tzahiV/iStock via Getty Images

EPR Properties (NYSE:EPR) has a few catalysts in 2023 that will help support its recovery and its common shares moving back to their $55 pre-Regal Cinemas bankruptcy high. The first is the exit of Regal’s parent Cineworld (OTCPK:CNWGQ) from Chapter 11 bankruptcy initially filed on the 7th of September. This is set for the end of January next year and would allow the market to assess the full financial impact of the filing on EPR. It’s important to note that whilst Regal skipped rent for September, it has continued to make payments in the subsequent months. Hence, the impact of the Chapter 11 filing so far on EPR has been quite limited with none of EPR’s theatres closed. This is against an initial submission by Regal to the Southern District of Texas to close 46 locations around the US.

EPR’s common shares pulled back from $55 to lows of $36 on the back of Regal’s bankruptcy filing. The stock market does not like uncertainty so the prospect of material disruptions to EPR’s rental revenue from the restructuring of its second-largest tenant rightly caused concern. It fed directly into the bearish arguments that theatres would be stranded assets in the post-pandemic economic zeitgeist. Indeed, there has already been a number of casualties including Pacific Theatres and Arclight Cinemas who both filed chapter 7 last year.

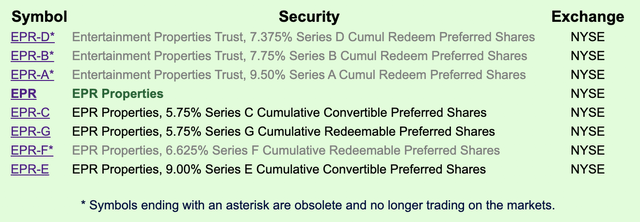

Understandably, some prospective investors will not be comfortable holding the commons. Hence, the 9.00% Series E Cumulative Convertible Preferred Shares (NYSE:EPR.PE) offer an alternative method to gain exposure.

Whilst EPR has paid off most of its preferred share capital structure, the Series E are perpetual and only redeemable on a conversion basis. Each Series E share can be converted into common shares of EPR at a 0.4826 conversion rate. They also have a $25 par value which essentially creates a floor for holders against what could be more volatility in the commons.

The preferred trade at $27 and pay $0.5625 as a quarterly cash dividend payment for an 8.3% annual yield. There could be a forced conversion if the common shares trade at 1.5x the $51.80 conversion price for 20 of any 30 consecutive trading days but EPR has yet to reach this level.

Recovery From The Pandemic Continues

The second catalyst builds on the first. The effects of pandemic-era restrictions on theatres are still undoubtedly reverberating across the industry which is now undergoing a period of restructuring and consolidation. This will see unprofitable theatres at a local level shut down whilst overleveraged operators reformat their debts. The end output will be a healthier deleveraging industry with the theatres in the best locations performing well.

Hence, the second catalyst next year will come from the growth of rental revenue on the back of continued deferred rent collection. Deferred rent booked as receivables as of the end of the company’s fiscal 2022 third quarter stood at $7 million, down from $12.1 million in the second quarter. This will come against the backdrop of a stronger 2023 movie slate which should see more stable revenue recognition for theatre operators. Critically, the current fourth quarter is shaping up to be the strongest post-pandemic quarter for the box office with Black Panther: Wakanda Forever debuting with the largest-ever November movie opening and the 13th-largest opening of all time. This rubbishes the bearish perspective of a structural shift away from theatres. The problem is the movie slate, good movies will always attract a large number of moviegoers and that will continue even amidst the growth of streaming.

Both Netflix (NFLX) and Amazon (AMZN) have indicated a small pivot to theatrical releases. Netflix with the release of its Glass Onion: A Knives Out Mystery in select theatres and the Seattle-based eCommerce giant looking to invest at least $1 billion per year in making movies that’ll be released in theatres.

2023 Looks Bright For EPR In An Otherwise Bleak Macroeconomic Context

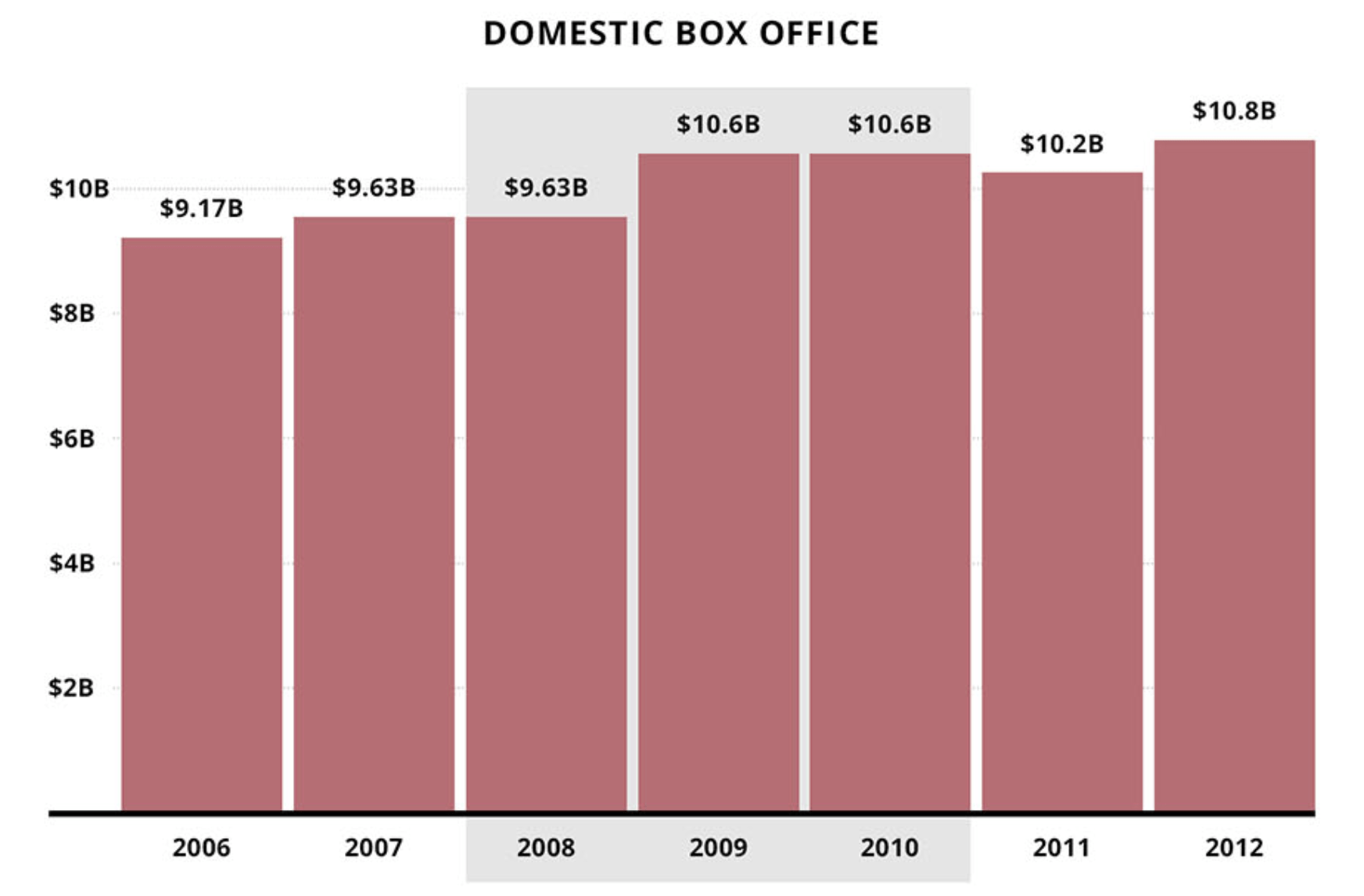

The Amazon move is a vote of confidence in the sector against what many economists assume will be a recession in the second half of next year. However, the US domestic box office has historically remained stable even amidst periods of economic disruption. During the 2008 global financial recession, the domestic box office actually rose with the movies providing an entertainment outlet for millions of US households.

The Hollywood Reporter

Theatres are a quasi-recession-proof business and EPR’s top 2 tenants should do relatively well next year against a stronger movie slate. This will help drive stable financials against what looks set to be a somewhat bleak period. I hold the company’s common shares and intend to keep adding to my position but the preferred offer is an alternative and a less volatile way to gain exposure to the ongoing recovery.

Be the first to comment