kokkai

Introduction

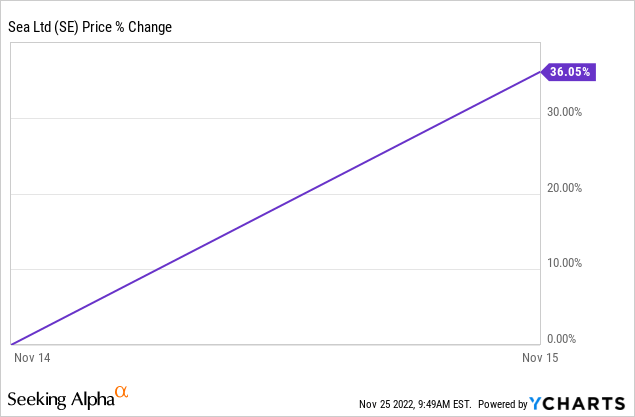

Last Tuesday, Sea Limited (NYSE:SE) reported its Q3 2022 earnings. From the market reaction, I think it’s clear how these were perceived. The stock shot up 36% following the announcement.

This is of course the result of a raging short squeeze. Many traders were shorting Sea and they had to buy back as soon as possible. But that short squeeze was driven by fundamentals that looked better than before.

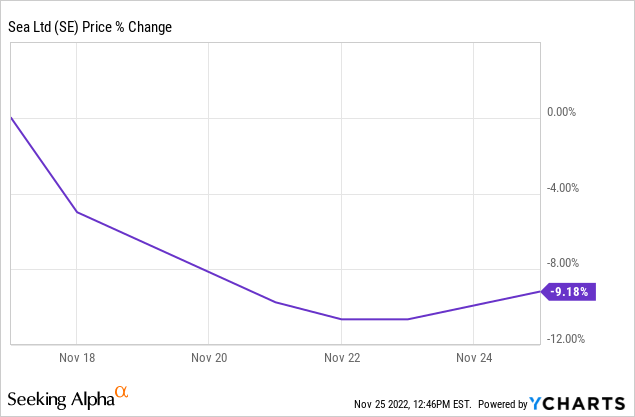

In the meantime, the stock has gone down again by 9%.

Let’s dive into the numbers to analyze the situation.

The numbers

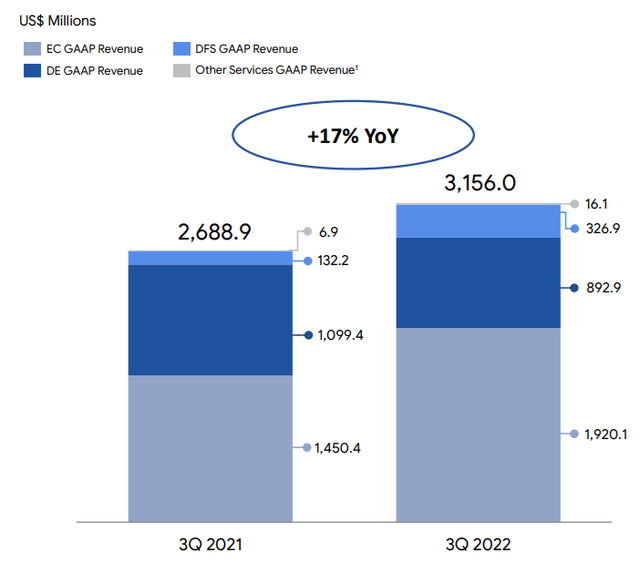

As Sea consists of three businesses under one hood, gaming, e-commerce and digital banking, there are always more numbers to go through. We’ll start with the group and then we’ll go over the 3 arms.

Group

The Q3 revenue came in at $3.2 billion, up 17.4% year-over-year, beating the consensus by $190M or 6.3%.

Sea’s Q3 earnings call slides deck

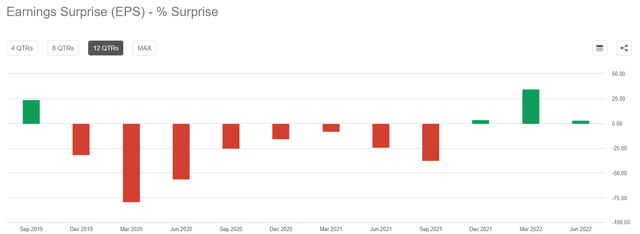

Sea reported non-GAAP EPS of -$0.66, beating the consensus by a whopping $0.29 or more than 30%.

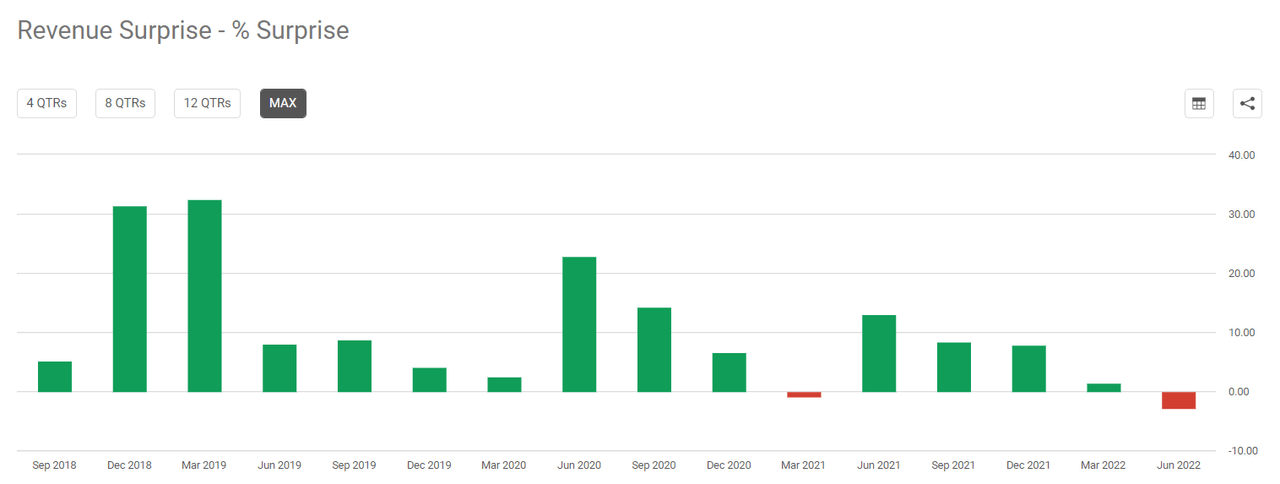

This has become a pattern for Sea. It has almost always been beating on its topline expectations. 14 beats out of 16 quarters.

Seeking Alpha Premium

For EPS, the picture was completely different. The company almost always missed expectations, at least until recently.

As you can see, this is the fourth consecutive quarter management beats on EPS, for the second time by 30%+. That’s the right message to the market, now that it focuses more on the bottom line. Of course, Sea is not profitable yet, but it is showing faster improvements than the market had given it credit for. Net loss came in at -$569.3 million, flat year-over-year, but an improvement of a whopping 38.9% quarter-over-quarter.

Gross profit landed at $1.2 billion, up 21.7% year-over-year. On $3.2 billion in revenue, that means gross margins of 37.5% vs. 37.9% in Q2 and 37% in Q3 2021. This metric is stable.

If you exclude SBC, stock-based compensation, severance packs and lease termination fees, net loss even improved by 49.4% quarter-over-quarter. You can argue about excluding these things, of course, but SBC is not a cash expense and the rest is a one-time expense that will save more money in the future. Impressive to see such a turnaround in just a quarter.

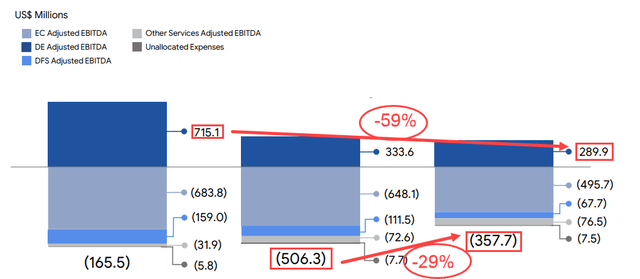

Adjusted EBITDA was -$357.7 million compared to -$165.5 million in Q3 2021, but 29.4% better than in Q2 2022. If you exclude SBC, severance and lease termination costs, EBITDA improved 44.7% quarter-over-quarter.

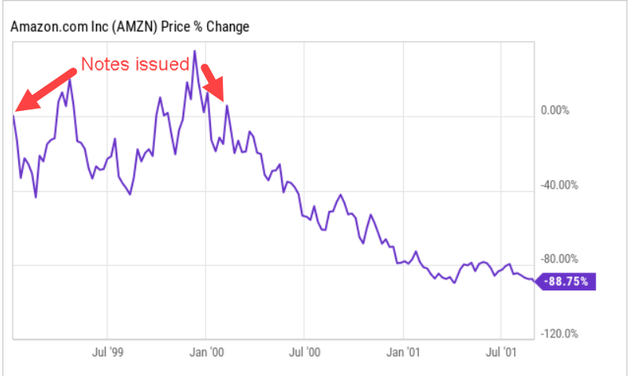

Sea is still financially stable, with $7.3B in cash, equivalents and short-term investments. The company has $3.74 billion in convertible notes. The biggest part, $2.5 billion, is issued when Sea’s stock price was much higher. They were offered at $318 per share. They have an interest of 0.25%. They have a conversion price of $477. Very well timed, Sea!

YCharts, adapted by the author

I have already said that Sea reminds me in different ways of Amazon (AMZN). You always have to be very careful with such comparisons. I’m not implying that Sea will become the next Amazon; every situation is different. But there are similarities. One of them is that Amazon also issued notes just before the top. $1.25 billion in January 1999 at 4.75% and $655 million in February 2000 at 6.9%, both for 10 years.

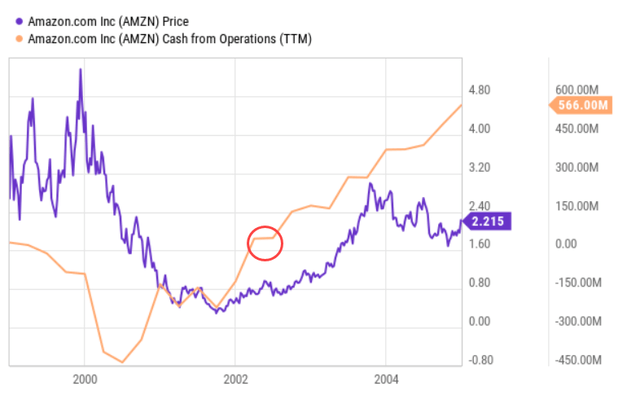

YCharts, adapted by the author

This was one of the main reasons Amazon could survive the dotcom crash, while almost all other tech companies went under. Jeff Bezos promised the company would focus on profitability. Does that sound familiar? Bezos indeed turned the company and it became profitable 2.5 years later. The red circle shows when Amazon became profitable on operational cash flow, probably the best metric to track retail. You can also see how fast this goes up after that.

YCharts, adapted by the author

I now hear some people say Sea will have to file for bankruptcy in a few years. That’s very unlikely. If the stock price is still a lot under that price, which is likely, some note investors may want to be repaid in cash. But to start with, Sea has the necessary money up to now; secondly, often there are renegotiations, in which the notes are extended and the conversion prices are brought down.

Forrest Li, Sea’s Founder and CEO, sent out a very clear message to the doubters on the conference call about the notes or convertible bonds, the name he uses here:

We aim to continue to maintain a net cash position, after budgeting for the full retirement in cash of outstanding convertible bonds and assuming no external funding.

So, Li wants to have a cash position after having paid off all outstanding notes. That means that the company will go fast and that this quarter was just the start of a turnaround. Li added:

I’m confident in our ability to execute well against our stated goals, as we have demonstrated so many times in the past.

Let’s look at the different groups now.

Shopee

Shopee’s revenue was up 32.4% year-over-year to $1.9 billion, 38.8% in constant currency. Adjusted EBITDA for Shopee was -$495.7 million, improving 27.5% year-over-year and 23.5% quarter-over-quarter.

The core marketplace revenue was up 54.1% year-over-year to $1 billion, which is very strong and the main driver of the fast improvements in Shopee’s losses. This shows what Forrest Li has been preaching for years, that scale will bring cost advantages, which shows up in the numbers. The core marketplace mainly consists of third-party revenue and ads.

That marketplace revenue is up much more than GMV shows scale advantages kicking in and ads and other services gaining traction. Shopee has also made its take-rate higher to make its transition to profitability faster.

Shopee’s Sales & Marketing expenses of $575.7M were down by 16.4% year-over-year and 14.6% quarter-over-quarter. Raising take rates, cutting on S&M and still being able to grow revenue by 54%, for the core marketplace. That’s strong.

VAS or Value-added services revenue was up 20.3% year-over-year to $600 million. This mainly consists of logistics. It hides the growth of the core marketplace a bit.

There were 2 billion orders, up 19.2% year-over-year against tough comps. Last year in the same quarter, orders were up a whopping 123%. At the same time, orders were flat compared to the last quarter. Probably, this is because the company slashed the free shipping for most cheap products. This is no problem, I think.

GMV grew 13.5% to $19.1B. On an FX-neutral basis, GMV was up 21.4%. That’s on top of the 80.6% GMV growth in Q3 2021. Quarter-over-quarter growth, though, was just $100 million or 0.5%. I think this is what Forrest Li hinted at when he said on the conference call:

We believe our strong focus on cash flow and achieving self sufficiency as much as possible is the right strategy to pursue at this stage, even though we may see no growth or even negative growth in certain operating metrics in the near-term.

Slashing free shipping, higher take rates for merchants, lower sales and marketing spend, it all adds up to lower growth. Of course, there are two other very important elements here: the macroeconomic environment and the tough comps. In this environment, though, I think Sea is right in focusing on becoming profitable first. Forrest Li explains the strategy:

To be very clear, we remain highly confident about the compelling long-term growth prospects of our businesses and the market. Once we achieve self-sufficiency, we will be in a position to decide to reaccelerate growth again in a much more efficient and a long-term sustainable manner.

Something I have been irritated by for a long time is the exclusion of headquarters expenses in Adjusted EBITDA. From now on excluding HQ expenses will be called contribution margin, as it should be. Glad to finally see that corrected.

Asia markets adjusted EBITDA came in at -$216.8 million, improving by 31.4% quarter-over-quarter. In most Southeast Asian countries, there was already a positive contribution margin for Shopee, including Indonesia, its biggest market. Malaysia and Taiwan recorded positive adjusted EBITDA.

For the other markets adjusted EBITDA came in at 279 million, improving by 16% quarter-over-quarter. While management had previously shared that they wanted to have profitability for Shopee in its core markets in 2023, it added an extra goal now. Founder and CEO Forrest Li:

we are currently working towards adjusted EBITDA breakeven for Shopee overall by the end of 2023.

That includes Brazil. In Brazil, unit costs were $1.03 per order, improving 27.4% quarter-over-quarter. Revenue was up a blistering 225% year-over-year. Management confirmed that Sea would continue to invest in Brazil.

Despite cost-cutting initiatives, Sea will continue investing in its platform and that leads to success. Forrest Li on the earnings call:

The number of brands on Shopee Mall also continued to grow strongly by 36% year-on-year to over 42,000, reflecting more brands recognizing the value Shopee brings to them. Importantly, we are always looking to further improve the services we offer our sellers and provide a superior shopping experience for our buyers.

Garena

Some call it Sea’s problem child, but Garena has allowed Sea to grow so fast. DE or digital entertainment, as the company calls it, has been in decline, which is not strange after reopenings. Revenue came in at $892.9 million, down 0.8% quarter-over-quarter and down almost 20% from $1.1 billion last year. But just to show you how difficult last year’s comps were, then revenue was up 93.2% for a division that mainly is about a game released 4 years prior. Bookings were down a bit more than revenue, 4% quarter-over-quarter on an FX-neutral basis, from $664.7 million vs. $717.4 million in Q2. Bookings are a window into the future, as they show the money players have already paid but that the company can’t recognize yet, as it’s not spent yet. The fast decline here seems to have stopped but the trend has not been reversed.

Adjusted EBITDA was down from $333.6 million in Q2 to $289.9 million, down 13% quarter-over-quarter, but down 59% compared to last year.

From the Q3 earnings call slides, adapted by the author

That’s of course what has worried the market and why it has been so worried about Sea. That Sea can now reduce overall losses by 29% in just a quarter is exactly what Wall Street wanted to see. Management shows results, not just vague promises. The graph also clearly shows that Sea still has more work to do. But the market now knows that management is doing what it should do.

Garena’s quarterly active users came in at 568.2 million, down from 619.3 million in Q2 or 8.3%. There are 51.5 million paying users or 9.1%, unchanged from Q2. Average bookings per user were $1.2, also flat quarter-over-quarter.

Management further reduced the outlook for Garena by about 10%.

Given rising macro uncertainties, and with reopening trends having an ongoing effect on the business, we are revising the guidance for digital entertainment. We now expect bookings for the full year of 2022 to be between US$2.6 billion and US$2.8 billion, as compared to the previous guidance of between US$2.9 billion to US$3.1 billion.

Riot Games recently did not renew its contract with Garena, taking the publishing rights of its games League of Legends and Teamfight Tactics with it. The first analyst immediately asked if this would impact its relationship with Tencent, which bought Riot in 2011, one year after its partnership with Sea had started. This is the answer of Min Ju Song, the Director of The Group’s Chief Corporate Officer’s Office, who always answers all questions.

And the recent termination of the — as we announced legal merchant partnership with Riot as a result of the expiry of agreement would have no impact on our overall publishing business as the contribution is immaterial from the particular game.

(…)

Also, this decision is a right decision and has no relationship to anything regarding the right of first refusal agreement what we have Tencent.

We will have to see in 2023 when the agreement with Tencent expires. In the meantime, Garena keeps working on its pipeline but doesn’t really want to share anything specifically. Min Ju Song:

In terms of the game pipeline, we do have games in our pipeline on self-development as well as publishing. And as usual, we don’t discuss specific games that we haven’t announced for launch yet, but there are always things that we are working to.

An interesting answer from Min Ju Song shone a light, not just on what management thinks but also how they work. It was about Arena of Valor, a game by TiMi Studios, which is part of Tencent.

Of course, as we also shared regarding Arena of Valor, as an example that, it’s a six-year-old game and we started to see some new growth in the game six years since its launch. So, we believe that after you reach certain core user base and for a very long-term game, with the right type of operations and efforts, there could be potential upside to the game

This quote shows that management trusts that Free Fire still has a long runway. At the same time, as they are the distributor, they see what works and they can apply that to Free Fire.

SeaMoney

Revenue came in at $326.9 million, up 147.2% year-over-year and a bit more than 17% quarter-over-quarter. Adjusted EBITDA was -$67.7 million, improving by 57.4% year-over-year and 39.3% quarter-over-quarter. The improvements came from better sales and marketing spending and the “healthy profitable” credit business.

The total loans outstanding in Q3 added up to $2.2B, allowance for credit losses of $253.4M not included. Non-performing loans of more than 90 days came in at less than 4% of loans receivable and the average tenure of the loans was about 4 months.

Something I didn’t like was that management left out two metrics that they had shared before: active users and total payment volume. Even if these didn’t look great, you should either give the numbers or explain why you don’t report them anymore. There was no question about this from analysts. They were either briefed beforehand, didn’t dare to ask the question, or were asleep at the wheel.

No matter what, SeaMoney keeps growing explosively and that’s great to see. The evolution that we have seen with Mercado Pago at Mercado Libre can be a model for SeaMoney. However, there is more competition in Southeast Asia than in Latin America when Mercado Pago started and even today. On top of that, management will deprioritize off-platform usage growth.

Finally, at SeaMoney, we have deprioritized off-line adoption of ShopeePay and further diversifying funding for our credit business across multiple sources. Our current initiatives are designed to further quantify our leading positions and enable us to continue to win in our key markets over the long run.

Management made it clear for all cost cuts that it would turn them back on when it’s self-sufficient if they think they are worth it.

Management keeps a close look at the loans that SeaMoney provides.

With the growing volatility across our markets, we are closely monitoring the health of our credit business and our loan book.

Up to now, though, loans are very profitable.

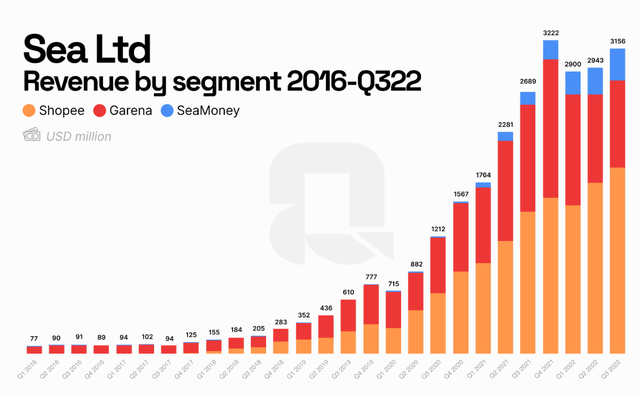

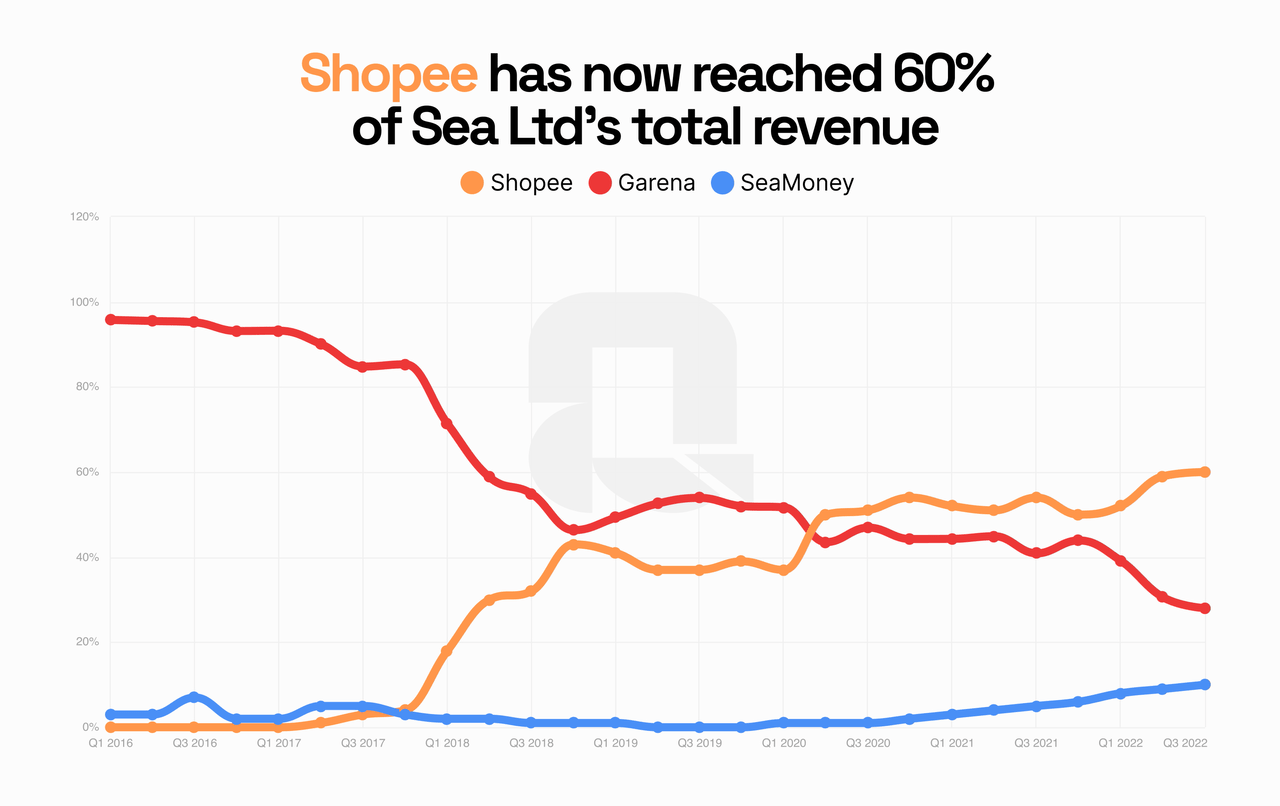

To summarize this part, let’s look at some interesting stats, made by Quartr.

Notes from the conference call

Before we go into the conference call, I want to share my general observation about it. Forrest Li, the founder and CEO of Sea, has always been a part of my investment case for Sea. Of course, there’s much more, but to me, he’s a great leader. If you read his letters, even his leaked internal mails and if you hear him talk, you always have the feeling: “Yes, this man knows what he is talking about.”

But during the last conference call, for the first time, I heard some doubt in his voice. Of course, this could be totally subjective. During this conference call, though, Li sounded confident and humble as usual.

On the conference call, he first mentioned that Sea had its IPO 5 years ago and that he has learned a lot by being a public company. Then he went immediately on to the main focus of the quarter. I have added some italic fonts to underline the important passages.

Given the significant uncertainties in the macro environment, we have entirely shifted our mindset and focus from growth to achieving self-sufficiency and profitability as soon as possible without relying on any external funding.

We are adapting quickly to the changing climate because we believe that companies that fail to do so may not survive. All our efforts are directed to ensure that Sea not only survives the macro storms, but emerge stronger, more efficient, and more resilient and as a long-term winner in our markets.

Right away straight to the core: pointing out the problem and showing what the strategy of the company is. That’s a good start. We already had this in the Overview Of The Week, but it can be a reminder here:

I announced in mid-September that the management team will stop receiving cash compensation until we achieve self-sufficiency.

Forrest Li also warned, and that was repeated by the other management teams, that the upcoming quarters may be somewhat lumpy but restated that Sea wants Shopee to be breakeven on an adjusted EBITDA basis before the end of the year next year.

In the coming quarters, we will continue to focus on improving key financial metrics for the long-term health of our business. While our results may fluctuate and affected by the macro environment and many other factors, we are currently working towards adjusted EBITDA breakeven for Shopee, overall by the end of 2023.

During the Q&A, management answered that the efficiencies will come from both sides, so controlling expenses and revenue growth.

There was also an interesting question about margin profile for Shopee over the long term. This was the answer:

In terms of the margins for Shopee, as we shared, there are main two components in our marketplace revenue, once the core marketplace revenue, the other is value-added services.

Marketplace revenue is mainly transaction-based fees and advertisement. We believe the margin for this portion of the revenue in the long-term steady state could potentially be more in line with what you would normally see for a pure-play marketplace type of business model.

The typical EBITDA margin for e-commerce is between 5% and 15%. Amazon, for example, is usually around 10% and MercadoLibre (MELI) is as well. Net margins are generally between 3% and 5%, although there are exceptions on both sides, of course. If Shopee would already be profitable now, that could mean EBITDA between $200 million and $600 million for this quarter. Min Ju Song continued:

Now because of this revenue is mostly related to logistics services, these will be more reflected of potentially logistic services type of margin in the long run.

This is something I didn’t know, but I found a McKinsey report that says that EBIT margins are typically 1% to 11% in the sector.

My take on this quarter

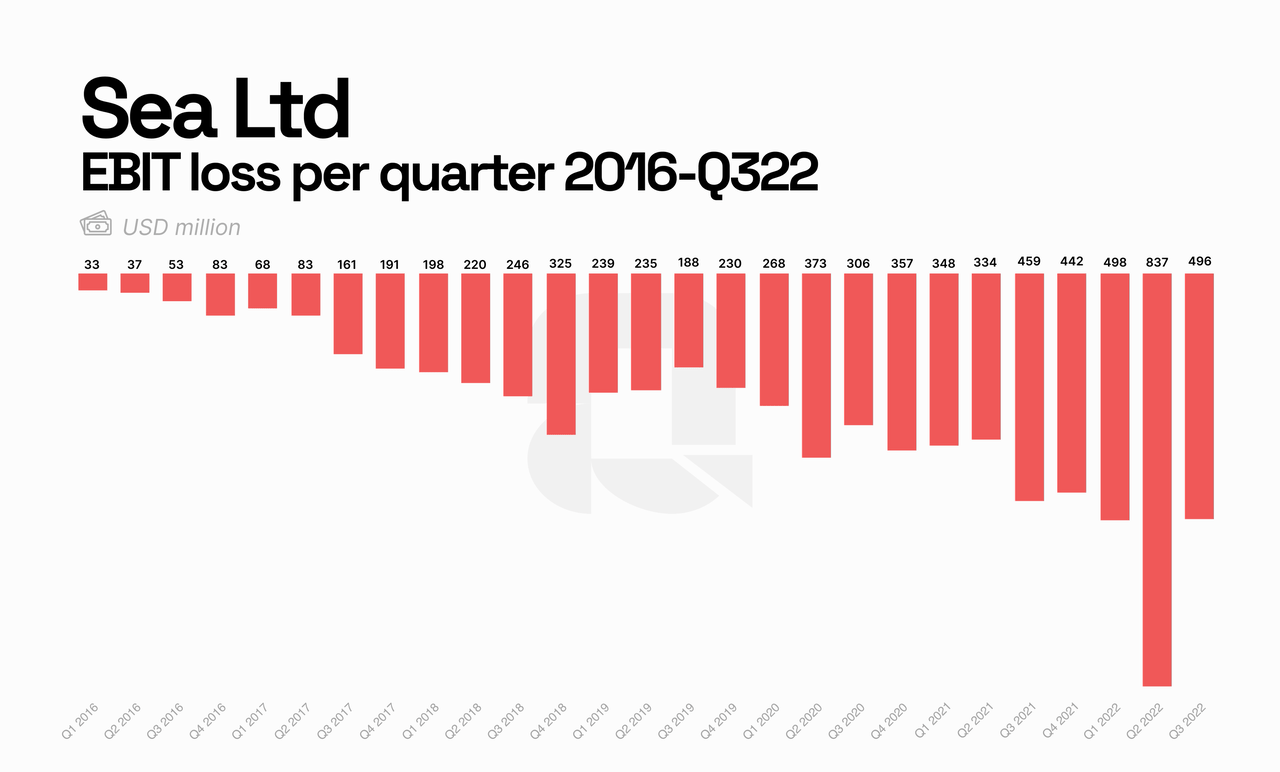

This quarter could mark the turnaround at Sea. That was necessary, as this chart clearly shows.

Quartr

The turnaround is fast and big. While the improvements are impressive, Forrest Li said that most would only be visible in the upcoming quarters.

As we began more focused efforts on optimizing HQ costs, including R&D costs, from the later part of the third quarter, we expect savings on shared costs to start to show in the following quarters.

The word ‘efficiency’ was used 25 times during the conference call. I think that shows enough what management is focused on.

To me, the biggest takeaway is that management did what it had promised. Again, I should add. This management team delivers on its promises and that is great to see.

The fact that Forrest Li assured the market that the company wants to pay all of its outstanding notes and still have cash reassured me and probably everyone following Sea.

If management continues to deliver as it has done again, I see no reason not to buy Sea’s stock, even though I would only add very little at a time. After all, as management said, the quarters could be lumpy, so maybe better prices could still be in front of us.

Sea has shown again that it’s worth investors’ trust. It has adapted very fast to a totally new situation.

Conclusion

While this was not a quarter to get really excited about as such, it was the quarter that Sea needed. It has proven that it can turn around the ship fast. The focus on profitability is the right choice. The affirmation that Sea wants to remain cash positive after paying off all of the convertible bonds is very encouraging. This removes quite a bit of the risk that had popped up in the last quarter.

To me, Sea is much more investable again. The upcoming quarters may be lumpy but the long-term prospects for this company are still good. It’s still early in its development and has several tailwinds helping its ship sail safely.

In the meantime, keep growing!

Be the first to comment