JJ Gouin

I have previously discussed my view that real estate rental rates are going to rise as a result of both inflation and higher interest rates, but I have not yet discussed the timing of it. Knowing the underlying mechanisms is crucial for understanding the timing and not being misled by reports suggesting the opposite.

An increasing number of reports are coming out suggesting rent growth is slowing in the recently hot real estate sectors.

- Home sales are down 25% and the October 18th homebuilder survey showed the lowest read in many years.

- Apartment rents are declining from the unprecedented 15% rent rollups seen in 1Q and 2Q down to a more moderate 5% or so.

- Industrial has not slowed yet based on TRNO’s report that we covered recently, but as supply comes in it is likely to cool a bit.

I think headlines like this bring quite a bit of confusion because it conflicts with the idea that real estate is an inflation hedge. Given the high inflation environment, shouldn’t rent growth be accelerating not decelerating?

Well, there is a delay in the underlying mechanisms that govern rental rates.

I posit the following:

- Higher interest rates increase rental rates

- Higher OpEx increases rental rates

- Higher construction costs increase rental rates

In fact, I would even suggest that said increases are nearly inevitable over a long time span. The nature of the mechanism simply causes it to take years to factor in.

Therefore, I anticipate a slowing in same store NOI growth followed by an acceleration a few years down the road. Let me begin with the source of the near-term slowdown in rental rate growth and follow with the reasoning for a longer term acceleration.

Supply is coming in

Construction of commercial real estate is a slow process. Permitting is slow, material sourcing is slow, construction labor is undersupplied, and the physical building of large CRE takes a couple years. Thus, from the planning stage to opening is often a 2-5 year process.

As such, the amount of supply arriving in a given year is less related to today’s economics and much more related to the economics of 2 to 5 years ago.

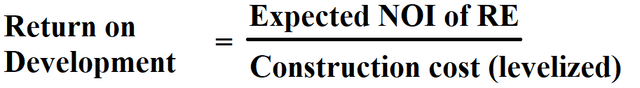

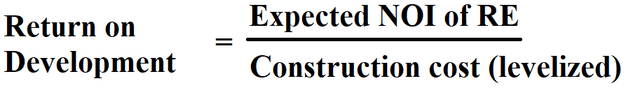

It all boils down to spreads. The basic development equation is this:

Development involves risk and has a delayed reward, so a rational developer demands a return on development that is substantially north of cap rates on stabilized real estate.

2-5 years ago, development returns penciled out great. The zero interest rate environment made financing development extremely cheap which juiced the return on development. It was also a time when the “risk free” rate was about 1% and stabilized cap rates were about 5% for those asset types which meant a development return of just 6%-7% was sufficient to spur development.

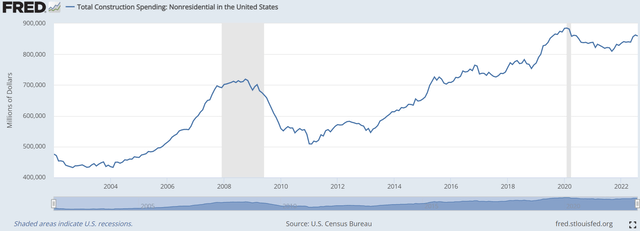

Naturally, these factors led to a significant amount of development over the past 5 years. Shown below is the construction activity in the U.S. excluding housing.

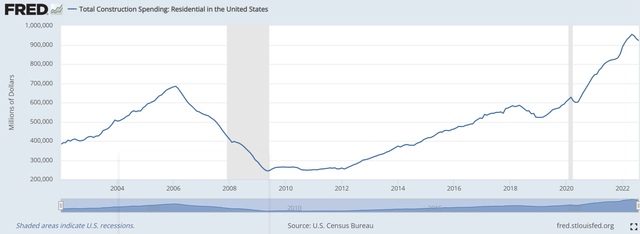

Housing construction was also quite significant although it was heavily weighted toward apartments rather than homes.

Due to how long these projects take to complete, most of that supply is coming online now through 2023.

This is largely what is causing the hiccup in rental rate growth. It is not inflation or the rise in interest rates, but rather the fact that interest rates were so low 2-5 years ago.

Zero interest rates are terrible for REITs because they stimulate development of competing supply.

Today, however, inflation and substantially higher interest rates with the 10 year Treasury over 4% have ushered in the opposite development environment. That same equation no longer pencils out.

- Construction costs are up dramatically

- Operating expenses are up

- Required return is up to about 8%-10%

Rents have risen in 2022, so expected property NOI is up, but it not up anywhere near enough to make up for the cost of construction and the now higher required level of return.

This is where market forces come in.

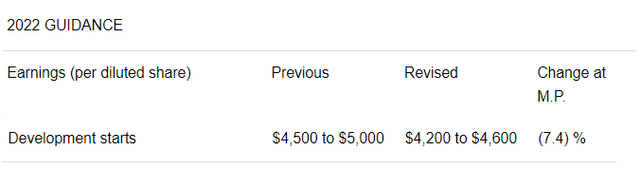

Development will naturally slow. In its 3Q22 earnings release, Prologis (PLD) reduced its development guidance by $350 million.

In industrial, developments are only slowing a little bit because rents have come up so dramatically (up over 50% in just a couple years).

In other areas where rents have come up more modestly, development will slow more significantly.

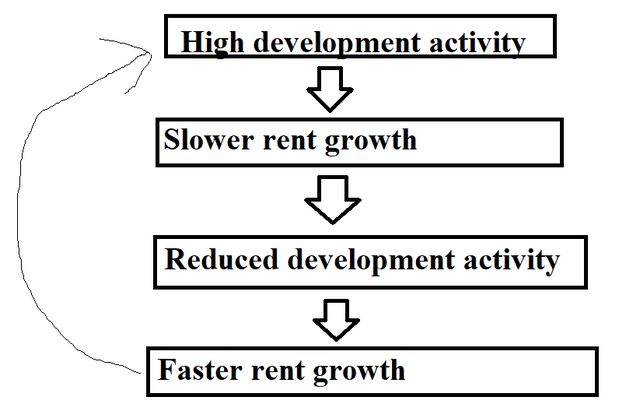

Like most things in economics, it forms a cyclical equilibrium. As rental rate growth slows, development becomes less financially viable which in turn causes a given property type to become undersupplied which then increases rental rate growth. Here is the basic feedback loop.

It can take as much as a decade to complete the above cycle, but that is how real estate cycles have gone for generations.

External macro forces can impact the cycle. Right now, the big external forces are high interest rates and inflation, both of which result in dramatically reduced development activity.

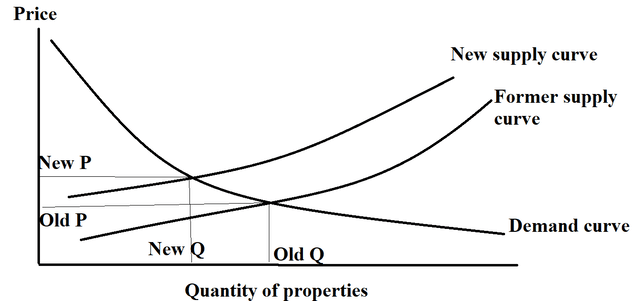

With how expensive it is to build, one generally cannot get an 8%-10% development return at current rental rates. This effectively is a shift in the supply curve.

For any given level of NOI, the quantity of properties delivered will be lower. Here are the supply and demand curves in qualitative form to illustrate the concept.

Price manifests in many forms. To a developer intending to sell the property upon completion it is the sale price of the property. To a developer who intends to own the property and lease it out, price represents the net operating income of the property (rental income less expenses).

Rental rates end up being the dependent variable. They move to equilibrate the quantity of incremental properties demanded with the quantity of incremental properties supplied.

Since construction costs and required rate of return are up, the level of rental rates that equilibrates the market will be higher.

With this framework in mind here is how I see the trajectory of rental rates going forward.

Rental rate outlook by year

- Current levels of property inventory are undersupplied for apartments and industrial.

- Current levels of inventory for shopping centers are in balance.

These are measured by the abnormally low vacancy rates in apartments and industrial with normal vacancy in retail.

2023 and 2024

In-progress development is quite heavy for apartments and medium for industrial while retail has minimal in-progress development. So as the pipeline of current developments gets delivered I would anticipate supply of apartments and industrial to move from undersupplied to balanced supply. Retail will go from normal supply to slightly undersupplied.

The alleviation of undersupply in industrial/multifamily will cause rental rate growth to contract from the rapid speed of recent quarters to a more historically normal level. I anticipate roughly 5% rental rate growth for apartments and about 10%-20% for industrial.

Shopping centers, however, are likely to see a mild acceleration in rental rate growth which could reach low double digits.

2025 and beyond

In progress pipelines will have completed and we will see the slowed development starts activity start to trickle into completions. This will reaccelerate rental rate growth until it reaches a sufficiently high level that development is more viable at a broad level. The real estate cycle will continue with alternating over and under development.

Implications for investment

The fundamentally ideal sectors are changing. Retail is now among the best sectors from a growth relative to valuation standpoint. Apartments and industrial are still healthy sectors but no longer deserving of the premium multiples they once commanded. Valuations have come down quite far already in these sectors so they are reasonable buys at today’s level, but I would not expect a return to the 25X to 35X FFO multiples.

REITs are broadly undervalued as the market is interpreting the deceleration in rental rate growth as a new direction. Instead, it is a hiccup resultant from the after-effects of the zero interest rate environment. If interest rates stay up in a healthy range with the 10 year Treasury at 3% or higher (4% today) the long term outlook on rental rates looks quite strong.

Be the first to comment