained tentative over re-rating DVN much further, even as it posted a YTD total return of 81.34%.

Hence, there’s no doubt that DVN has easily outperformed the market. Coupled with a relative valuation that remains well under its historical averages, investors are encouraged to demand further upside from Mr. Market.

But, we believe there are reasons for investors to be cautious here.

Devon Energy’s Growth Is Projected To Slow

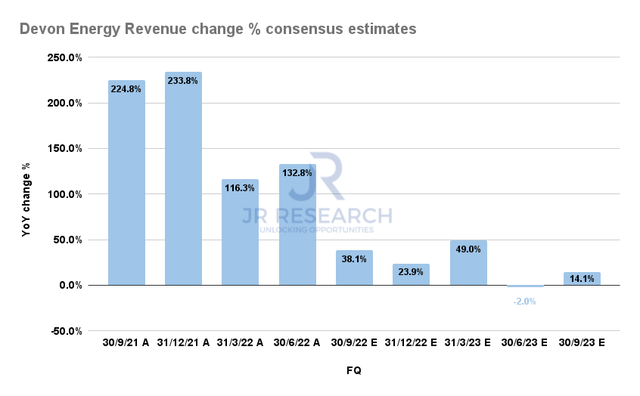

Devon Energy Revenue change % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) indicate that Devon Energy could post revenue growth of 38.1% in its upcoming Q3 release. However, that would be a significant deceleration from Q2’s 132.8% growth.

We believe these estimates are reasonable with the weakness in the energy markets in Q3. Notwithstanding, investors should consider what could lie ahead for Devon Energy, as markets tend to be forward-looking.

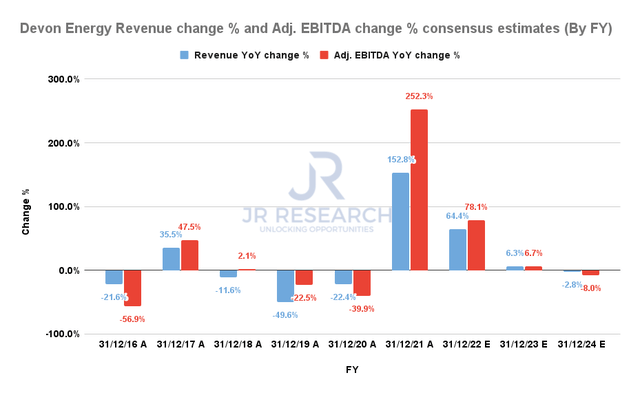

Devon Energy Revenue change % and Adjusted EBITDA change % consensus estimates (By FY) (S&P Cap IQ)

Even the bullish Street analysts don’t expect Devon Energy to repeat its stellar performances from 2022 in the following two years. Accordingly, Devon Energy is projected to post revenue growth of 6.3% in 2023, down from FY22’s 64.4% growth. As a result, its adjusted EBITDA growth is also estimated to normalize to 6.7%, down from FY22’s 78.1% uptick.

Moreover, Devon’s analysts still expect the company to post better operating performance than its E&P peers. According to Refinitiv data, the E&P industry is projected to post revenue growth of -2.2% and earnings growth of 1.3% in 2023.

DVN’s NTM P/E of 8x is slightly ahead of the E&P industry’s forward P/E of 7.8x. However, it trades at a premium against its oil and gas peers’ median P/E of 6x (according to S&P Cap IQ data).

Therefore, we assess that the market has already accorded DVN a reasonable valuation, given better-than-expected operating performance in the following year. Hence, investors should be wary about thinking that DVN looks undervalued at the current levels.

Is DVN Stock A Buy, Sell, Or Hold?

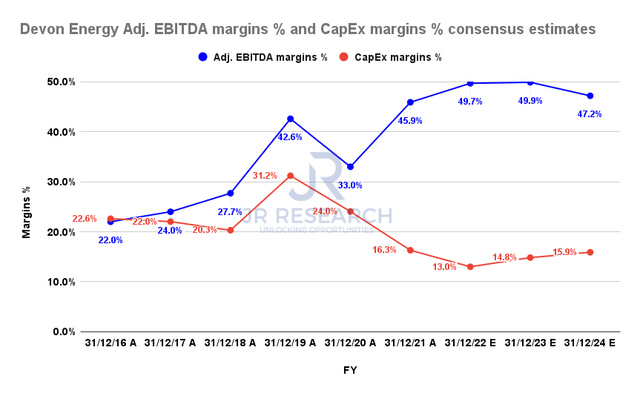

Devon Energy Adjusted EBITDA margins % and CapEx margins % consensus estimates (S&P Cap IQ)

Management has committed to distributing its record profitability gains to shareholders instead of investing aggressively in new production. As such, it should help keep its margins robust, even though it’s also expected to normalize.

Therefore, maintaining its CapEx margins well below its pre-COVID days should keep investors confident about its capital allocation strategy.

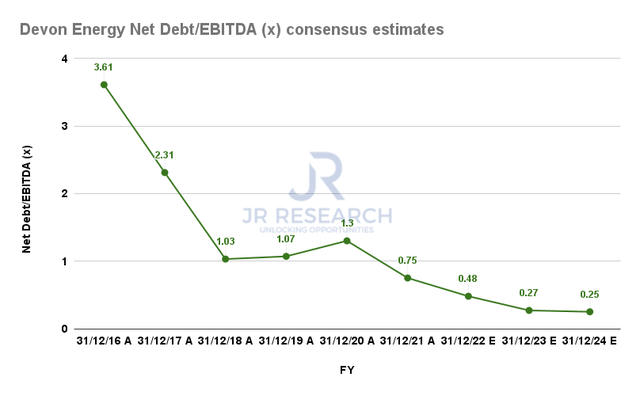

Devon Energy Net Debt/EBITDA consensus estimates (S&P Cap IQ)

Furthermore, its low leverage is also expected to help bolster its balance sheet strength, giving further ammunition to management to boost dividend hikes and share buybacks. We believe these are relevant considerations for investors when considering initiating/accumulating DVN.

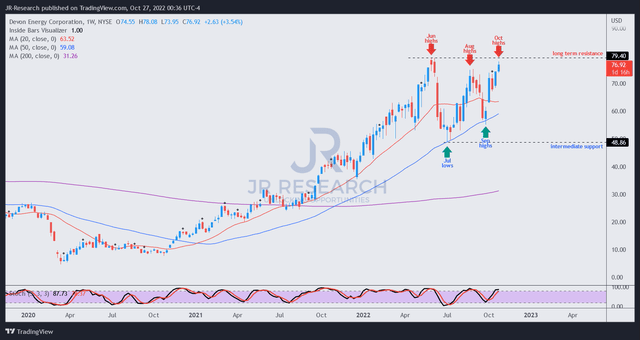

DVN price chart (weekly) (TradingView)

Despite that, we believe that DVN’s near- and medium-term upside has been reflected at the current levels.

DVN’s price action shows it’s closing in against its June highs, even though the underlying energy markets have struggled for momentum. Therefore, we postulate that DVN’s price action is not in sync with what we observed in the underlying markets. Hence, we assess that the optimism in DVN has already been reflected accordingly.

Consequently, we emphasize that investors looking to add exposure should consider waiting for a deep pullback. Investors looking to cut exposure can capitalize on the recent rally to layer out. More conservative investors can wait for a validated bearish reversal price action before pulling the sell trigger.

We rate DVN as a Sell.

Be the first to comment