Wolterk

Investment Thesis

The shares of Marathon Petroleum Corporation (NYSE:MPC) have gained attractively around 98% year to date. It surpassed its 52-week high price and made a new high at $126.6. The company has announced a dividend increase of around 30% for its shareholders in the recently concluded quarter. Marathon Petroleum works with a goal that each of its individual asset generates free cash flow for the business and contributes to shareholder returns. MPC can be a strong candidate to be considered for the long term with handsome margins, low debt, good coverage of obligations, well-covered dividends, and very solid outlook.

About the Company

Headquartered in Findlay, Ohio, Marathon Petroleum Corporation is one of the US’ largest refining and downstream energy company. Its refining operations include refining of crude oil and other feedstocks. Midstream segment transports, stores, distributes, and markets crude oil and refined products principally for the Refining & Marketing segment via refining logistics assets, pipelines, terminals, towboats, and barges. These midstream operations are largely carried under its subsidiary MPLX (MPLX), owned majorly by MPC.

Strong Financial Performance

Even though the crude oil prices have fallen from their 14-year high hit in March, they still remain attractive. Yet, falling crude prices and backwardation hurt refining margins sequentially in the third quarter. For the long-term, investors are optimistic on the American energy industry. The industry is trading at a PE ratio higher than its 3-year average PE.

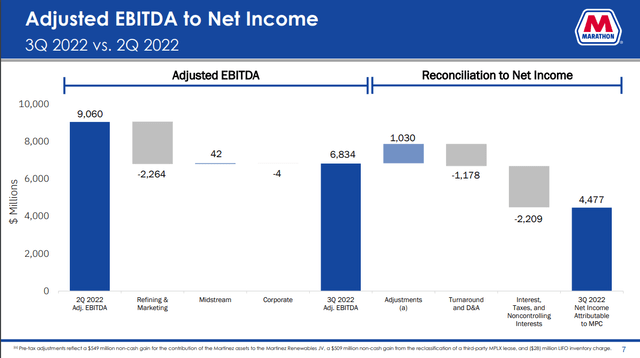

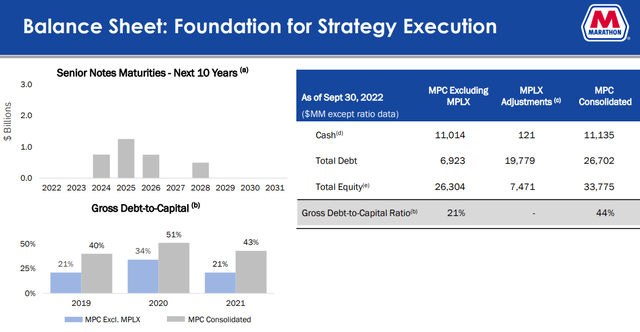

In the third quarter of 2022, Marathon Petroleum reported an adjusted EBITDA at $6.8 billion displaying better operational and commercial execution as the company focused on delivering products for consumers in this very tight market. The company’s refining system ran at near-full utilization to meet demand. Net income showed an attractive rise to $4.5 billion compared to $694 million for the third quarter of 2021. The company had $11.1 billion in cash, cash equivalents, and short-term investments and $5 billion available on its bank revolving credit facility at the end of the quarter. MPC also reported a favorable debt to capital ratio of 21% during the third quarter.

MPC has also completed its $15 billion return of capital commitment, having repurchased approximately 30% of outstanding shares since the program’s commencement. The company has approximately $5 billion remaining available under its current share repurchase authorizations.

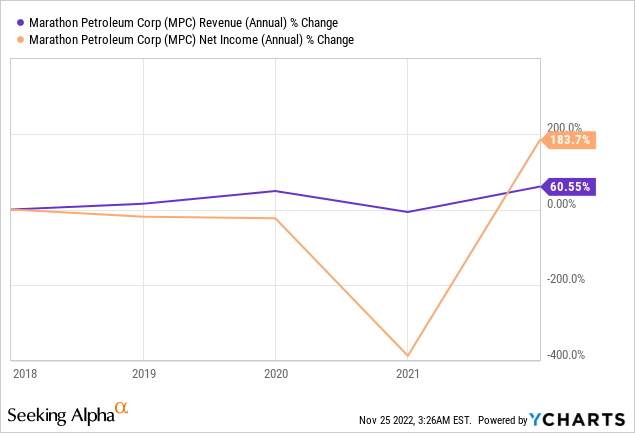

Comparing the results delivered by the company on an annual basis, the revenue and net profits grew attractively in 2021 as compared to the previous four years.

The company had planned to work on four main financial priorities for 2022, namely: sustaining capital; pay secure, competitive, and growing dividend; capital growth with disciplined growth opportunities and focus on renewables; and commitment to return capital to shareholders. The company’s balance sheet as of September 2022 displays the robust foundation laid for the execution of its strategy.

Marathon Petroleum’s debt-to-equity ratio has been declining on a quarterly basis since March 2020.

The segment adjusted EBITDA for Refining & Marketing segment was $5.5 billion in Q3 as compared to $1.2 billion last year, driven by high margins and volumes. Crude capacity utilization also improved and recorded at 98% versus 93% reported in previous year’s same quarter. The segment adjusted EBITDA for midstream segment showed a growth of around 9% on a YoY basis.

Joint Venture with Neste Improves MPC’s Outlook

In the third quarter of 2022, Marathon Petroleum closed a joint venture with Neste (OTCPK:NTOIF) for its Martinez Renewables project. Neste contributed $400 million plus 50% of capital spent to date. The first phase of the Martinez renewables project facility is expected to be completed by end of year 2022. The initial production capacity is expected to be 260 million gallons per year of renewable fuels. In the second half of 2023, the pretreatment capabilities are expected to come online and it is expected that the facility will be capable of producing 730 million gallons per year by the end of 2023.

Peer Comparison

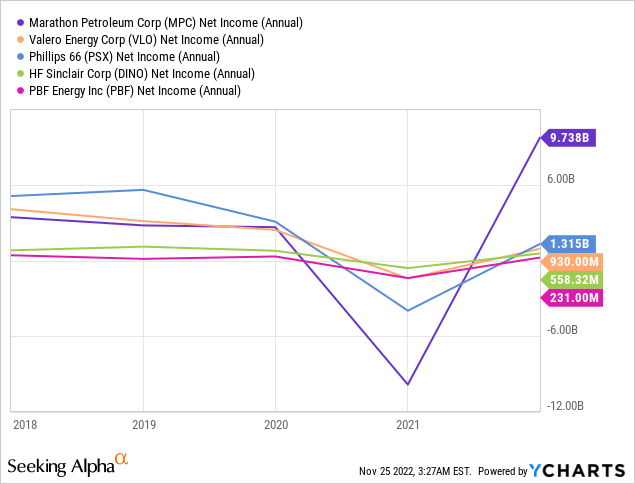

On an annual basis, MPC has shown a higher net income growth as compared to some of its peers including Valero Energy (VLO), Phillips 66 (PSX), HF Sinclair Corp (DINO), and PBF Energy (PBF). The key driver for the drastic rise in net income is a one-time gain recorded on sale of assets. In May 2021, the company completed sale of its retail transportation fuel and convenience store business named Speedway. The transaction resulted in an after-tax gain of $8.02 billion which is included in the net income shown in the chart below. Excluding the gain resulting from the sale of Speedway, the company’s after- tax net income of $2,553 million is still peer-leading.

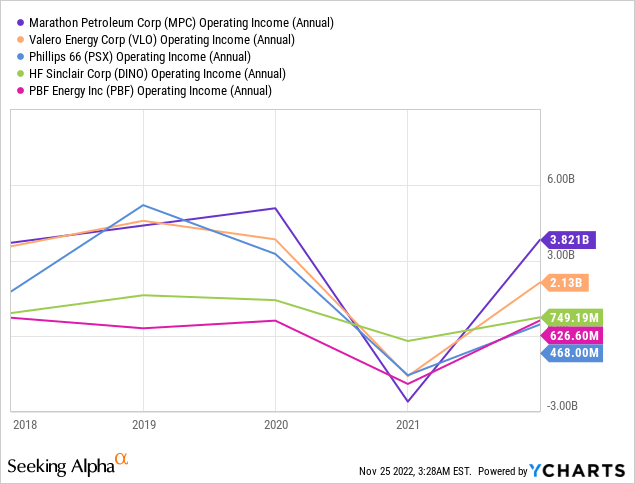

MPC also led in terms of operating income in the last five years as compared to its peer companies.

Valuation

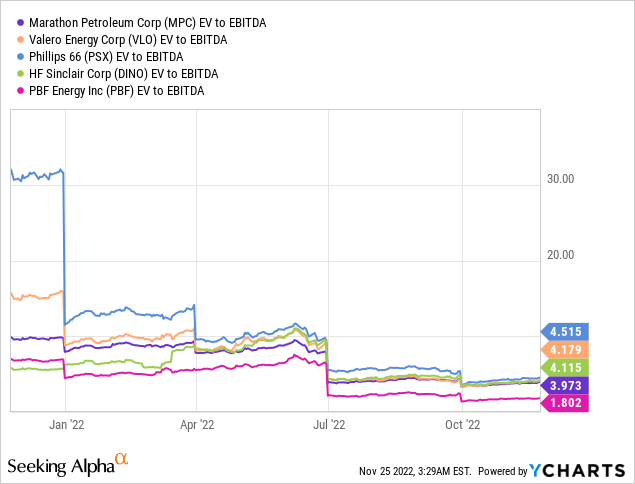

The following graph shows where the peer companies and MPC stands in terms of EV to EBITDA ratio. MPC’s EV to EBITDA ratio compares favorably with its peers.

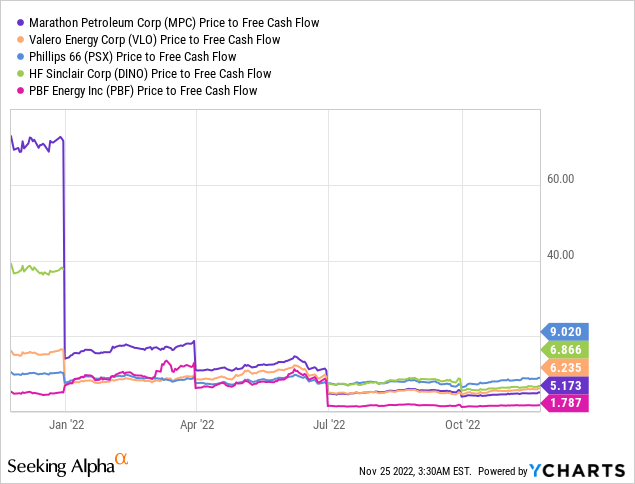

MPC stock also trades at relatively lower Price to FCF ratio as compared to its peers, which indicates undervaluation.

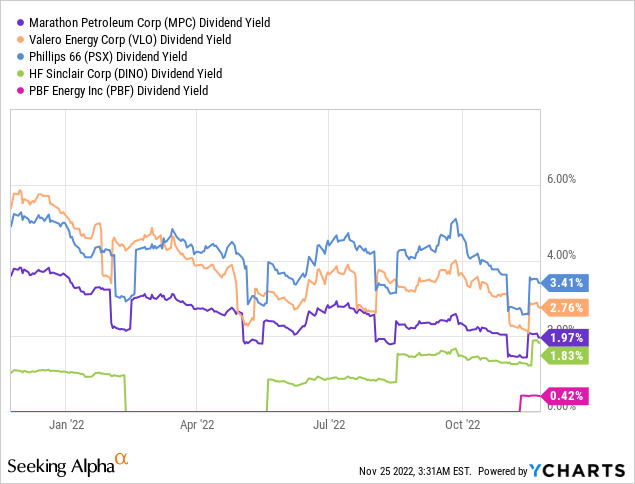

The stock offers an attractive yield of about 2%. The below graph compares MPC’s yield with its top peers. As the graph shows, the rise in prices of refining stocks has resulted in a fall in their yields.

Seeking Alpha’s proprietary quant ratings rate Marathon Petroleum stock as “strong buy.” The stock is rated high on profitability, momentum, and revisions factors.

Risks

The largest risk that MPC faces is obviously volatility in commodity prices. Numerous factors drive the oil demand and prices which are not in the company’s control. The growth trajectory of oil supply has been off-track as OPEC+ plans to sharply curtail oil supplies resulting higher price levels adding more to the market volatility and rising energy security concerns. The company employs various strategies, including the use of commodity derivative instruments, to hedge the risks related to these price fluctuations. The company is also exposed to market risks related to changes in interest rates and foreign currency exchange rates.

Conclusion

The demand for oil and gas products is expected to remain robust in the coming decades, helping Marathon Petroleum to continue generating attractive returns for its shareholders. The company’s balance sheet looks strong, and it intends to return value to its shareholders through stock repurchases and dividend growth. The stock looks attractively valued compared to its peers.

Be the first to comment