mgallar/iStock Editorial via Getty Images

As already mentioned, starting from the 27th of September, Exor (OTCPK:EXXRF) left Euronext Milan and moved to the Amsterdam stock exchange. So today, we are looking back at the thirteen years of Exor’s history in Piazza Affari. Indeed, the company was completely transformed, and the Agnelli family empire was completely reshaped. So, after more than a decade, for those who chose to invest, the holding company represented an excellent proposition. In detail, John Elkann usually mentioned that for every €1 invested, shareholders received €10 (excluding dividends that combined add an additional extra performance – sum of the total dividend received is approximately €5 per share).

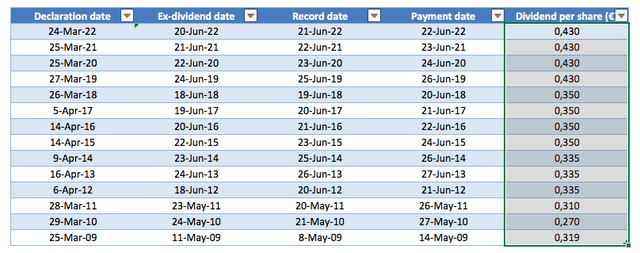

Exor dividend per share development

Source: Exor Dividend History (download from Corporate Website)

After all, these are the numbers. The company was born in March 2009 with a stock price of €6 per share and left Piazza Affari with a price of around €60 per share. In 2009, Exor’s NAV was €3.1 billion, the last half-year shows the same figure at €25.5 billion. In terms of composition ten years ago, 62% of the portfolio was concentrated in four large companies: Fiat Group (29%), SGS (19%), C&W (9%), and Intesa Sanpaolo (5%). Today, only one of these 4 companies is still in Exor’s portfolio, Fiat, today is known as Stellantis. There are other three important holdings: Ferrari, CNH Industrial, and Iveco (all covered by Mare Evidence Lab). In the meantime, the US reinsurance group Partner Re, which until the last half-year was the second investment behind Ferrari in terms of weight on the holding’s portfolio, was sold to the French Covea. An operation that was closed with a maxi capital gain for the Agnelli family’s Exor with a net gain of $3.2 billion which brings the holding’s liquid assets to €9 billion.

Here at the Lab, we already commented on the half-year results, today we would like to emphasize the following:

- Having participated in all the major Q3 results of the companies controlled by Exor, it is important to report that CNH Industrial is also considering leaving the Milan stock exchange. This was announced by the CEO, Scott Wine, during the presentation of the last quarter results, specifying also that no decision has yet been taken in this regard, but internally they are evaluating the pros and cons. This should support CNH liquidity and align Exor’s shareholder structure;

- The company is reorganizing its investment activities and already announced the appointment of three new key senior figures. This was positively welcomed by Wall Street;

- Here at the Lab, we believe that Exor’s track record is not sufficiently priced in by the market;

- Looking at the company’s history, Exor’s portfolio is a safer investment thanks to its latest steps into the healthcare and the luxury sector.

- Still related to point 4), Teva Pharmaceutical joins Exor’s portfolio. At the end of September, the holding funds owned more than 11.5 million shares of the Israeli manufacturer of generics (+22% since the beginning of the year). The equity stake is equal to around 1% of the company’s capital and at current prices is worth just under $100 million. This is also combined with the other two investments within the sector: Institut Mériuex and Lifenet S.r.l.;

- The company has an ongoing buyback plan to reduce its NAV discount;

- Going to the valuation, Exor subsidiaries were pretty resilient in the Q3 results. On the stock market, Exor is still worth 40% less than the sum of its jewels. Here at the Lab, we believe that this discount is not justified, Exor portfolio is safer and more resilient than in the past. Speaking of numbers, the NAV discount is above Exor’s historical average (25% versus 40%); however, we continue to apply a 20% discount, reaffirming our target price at €96 per share. Aside from the share repurchase, the company plans to invest more than €8 billion in anti-cyclical sectors, and given the company’s past track record, this should support its upside valuation.

Be the first to comment