Justin Sullivan

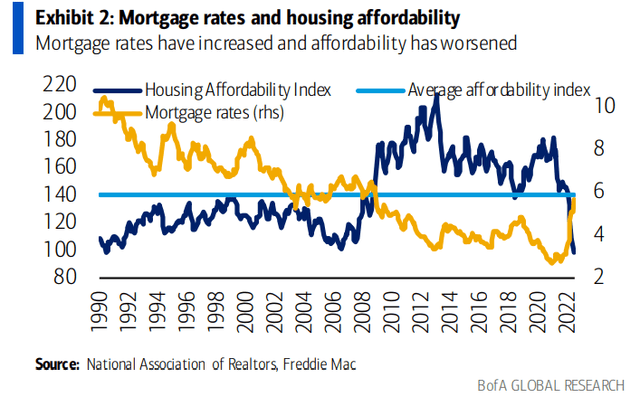

Surging mortgage rates and still-high real estate prices are the perfect recipes for a slowdown in homebuying activity. On the bullish side, though, the jobs market remains strong, as seen in the July and August NFP reports and recent claims data. Moreover, Gen Z and millennials are reaching their peak family formation years, a solid long-term tailwind for the real estate market.

But you cannot ignore what’s happening with housing affordability, which is now near its lowest level in more than 30 years. One mid-cap homebuilder, along with Lennar (LEN), reports results Wednesday afternoon.

Mortgage Rates Up, Housing Affordability Tanks

According to Bank of America Global Research, KB Home (NYSE:KBH) is one of the largest US homebuilders with a roughly 3% market share. The company builds single-family homes, townhomes, and condominiums for first-time, move-up, and active-adult buyers. KBH is positioned in roughly 40 markets, with around 70% of revenues attributable to the West and Central regions. Exposure to first-time home buyers carries risk, but also opportunity, considering the big demographic group of Gen Z and millennials is reaching peak household formation years.

The California-based $2.6 billion market cap homebuilder is part of the Consumer Discretionary sector and trades at a stunningly cheap trailing 12-month GAAP price-to-earnings ratio of just 3.9 and pays a 2.1% dividend yield, according to The Wall Street Journal. Importantly, ahead of earnings Wednesday night is a material 7% short interest in the stock. The homebuilder was recently upgraded by an analyst at KeyBanc Capital Markets.

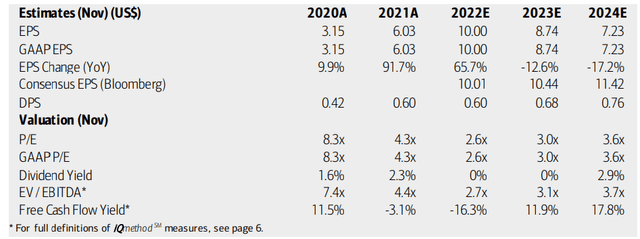

On valuation, industry margins are expected to decrease, resulting in lower profits compared to 2022’s peak earnings figure. Assuming a bit over $7 in EPS by 2024, the stock still trades at a very inexpensive P/E. Moreover, dividends are expected to remain on the increase despite lower EPS in the years ahead. Finally, free cash flow is also very impressive looking out to 2023 and 2024.

KBH Earnings, Valuation, and Dividend Forecasts

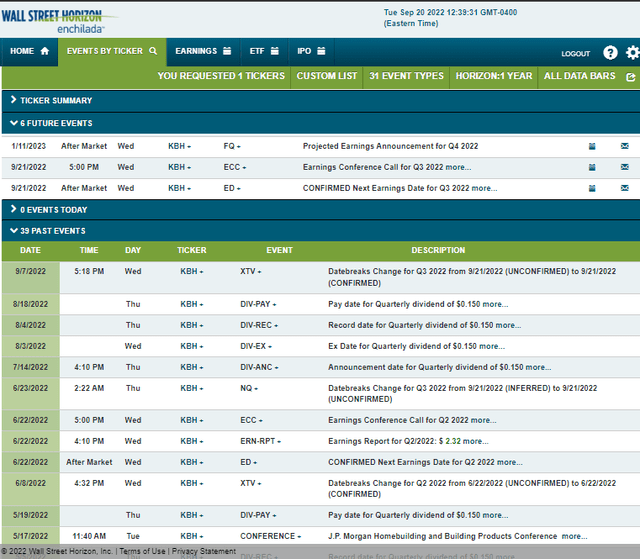

Looking ahead, KBH has a confirmed earnings date of Wednesday, Sept. 21, after the closing bell, according to data provided by Wall Street Horizon. A conference call begins at 5 pm ET Wednesday and investors can listen live here.

Corporate Event Calendar

The Options Angle

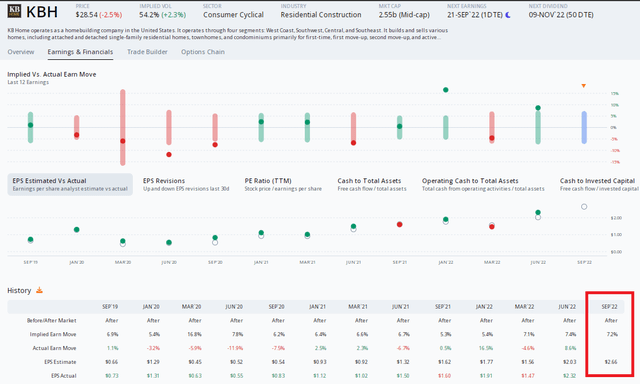

Option Research & Technology Services (ORATS) reports that traders have priced in a 7.5% earnings-related stock price move using the nearest-expiration at-the-money straddle. That’s a fairly cheap straddle given some recent earnings swings.

ORATS also shows a consensus EPS forecast of $2.66 of per-share profits for KB Home – a massive increase from the same quarter a year ago. While shares are down 30% year-on-year, earnings have beaten analysts’ estimates in six of the last eight reports.

KBH: Big EPS Growth, Somewhat Modest Straddle Cost

The Technical Take

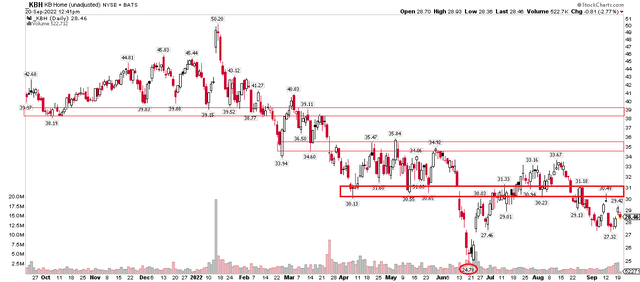

Amid a steep drawdown, what do the technicals say about KBH’s future? Is there a solid foundation for this homebuilder? Unfortunately, for the bulls, not. I spot three ‘stories’ of resistance on the one-year daily chart.

Immediately above the current price is the problematic $30 to $31 range, which has been pivotal over the past six months. Then since February, $34.50 to $35.50 caused issues for the longs. Finally, there was key support around $38 to $39 that broke down in early 2022.

While $27 and change might provide some support as well as the high-volume June low near $25, the path of least resistance looks lower per the chart.

KBH: Many Steps of Resistance

The Bottom Line

I think value investors could buy KBH shares even cheaper than where they are now. Buying on the dip into the mid-$20s looks like a good strategy, but I see more bearish than bullish risks as we head into earnings, despite the very-cheap valuation.

Be the first to comment