cemagraphics

It’s been about five months since I wrote my bullish article on Cara Therapeutics Inc. (NASDAQ:CARA) and in that time the shares are up about 19.5% against a gain of 5.4% for the S&P 500. While that’s a gratifying outcome, I’m still down from my initial investment I made in this company earlier in the year. Given that the shares have done really well recently, it’s time to revisit the name to see if it makes sense to add to my position, sell, or hold the shares and wait for further developments. I’ll make this determination by looking at the most recent financial results, and by looking at the stock as a thing distinct from the underlying business. I’m also going to comment on the call options I bought earlier, as these have done very well on a risk-adjusted basis in my view. I think we can draw a general conclusion from this specific circumstance, namely that calls often offer superior risk adjusted returns to the stocks of non-dividend paying companies.

Welcome to the “thesis statement” portion of the article. I offer this in all of my articles for those people who want a bit more than they get from titles and bullet points, but a bit less than the 1,700 words that I typically splash at my readers. The only thing that’s keeping me invested here is the strength of the balance sheet. This company has enough dry powder to linger for years, and so I consider it to be a lottery ticket in some sense. I’m distressed by the fact that the company remains unprofitable in spite of growing sales. This prompts the question I’ve asked many times: if growing sales doesn’t lead to profits, what will? Additionally, the valuation is hardly cheap. Also, while I’m in the mood to ask uncomfortable questions, I’ll wonder why insiders keep selling so aggressively if this is such a wonderful business? While I normally recommend call options in lieu of share ownership, the premia being asked at the moment are too great in my view. For that reason, I’m going to stand pat. I’ll hold what I’ve got, but I won’t add. If you’re just joining this party, I would recommend you hold off and not buy these shares until the valuation improves and/or the premia being demanded of call buyers drops.

Financial Snapshot

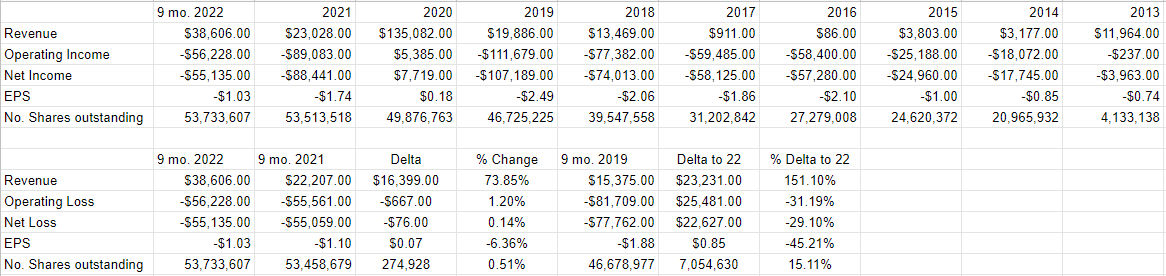

The financial performance here has been “consistent” in my view, because it continued a trend I’ve lamented previously. Specifically, the company grew revenues and losses simultaneously. Specifically, revenue for the first three quarters of 2022 was about 74% higher than it was in 2021, while operating and net losses increased by 1.2% and .14% respectively. The reason for this relates to the 10% uptick in R&D expenses, and 33% increase in G&A expenses. The EPS figure has moved from a loss of $1.07 to $1.03, but that’s simply a function of dilution. There are 274,928 more shares outstanding now than there were this time last year. I’ve written about this phenomenon before, but those who know me best know that I’m very comfortable with repetition, so I’ll write it again here. If growing sales doesn’t lead to growing profits, what’s the point? In other words, if growing sales doesn’t lead to consistent profitability, what does?

It’s not all terrible news at Cara, though. For instance, relative to 2019, the net loss has shrunk by $22.7 million. Admittedly that’s the high point (low point?) of losses at the firm, but improvement is improvement. Additionally, the capital structure remains rock solid. For example, cash and marketable securities are 5.42 times greater than total liabilities. This is one of the cleanest balance sheets I’ve seen. For that reason, I think it’s worth considering this business on the assumption that they have a great deal of time to turn profitability. Investing in companies where “time is your enemy” is generally a bad idea. It can be a great idea to invest in companies where “time is your friend”, and given the resources here, I think time can be Cara’s friend. It’s therefore worth considering in my view.

Cara Therapeutics Financials (Cara Therapeutics investor relations)

The Stock

If you read my stuff regularly you know what time it is. It’s the time where I turn into a bit of a “downer” as the young people say, because we’ve reached the point of the article where I remind everyone that a company is distinct from its stock. It’s here where I remind everyone that a growth business can be a terrible investment at the wrong price. The company invests in various research activities designed to target the body’s peripheral nervous system and immune cells, and hopefully generates revenue from their efforts. The stock, on the other hand, is a piece of paper that gets traded around in a public market and is influenced by a great many factors, many of which are only peripherally related to the underlying business. While the stock price is certainly impacted by the company’s recent financial performance, or various ideas about how Kapruvia is going to perform in Europe, or the state of the competitive landscape for certain treatments. The stock price also is potentially impacted by the crowd’s ever-changing perspectives on the relative merits of “stocks” as an asset class. For these reasons, the stock is a much more volatile thing than the underlying business. While this is tiresome, it’s potentially profitable. If we can spot the discrepancies between the crowd’s take on a given business, and the assumptions embedded in the price, we can earn a profit.

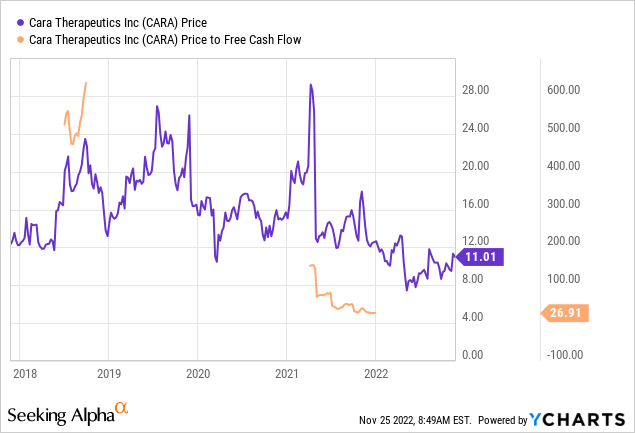

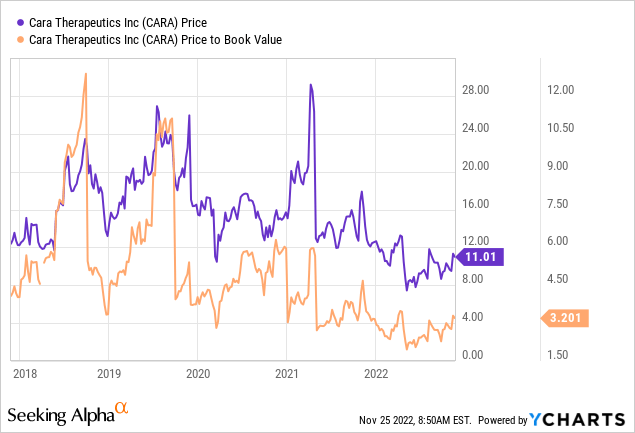

Finally, I should point out that I’ve found that cheaper stocks offer a higher risk-adjusted return, so I like to buy shares when I consider them to be cheap and eschew them when they get expensive. If you’re one of my regular readers you know that I measure the cheapness (or not) of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of price to some measure of economic value like sales, earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both its own history and the overall market. In my previous missive, I was glad to see that the shares were trading near the low end of their range on both price to free cash and price to book bases. Specifically, these were 26.9 times and 2.11 times respectively. Fast forward to the present, and free cash flow is non-existent, making comparisons challenging. The price to book ratio is about 52% more expensive, though, per the following:

Given that I consider the optionality built into the “book” to be the greatest source of value here, this spike in valuation isn’t encouraging in my view. Given that, I’m not going to buy any of the stock today. In order to get excited about this name, I’m going to need to see some evidence of consistent profitability, and/or deeply discounted valuation. I see neither at the moment, so I’m not putting serious capital to work here.

But Wait, There’s More: Insider Activity

I don’t normally pay too much attention to insider sells, because there are a host of reasons why insiders of an established company may sell shares besides wanting to unload an unprofitable investment. In this case, they’re worth writing about though in my opinion. I am prompted to ask “if Cara is such a wonderful investment, why would the people who know the business best sell so consistently?”

Let’s zero in on April of this year. Kapruvia was approved in the European Union on April 28th, and in the United Kingdom the next day. That was a significant milestone in my view. At the same time, though, insiders collectively sold 7.074 shares that month alone. Additionally, between mid-July and mid November, insiders have sold an additional 36,070 shares.

CARA – Cara Therapeutics, Inc. – SEC Form 4 Insider Trading Screener

This insider activity would not normally make me fret as much, but in this case it does. Just as I don’t have an answer to the question “if growing sales won’t lead to profits, what will?” I don’t have an answer to the question “if this is such a wonderful, profitable business, why would so many of the people who know it best sell so consistently?”

Options Update

You may remember that in my previous missive on this name, I decided to eschew the shares, but reflected a (speculative) bullish position by buying 4 February 2023 calls with a strike of $7.50 for $2.75. Now that the shares have risen about 19%, these are now priced at $3.30-$4.10, so the trade’s worked out fairly well in my view. The shares have earned about $1.86 since I wrote about the name, while the calls have earned “only” about $.55 minimum since. Although the calls made less money, assuming the seller simply takes the bid, they’ve done better than shares in my estimation. The call investor risked much less capital, obviously, and earned the same 20% return as the stock buyer. Given that there’s no dividend here, I think my previous calls, uh, “call” was the best way to take a speculative bullish stance here.

While I normally like to try to repeat success, I can’t in this instance because the premia being demanded is too great in my view. For instance, the February call with a strike of $10 is being asked at $2.55. Although that strike is ~$1 in the money, I think the premia is still too rich. In order to generate a theoretical profit on these calls, the shares will need to climb another 13.6% from current levels. In my view, that’s a bit of a heavy lift, and so I think it makes the most sense for new people to sit this trade out until the shares drop in price and/or the premia being demanded for calls dries up a bit. I’m going to hang on to my calls, but I wouldn’t recommend people buy in at current prices as they’re too dear in my view.

Be the first to comment