Taiyou Nomachi

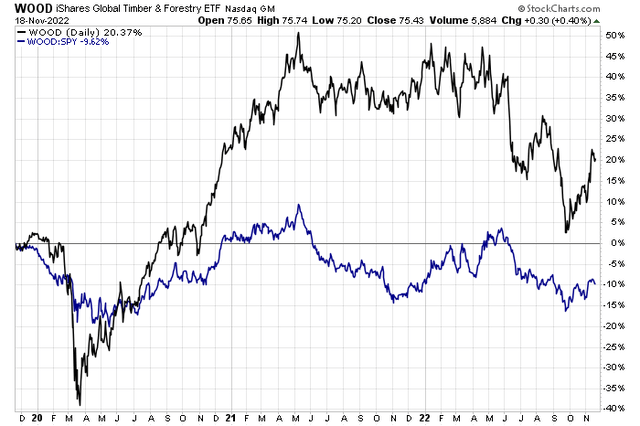

Timber REITs have struggled following the meteoric rise of lumber futures during the first half of 2021. Even with the supplemental bump up caused by Russia’s invasion of Ukraine, the REIT niche has not cut it.

Notice how the iShares S&P Global Timber & Forestry Index ETF (WOOD) is down sharply from its Q2 2022 high and trending lower against the broad market. One firm with heartland exposure is undergoing a merger and earnings risk is high.

Timber & Forestry Stocks Struggling In The Last 6 Months

Lumber Futures: Near The Lowest Since June 2020

According to Bank of America Global Research, PotlatchDeltic (NASDAQ:PCH) is one of three publicly traded timber REITs. The company owns around 1.8 million acres of timberland in Idaho, Arkansas, Minnesota, Alabama, Mississippi, and Louisiana. As part of its real estate segment, PCH seeks to sell certain non-strategic and higher and better-use properties. PCH also has a wood products business with approximately 1.1bbf of lumber capacity.

The Washington-based $3.8 billion market cap Equity Real Estate Investment Trusts (REITs) industry company within the Real Estate sector trades at a low 8.9 trailing 12-month GAAP price-to-earnings ratio and pays a high 3.7% dividend yield, according to The Wall Street Journal.

PCH has obvious risks to the slumping real estate market and lumber prices that are not far from 30-month lows. On the plus side, though, is the firm’s decent balance sheet and financial position. Most wood products names feature volatility earnings trajectories, and PCH is one the same with a massive drop-off in per-share profits expected in its FY 2023.

Another risk to PotlatchDeltic is a further inverted yield curve which generally hurt REITs. An idiosyncratic concern is how the company handles its recent merger with CatchMark which is not yet completed.

What’s good, however, is that there should be limited tax changes that would impact its earnings and dividend payouts now that a divided Congress is known. Upside potential stems from an improving housing market and favorable dividend trends.

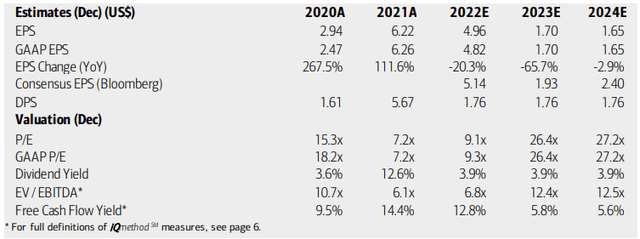

On valuation, analysts at BofA see earnings falling significantly this year and next, then troughing at a low level in 2024. The Bloomberg consensus forecast is more sanguine than BofA’s outlook. Dividends were abnormally high last year and should hold at the $1.76 level going forward.

While PCH’s current operating and GAAP P/Es are low, expected per-share profit declines will make the earnings multiples increase considerably. The same goes for the firm’s EV/EBITDA ratio. On the positive side of the ledger, though, is that PotlatchDeltic has a solid free cash flow yield. Overall, I do not like the valuation trends.

PCH: Earnings, Valuation, Dividend Yield Forecasts

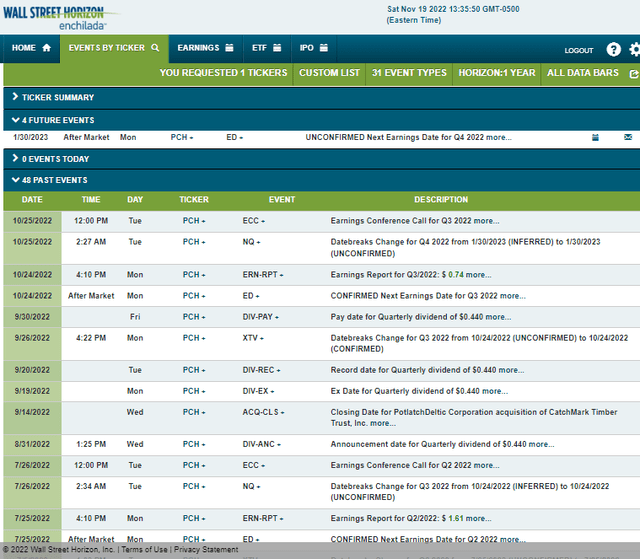

Looking ahead, corporate event data provider Wall Street Horizon shows an unconfirmed Q4 2022 earning date of Monday, January 30 AMC. The corporate event calendar is light aside from that earnings date.

Corporate Event Calendar

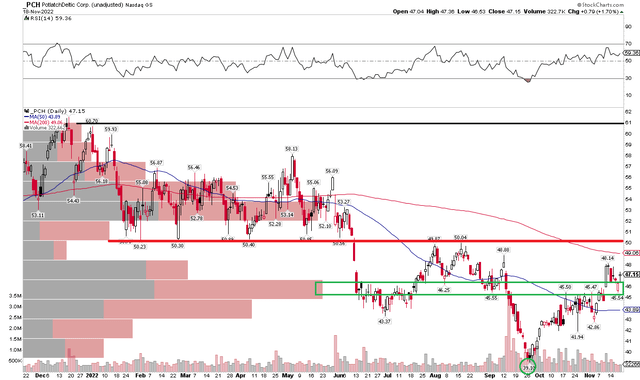

The Technical Take

PCH has clear resistance at $50 which nearly coincides with where the flattening 200-day moving average lies. I see support in the $45 to $46 area, so shares are simply stuck in that range right now. Notice in the chart below that there is a significant amount of volume at the noted support zone – a break below $45 could leave the REIT susceptible to a move into the low $40s or even to a retest of the September low near $39.

If PCH breaks out above $50, a bullish price objective of $61 would be in play – that is the high from last December. I could see resistance hitting the stock in the $52 to $53 congestion zone as well. Overall, the stock is below important resistance, so it’s not a great technical look today.

PCH: Shares Trending Lower, But Eyeing $50 For A Possible Breakout

The Bottom Line

With a weak earnings outlook and an unimpressive chart, I am a sell on PCH right now. The housing market needs to turn more favorable to allow for profitability to improve, allowing for bigger distributions to shareholders. Near-term, if shares rally through $50, I’m constructive on a technical basis.

Be the first to comment