Dilok Klaisataporn

Sapiens International (NASDAQ:SPNS) saw pressure on growth in selling its insurtech suite, partially due to slowdowns in the sales cycle, but mainly due to currency effects. The large share of revenues outside of the US is a problem for the company, and there’s a secular problem given the macroeconomic environment, which should continue to put pressure on the Euro relative to the dollar. Still, SPNS achieves gross margin expansion thanks to offshoring, but comprehensive of valuation considerations, SPNS is not a strong case.

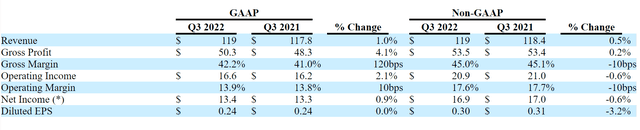

Q3 Breakdown

The revenue growth was very limited on a headline basis. On a constant currency basis the growth was 8%, with the losses in revenues from FX amount to about $27 million.

IS (PR Q3 2022)

Organic growth of 8% isn’t bad, but it is reflecting pressure on sales velocity, with slowdowns in particular in the closing phase of an already pretty long sales cycle.

The mainly delay, it’s on the contract and final decision. I think we continue to see demand from the market. The sales cycle in our business is long. I think at this time everything around the contract and the commercial side and negotiation in this area taking longer and longer. With Sapiens also to protect ourselves, we are also giving some hard time to our customer because we are entering to what we call blueprint stage to make sure that we and the customer understand the size of the deals. And this is the majority of the delay to closing the deals.

But is also reflecting a strong Q3 2021 comp, when momentum in tech investment was still very high.

The other major thing to report is the offshoring ratio:

Over the last year we increased our offshore ratio by 5%. We passed the offshore ratio by — from 45% to almost slightly above 50%. So this is one factor.

Roni Al-Dor, CEO of SPNS

This refers to the amount of professional services have been offshored to places like India and Poland, and its impact is primarily felt on the gross margins which have increased 1.2%. Inflation of outsourced services to India and Poland have limited the return on outsourcing for the bottom line, but overall the effect is still positive.

Bottom Line

Unfortunately, the FX effects aren’t likely to let up soon. The Fed continues to push the line that rates need to rise, and that there is still work to do to fight inflation. Stock markets have reacted to that as a credible signal, the dollar’s recent reversal has also tapered, although FX markets seem less sure. Still, the dollar is unlikely to give up its gains and the ECB’s inability to affect the economic situation, primarily brought on by major energy supply dislocations, will put the Euro at a continuous disadvantage until the Fed actually pivots. It could be another year of FX pressures on revenues, as well as continuous slowing of the sales cycle and economic pressures mount.

While base effects do play a role in the slowdown, indeed Q3 2021 was a record quarter, with such a bulk of the revenue coming from Europe, more than 50%, the secular picture remains demonstrably strong given that European recession is more evident than a US one. Insurtech remains an exciting vertical, and Sapiens in delivering on closing deals and benefiting from its local presence, particularly in the Nordics. They recently closed a deal with a major Finnish insurance player, demonstrating that they are making headway with Tier 1 players, at least within their respective regions. The matter of graduating out of Tier 2 with reinsurance players and other smaller players remains an objective for the company, but the LocalTapioca win in Finland is a good sign.

However, comprehensive with the PE at 15x, the assumption of growth in the multiple is already quite clear. Even just a year of slowed growth matters for the return profile. While secular trends remain strong, and SPNS capable of graduating into a higher tier of customers, we just don’t see a strong enough draw with the valuation.

Be the first to comment