Jitalia17/E+ via Getty Images

Recently, I wrote an article warning investors about the duration risk for TIPS-focused ETFs like the iShares TIPS Bond ETF (TIP). Some readers appear confused about the inflation risk and duration risk in these funds.

In this article, I will review the Schwab U.S. TIPS ETF (NYSEARCA:SCHP) and take the opportunity to clarify the difference between inflation risk and duration risk.

SCHP, like other TIPS-focused ETFs, may be protected from inflation with adjustments in its principal and coupons to reflect changes in the CPI index. However, like all fixed income securities, SCHP has duration risk, which has led to a 13.8% YTD loss for the SCHP ETF. Investors may wish to consider strategies that mitigate the duration risk in TIPS bonds.

Fund Overview

The Schwab U.S. TIPS ETF provides investors with a straightforward, low-cost way to gain exposure to a basket of inflation-protected U.S. Treasury securities. SCHP has $14 billion in assets.

Strategy

The SCHP ETF achieves its investment objective by tracking the investment returns of the Bloomberg US Treasury Inflation-Linked Bond Index, an index of Treasury Inflation-Protected Securities (“TIPS”).

TIPS are bonds issued by the U.S. Treasury Department that gives investors protection against inflation. TIPS achieve this by adjusting the principal of the bond up for inflation (or down for deflation), as measured by the Consumer Price Index (“CPI”). When a TIPS matures, investors receive the greater of the adjusted principal amount or the original principal.

TIPS pay bi-annual interest payments that are calculated on the adjusted principal, so when inflation increases, interest payments increase as well.

Portfolio Holdings

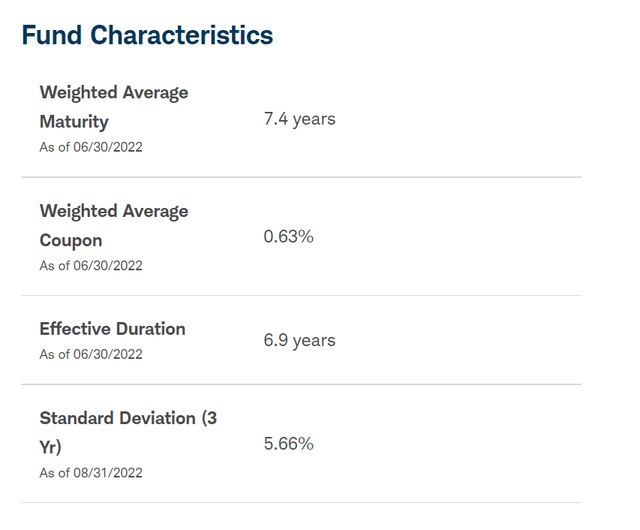

The portfolio of the SCHP ETF contains 48 holdings of various TIPS bonds, with a weighted average maturity of 7.4 years and an effective duration of 6.9 years (Figure 1).

Figure 1 – SCHP Portfolio Characteristic (schwabassetmanagement.com)

Returns

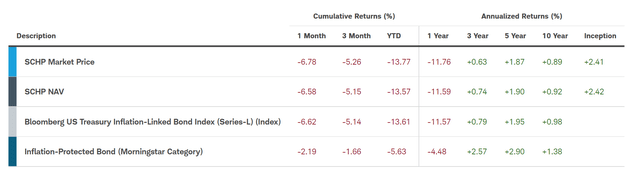

As of September 30, 2022, the SCHP ETF has delivered YTD total returns of -13.6% on a NAV basis. On longer time frames, SCHP has delivered 3, 5, and 10Yr annualized returns of 0.6%, 1.87%, and 0.9% respectively (Figure 2).

Figure 2 – SCHP Returns (schwabassetmanagement.com)

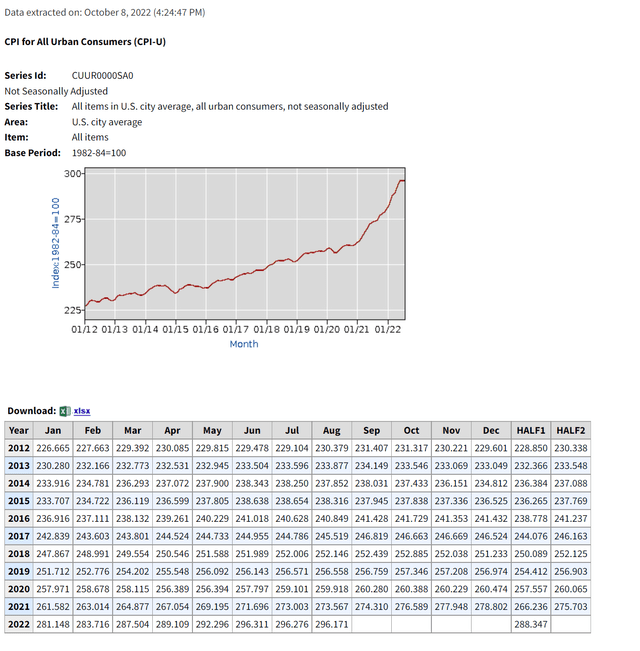

Note, if we look at CPI data from the Bureau of Labor Statistics, we can see that the CPI-U index has compounded at 4.9%/3.7%/2.5% over 3/5/10 Years to August, 2022 (Figure 3). So the SCHP ETF’s total return has significantly underperformed inflation.

Figure 3 – CPI Inflation Index (bls.gov)

Distribution & Yield

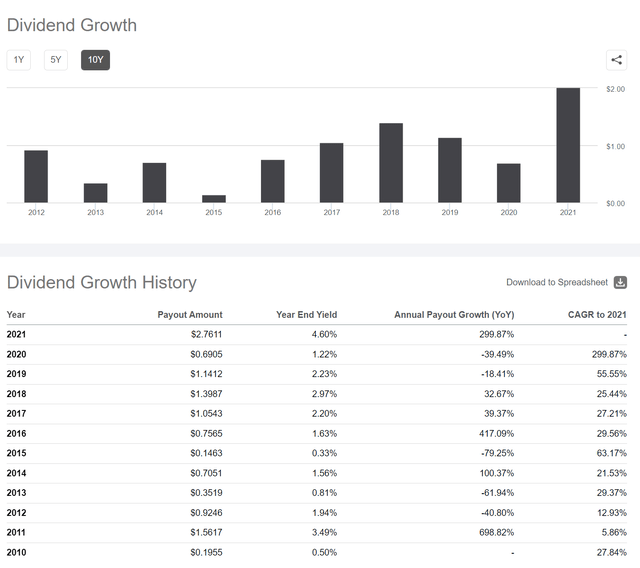

The SCHP ETF has a trailing 12-month distribution yield of 7.14%. The fund’s distribution is variable, and is dependent on the level of inflation. When inflation is low, like in 2015 (From December 2014 to December 2015, the CPI-U index increased just 0.7%), the distribution paid by the fund is correspondingly low at just $0.1463 / unit or 0.33% year end yield.

Figure 4 – SCHP Historical Distribution (Seeking Alpha)

There is also a time lag between inflation increases and distribution increases. For example, if we compare year-end index levels, we can see that the 2021 year-end ‘inflation’ was 7.0% (December 2021 CPI-U index level of 278.8 vs. 260.5 YoY), but the 2021 year end yield of the SCHP ETF was only 4.6%.

Fees

The SCHP ETF has one of the lowest expense ratio in the market, at only 0.04%.

Confusion About Inflation Vs. Duration Risk

When I wrote my previous article on the TIP ETF, I mentioned that TIPS bonds, although they protect investors from inflation (as principal and interest payments are adjusted for inflation), is still susceptible to interest rate risk. For example, the SCHP ETF has an effective duration of 6.9 years, so for a 1% increase in interest rates, the portfolio is expected to lose 6.9% in value. As interest rates have risen in 2022, the value of TIPS bonds have correspondingly fallen in value, leading to negative total returns for TIPS-focused funds like the SCHP.

Some readers appear to be confused about the fall in value due to duration, and claim TIPS to be very ‘cheap’ unless real yields continue to increase. As with most things in life, the answer is ‘it depends’.

To properly assess the ‘value’ of TIPS bonds, we need to think about their two isolated properties: 1) the inflation-adjustment component which compensates for inflation shocks, and 2) the duration component, which comes from the periodic payment of coupons and principal, just like any other fixed income security.

These two qualities of TIPS bonds can move together or offset each other, depending on the movement of interest rates and inflation. In 2022, we have the situation where inflation is rapidly increasing, causing upward principal adjustments to TIPS bonds and rising coupon payments. However, interest rates have been rising rapidly in response to inflation, which have overwhelmed the principal adjustment benefit.

There are two scenarios where TIPS bonds could be considered cheap: 1) future inflation is higher than expected but the interest rate response has a smaller impact than the principal adjustment, or 2) future inflation could be higher or lower than expected, but interest rates fall with a bigger impact than the inflation principal adjustment.

For now, scenario 1 does not appear likely, as interest rates, driven by central bank policy decisions, have risen aggressively in response to inflation. If inflation continues to be high, interest rate responses will likely remain aggressive. However, scenario 2 could happen if investors start pricing in a recession and there is a future cut in interest rates by central banks.

A TIPS Bond Ladder Can Also Mitigate Duration Risk

In my prior article, I recommended a pair trade between a TIPS-focused fund like SCHP and a treasury bond fund like the iShares 7 – 10 Year Treasury Bond ETF (IEF) could mitigate the duration risk.

Another way individual investors can mitigate the duration risk of TIPS bonds is by holding individual TIPS bonds to maturity in a bond ladder. If a TIPS bond is held to maturity, then the investor receives the adjusted principal, and mark-to-market changes from duration would not matter.

However, there are drawbacks to a TIPS bond ladder as well. For example, if the bond ladder is a rolling ladder (maturing bonds used to acquire new bonds at the end of the ladder), then it more or less becomes a bond fund. Also, individual TIPS bonds, prior to maturity, fluctuate in price according to interest rates. So if investors have liquidity needs beyond the maturing bond principal, they may have to sell their TIPS bonds at inopportune times.

Investors interested in TIPS bond ladders may want to do seek out the investment thoughts and ideas advocated by Boston University Professor, Zvi Bodie.

Conclusion

In conclusion, SCHP, like other TIPS-focused ETFs, may be protected from inflation with adjustments in its principal and coupons to reflect changes in the CPI index. However, they still suffer from duration risk, which has led to a 13.8% YTD loss for the SCHP ETF. There are ways to mitigate duration risk, for example by hedging with a treasury bond ETF like the IEF, or by constructing a TIPS bond ladder. Both methods offer their pros and cons.

Be the first to comment