Insolvency Litigation Financing. A Lucrative Business ArLawKa AungTun/iStock via Getty Images

Introduction

In my previous articles on Manolete Partners (OTCPK:MANOF) (London: MANO) I introduced Seeking Alpha readers to a largely unknown niche business operating in the lucrative field of Insolvency Litigation. Please refer to those articles for background information:

In the interests of brevity, I shall not repeat what has been said in the prior articles save for the parts that are pertinent to the recent profits warning.

Background To The Profit Warning

The issue that I intend to focus on in this article relates to the outdated accounting rules which have not kept up with the reality of modern businesses such as Manolete Partners. In fact, they cause the business to misrepresent its profitability which is misleading for shareholders and so enormously problematic.

Allow me to explain.

The investments in insolvency cases made by Manolete Partners are classified as financial instruments and so are required to be reported pursuant to IFRS9 (International Financial Reporting Standards).

An investment in an insolvency claim is capitalised on the Balance Sheet as an asset of the business. These assets (cases) are marked-to-market on a regular basis and valuations are assessed based on the net settlement value of the claim adjusted by the probability of success.

Prior to settlement of the cases these adjustments are recorded on the Income Statement as ‘unrealized revenue’. Subsequently, when the case settles an adjustment is made and ‘unrealized revenue’ becomes ‘realized revenue’.

This means that some of the numbers on the Income Statement are a subjective assessment of the intrinsic value of an ongoing legal claim rather than being crystallized revenue.

Aside from the subjectivity issue, this accounting requirement creates additional challenges for the business. The average time to settlement for each claim is approximately eleven months and so newly funded cases in the current tax year will often not settle until the subsequent tax year which means that the company is being subjected to corporation tax each year on income yet to be realized.

Similarly professional costs incurred during the course of a case are capitalized on the balance sheet and released to the income statement only on completion of a case. So this creates a misalignment of taxable profit with the costs associated with that profit. Each is invariably included in the income statement for a different accounting year.

The effect of this accounting issue on the company’s financial position, particularly when the business is investing aggressively in new cases as it grows, is that cash flows are negatively impacted. Said differently, the cash flow statement lags behind the income statement because next year’s costs are brought forward to this year, while next year’s revenue will not flow until next year!

Proposed Solution

IFRS9 is a problem for Manolete Partners, but it is not insurmountable.

When dealing with liquid assets for which there is an active market, the valuation of those assets will invariably be the market price. There is little or no flexibility in this regard.

However, when dealing in assets that are legal claims in insolvency litigation, the situation could not be more different.

There is no market to use as a price discovery tool. More particularly, ask yourself this:

- if Manolete Partners ever wanted to dispose of its rights in a claim prior to judicial resolution, at what price could it do so?

- Would it be able to do so or might it simply need to write off its initial investment entirely?

Against this backdrop there is some flexibility afforded to Manolete Partners in discharging its IFRS9 obligations.

Indeed, if the company were to value the rights in the claim at cost then it would be perfectly reasonable to do so. Moreover, how could anyone refute that valuation? On what basis and on what evidence would they do so?

It was on this basis that I wrote an email to Mark Tavener, CFO of Manolete Partners, back on 22nd February 2021. I drew comparisons with RBG Holdings Plc (RBGP), a UK legal business that is concerned, at least in part, with litigation financing. In that missive, I asked, inter alia:

In relation to unrealised gains booked under IFRS9, these are reported at “fair value” as required by the accounting standards but RBG take the position that fair value is the cash cost because the outcome of litigation is inherently uncertain and so the cash acquisition cost is the best true measure of value until gains or losses are crystalised. This is a clever position to take and difficult to refute. It seems to me that the approach taken by RBG is sensible and preferable to the approach taken by Manolete Partners because it allows revenue to be booked as it accrues rather than on a forward basis which brings benefits including the avoidance of tax liabilities being brought forward on revenue booked but not yet reaslised … Would you consider doing it this way going forward perhaps with ex-post adjustments to prior reports for comparison purposes?

Unfortunately, the response received on 24th February read as follows:

…we do not see RBG Holdings as a sensible comparator, as you note they undertake other activities and they hold very few insolvency cases. If you look across a wider cross-section of our competitors both in the UK and internationally, you will find a number of different approaches to the valuation of live cases, many of which are consistent with our approach.

I was disappointed that the response took the form of a defensive position rather than an acceptance of a constructive solution proffered by a shareholder with the best interests of the company in mind.

In any event, no changes were made at that time and this has exacerbated the situation that lead to the recent profit warning.

The Profit Warning

On 9th September 2022 Manolete Partners published the following statements:

Manolete Partners Plc (AIM: MANO), the leading listed insolvency litigation financing firm in the UK, announces that it has received a rare adverse decision in the High Court on one of its larger cases. While Manolete has applied for permission to appeal this surprising decision, the Board has decided to write down the full value of the case in its forthcoming results for the six months ended 30 September 2022 (“FY23 Interim Results”). The impact will be a reduction of £2.3m to pre-tax profits, of which the cash costs paid out on this case to date are £636,756.

Separately, reflecting the widely reported deterioration and challenges presenting in the UK macro-economic climate, the Board has taken a more prudent view of the valuation of the Company’s c.280 ongoing litigation case investments.

As a combination of both of these factors, the Company expects to announce a pre-tax loss of c.£5m in the FY23 Interim Results, the large majority of which will be due to the adjustment of unrealised revenues and unrealised profits.

Ironically, the “more prudent view” being taken by the company on its portfolio of circa 280 cases is exactly the approach that I had advocated 18 months earlier. C’est la vie!

The good news is that the IRFS9 valuation approach being adopted by the business now is far better than before and a huge step in the right direction.

Additionally, the profit warning is largely as a result of the move to this more prudent approach to accounting for unrealized gains on the Income Statement. It has absolutely no bearing on the actual sums that the company will realize on its portfolio of live cases, which I believe to be largely unchanged.

Finally, with reference to the “widely reported deterioration and challenges presenting in the UK macro-economic climate” mentioned in the statement, while this is bad news for the economy as a whole it suggests that insolvency numbers are highly likely to increase in the coming 12 to 18 months which is the life-blood of the Manolete Partners business.

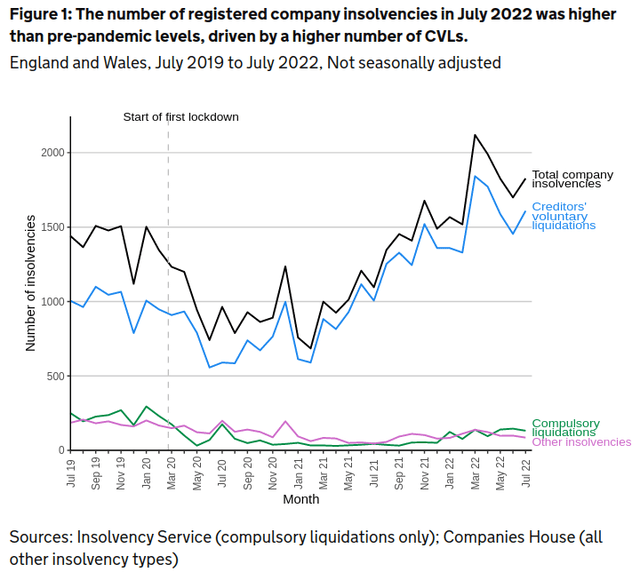

This is fully supported by official data:

UK Insolvency Service; Companies House

Robust Underlying Business Performance

As we have seen, IFRS9 creates something of a fictional story on the Income Statement and so for a more accurate picture it is important to look at the Cash Flow Statement.

The business continues to operate well, in particular, gross cash generation from completed cases in the first five months of the current trading year is at a record £15m. This compares to £15.6m gross cash generation for the entire 12 months for the year ended 31 March 2022. This strong cash performance enabled the Company to repay a net £3.7m of indebtedness during the first half of this financial year. Furthermore, unaudited realised revenues, on completed cases, for the first five months of FY23 were 175% higher at £10.6m (FY22: £3.9m).

From 1 April 2022, UK insolvency regulations returned to normal after a near two-year suppression of insolvencies by the Government in response to the Covid-19 pandemic. The benefits of this are now starting to flow into the Company’s key performance metrics, with new case enquiries already up 24% compared to the whole of H1 FY22.

The Company is also working closely with blue-chip strategic financial services and Government entities, which may lead to a material involvement in the recovery of monies loaned to UK SMEs under the Bounce Back Loan schemes.

The Company will provide a further update when the FY23 Interim Results are published later in the year.

Steven Cooklin, CEO of Manolete commented:

The Board and our legal advisers were surprised and disappointed by the very rare adverse initial judgment that we received on one of our larger cases, a case that we originally signed up in 2019. For the first time in our 13-year history, we have applied for permission to appeal that decision to the Court of Appeal. We have taken a cautious stance by reducing the carrying value of that case to zero until we know the final outcome of the appeal process. On the wider front, while we have taken a deliberately prudent view on the latest valuation of the portfolio of our 280 in-process cases, we note that our key forward-looking performance indicator of ‘new case enquiries’ is now showing strong signs of recovery. I am optimistic that the second half of this financial year and beyond will see much improved trading results.

So, not only are the company’s fundamentals rapidly improving, but the case for which an adverse initial judgment was received is headed to the appeal Courts and the judgment may be overturned in favour of Manolete Partners.

Either way, it is inevitable that in the world of litigation one cannot win them all. The loss rate at Manolete Partners is less than 1% over a 13 year period. This single judgement does not undermine the investment thesis in any way.

Conclusion

Manolete Partners is a small company in a niche field that generally goes under the radar of most investors. Therein lies a wonderful opportunity.

Little over 6 months ago this stock was trading at a level which is 50% above today’s market price. The business fundamentals have improved since then, not deteriorated.

This is one of the largest holdings in my portfolio and I am unwavering in my conviction to the investment thesis, and in Steven Cooklin to deliver on the wonderful opportunity ahead.

The change in corporate policy in terms of taking a more prudent approach to portfolio valuations will vastly improve the working cash position of the business because in future less corporation tax will accrue on unrealized profits. I would still like the business to go further and value its portfolio at cost for IFRS9 purposes, but we have taken a step in the right direction.

Long story short, this will be a company that will enjoy accelerated compounded growth in the years to come.

I would advocate buying this dip.

Be the first to comment