wildpixel

Main Thesis And Background

The purpose of this article is to evaluate the SPDR S&P Dividend ETF (NYSEARCA:SDY) as an investment option at its current market price. This fund’s objective is “to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P High Yield Dividend Aristocrats Index”. This includes companies that have increased their dividend for at least 20 consecutive years.

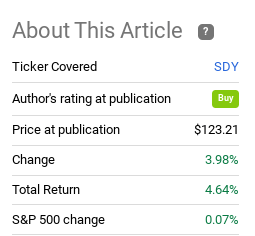

I have written about SDY and also owned it for a long time. For the most part, it has served me well, and this is why I have emphasized it over the years with my followers. I reiterated this sentiment back in September and the fund has indeed performed quite well since that time:

Fund Performance (Seeking Alpha)

As 2022 draws to a close, SDY will continue to have an important place in my portfolio. I see this positive momentum as support for adding to my position, and I will explain why in detail below.

Underlying Index Not Expensive Historically

When I take a step back and think about the stock market collectively, I see a challenging backdrop. The economic environment, both in the U.S. and globally, is not exactly rosy. There are good signs and bad, but unlike most years we are contending with a rising interest rate environment. This is putting pressure on the forward outlook for equities in particular. This tells me we have to weigh the negative/challenging attributes of the economy very carefully at the moment.

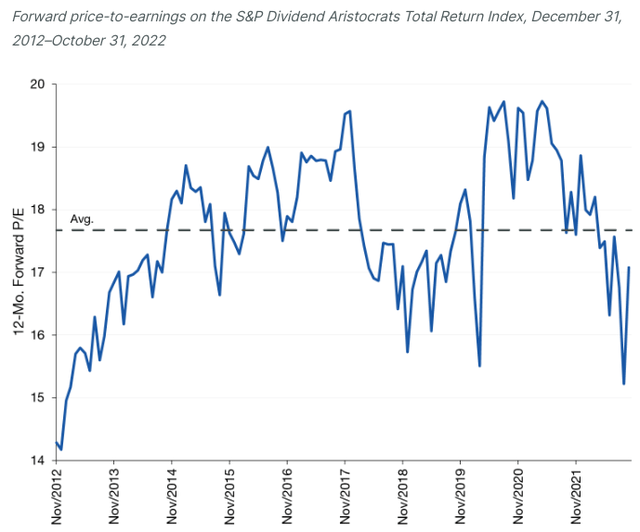

A key way to navigate this climate is to focus on selective buying. This could mean defensive plays, value plays, or a combination of the two. The dividend aristocrat index captures both these characteristics to some degree. By managing to raise dividend payouts for over two decades, the underlying companies show they can remain profitable in all types of business cycles. Further, at current valuations, this index does not seem overly expensive. While I would not call it “cheap” (and the valuation has been rising along with the broader equity rebound in the past 4-6 weeks), it is trading at a forward P/E that is less than its historical average:

Forward P/E: S&P Dividend Aristocrats Index (FactSet)

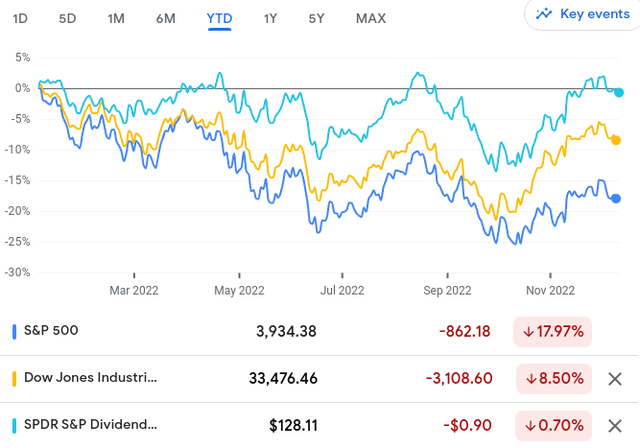

The takeaway for me is that while it may appear that dividend aristocrats are getting more expensive it really depends how you look at it. Are they more expensive than they were a few months ago? Yes. But they are cheaper than they were a year ago, and also, they are collectively still trading well below historical P/E levels. This is an indication that investors are willing to pay a premium for these types of companies, which directly benefits SDY. Given SDY’s market beating performance through 2022, this gives me confidence:

YTD Performance (Google Finance)

I see no reason why this cannot continue in 2023 given that many of the same challenges – such as rising interest rates, ongoing war in Europe, and doubts over future economic growth – will all still be present. This leaves continued upside for SDY in my view, and validates my continued “buy” rating.

Economic Worries Mount

I already mentioned that I see a difficult macro-economic environment. This is key to why I want to buy SDY and I feel compelled to emphasize that here. I have been building cash, rotating back into bonds, and the equity buys I have made have been mainly value and quality. To understand why this is my strategy, I want to give some data to show the why behind this outlook.

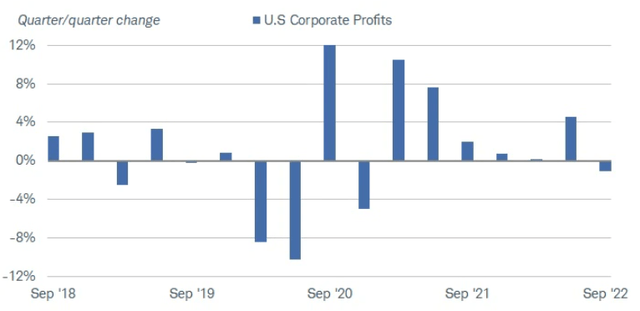

First, corporate profits are under pressure. This reverts back to the stability of dividend aristocrats. When I see corporate profits decline or turn negative, I worry about “growth” plays and other more speculative assets. When corporate America faces tough times, the merits of dividend aristocrats shine through. And this is precisely what we are facing now, with U.S. corporate profits turning negative in Q3:

U.S. Corporate Profits (Quarter over Quarter) (Charles Schwab)

This should at the very least signal investors to get somewhat cautious. With consumers feeling the pressure of inflation and businesses facing higher borrowing costs, the likely scenario to me is that corporate profits remain weak for at least the next few quarters. This ties back to my strategy to buy time-tested companies. That is precisely what is in SDY’s portfolio, so I see the above chart as a reason to buy SDY at the expense of other discretionary plays in my portfolio.

Labor Market Starting To Cool

Expanding on the above discussion, another reason for general economic weakness is the cracks forming in the labor market. This has been one of the most resilient aspects of the economy (in the U.S.) over the past year. This has prevented a deepening recession, but those days could be nearing an end.

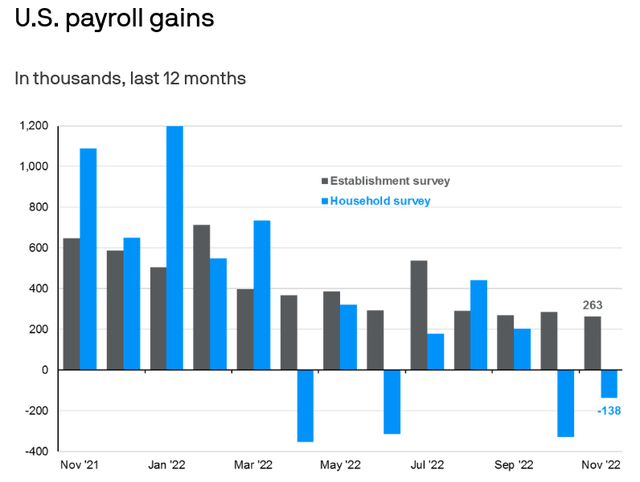

The reason being that wage growth, while still present, is starting to cool. Further, U.S. households are feeling more negative, as measured by the “household survey”, illustrated below:

Payroll Metrics (JPMorgan Asset Management)

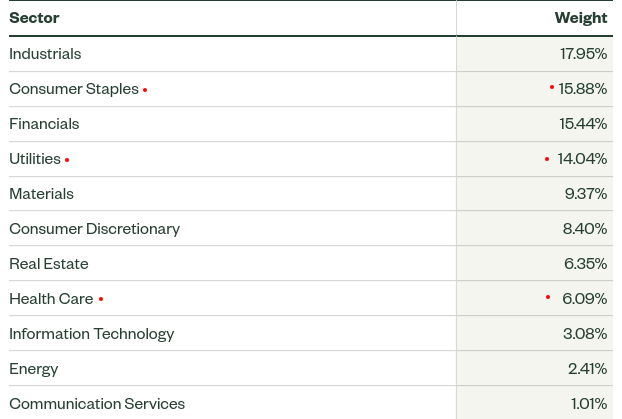

These are metrics that are also starting to fall below short-term averages. That concerns me and suggests that consumer discretionary spend is about to take a bigger hit than it already has in the months to come. This means readers should probably look to take on more defensive exposure, in Consumer Staples, Utilities, or Health Care sectors, for example. As it happens, those three sectors make up roughly 36% of total fund assets in SDY:

SDY’s Sector Weightings (State Street)

These holdings help to balance out a U.S.-centric portfolio that is probably very Tech/Growth heavy. It comes at a time when buying in to more defensive names has a lot of merit, especially if the weakening in the labor market continues in early 2023. This is another supporting factor in deciding to be long the SDY ETF.

I’m Glad The Fund Is Light On Retail / Discretionary

My next point reflects on what SDY doesn’t have. At the graphic in the prior paragraph showed, SDY is very flight on Consumer Discretionary. At just over 8% of total fund assets, this is fairly minimal exposure. As my followers are aware, I am neutral/under-weight on retail and other consumer discretionary plays for a number of reasons. This is primarily due to inflation and the weakening labor market, but it also stems from consumer sentiment as well.

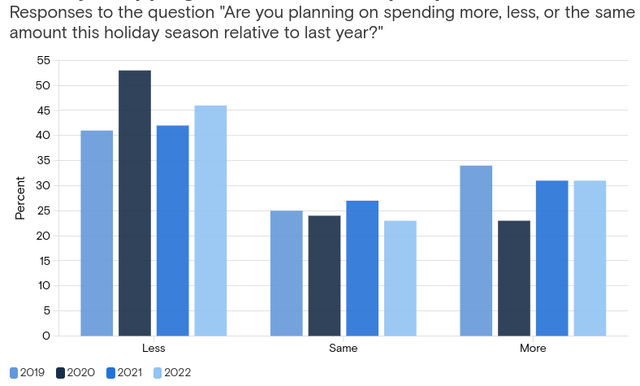

Specifically, a survey done by Goldman Sachs shows that 31% of U.S. consumers said they would spend more than they did last year, while 46% indicated they would likely spend less. This is a sharp contrast from 2021:

Consumer Spending Survey (Goldman Sachs)

Responses like the one demonstrated here convince me that avoiding retail continues to make sense. While SDY does not completely avoid it, I prefer funds that are not too heavily exposure, and SDY is not. So I view its relative exclusion (by comparison, the S&P 500 is 11% weighted towards consumer discretionary) as a benefit.

Bottom-line

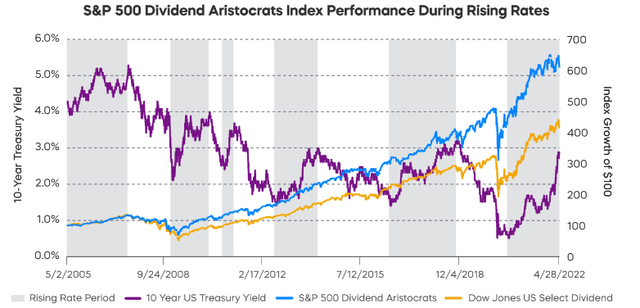

With rates set to continue rising in the short-term, inflation remaining a headline risk, and consumers treading cautiously, I am going to stick with a dividend strategy. This has served me well over time, including in 2022, especially when times are difficult. But all dividends are not created equally. Dividend aristocrats are a rare breed by nature, and a breed that often out-performs when interest rates are on the rise:

Relative Performance (ProShares)

This historical performance suggests to me to keep it simple. SDY has had a relatively strong year, is priced reasonably, and continues to offer a growing income stream. As a result, I will reiterate my “buy” rating on SDY and suggest readers give this fund some consideration at this time.

Be the first to comment