eclipse_images/E+ via Getty Images

Investment Thesis: While Oxford Industries has seen an encouraging recovery in sales, a significant portion of the Tommy Bahama range is produced in China. Supply chain bottlenecks could potentially lead to issues in meeting demand.

In a previous article, I made the argument that Oxford Industries (NYSE:OXM) could be in a good position to go higher given a strong balance sheet as well as a rising inventory turnover ratio.

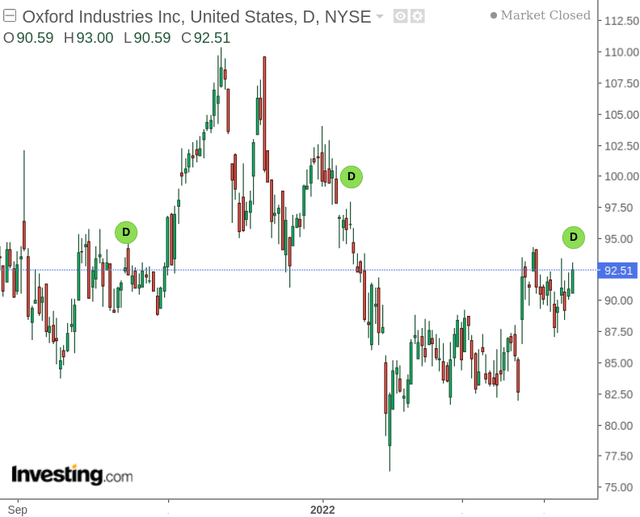

Since my last article in September, we have seen the stock take a slight climb from $86 to $92, despite significant price volatility in the interim:

The clothing industry as a whole is expected to come under significant strain as a result of higher energy prices caused in significant part due to the ongoing geopolitical situation between Russia and Ukraine, as well as continued COVID lockdowns across China causing significant supply chain issues. Higher fuel costs and shipping delays mean that transporting of raw materials becomes more expensive – which in turn raises the cost of cloth manufacturing. These costs are in turn passed on to the consumer in the form of higher prices.

The purpose of this article is to determine whether Oxford Industries could continue to see upside from here given the current macroeconomic environment.

Performance

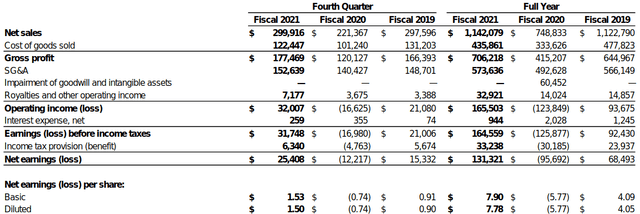

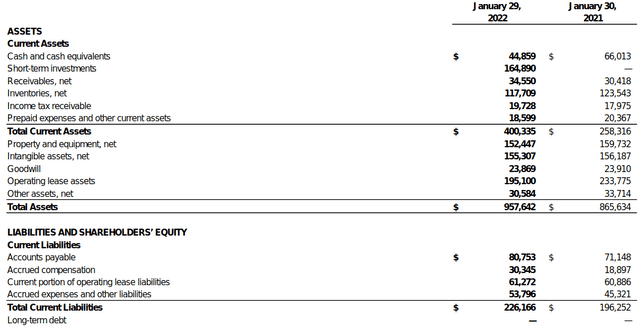

In the company’s most recent quarter, we can see that even though net sales have significantly recovered and slightly exceeded 2019 levels, the company has seen a fall in cash and cash equivalents along with an increase in current liabilities as the company has had to ramp up production to meet higher demand. However, the company has not had to incur long-term debt to finance its business, which is encouraging.

Net Sales

Oxford Industries: Fourth Quarter and Full 2021 Fiscal Year

Balance Sheet

Oxford Industries: Fourth Quarter and Full 2021 Fiscal Year

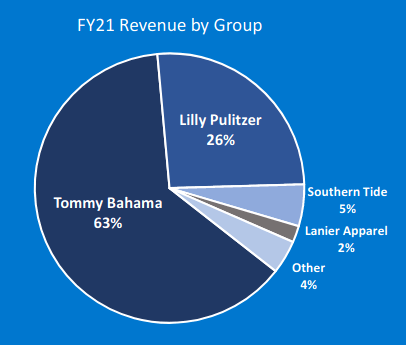

In terms of the company’s revenue by group, we can see that over 60% of the revenue of Oxford Industries in 2021 came from the Tommy Bahama range.

Oxford Industries: Investor Highlights Investor Highlights March 23, 2022

With that being said, the company’s latest Form 10-K points out that 49% of products for the Tommy Bahama operating group were sourced from China. In this regard, higher transport costs from Asia will invariably have a knock-on impact on the company’s cost base across its main brand.

Looking Forward

While Oxford Industries also states that its intention is to reduce its proportion of products sourced from China in the future – the company also points out that the bulk of fibers included in the company’s apparel and other products originate from China – even if the actual production process takes place elsewhere.

Therefore, while the company can take steps to reduce costs of shipping finished products themselves from China – significant costs are still likely to be incurred as a result of having to transport raw materials including fibers.

Moreover, continued COVID lockdowns in China are significantly adding to supply chain issues. For instance, the fact that many goods cannot be transported from China at present could mean that demand for shipping will be too great once the country starts to open up once again. This could result in significant delays in sourcing both raw materials and finished products – and risks the company not being able to fully meet demand for its products.

With a significant portion of inventory for the Tommy Bahama brand originating from China – Oxford Industries could see an impact in terms of higher costs and/or inability to fully meet demand.

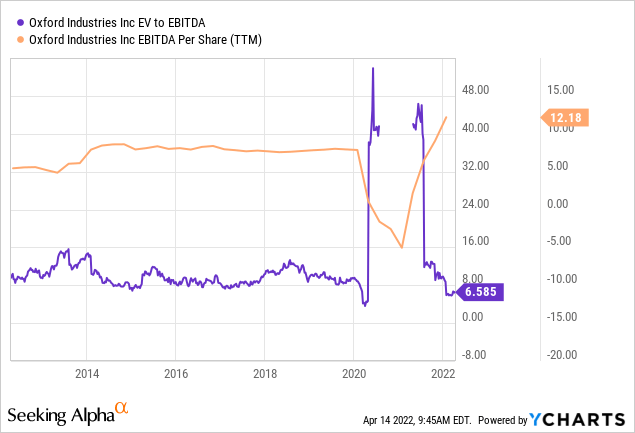

In terms of valuation, we can see that the EV to EBITDA ratio has reverted to similar levels that we saw pre-2020 (after having risen quite dramatically as earnings dipped in 2020), while EBITDA itself (earnings before interest, taxes and depreciation) is slightly higher than pre-2020 levels.

ycharts.com

In this regard, the stock is not expensive on an earnings basis, and given that we are seeing higher earnings – there is a case for arguing that the stock is trading at slightly better value than would have been the case pre-2020.

Should we see a decline in price as a result of investor concerns as elaborated on above, this could mean that the stock could end up in value territory with significant potential upside. Specifically, a decline back to the lows of $80-85 as seen at the beginning of the year could signal a buying opportunity provided earnings growth continues.

Conclusion

To conclude, Oxford Industries has seen an encouraging recovery in sales. However, sourcing supplies from China could prove to be a significant bottleneck for the company in the coming months and investors might be somewhat apprehensive on the stock until the situation becomes more stable. However, this could represent a buying opportunity if investor apprehension pushes the stock to value levels.

Additional disclosure: This article is written on an “as is” basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.

Be the first to comment